Ppf Tax Benefit In New Tax Regime No the interest income from the Public Provident Fund PPF remains completely exempt from income tax even in the New Tax regime because the interest earned on PPF is considered as an

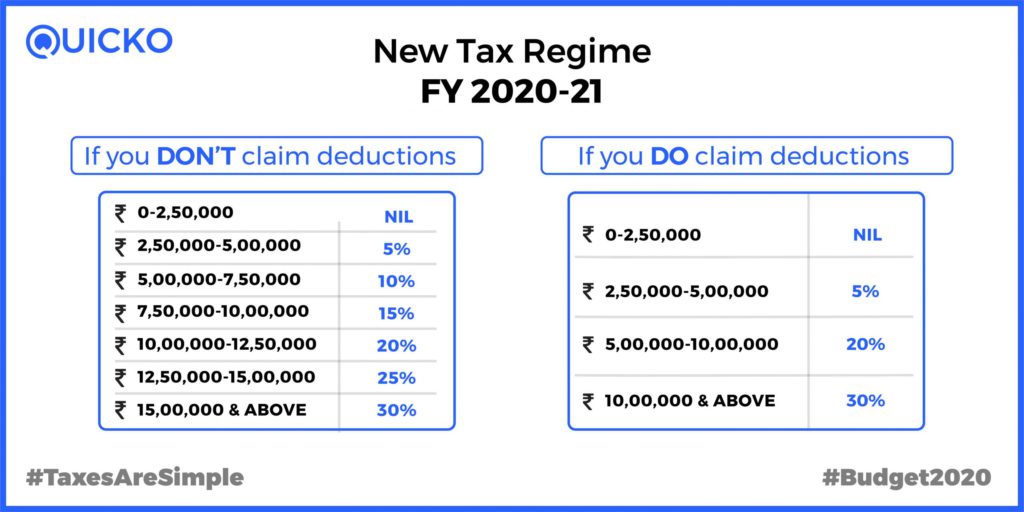

Tax saving investments PPF offers tax exemptions at the time of investment accrual and withdrawal It has a current interest rate of 7 1 per annum and a maximum deposit limit of Rs 1 5 lakh per financial year PPF It only stipulates that under the new tax regime deduction under Section 80C which covers investment in PPF account and section 80D which covers medical insurance premium payment of the

Ppf Tax Benefit In New Tax Regime

Ppf Tax Benefit In New Tax Regime

https://i.ytimg.com/vi/cFdWCd9EneI/maxresdefault.jpg

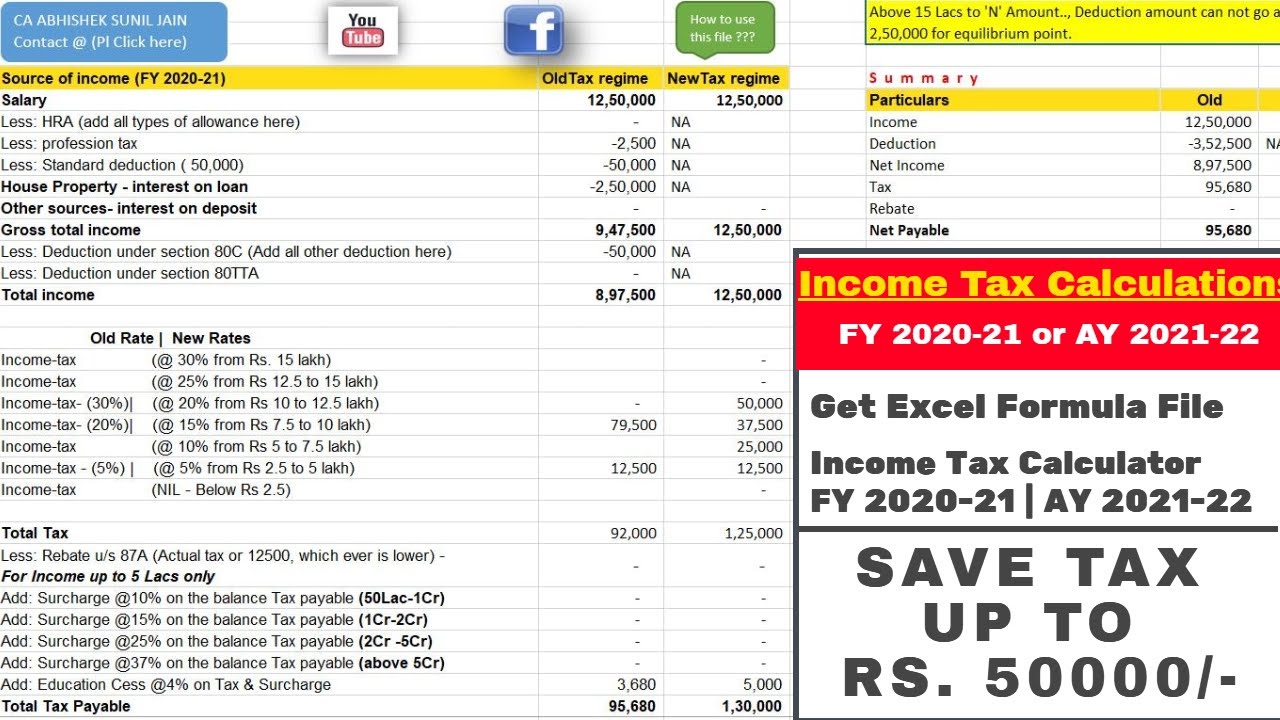

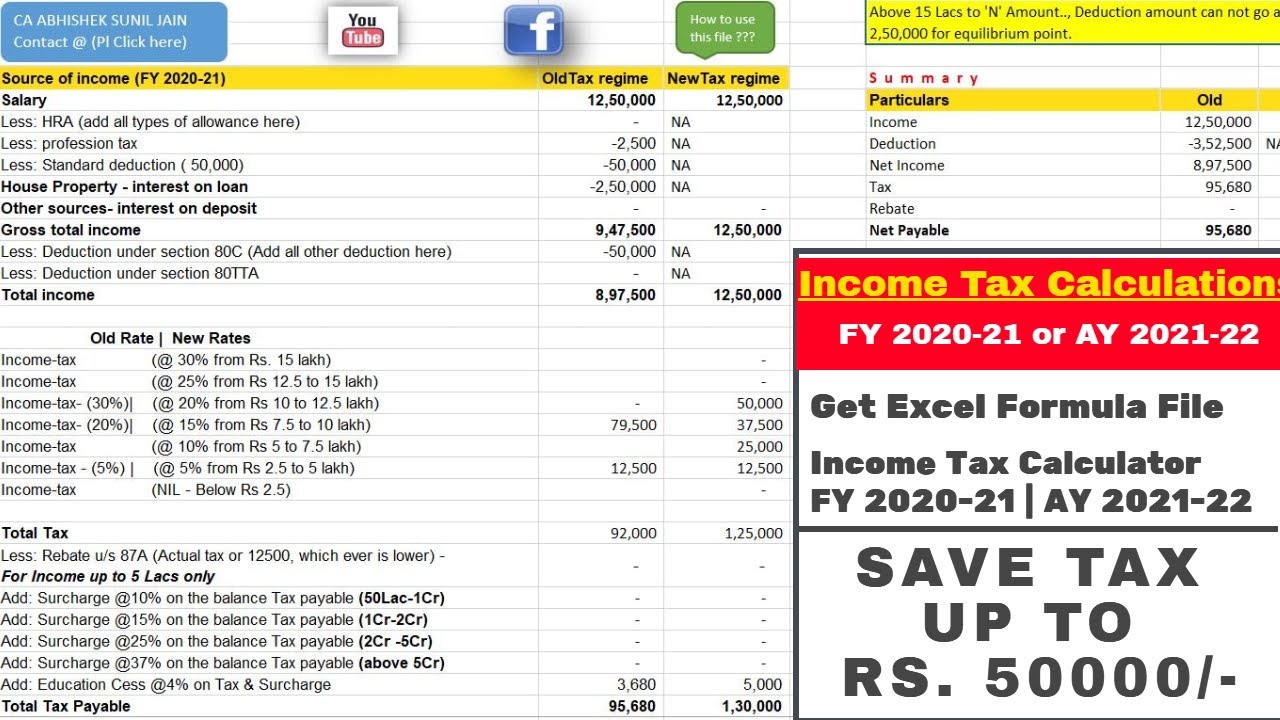

INCOME TAX NEW REGIME VS OLD REGIME CALCULATOR ITR E FILING AY 2021

https://i.ytimg.com/vi/VgUfYH0-cn8/maxresdefault.jpg

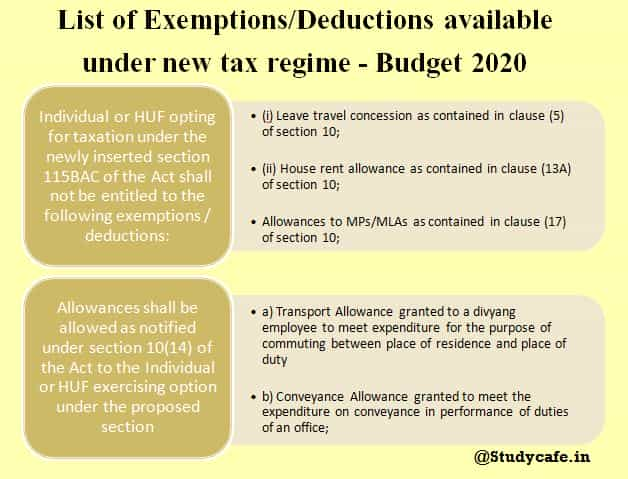

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://studycafe.in/wp-content/uploads/2020/02/List-of-ExemptionsDeductions-available-under-new-tax-regime-Budget-2020-1.jpg

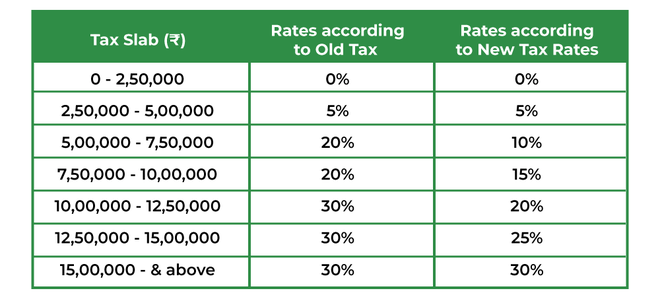

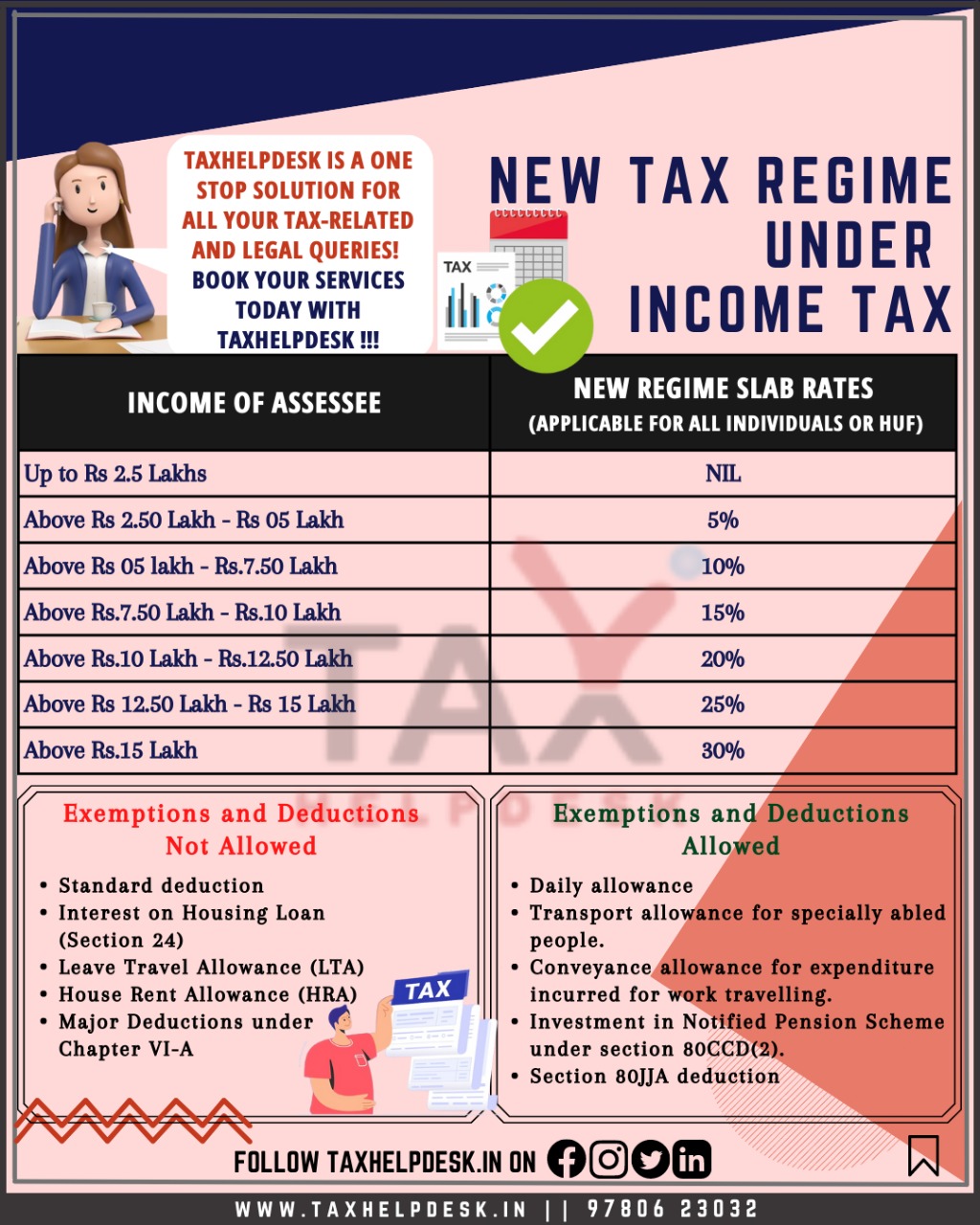

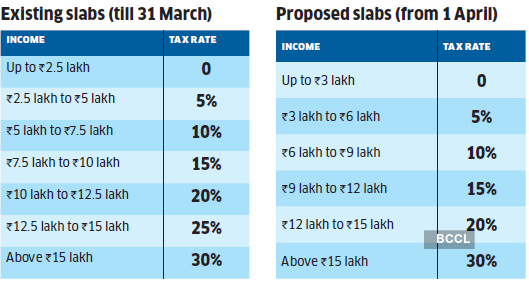

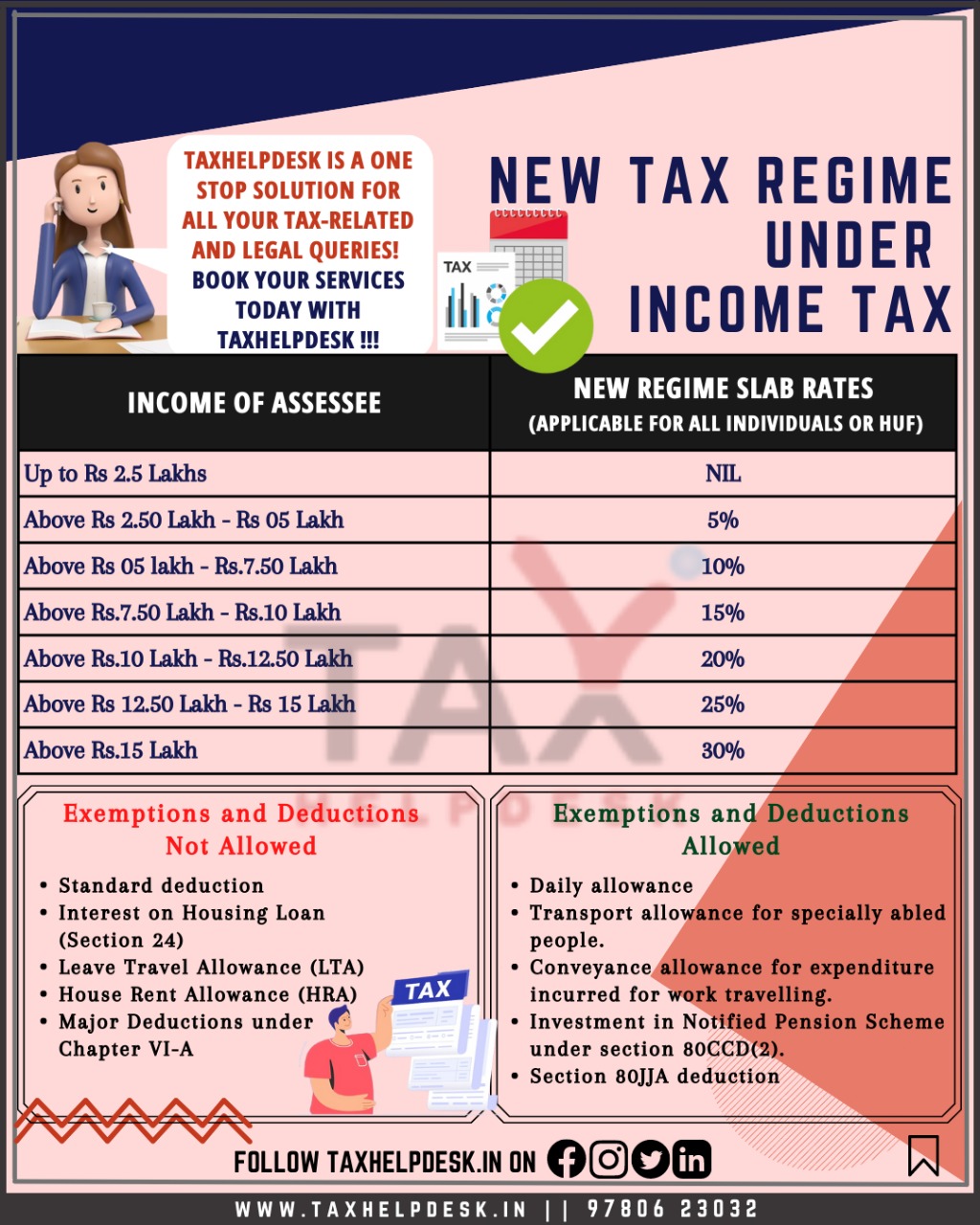

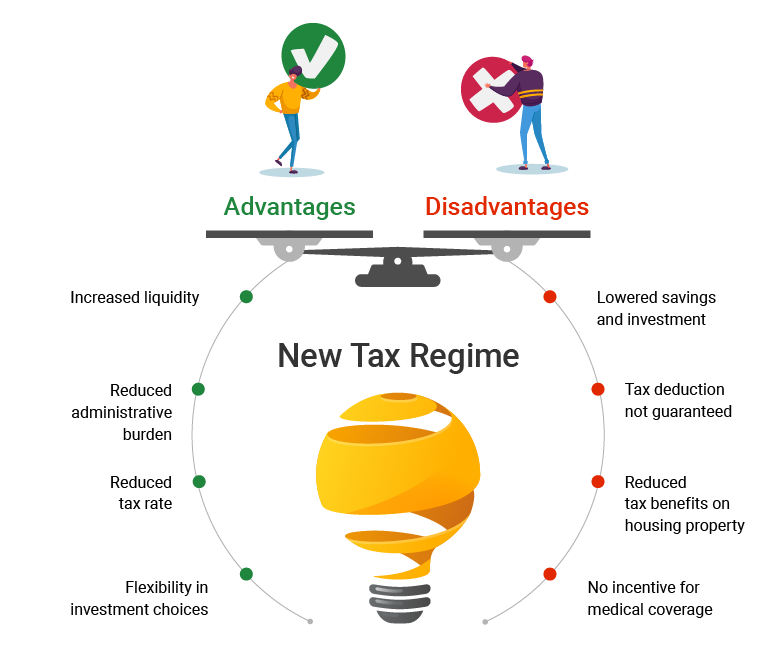

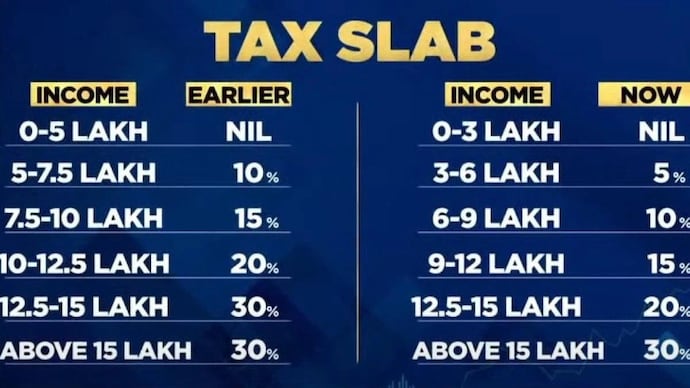

Please note that new tax regime is default regime for AY 2024 25 Any actions in any previous years with respect to choice of regimes will not be applicable from AY 2024 25 As the new regime offers six lower income tax slabs anyone paying taxes without claiming tax deductions can benefit from paying a lower rate of tax under the new tax regime For instance the assessee having total

Under the New Tax Regime you can claim tax exemptions for the following Specially abled taxpayers can claim transport allowances up to a specified limit Section 80JJAA of the Indian As announced at Autumn Budget 2024 the government will introduce legislation in Finance Bill 2024 25 to increase the main rates of Capital Gains Tax CGT from 10 and

Download Ppf Tax Benefit In New Tax Regime

More picture related to Ppf Tax Benefit In New Tax Regime

Old Tax Regime Vs New Tax Regime GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220927170008/DifferenceBetweenOldVsNewTaxRegime1-660x299.png

PPF Account Full Details Benefit And Interest Rate Tax Exemption On

https://i.ytimg.com/vi/ZP5dnwshzUE/maxresdefault.jpg

The New Tax Regime FY 2020 21 VS The Old Tax Regime Quick Tax Help

https://mkrk.co.in/wp-content/uploads/2021/03/Blog18-Old-Versus-New-Tax-Regime-33-1170x560.png

Interest amount and the maturity amount received from recognised provident fund are exempt from income tax under the new tax regime also by virtue of Section 10 11 and Section 10 12 Is PPF tax free under the new tax regime PPF is always tax free irrespective of the old and new tax regimes However you cannot claim a deduction for PPF contribution under the new tax regime

After introducing New Tax Regime in Budget 2023 many investors are unsure whether Public Provident Fund PPF is still a good investment choice for the new tax regime Finance Minister Nirmala Sitharaman introduced an alternate new tax regime in Union Budget 2020 21 which provided for lower tax rates for individuals compared to tax rates

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax.jpeg

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

http://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

https://www.businesstoday.in/personal-fi…

No the interest income from the Public Provident Fund PPF remains completely exempt from income tax even in the New Tax regime because the interest earned on PPF is considered as an

https://economictimes.indiatimes.com…

Tax saving investments PPF offers tax exemptions at the time of investment accrual and withdrawal It has a current interest rate of 7 1 per annum and a maximum deposit limit of Rs 1 5 lakh per financial year PPF

The New Tax Regime Offers A Higher Tax Exemption Raises The Threshold

Income Tax Under New Regime Understand Everything

PPF Tax Exemption In Hindi

Tax Regime For Employers And Employees Parichay Webinar

INTRODUCTION OF SECTION 115BAC TO INCOME TAX ACT 1961 Onfiling Blog

What Is The Concessional Tax Rate Regime UPSC Notes

What Is The Concessional Tax Rate Regime UPSC Notes

Share

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

Income Tax Clarification Opting For The New Income Tax Regime U s

Ppf Tax Benefit In New Tax Regime - PPF qualifies for the EEE tax regime Under Section 80C of the IT Act PPF deposits are tax deductible up to 1 5 Lakh per financial year Moreover the interest