Property Tax Homestead Exemption Tennessee Property tax exemptions are addressed in the Tennessee Code in Title 67 Chapter 5 The code defines the types of property that may qualify for tax exemption and establishes the

WHAT IS PROPERTY TAX RELIEF Tennessee state law provides for property tax relief for low income elderly and disabled homeowners as well as disabled veteran homeowners or their In Tennessee an individual homeowner can claim a homestead exemption up to 35 000 A married couple can claim a homestead exemption up to 52 500 The homestead

Property Tax Homestead Exemption Tennessee

Property Tax Homestead Exemption Tennessee

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

New Homestead Exemption Law Benefits Residential Purchasers

https://www.texasrealestate.com/wp-content/uploads/subdivision640x390.jpg

Homestead Property Tax Exemption YouTube

https://i.ytimg.com/vi/hDuzxw2wxWY/maxresdefault.jpg

Beginning January 2022 the homestead exemption for Tennessee will be simplified and increased The exemptions will be more of a one size fits all No longer will a homeowner have to have minor children The report provides a brief history of the homestead exemption in Tennessee compares the homestead exemptions of all states and examines the homestead exemption in the context of

Tennessee s homestead exemption permits homeowners to gain a reimbursement amount of up to 5 000 on their next tax return for their main residence Tennessee has one of the lowest homestead exemptions Tennessee s property tax relief program and property tax freeze offer financial assistance to eligible homeowners struggling to pay property taxes The state funds this program and successful applicants receive

Download Property Tax Homestead Exemption Tennessee

More picture related to Property Tax Homestead Exemption Tennessee

Qualifying Trusts For Property Tax Homestead Exemption Sprouse

https://www.sprouselaw.com/wp-content/uploads/2022/05/BAC-Tax-Home-Exemption-2022.5.png

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

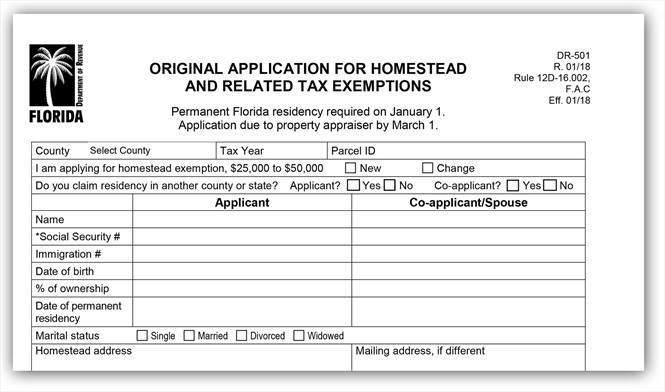

Florida Property Tax Homestead Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/what-documents-do-you-need-to-file-for-homestead-exemption-in-florida.jpg

An individual whether a head of family or not shall be entitled to a homestead exemption upon real property which is owned by the individual and used by the individual or the individual s The State of Tennessee offers a property tax rebate application for certain homeowners age 65 or older and whose total combined annual income from all sources for all owners including

The purpose of this manual is to educate the reader about property tax exemptions in Tennessee and inform taxpayers and government officials how property tax exemption decisions are Property tax relief is a payment made by the State of Tennessee to reimburse homeowners who qualify for the program To receive reimbursement you must pay all property taxes listed on

Rezone Paves Way For North Road Office Building City Of Snellville GA

https://www.snellville.org/sites/default/files/uploads/press-releases/3.1.22-north-road.JPG

Snellville s Senior Center May Be Closed But That s Not Stopping The

https://www.snellville.org/sites/default/files/uploads/press-releases/6.19.20-exercizing-seniors.jpg

https://comptroller.tn.gov/content/dam/cot/sboe/...

Property tax exemptions are addressed in the Tennessee Code in Title 67 Chapter 5 The code defines the types of property that may qualify for tax exemption and establishes the

https://comptroller.tn.gov/.../TaxReliefBrochure.pdf

WHAT IS PROPERTY TAX RELIEF Tennessee state law provides for property tax relief for low income elderly and disabled homeowners as well as disabled veteran homeowners or their

Snellville Named Tree City USA For 21st Consecutive Year By Arbor Day

Rezone Paves Way For North Road Office Building City Of Snellville GA

How Do You File For Homestead Exemption In Tennessee

Matthew Pepper Named Assistant City Manager For Snellville City Of

Homemade Treatment For Dog Lice Homemade Ftempo

Briscoe Park based Tennis Teams Is Finalist In Tourney City Of

Briscoe Park based Tennis Teams Is Finalist In Tourney City Of

Gwinnett Tech Offering Classes At Snellville City Hall City Of

Sept 11 Memorial Unveiled At City Hall City Of Snellville GA

City Officials Still Looking For Input On T W Briscoe Park Master Plan

Property Tax Homestead Exemption Tennessee - Tennessee s homestead exemption permits homeowners to gain a reimbursement amount of up to 5 000 on their next tax return for their main residence Tennessee has one of the lowest homestead exemptions