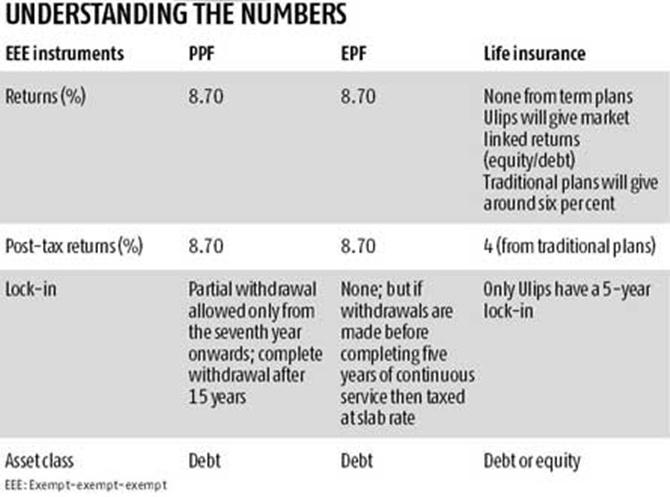

Ppf Tax Rebate Web 26 juin 2018 nbsp 0183 32 The current PPF interest rate is 7 6 tax free If a person is in the 30 tax bracket and is earning 11 interest from any other source the after tax interest rate

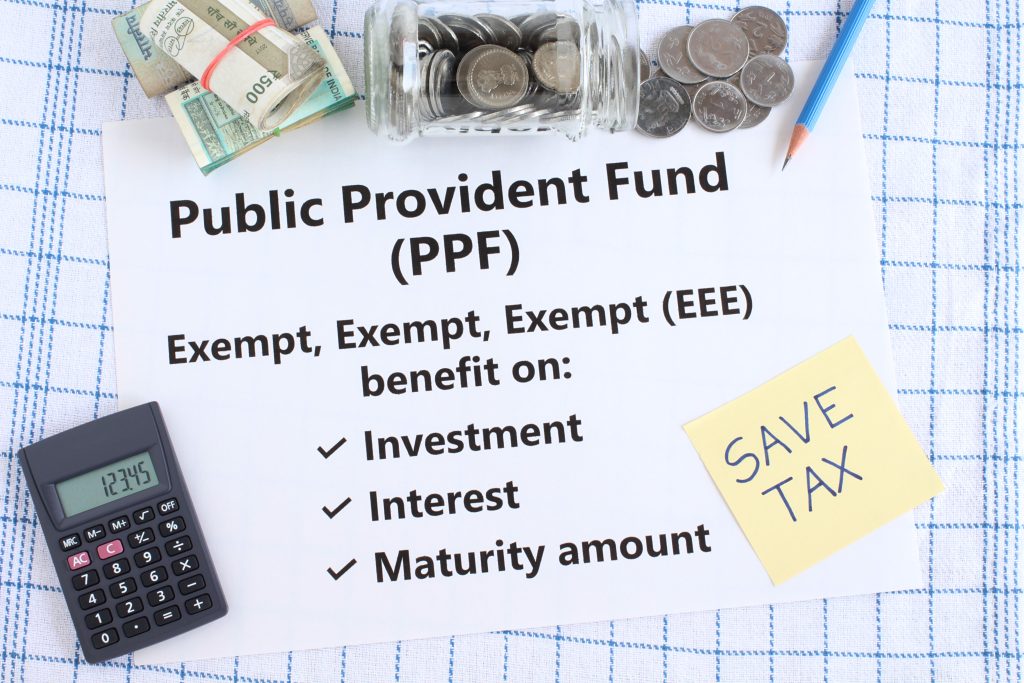

Web 1 f 233 vr 2022 nbsp 0183 32 Income tax rebate to PPF top 5 budget 2022 announcements expected 2 min read 01 Feb 2022 08 45 AM IST Asit Manohar Budget 2022 expectations Income Web 16 f 233 vr 2022 nbsp 0183 32 The Public Provident Fund PPF gets triple exemption when it comes to income tax not many investments have this benefit You get tax exemption at the time

Ppf Tax Rebate

Ppf Tax Rebate

https://www.inventiva.co.in/wp-content/uploads/2021/02/PPF.v1.cropped.jpg

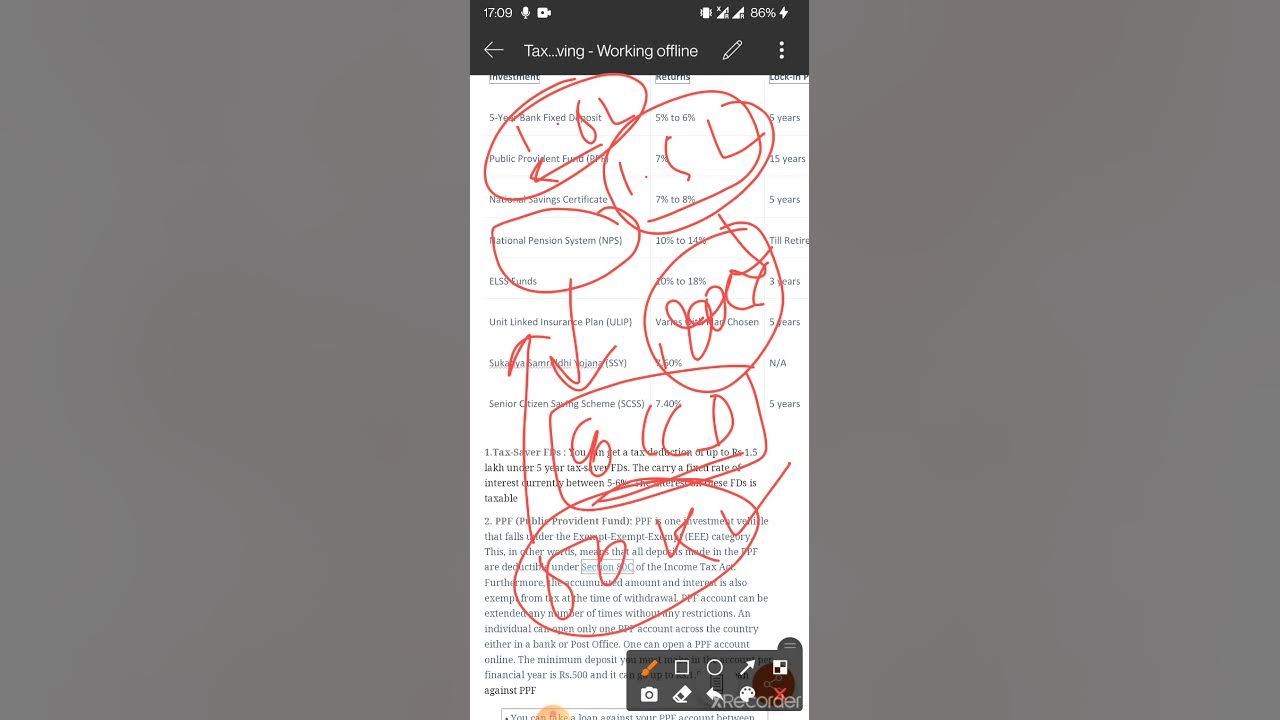

Tax Saving Plan In come Tax Rebate Investment ELSS PPF NPS

https://i.ytimg.com/vi/RtMJmT7wNMo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHiAYAC4AOKAgwIABABGFsgWyhbMA8=&rs=AOn4CLDu_QgggKXtss6SIZDN3uuxmdgInA

PPF Still The Best Among Tax exempt Instruments Rediff Business

http://im.rediff.com/money/2014/aug/11pf.jpg

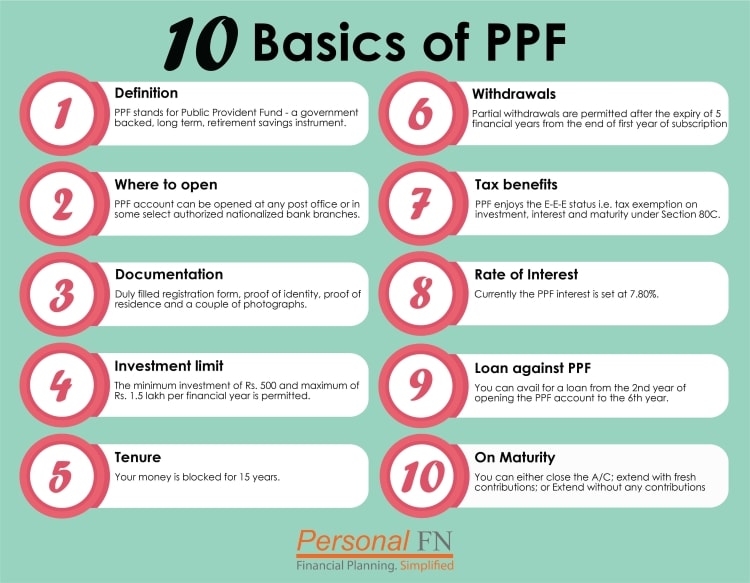

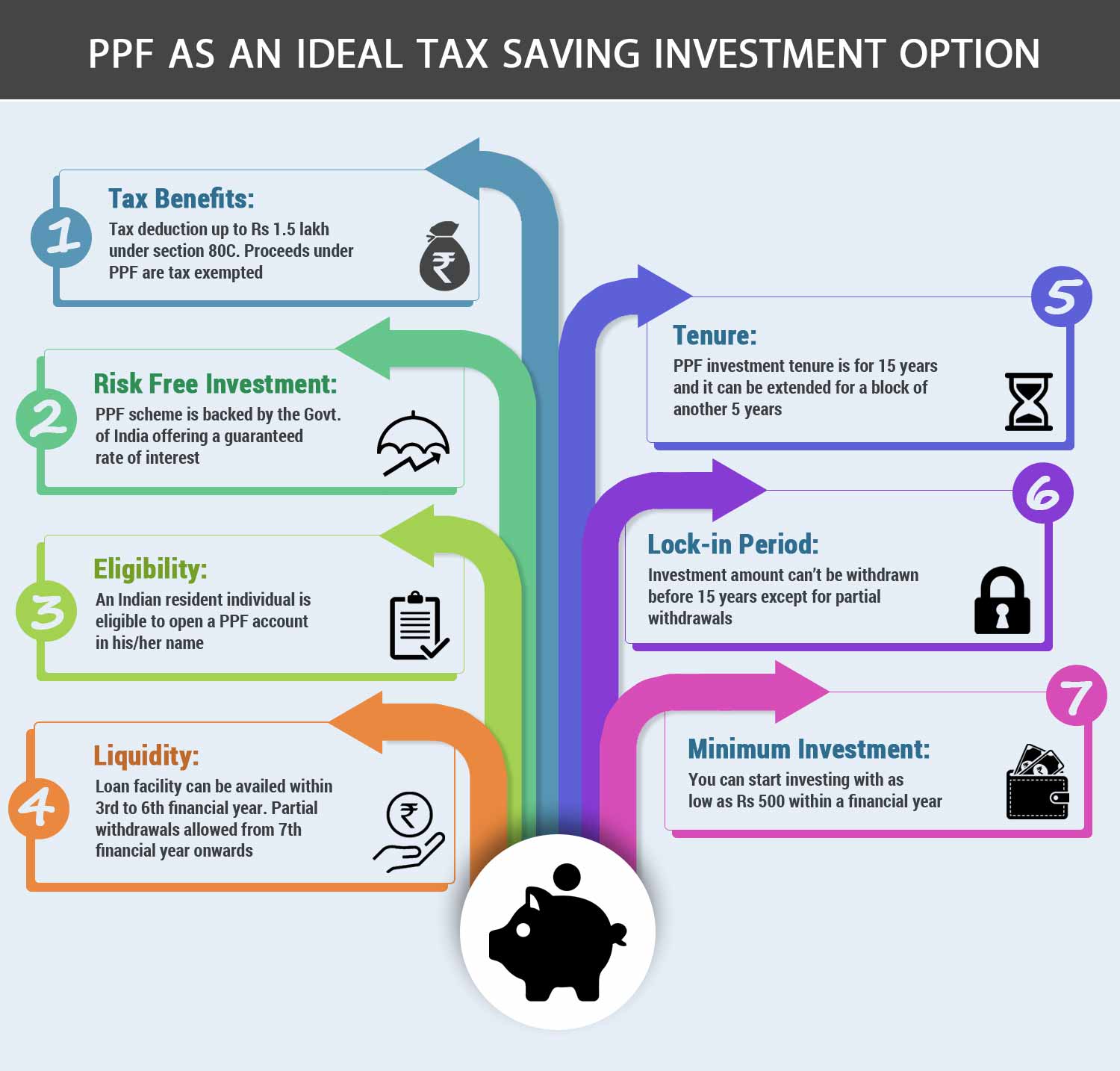

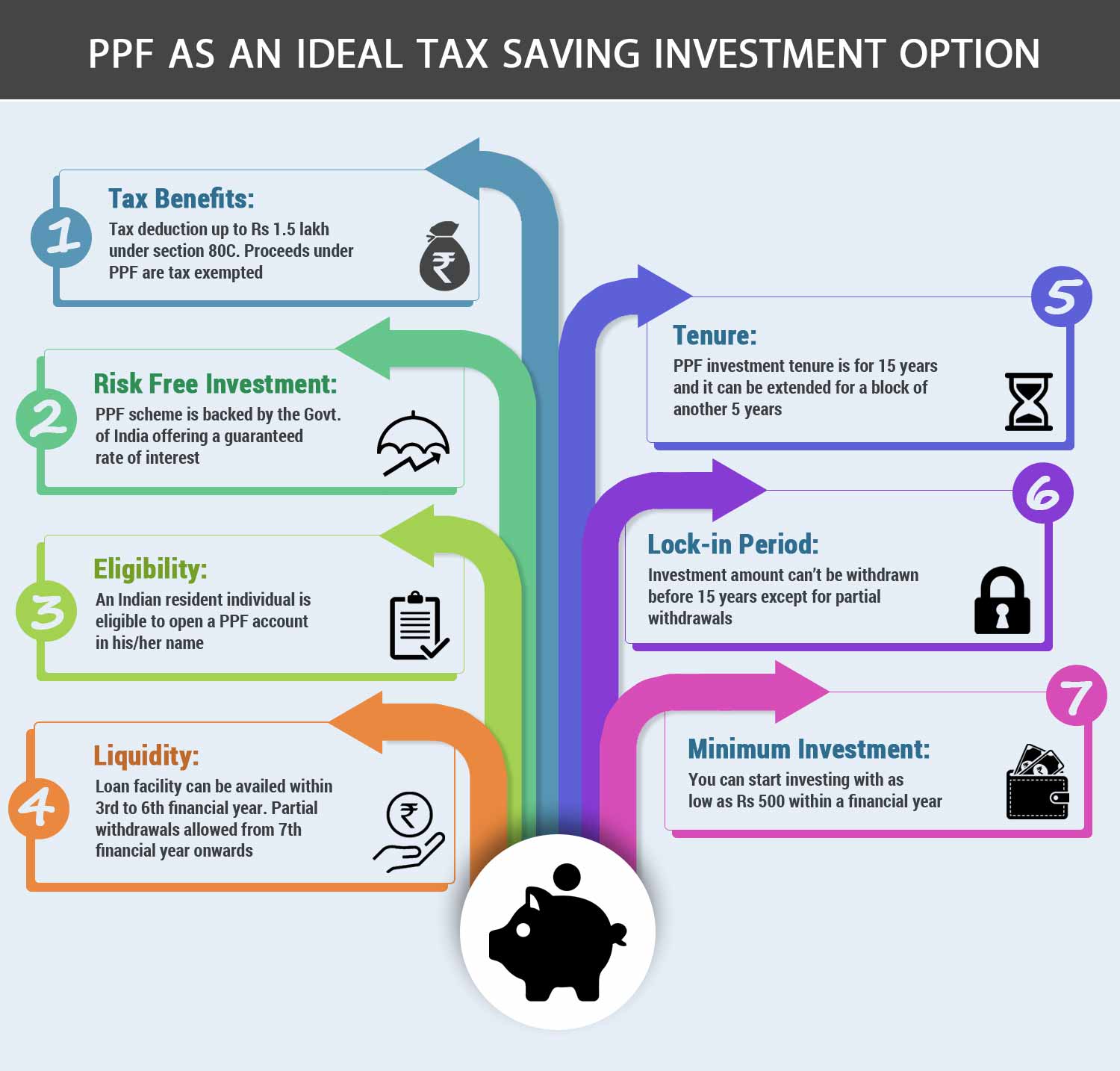

Web Principal Amount A minimum of Rs 500 and a maximum of Rs 1 5 Lakh can be invested in a provident fund scheme annually This investment can be undertaken on a lump sum or Web 46 lignes nbsp 0183 32 PPF account offers EEE Exempt Exempt Exempt tax benefit to the investors which means that All the contributions made maximum upto Rs 1 5 lakhs each financial

Web PPF stands for Public Provident Fund Its features like guaranteed return tax exemption as well as tax free interest makes it the most popular investment among the risk averse Web 21 juil 2023 nbsp 0183 32 PPF Deposit Rebate Detailed Guide Provident Fund Do Both Online and Offline PPF Deposits Qualify for Rebates in Income Tax Staff Desk Jul 21 2023 349 6

Download Ppf Tax Rebate

More picture related to Ppf Tax Rebate

PPF Tax Exemption What Does It Mean Investment Simplified

https://www.investmentsimplified.in/wp-content/uploads/2022/08/shutterstock_1398995054-1024x683.jpg

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

https://1.bp.blogspot.com/-o016DqAIxCU/XsexiCnc3pI/AAAAAAAAdQo/ALxBcu7gUBg43xnqLbhGB99p9xeqjBUfgCLcBGAsYHQ/s1600/PPF%2BFeatures.jpg

PPF Mistakes That Can Lead To Closure Of PPF Account No Interest On

https://i.ytimg.com/vi/Ruk46OfkEz0/maxresdefault.jpg

Web Tax benefits of PPF Contributions made annually to your PPF account will be expect from tax As of 2015 16 the amount that can be claimed is Rs 150 000 However the entire Web 19 juil 2018 nbsp 0183 32 1 Where You can open a PPF Account and How 2 Who can and who cannot not open PPF Account 3 You can have only one PPF account in your name 5 Minimum and maximum deposit limit for PPF 6

Web Il y a 1 jour nbsp 0183 32 However after five years the account holder has two options a partial fund withdrawal or premature account closure and full withdrawal Partial Withdrawal After Web ItAbout the video Public Provident Fund PPF falls under EEE Exempt Exempt Exempt tax busket PPF accounts are eligible for Tax benefits under section

2 In 1 Savings And Investment In PNB PPF Account Know Benefits

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2022/01/05/171846-pnb-ppfpnb-twitter.jpg?itok=VlboCuBy&c=c5af8c0f92ccc8e249257bf0f1cb18e8

PPF As A Tax Saving Instrument ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/ppf-as-tax-saving-instrument.jpg

https://www.financialexpress.com/money/ppf-tax-benefits-features-and...

Web 26 juin 2018 nbsp 0183 32 The current PPF interest rate is 7 6 tax free If a person is in the 30 tax bracket and is earning 11 interest from any other source the after tax interest rate

https://www.livemint.com/budget/expectations/income-tax-rebate-to-ppf...

Web 1 f 233 vr 2022 nbsp 0183 32 Income tax rebate to PPF top 5 budget 2022 announcements expected 2 min read 01 Feb 2022 08 45 AM IST Asit Manohar Budget 2022 expectations Income

EPF PPF Or NPS Withdrawals Partial Full Latest Taxation Rules

2 In 1 Savings And Investment In PNB PPF Account Know Benefits

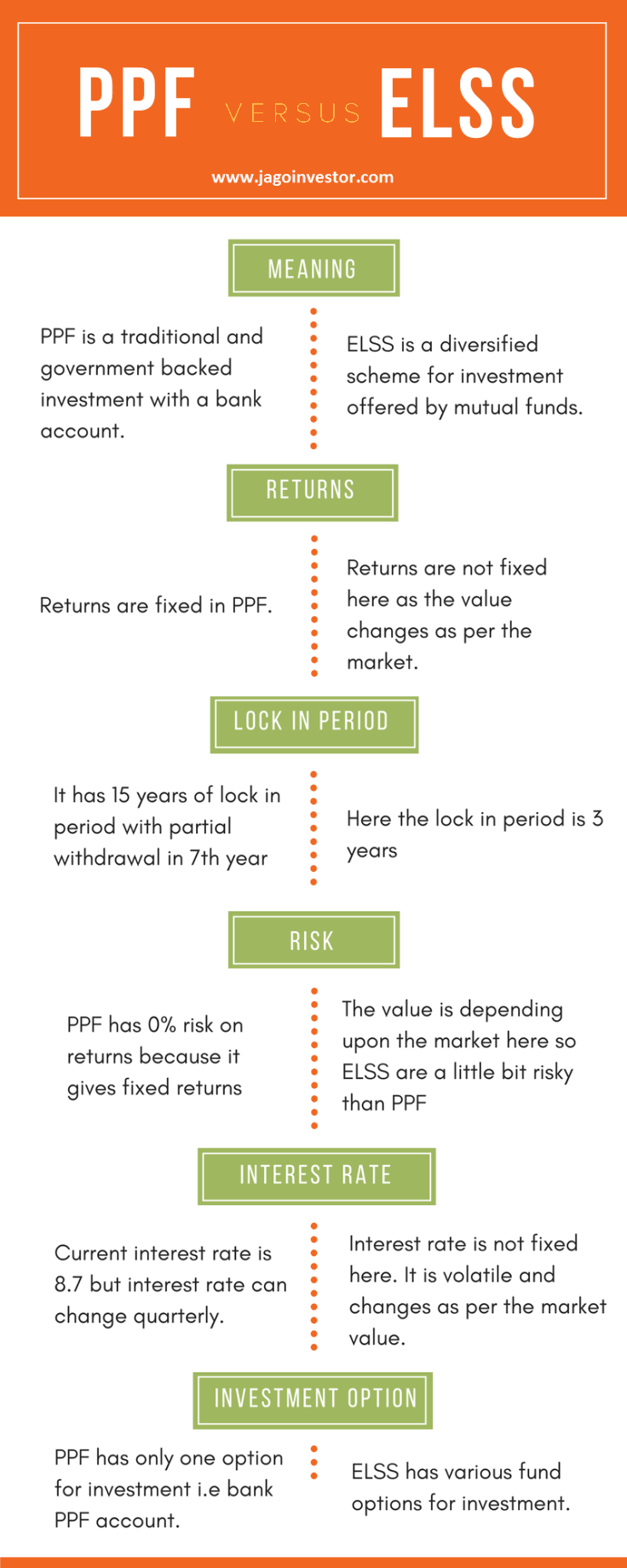

Is It Better To Invest In ELSS Than PPF Considering A Long Term

PPF Account Interest Rate PPF Account Gives Rs 28 Lakhs At The End

All You Need To Know About PPF

PPF As A Tax Saving Instrument ComparePolicy

PPF As A Tax Saving Instrument ComparePolicy

PPF Vs ELSS Where Should We Invest For Tax Saving

Public Provident Fund PPF Reference Guide Insurance Funda

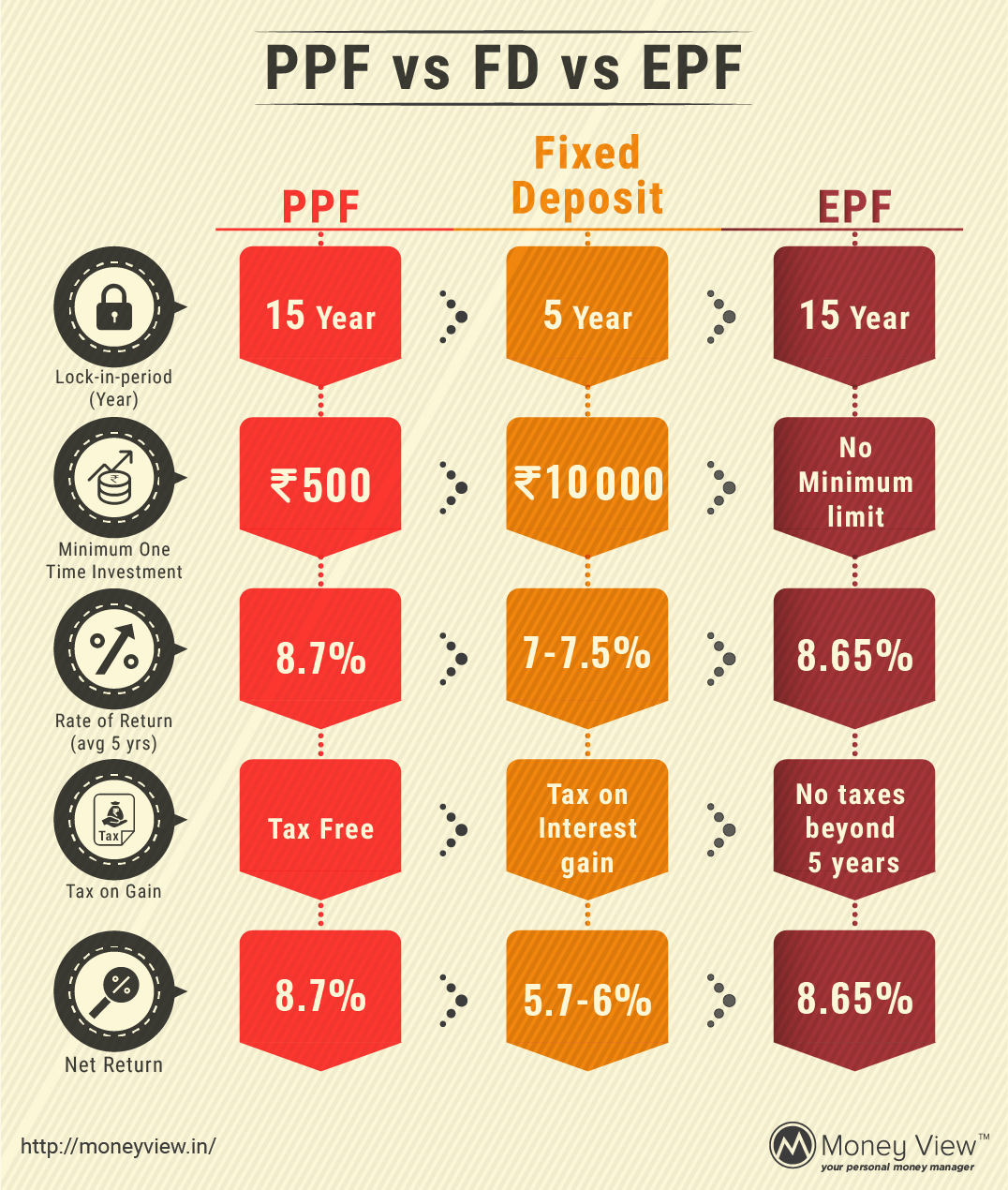

PPF EPF Or FD Which Is Better For Tax Planning Money View Loans

Ppf Tax Rebate - Web 21 juil 2023 nbsp 0183 32 PPF Deposit Rebate Detailed Guide Provident Fund Do Both Online and Offline PPF Deposits Qualify for Rebates in Income Tax Staff Desk Jul 21 2023 349 6