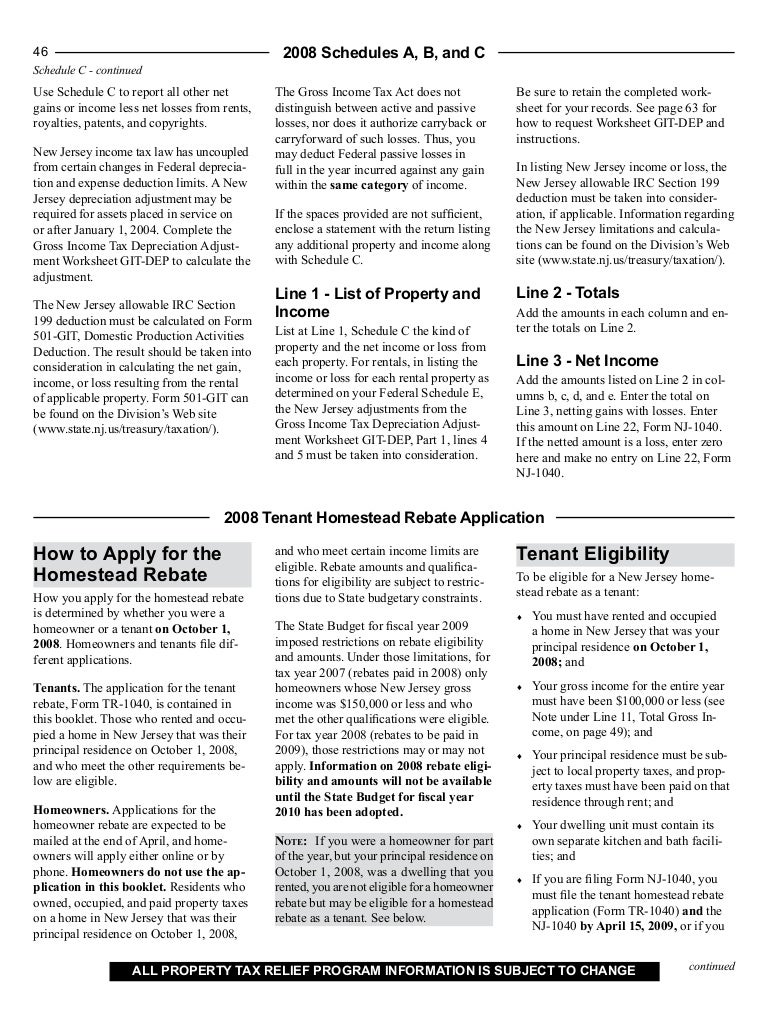

Property Tax Homestead Rebate Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The

Web 18 juil 2022 nbsp 0183 32 In late June with the June 30 budget adoption deadline approaching the governor announced an expansion of the ANCHOR program proposal with tax rebates of Web Property Tax Relief Programs ANCHOR Program Homeowners File Online Paper Application for Homeowners How Benefits are Calculated Check Benefit Status

Property Tax Homestead Rebate

Property Tax Homestead Rebate

https://data.formsbank.com/pdf_docs_html/172/1728/172895/page_1_thumb_big.png

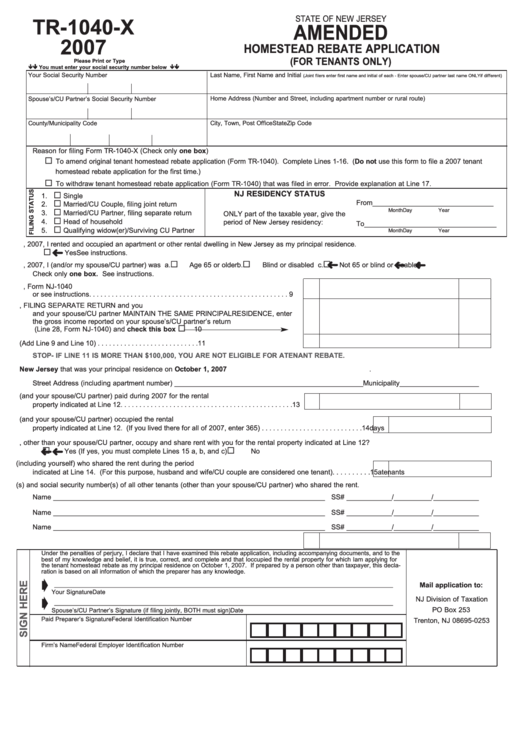

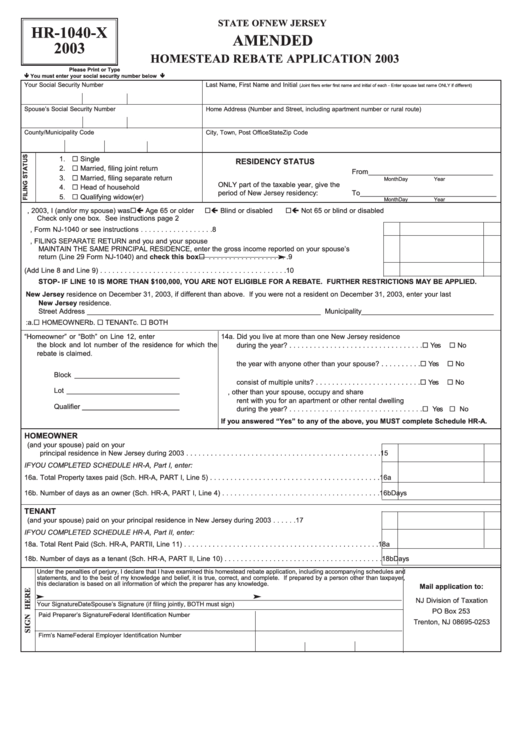

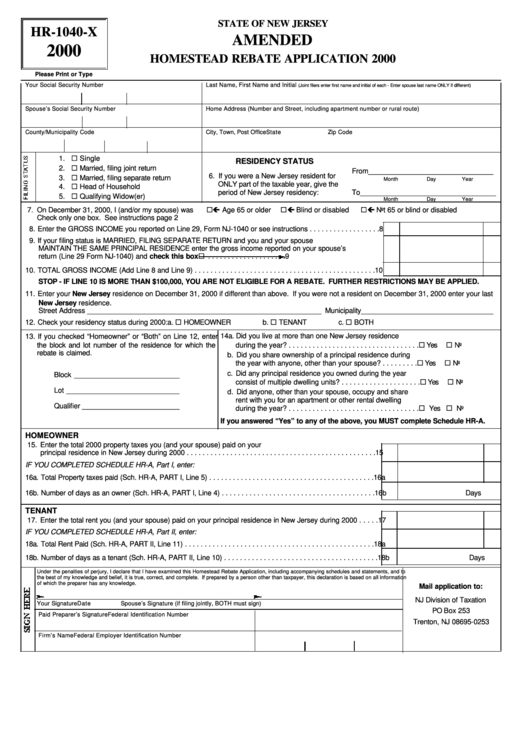

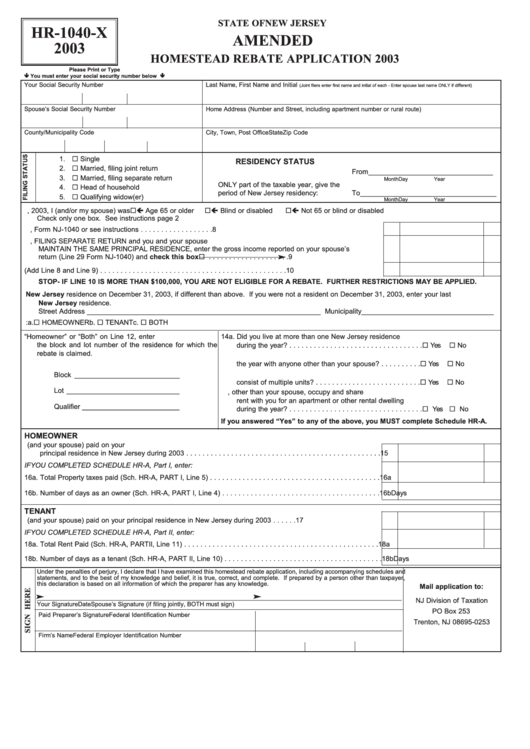

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2003

https://data.formsbank.com/pdf_docs_html/347/3478/347855/page_1_thumb_big.png

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

Web 27 sept 2021 nbsp 0183 32 Your income must be 150 000 or less for homeowners age 65 or over or blind or disabled or 75 000 or less for homeowners under age 65 and not blind Web 3 mars 2022 nbsp 0183 32 Under the ANCHOR Property Tax Relief Program homeowners making up to 250 000 per year are eligible to receive an average 700 rebate in FY2023 to offset

Web 28 mars 2022 nbsp 0183 32 We automatically receive a Homestead Rebate application in the mail every year and we do file for the rebate and receive it But how does the state know to include Web 22 sept 2021 nbsp 0183 32 Homeowners making up to 75 000 annually are eligible for Homestead benefits as are seniors and disabled homeowners who make up to 150 000 annually

Download Property Tax Homestead Rebate

More picture related to Property Tax Homestead Rebate

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

https://www.propertyrebate.net/wp-content/uploads/2023/05/form-hr-1040-sample-homestead-rebate-application-2000-printable-pdf-1.png

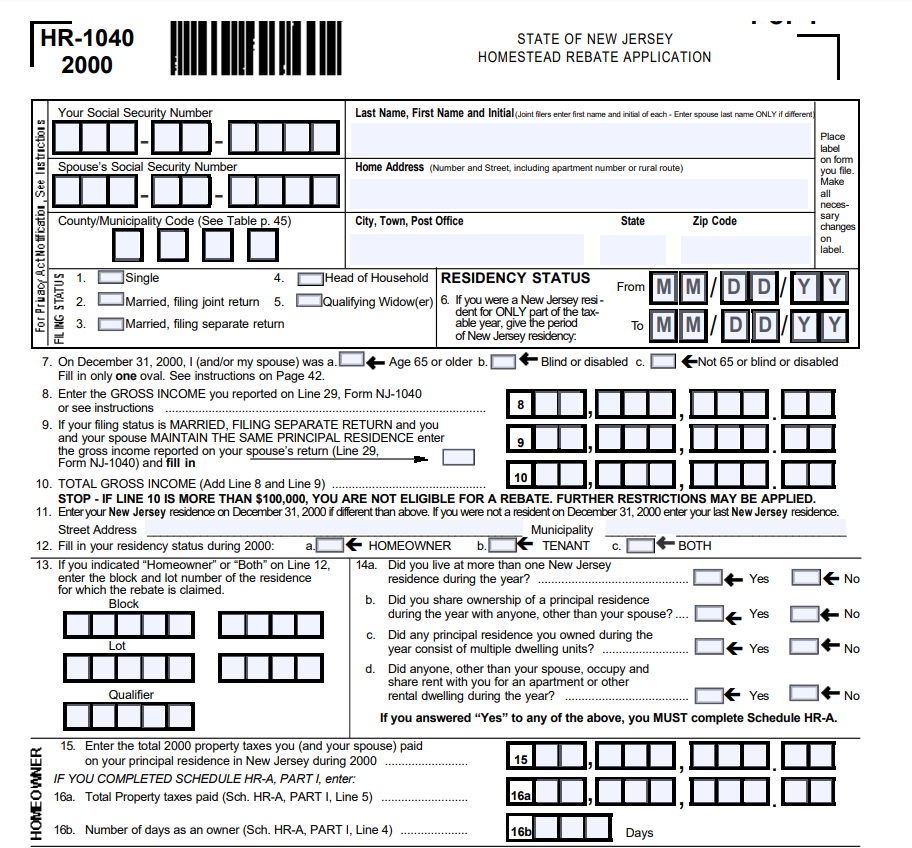

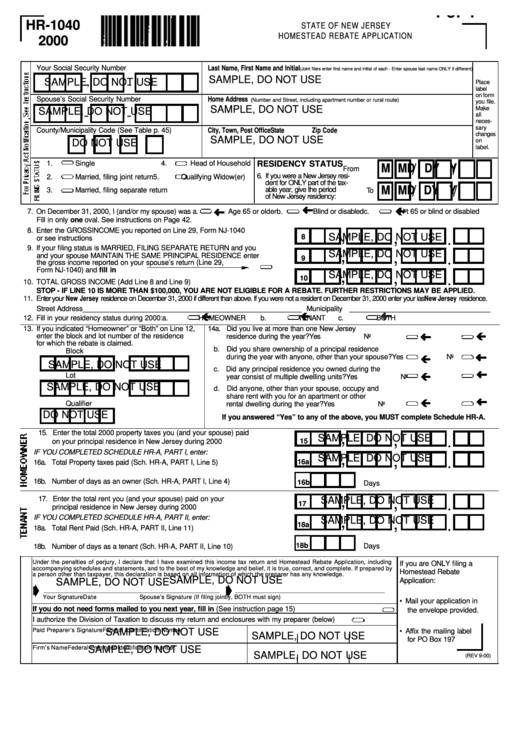

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

https://data.formsbank.com/pdf_docs_html/317/3170/317062/page_1_thumb_big.png

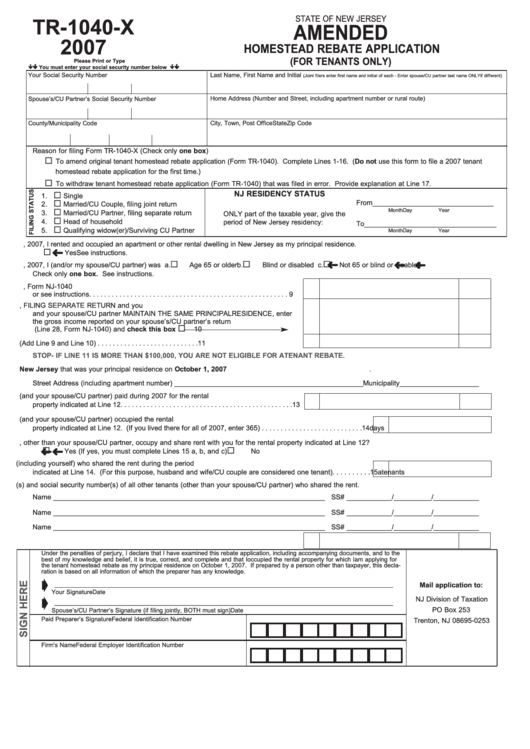

Homestead Rebate Nj For Renters RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2022/10/ppt-new-jersey-property-tax-relief-programs-powerpoint-presentation-1.jpg

Web 17 f 233 vr 2023 nbsp 0183 32 The deadline to apply is February 28 2023 Affordable New Jersey Communities for Homeowners and Renters ANCHOR replaces the Homestead Web Homestead Benefit Status NJ Taxation ANCHOR Benefit or Homestead Benefit Status Inquiry Electronic Services The inquiry system will tell you if your application is in

Web 18 nov 2020 nbsp 0183 32 The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to Web The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one

South Jersey Seniors Stressed About Homestead Property Tax Rebate Delay

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/south-jersey-seniors-stressed-about-homestead-property-tax-rebate-delay-2.jpg?w=1280&ssl=1

NJ Tax Rebate The ANCHOR Program Formerly Homestead Rebates

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/nj-tax-rebate-the-anchor-program-formerly-homestead-rebates-2.jpg?fit=800%2C450&ssl=1

https://nj.gov/treasury/taxation/anchor/index.shtml

Web This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The

https://njmoneyhelp.com/2022/07/do-i-need-to-apply-for-the-homestead...

Web 18 juil 2022 nbsp 0183 32 In late June with the June 30 budget adoption deadline approaching the governor announced an expansion of the ANCHOR program proposal with tax rebates of

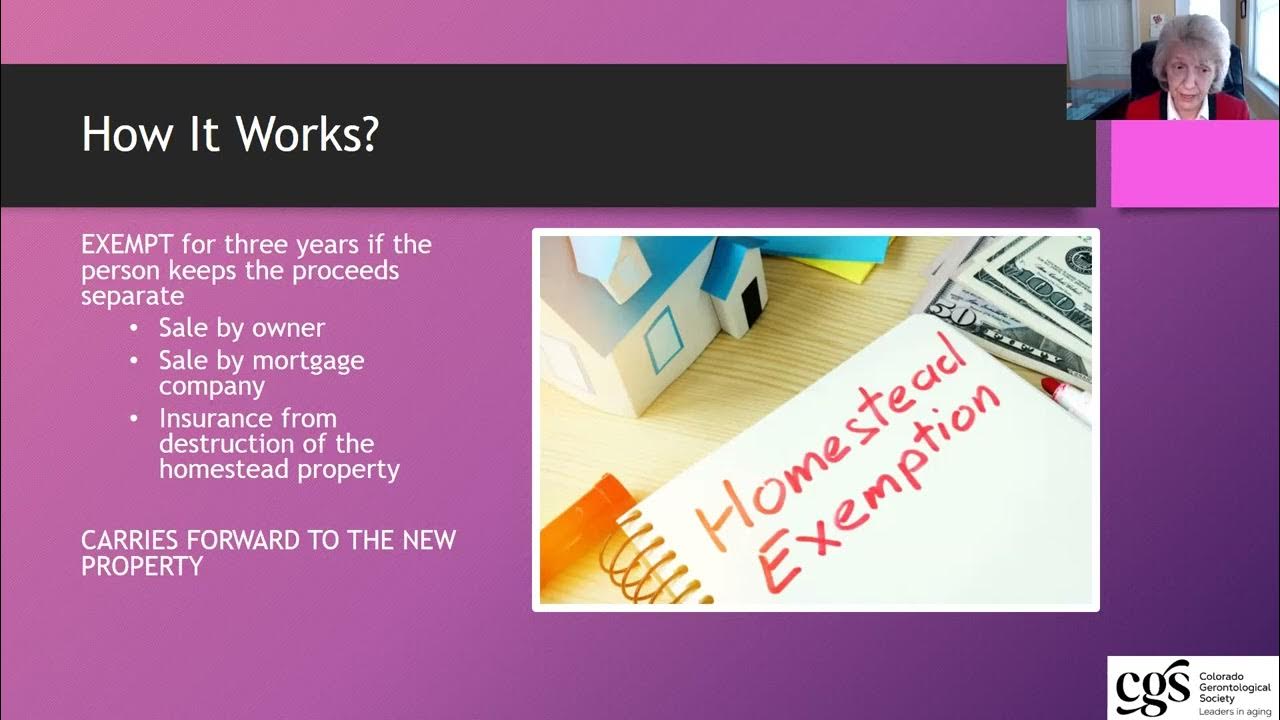

Aging In Place Property Taxes Homestead Exemptions Rebates And

South Jersey Seniors Stressed About Homestead Property Tax Rebate Delay

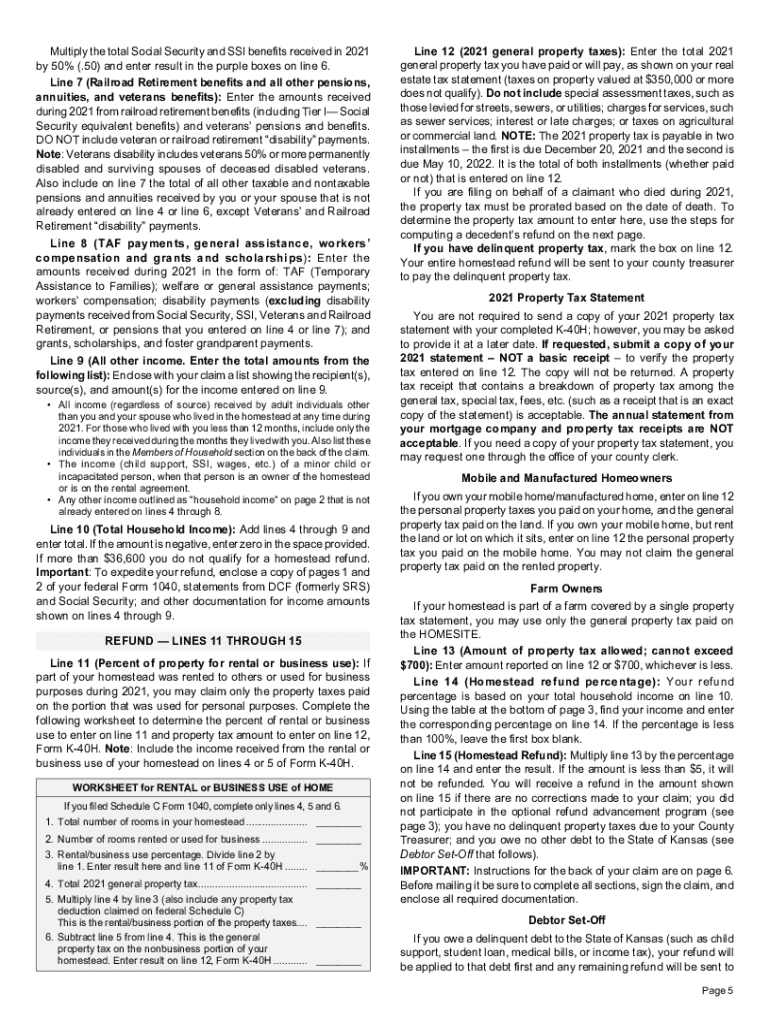

Kansas Homestead Refund Fill Out And Sign Printable PDF Template

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Nj Homestead Rebate 2023 Rebate2022

Nj Homestead Rebate 2023 Rebate2022

Fillable Form M1pr Homestead Credit Refund For Homeowners And

Homestead Rebate Application For Tenants Only

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Homestead Rebate - Web 28 mars 2022 nbsp 0183 32 We automatically receive a Homestead Rebate application in the mail every year and we do file for the rebate and receive it But how does the state know to include