Veterans Property Tax Exemption In Illinois Veterans 70 or more disabled receive an EAV reduction of 250 000 and because of this can be totally exempt from property taxes on their home The automatic renewal of this

The Disabled Veterans Standard Homestead Exemption provides a reduction in a property s EAV to a qualifying property owned by a veteran with a service connected The Cook County Assessor s Office administers property tax exemptions that may contribute to lowering veteran s property tax bill For veterans returning from active

Veterans Property Tax Exemption In Illinois

Veterans Property Tax Exemption In Illinois

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/veterans-property-tax-exemption-application-form-printable-pdf-download-1.png

16 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Texas-100-Disabled-Veteran-Property-Tax-Exemption-1024x1024.jpg

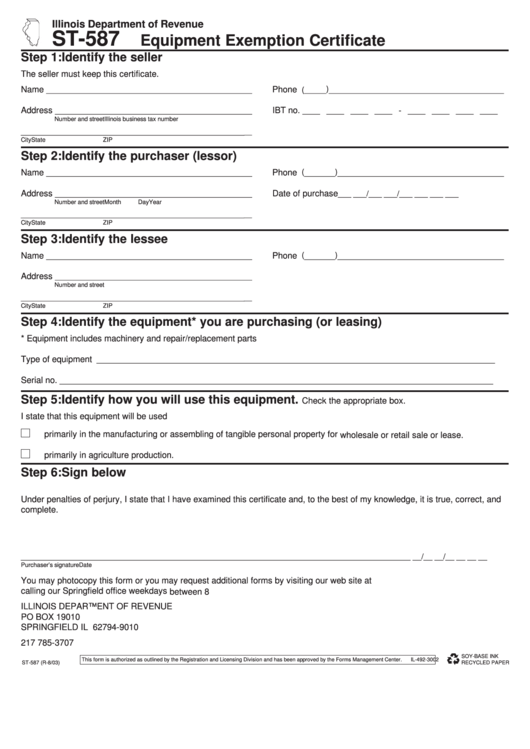

Arkansas Exemption Tax Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/5/422/5422932/large.png

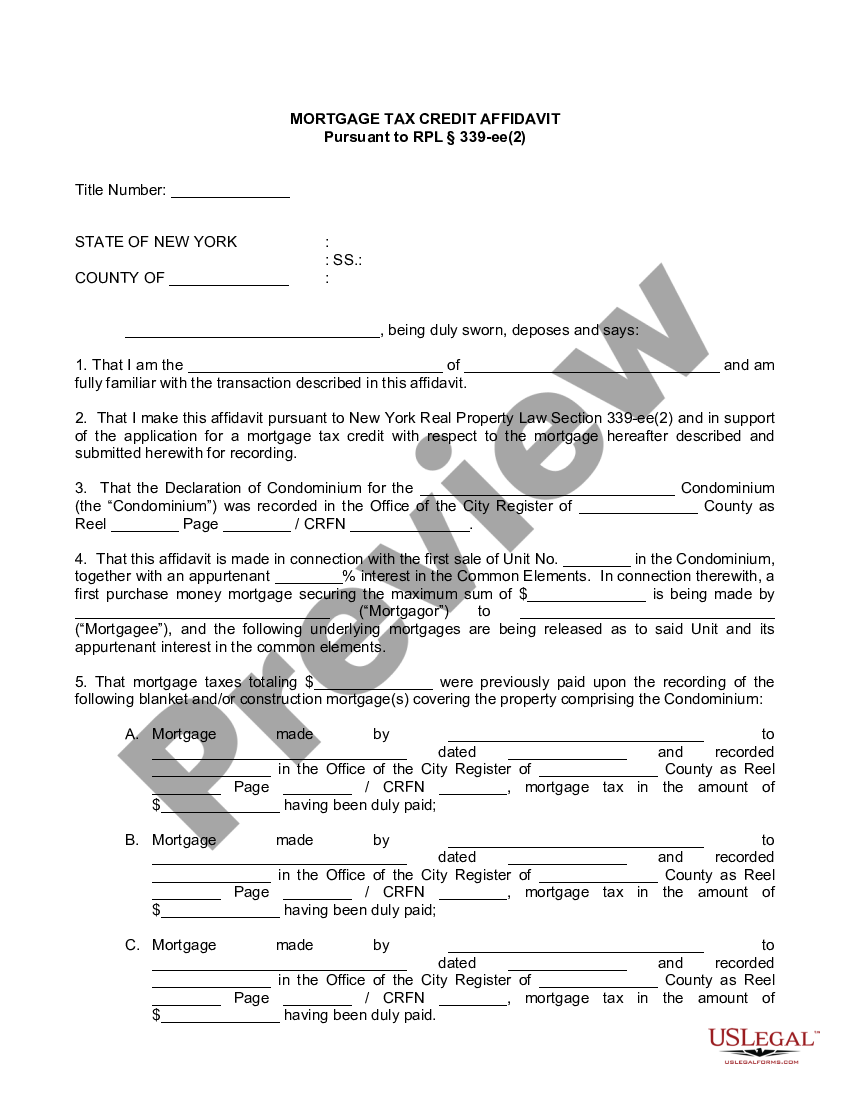

This exemption provides a reduction in equalized assessed value outlined below of a primary residence occupied by a veteran with a disability or the veteran s surviving Veterans and their spouses who qualified for the Specially Adapted Housing Exemption for Veterans with Disabilities 35 ILCS 200 15 165 for the 2014 tax year will receive

Benefit This Returning Veterans Homestead Exemption reduces the net taxable assessed value by 5 000 for the tax year the veteran returned from an armed conflict The Illinois Governor July 1 amended the property tax code to expand the homestead exemption for World War II veterans The law provides that from taxable

Download Veterans Property Tax Exemption In Illinois

More picture related to Veterans Property Tax Exemption In Illinois

Tax Exempt Form Tn Fill And Sign Printable Template Online Bank2home

https://www.pdffiller.com/preview/11/44/11044386/large.png

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Iowa-100-Disabled-Veteran-Property-Tax-Exemption-1536x1229.jpg

Agricultural Property Tax Exemption Illinois Propertyvb

https://data.formsbank.com/pdf_docs_html/256/2560/256008/page_1_thumb_big.png

Veterans with a certified disability of 30 49 can qualify for a 2 500 EAV reduction 50 69 can qualify for 5 000 EAV reduction 70 or more now can qualify for a 100 tax In 2015 Senate Bill 107 expanded the Illinois Disabled Veterans Property Tax Exemption Beginning in taxable year 2015 which is payable in 2016 veterans with a service

The reformed bill however now permits the first 250 000 of a property s valuation to be exempt from taxation a measure that can to significantly reduce the Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable

Property Tax Exemption For Illinois Disabled Veterans

https://www.homesteadfinancial.com/app/uploads/2023/05/VA-TAX-EXCEMPTION2-768x475.jpg

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

https://www.lcvetsfoundation.org/wp-content/uploads/2023/01/veteran-tax-exemptions1-1024x683.jpg

https://www.cookcountyassessor.com/veterans...

Veterans 70 or more disabled receive an EAV reduction of 250 000 and because of this can be totally exempt from property taxes on their home The automatic renewal of this

https://veterans.illinois.gov/services-benefits/real-estate.html

The Disabled Veterans Standard Homestead Exemption provides a reduction in a property s EAV to a qualifying property owned by a veteran with a service connected

Seniors And Veterans Can Now Apply For Property Tax Exemption

Property Tax Exemption For Illinois Disabled Veterans

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms

Veteran Disability Exemptions By State VA HLC

Yonkers New York City Veterans Property Tax Exemption Form US Legal Forms

Tax Exempt Forms San Patricio Electric Cooperative

Tax Exempt Forms San Patricio Electric Cooperative

Expanded Property Tax Exemptions Available For Disabled Veterans

Harris County Homestead Exemption Form ExemptForm

New Property Tax Exemption For Disabled Veterans In Illinois Learn

Veterans Property Tax Exemption In Illinois - Veterans and their spouses who qualified for the Specially Adapted Housing Exemption for Veterans with Disabilities 35 ILCS 200 15 165 for the 2014 tax year will receive