Property Tax Credit Illinois The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

Properties of religious charitable and educational organizations as well as units of federal state and local governments are eligible for exemption from property taxes to the extent provided by law Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including

Property Tax Credit Illinois

Property Tax Credit Illinois

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300

To offset a portion of the financial struggle taxpayers face small rebates can be claimed The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue

Download Property Tax Credit Illinois

More picture related to Property Tax Credit Illinois

Tax Credit Scholarship Oklahoma City OK

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100061266284369

Municipal Property Tax Niles IL Official Website

https://www.vniles.com/ImageRepository/Document?documentId=13871

Democratic Plan Would Close Tax Break On Exchange traded Funds

https://image.cnbcfm.com/api/v1/image/106893978-16231756852021-06-08t180456z_448255199_rc2cwn98an38_rtrmadp_0_usa-tax.jpeg?v=1676577042&w=1920&h=1080

Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before In Cook County this exemption is worth an 8 000 reduction on your home s EAV The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue

The property tax credit is available to residents who paid taxes on their main home that was located in Illinois for the time you owned and lived in the home Nonresidents of Illinois may not take this credit The Illinois Property Tax Credit is a credit on your individual income Prorated property tax you paid in the year you sold your tax return Form IL 1040 equal to 5 percent of Illinois Property Tax Illinois residence

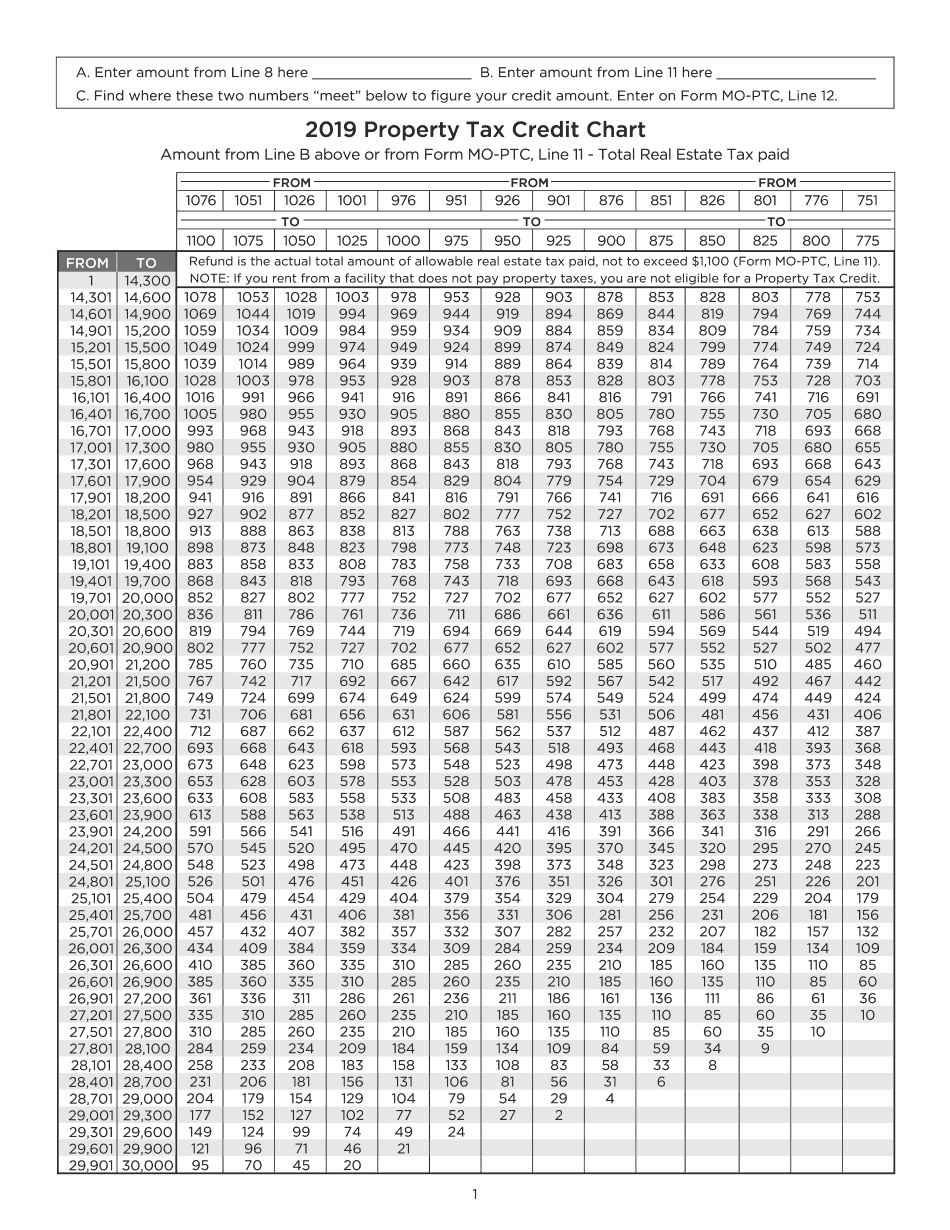

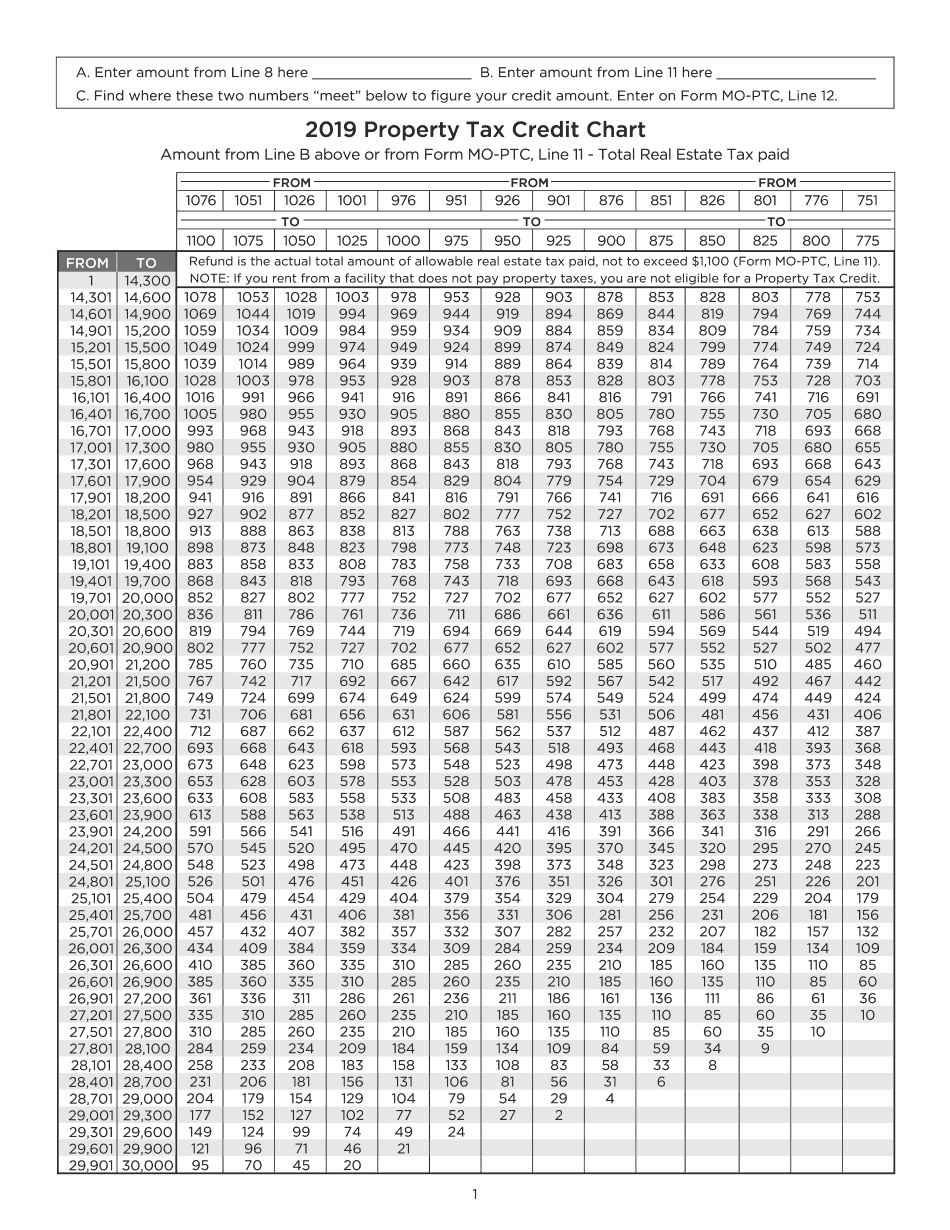

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

https://www.pdffiller.com/preview/491/866/491866144/big.png

House Lawmakers Scrutinize Pandemic era Employee Retention Tax Credit

https://image.cnbcfm.com/api/v1/image/107195083-16764793852023-02-15t162831z_138184697_rc2rbz9lix8g_rtrmadp_0_usa-congress-irs.jpeg?v=1690722001&w=1920&h=1080

https://tax.illinois.gov/content/dam/soi/en/web/...

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

https://tax.illinois.gov/localgovernments/property/taxrelief

Properties of religious charitable and educational organizations as well as units of federal state and local governments are eligible for exemption from property taxes to the extent provided by law

Property Tax Appeal Math And Supporting Documentation Page Design Web

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

Property Tax In Kakinada Online Payment Rates

How To Negotiate The Value Of Your Property To Help Reduce Your Tax

Navigating Texas Property Tax Rendition Leveraging Fair Market Value

Property Tax Increase Is Cause For Concern In DeKalb County

Property Tax Increase Is Cause For Concern In DeKalb County

Apply To Get A Property Tax Credit From The State Of ND

Commercial Properties Accurate Property Tax Inc

10 Tips To Reduce Tax On Property TaxLeopard

Property Tax Credit Illinois - To offset a portion of the financial struggle taxpayers face small rebates can be claimed The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a