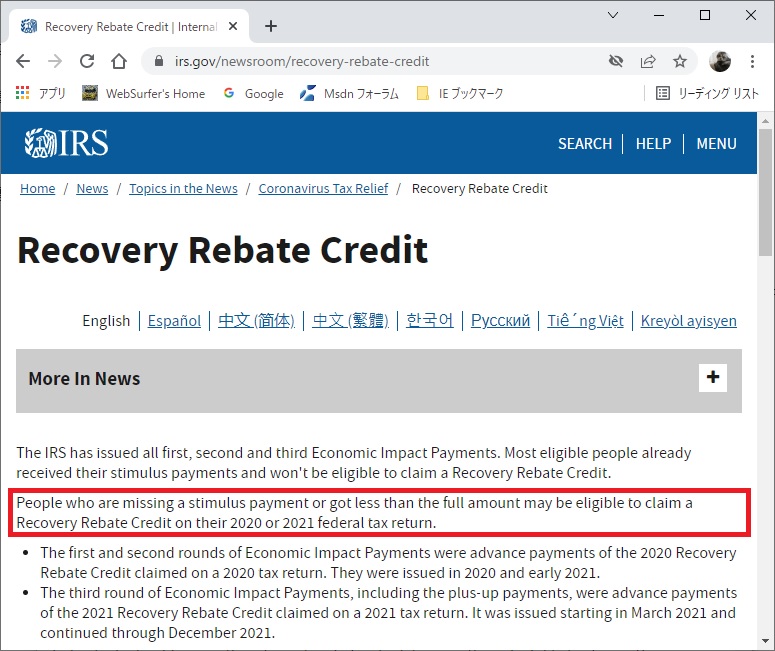

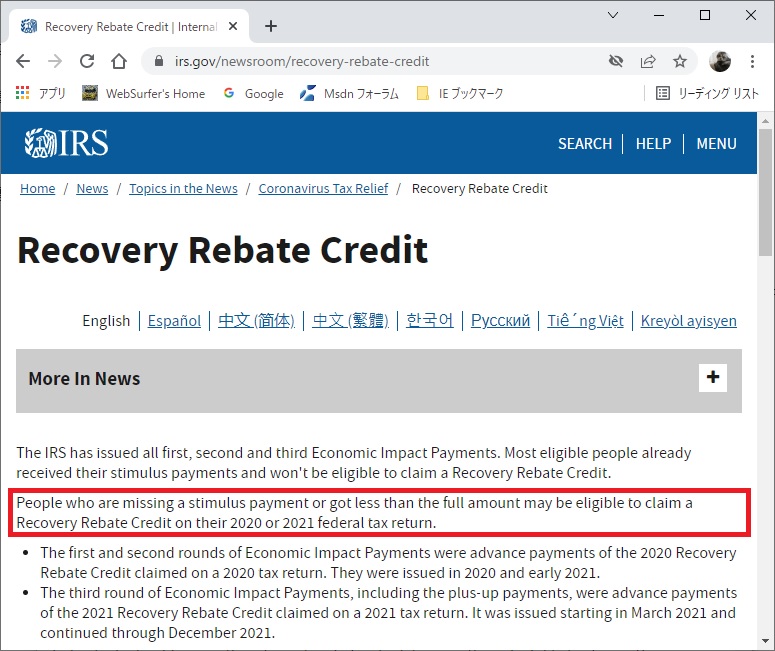

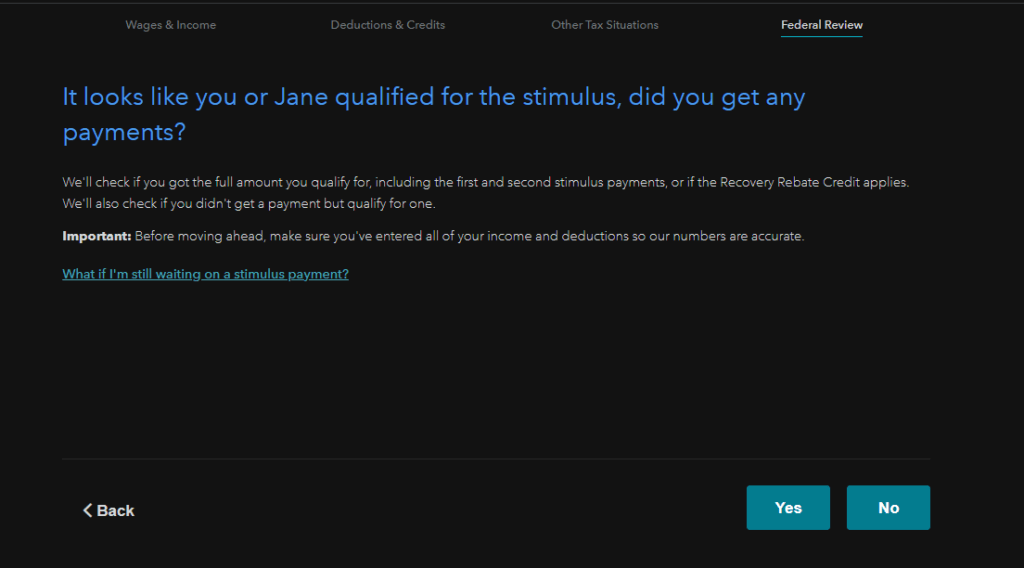

Qualification For Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate

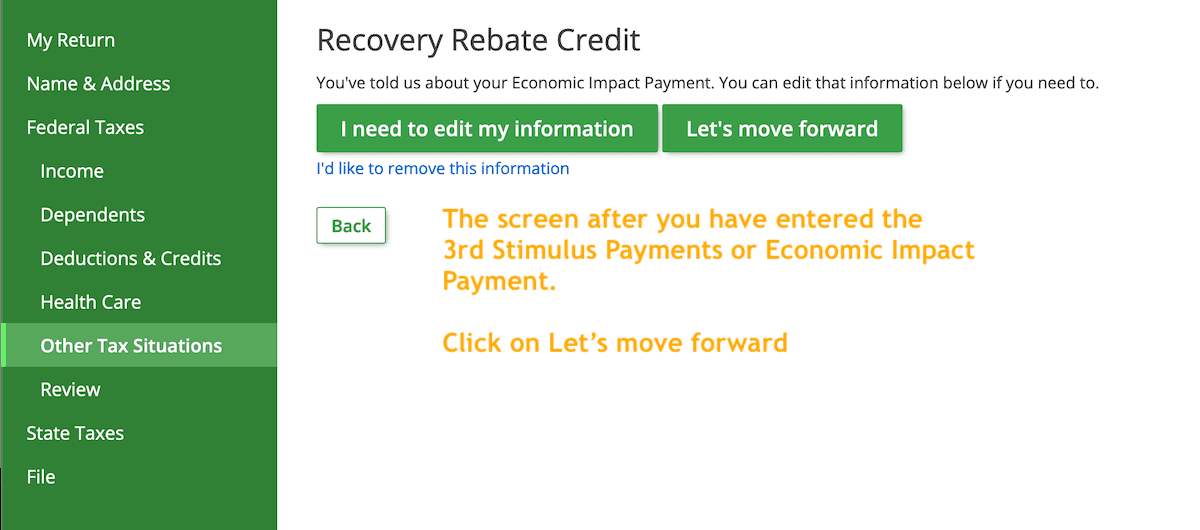

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a

Qualification For Recovery Rebate Credit

Qualification For Recovery Rebate Credit

https://www.taxgroupcenter.com/wp-content/uploads/2021/05/Recovery-rebate-credit.jpg

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Web 1 d 233 c 2022 nbsp 0183 32 If the result is zero or a negative amount you don t qualify for any additional credit on your 2020 tax return If your result is a positive amount then you are eligible for a 2020 Recovery Rebate Credit Web 30 mars 2022 nbsp 0183 32 To qualify you had to be either a U S citizen or resident alien in 2021 You also had to have a valid Social Security number though there are certain

Web 13 sept 2022 nbsp 0183 32 The Recovery Rebate can be applied to federal income tax returns up to 2021 You can receive up to 1 400 for each tax dependent who is eligible married Web 3 d 233 c 2022 nbsp 0183 32 The Recovery Rebate is available on federal income tax returns until 2021 Tax dependents can be qualified to receive as much as 1400 married couples with two

Download Qualification For Recovery Rebate Credit

More picture related to Qualification For Recovery Rebate Credit

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Eligibility For Recovery Rebate Credit Ft Myers Naples Markham Norton

https://www.markham-norton.com/wp-content/uploads/2021/03/Tax-Time-Guide-scaled.jpg

Recovery Rebate Credit 2022 2023 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-ss-1.jpg

Web 17 ao 251 t 2022 nbsp 0183 32 Edibility Requirements To be eligible for the credit you must have Been a U S citizen or U S resident alien in 2020 and or 2021 Not have been a dependent of another taxpayer for tax years Web 29 janv 2022 nbsp 0183 32 Single filers who had incomes above 80 000 in 2020 but less than this amount in 2021 may be eligible for up to 1 400 per person Married couples who filed

Web Generally only people who qualify for the RRC but don t normally file a tax return and don t receive federal benefits will not receive advanced payments and will need to file a 2021 Web You may also be able to get missing money for the first two checks as well by claiming it on your taxes in 2021 as a Recovery Rebate Credit

Recovery Rebate Credit CrossLink

https://www.crosslinktax.com/wp-content/uploads/2022/05/tax-update-Form-1040-Tax-Check-Money.jpg

Should You Claim The Recovery Rebate Credit On Your 2021 Tax Return

https://alloysilverstein.com/wp-content/uploads/2022/01/Tax-Tip-1.26.png

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

2021 Recovery Rebate Credit R R Accountants RC SD

Recovery Rebate Credit CrossLink

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Recovery Rebate Credit 2022 2023 Credits Zrivo

Recovery Rebate Credit 2020 Calculator KwameDawson

All Posts Tagged IRS

All Posts Tagged IRS

What s The Recovery Rebate Credit Eligibility And Facts 2022

IRS Free File Available Today Claim Recovery Rebate Credit And Other

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Qualification For Recovery Rebate Credit - Web 12 oct 2022 nbsp 0183 32 You re generally eligible to claim the recovery rebate credit if in 2021 you Were a U S citizen or U S resident alien