Property Tax Rebates In Illinois Web 31 ao 251 t 2022 nbsp 0183 32 In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing

Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 Web 11 ao 251 t 2022 nbsp 0183 32 To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly

Property Tax Rebates In Illinois

Property Tax Rebates In Illinois

https://files.illinoispolicy.org/wp-content/uploads/2017/04/Collar-counties.png

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

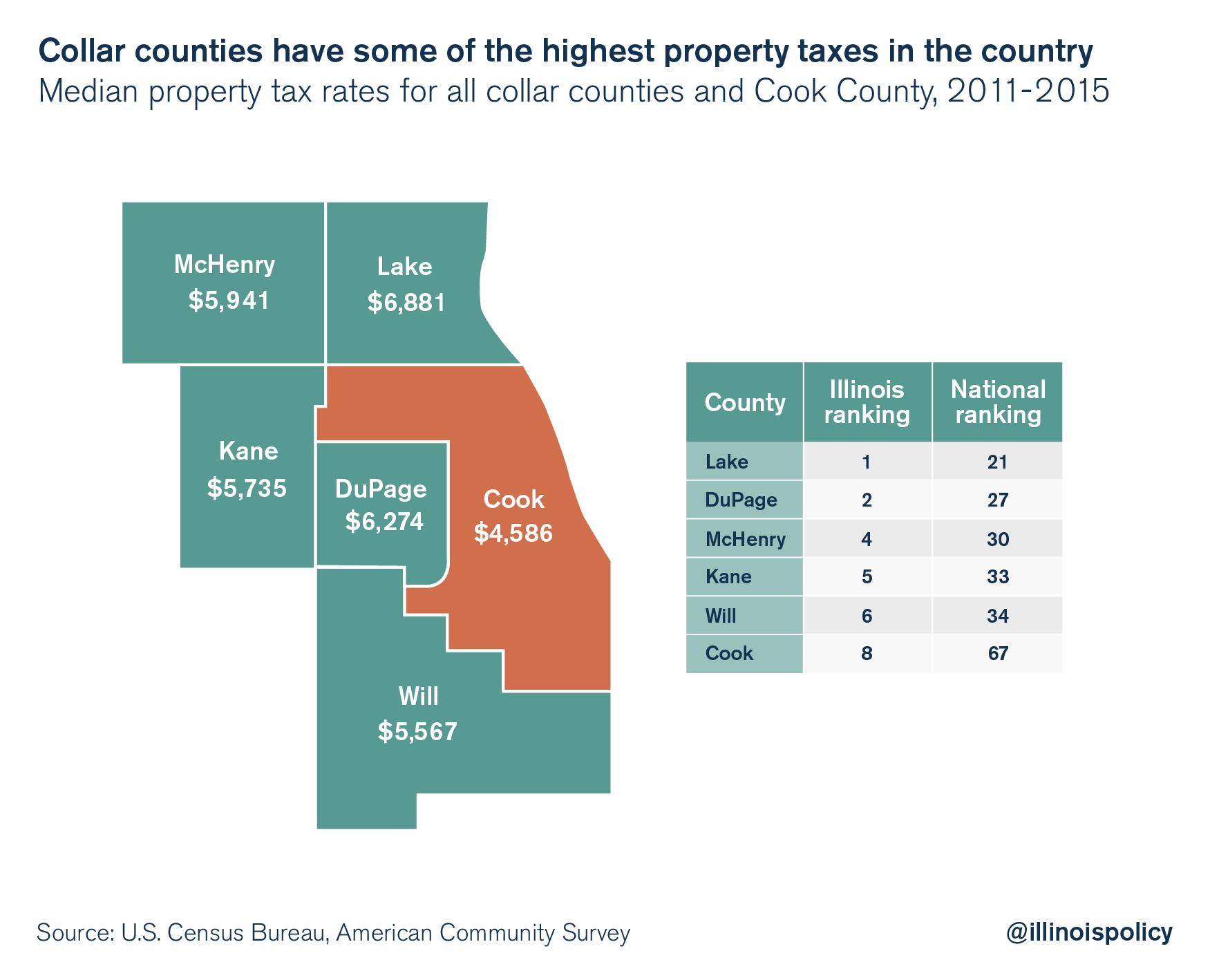

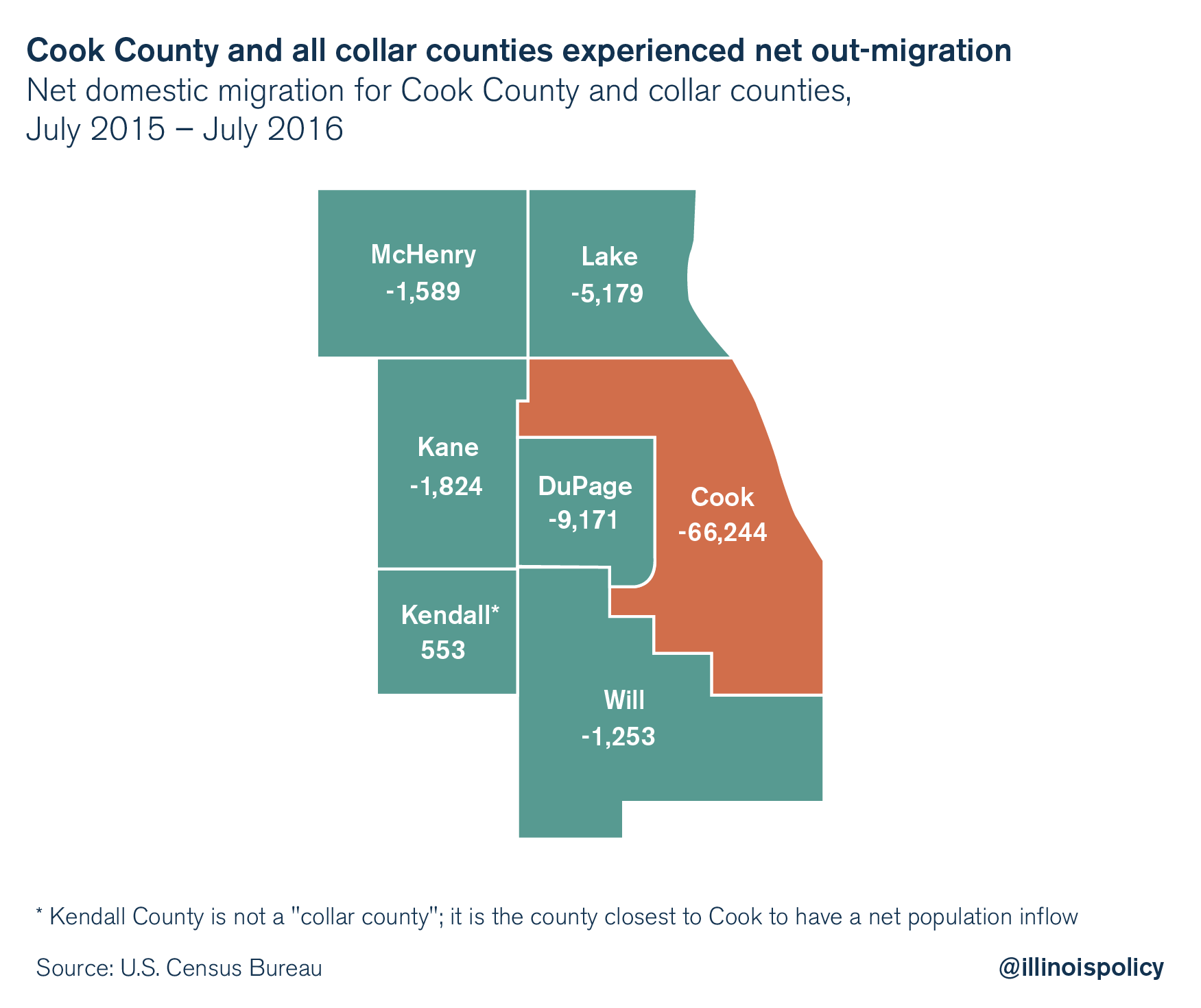

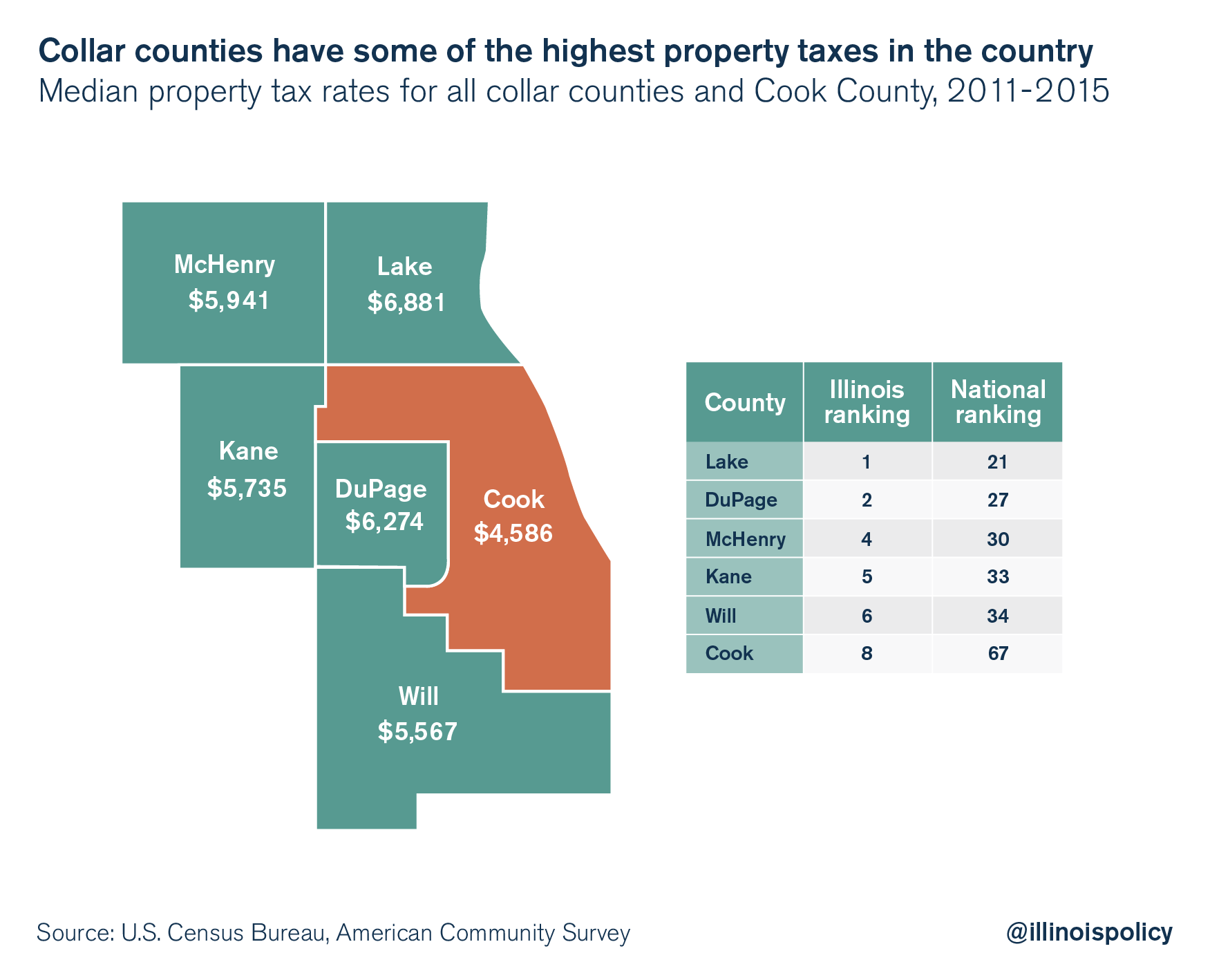

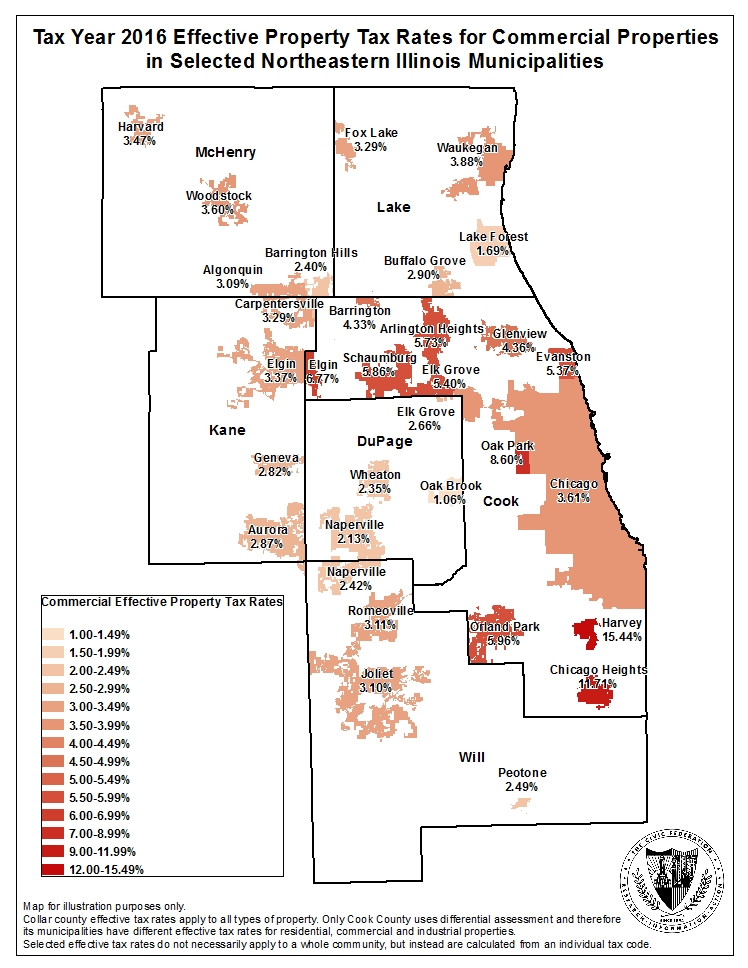

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

https://files.illinoispolicy.org/wp-content/uploads/2017/04/County_graphic-2_REV-1-1.png

Web 13 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be Web 12 sept 2022 nbsp 0183 32 About 6 million Illinois taxpayers will start to receive income and property tax rebates Monday Gov JB Pritzker said Those who made less than 200 000 in

Web 8 d 233 c 2022 nbsp 0183 32 Illinois Property Tax Rebates The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their

Download Property Tax Rebates In Illinois

More picture related to Property Tax Rebates In Illinois

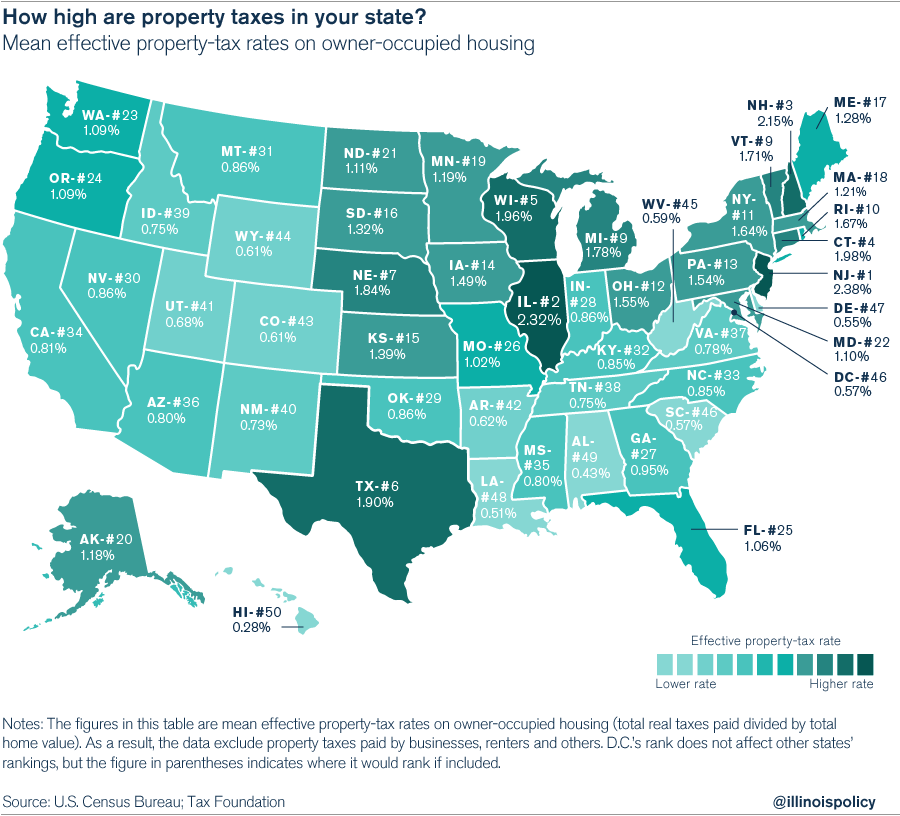

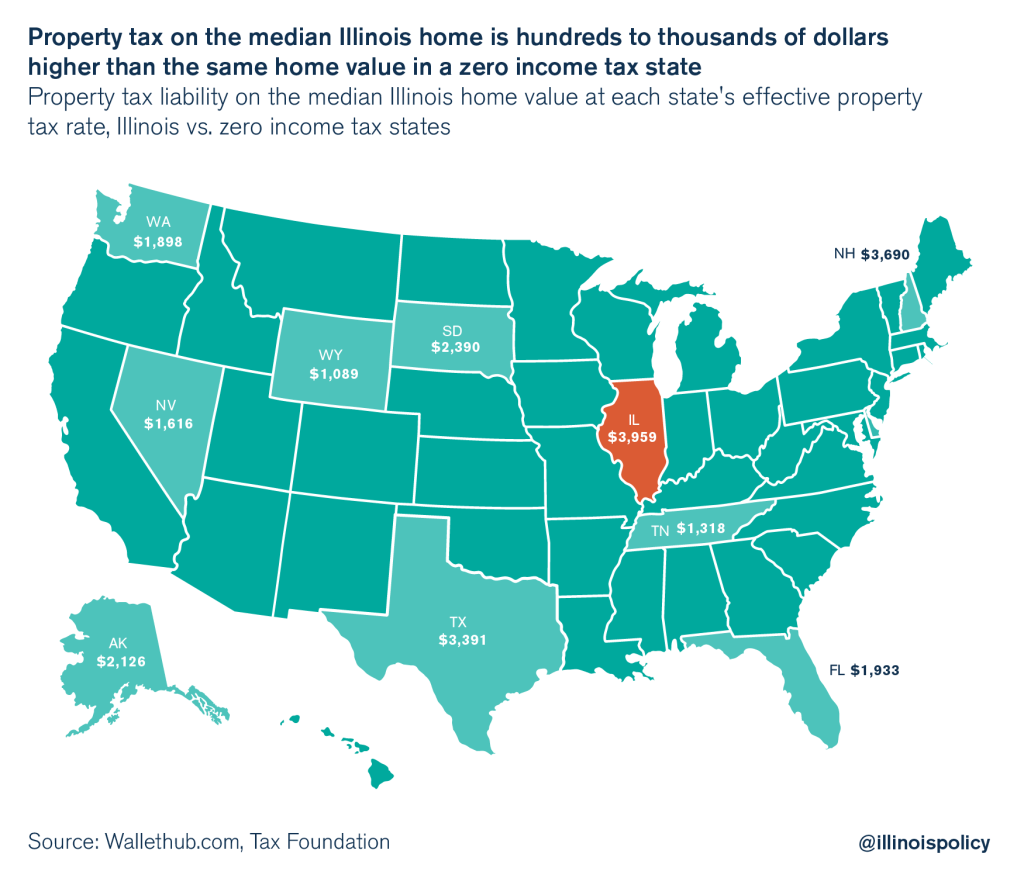

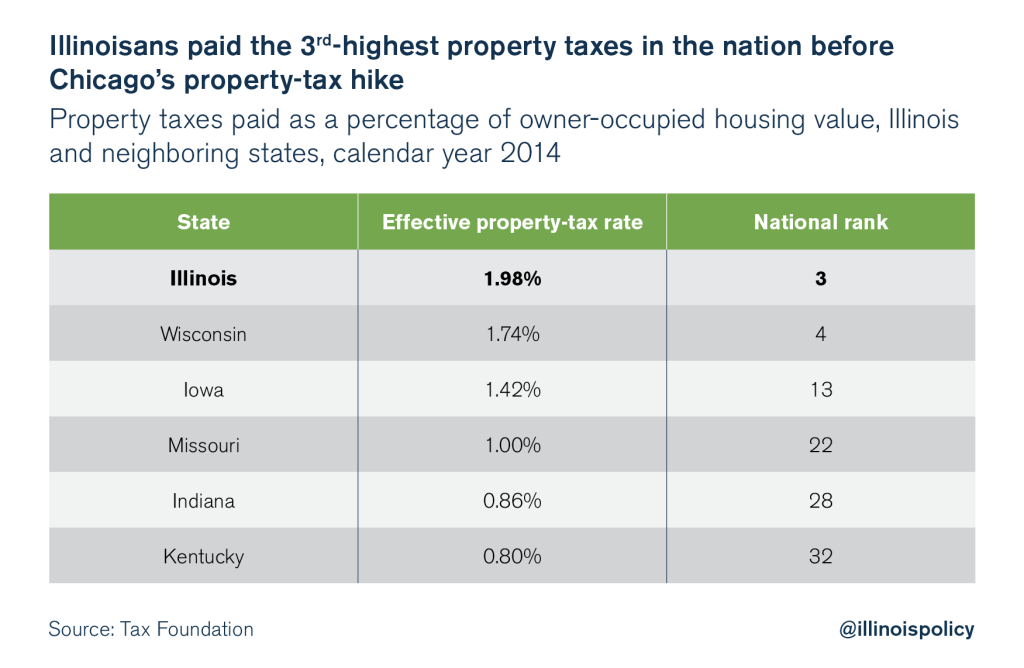

Illinois Homeowners Pay The Second highest Property Taxes In The U S

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2015/08/01_PropertyTaxes_JobsGrowth.png

DuPage County Residents Pay Some Of The Nation s Highest Property Tax Rates

https://files.illinoispolicy.org/wp-content/uploads/2019/04/property-taxes-average-01.png

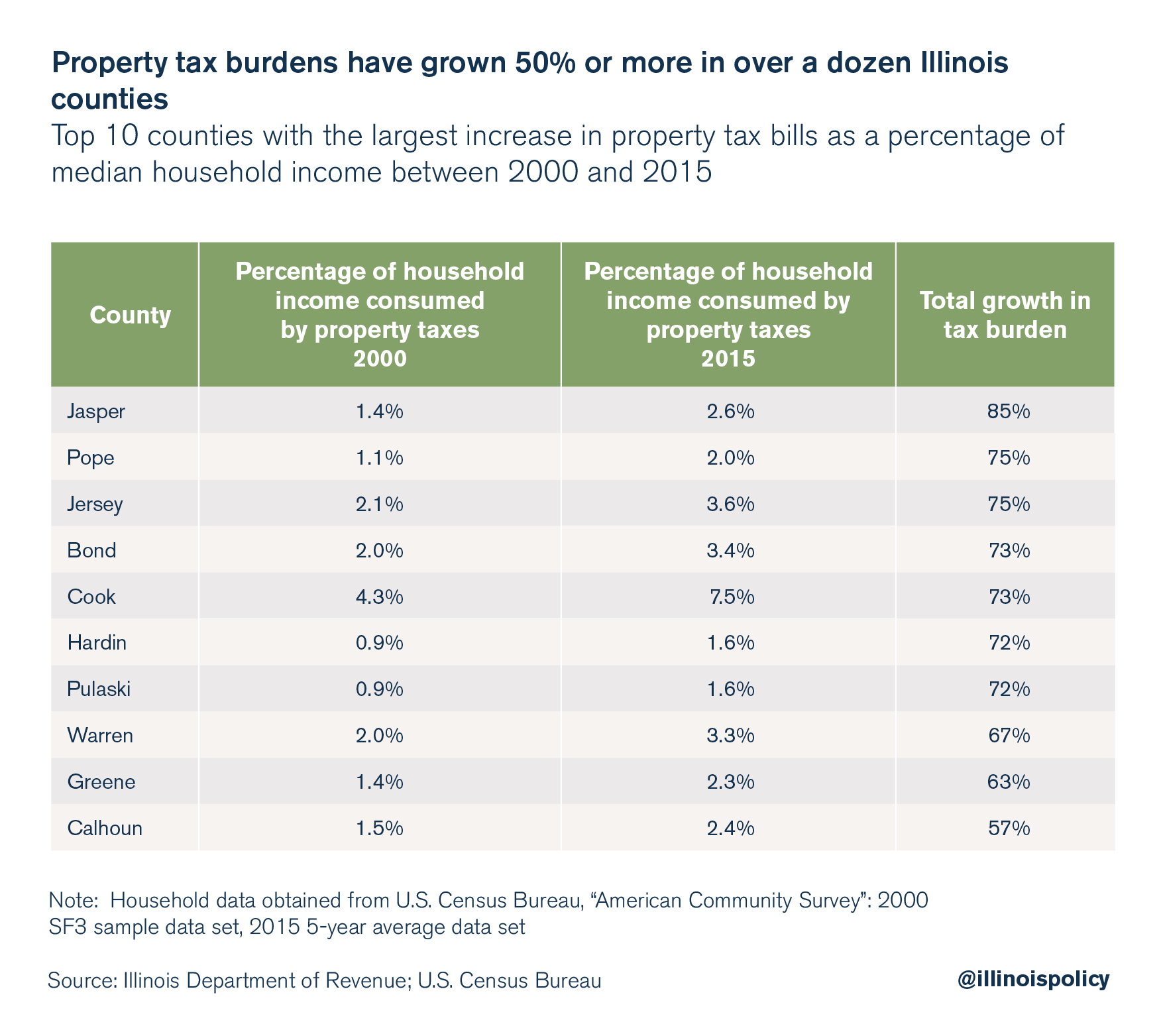

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

https://files.illinoispolicy.org/wp-content/uploads/2017/07/5.png

Web 29 sept 2022 nbsp 0183 32 NBCUniversal Media LLC File photo You could be one of nearly six million residents owed relief check from Illinois in the form of an income or property tax rebate Web By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102 0700 No filing

Web What is the Property Tax Rebate The property tax rebate was created by Public Act 102 0700 and is equal to the lesser of the property tax credit you could qualify for 2020 Web 1 ao 251 t 2022 nbsp 0183 32 To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly

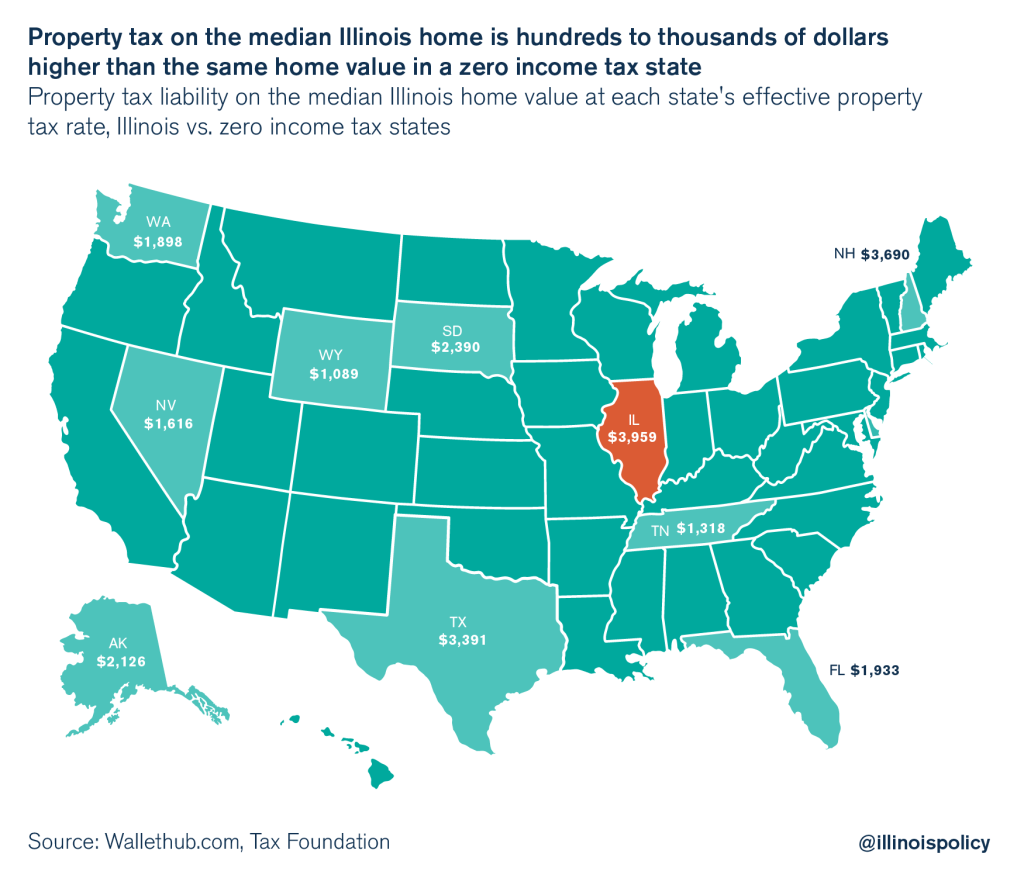

Illinois Has Higher Property Taxes Than Every State With No Income Tax

https://files.illinoispolicy.org/wp-content/uploads/2017/02/IL-higher-property-taxes_Graphic-2--1024x885.png

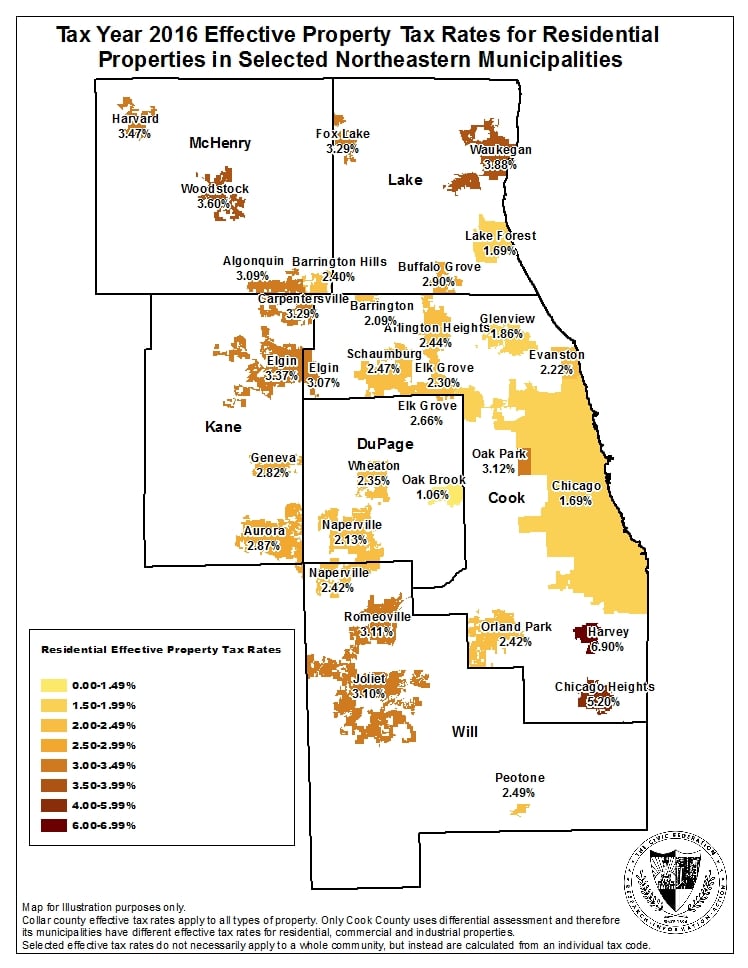

Estimated Effective Property Tax Rates 2008 2017 Selected

https://www.civicfed.org/sites/default/files/updated_residential2017etr_allcounties_webversion.jpg

https://www.nbcchicago.com/news/local/who-is-eligible-for-illinois...

Web 31 ao 251 t 2022 nbsp 0183 32 In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing

https://taxschool.illinois.edu/post/navigating-the-illinois-income-and...

Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

Why Your Property Tax Bill Is So High And How To Fix It

Illinois Has Higher Property Taxes Than Every State With No Income Tax

Estimated Effective Property Tax Rates 2007 2016 Selected

Estimated Effective Property Tax Rates 2007 2016 Selected

North Central Illinois Economic Development Corporation Property Taxes

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

How To Resolve Your Struggle With Illinois Property Taxes SkyDan

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

Illinois Is A High tax State Illinois Policy

Property Tax Rebates In Illinois - Web 27 sept 2022 nbsp 0183 32 To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly