Professional Tax Return Due Date For Company Maharashtra Professional Tax Payment Due Date In Maharashtra the date of enrolment determines the due date of professional tax payments For instance

Karnataka Professional Tax Know about tax slabs payment procedures applicability criteria due dates and exemptions Whether you are working in a private Government of Karnataka Commercial Taxes Department For more information please see the videos provided

Professional Tax Return Due Date For Company

Professional Tax Return Due Date For Company

https://pbs.twimg.com/media/FXhKfnhUUAAxG68.jpg:large

Tax Statutory Compliance Calendar For The Month Of March 2023

https://ebizfiling.com/wp-content/uploads/2023/03/March__4_.png

File Your Income Tax Return Now For AY 2023 24 Only 28 Days Left

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

Profession Tax Directorate of Commercial Taxes Government of West Bengal Return e Payment My Payment Status PTPC You are visitor 30267039 since 24 03 16 You need your accounts and tax return to meet deadlines for filing with Companies House and HM Revenue and Customs HMRC You can also use them to work out how much

The filing deadline for Form 1120 is typically on the 15th day of the fourth month after the end of a corporation s fiscal tax year For example if a corporation operates on a The return shall be accompanied by a treasury challan DD Cheque e payment in proof of payment of the full amount of tax due on or before 10th day of month succeeding the

Download Professional Tax Return Due Date For Company

More picture related to Professional Tax Return Due Date For Company

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

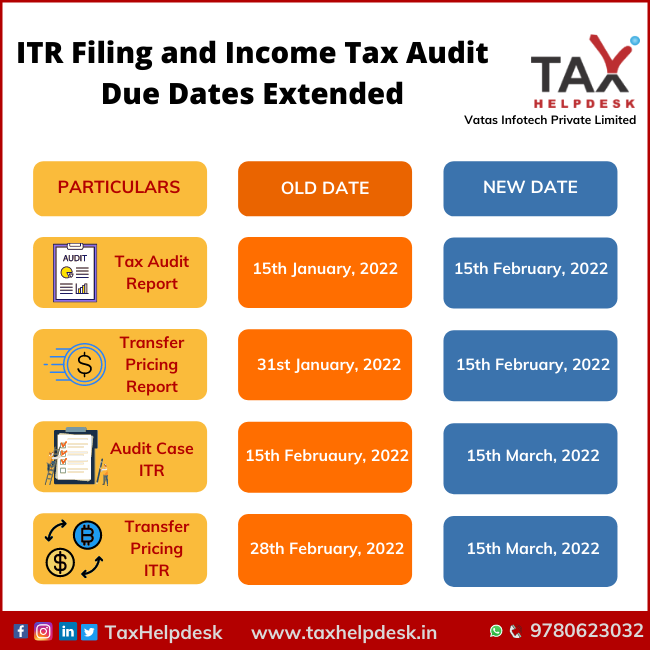

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/01/ITR-Filing-and-Income-Tax-Audit-Due-Dates-Extended.png

Income Tax Return Due Date Last Date 2021 ITR Filing Online Payment

https://static.india.com/wp-content/uploads/2021/12/Income-Tax-Return-ITR-Filing-News.jpg

Stay compliant with Maharashtras Profession Tax Rules effective from 01 04 2023 onwards Learn about the analysis of Rule 11 including returns payments and due dates Explore the details of Form Sir Keir Starmer is expected to announce at least 35 new bills in the King s Speech including on planning reform and rail nationalisation The speech read by the

If you pay after the due date you are charged 10 extra on professional tax as a penalty We know it s not easy to calculate taxes when there are many deductions According to Income Tax rules 128 9 it is imperative to submit Form 67 by the conclusion of the assessment year prior to filing the Original Return under section

Estate Income Tax Return Due Date 2021 Anibal Greenlee

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

https://cleartax.in/s/professional-tax-maharashtra

Maharashtra Professional Tax Payment Due Date In Maharashtra the date of enrolment determines the due date of professional tax payments For instance

https://cleartax.in/s/professional-tax-karnataka

Karnataka Professional Tax Know about tax slabs payment procedures applicability criteria due dates and exemptions Whether you are working in a private

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Estate Income Tax Return Due Date 2021 Anibal Greenlee

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Income Tax Returns Filing Due Dates Extended Ebizfiling

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Due dates For Filing Income Tax Returns InstaFiling

Due dates For Filing Income Tax Returns InstaFiling

File Your Income Tax Return By 31st July Ebizfiling

Four Days To ITR 2021 22 Filing Deadline Don t Forget To E verify Your

MRAZ TAX Tax Return Preparation Individuals And Small Business

Professional Tax Return Due Date For Company - Profession Tax Directorate of Commercial Taxes Government of West Bengal Return e Payment My Payment Status PTPC You are visitor 30267039 since 24 03 16