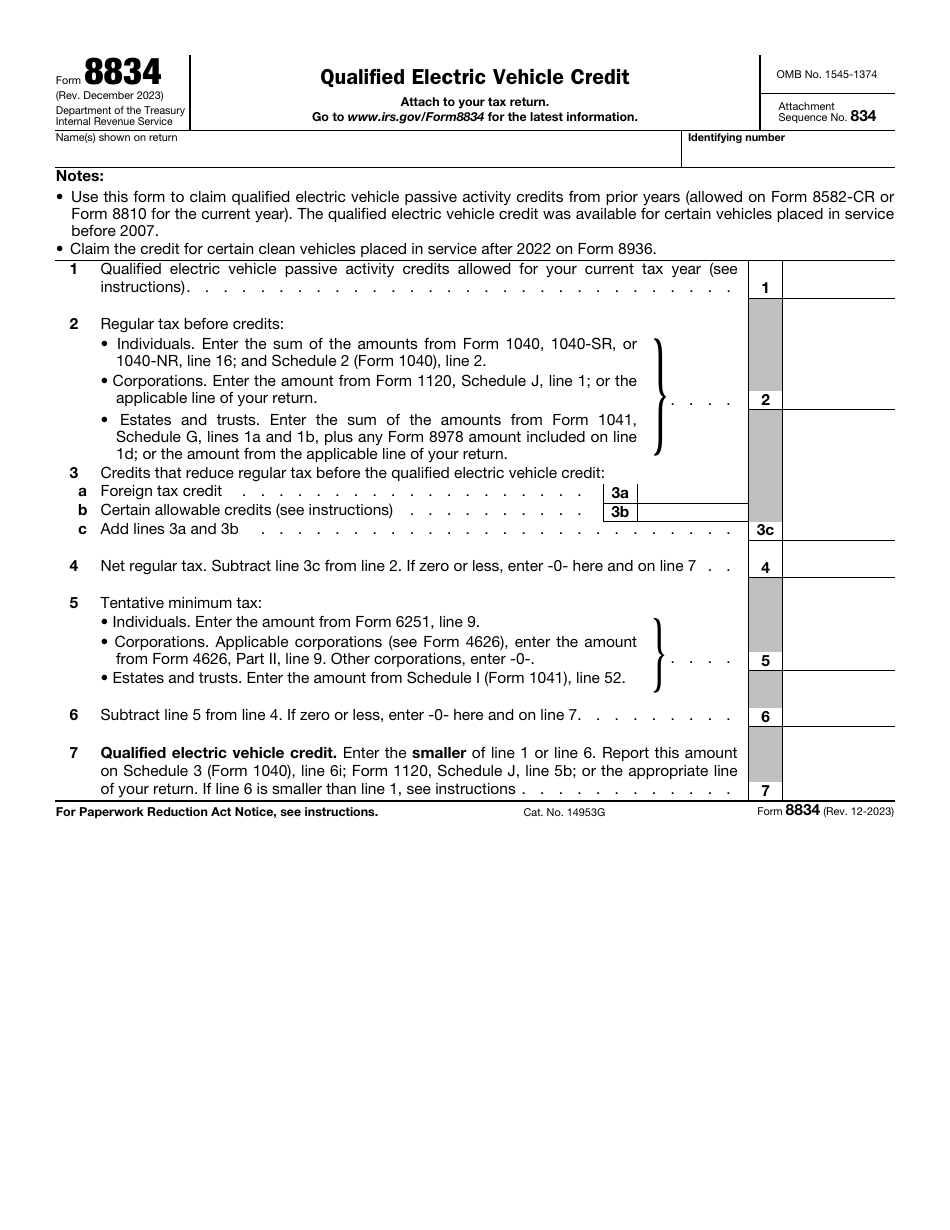

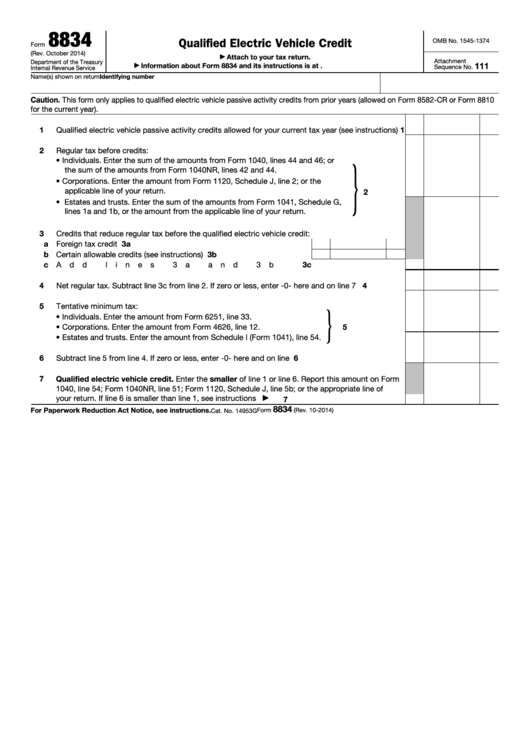

Qualified Electric Vehicle Credit Form 8834 Verkko Form 8834 Rev December 2023 Department of the Treasury Internal Revenue Service Qualified Electric Vehicle Credit Attach to your tax return Go to

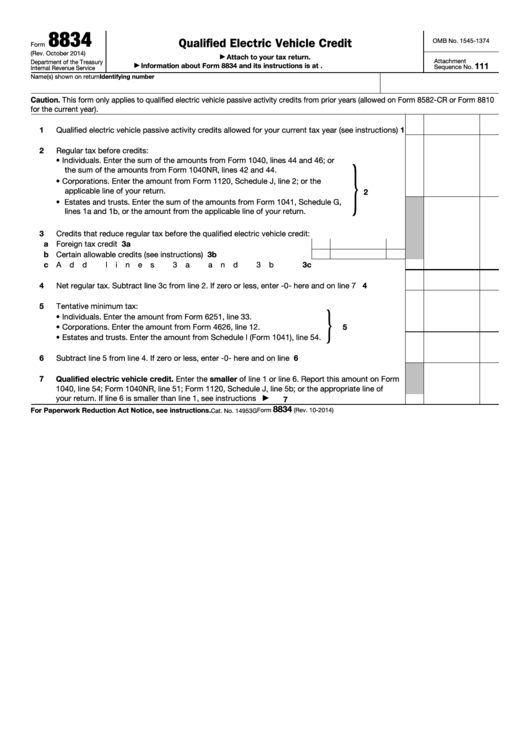

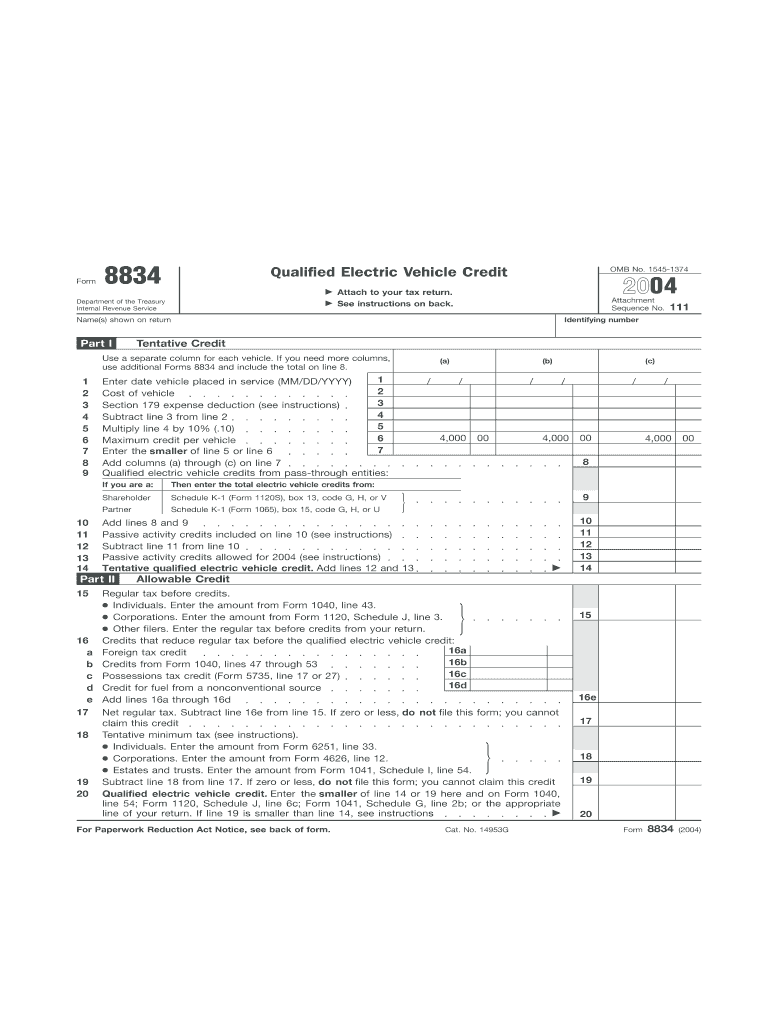

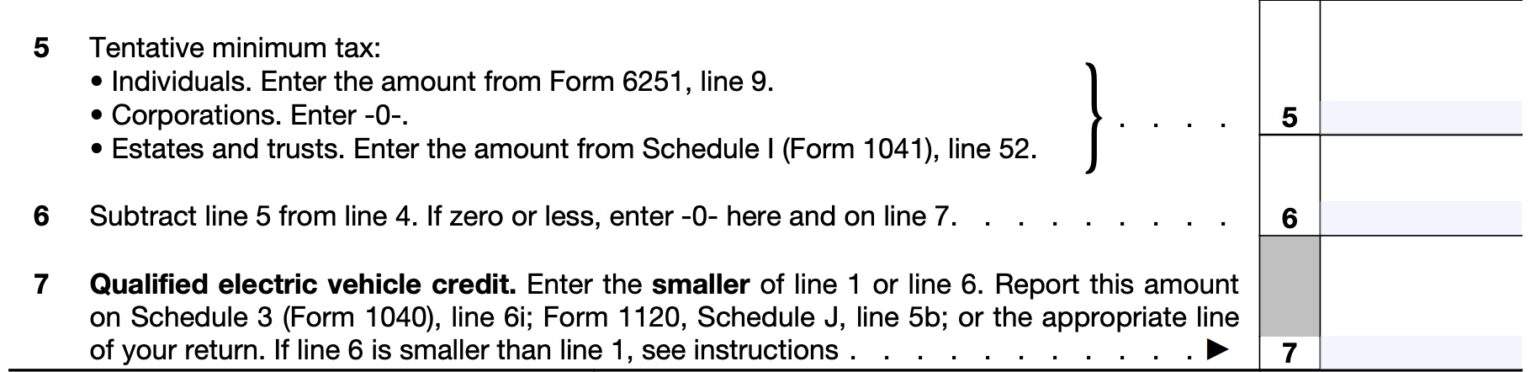

Verkko 30 elok 2023 nbsp 0183 32 IRS Form 8834 only applies to qualified electric vehicle passive activity credits from prior years The qualified electric vehicle credit was allowed for certain Verkko 7 kes 228 k 2023 nbsp 0183 32 Form 8834 Qualified Electric Vehicle Credit You can use Form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current

Qualified Electric Vehicle Credit Form 8834

Qualified Electric Vehicle Credit Form 8834

https://data.formsbank.com/pdf_docs_html/328/3289/328970/page_1_thumb_big.png

Fillable Online Irs 2001 Form 8834 Qualified Electric Vehicle Credit

https://www.pdffiller.com/preview/389/867/389867807/large.png

Fillable Online Notepad 2004 Form 8834 Qualified Electric Vehicle

https://www.pdffiller.com/preview/391/751/391751457/large.png

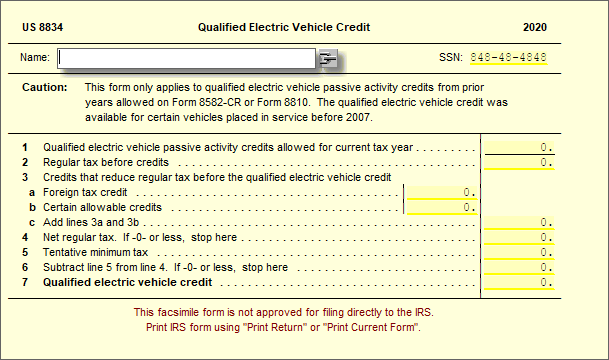

Verkko Use Form 8834 to claim any qualified electric vehicle passive activity credits from prior years allowed on Form 8582 CR or Form 8810 for the current tax year Part I and Verkko Per IRS Form 8834 Qualified Electric Vehicle Credit Caution This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form

Verkko 17 jouluk 2021 nbsp 0183 32 No car tax would have to be paid on fully electric vehicles or on nitrogen powered vehicles The change would enter into force on 1 January 2022 In Verkko Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV

Download Qualified Electric Vehicle Credit Form 8834

More picture related to Qualified Electric Vehicle Credit Form 8834

IRS Form 8834 Download Fillable PDF Or Fill Online Qualified Electric

https://data.templateroller.com/pdf_docs_html/2848/28487/2848761/irs-form-8834-qualified-electric-vehicle-credit_print_big.png

Electric Vehicle Tax Credit News Ev Electrek Money Qualify

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/08/irs_form_8834_bottom-1536x372.jpg

Verkko 11 huhtik 2023 nbsp 0183 32 If the total 4 month cost exceeds 2 000 you are entitled to the tax credit The size of the credit is 60 of the part going over the 2 000 euro threshold Verkko 7 hein 228 k 2022 nbsp 0183 32 Qualified Electric Vehicle Credit 8834 Passive Activity Credit Allowed for 20xx Enter the allowable amount from Form 8582 CR Note For electric

Verkko We last updated the Qualified Electric Vehicle Credit in February 2023 so this is the latest version of Form 8834 fully updated for tax year 2022 You can download or Verkko 5 lokak 2021 nbsp 0183 32 The draft government proposal for an act concerning purchase and conversion subsidies for low emission vehicles has been sent out for comments The

Form 8834 Qualified Electric Vehicle Credit Inscription On The Page

https://thumbs.dreamstime.com/z/form-qualified-electric-vehicle-credit-inscription-page-205937136.jpg

8834 Qualified Electric Vehicle Credit UltimateTax Solution Center

https://support.ultimatetax.com/hc/article_attachments/4406914134679/mceclip0.png

https://www.irs.gov/pub/irs-pdf/f8834.pdf

Verkko Form 8834 Rev December 2023 Department of the Treasury Internal Revenue Service Qualified Electric Vehicle Credit Attach to your tax return Go to

https://www.teachmepersonalfinance.com/irs-form-8834-instructions

Verkko 30 elok 2023 nbsp 0183 32 IRS Form 8834 only applies to qualified electric vehicle passive activity credits from prior years The qualified electric vehicle credit was allowed for certain

The 7 500 Electric Vehicle Tax Credit Would Be Killed Under This

Form 8834 Qualified Electric Vehicle Credit Inscription On The Page

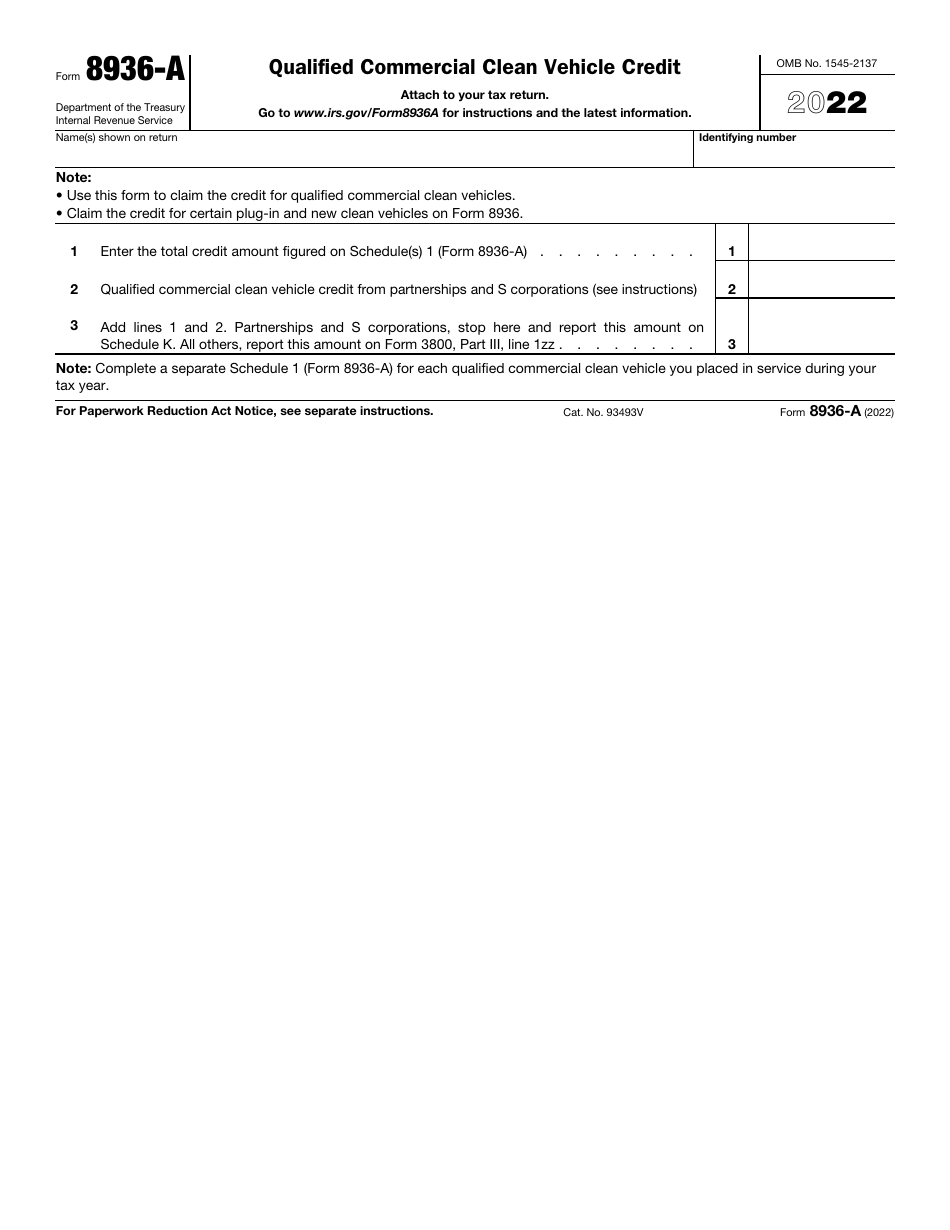

IRS Form 8936 A 2022 Fill Out Sign Online And Download Fillable

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

Form 8834 Qualified Electric Vehicle Credit 2014 Free Download

Fillable Online Ebsv Form 8834 PDF Bd8702633b41b446a4128260dcfc9dea

Fillable Online Ebsv Form 8834 PDF Bd8702633b41b446a4128260dcfc9dea

Fillable Online Etsuv Form 8834 PDF Bd8702633b41b446a4128260dcfc9dea

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

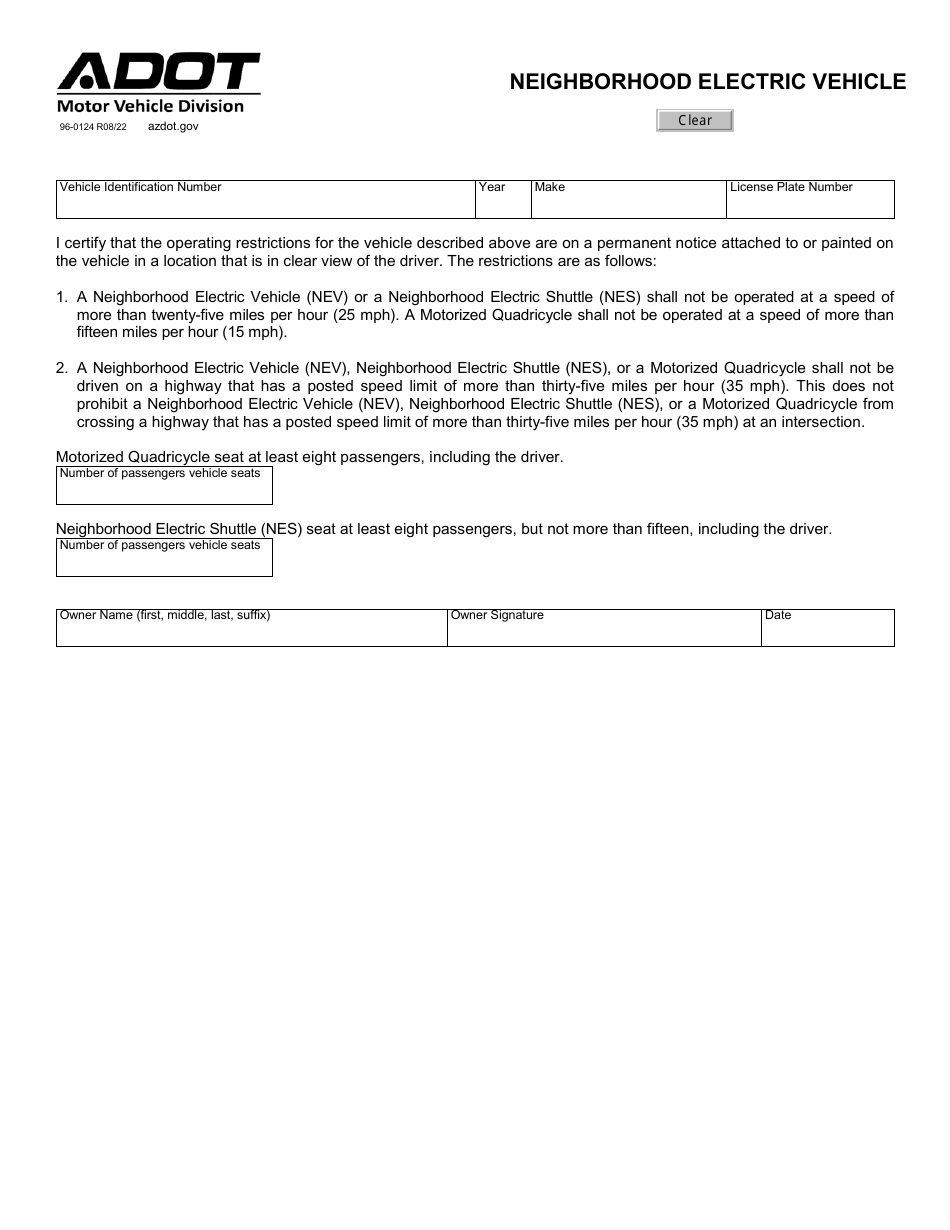

Form 96 0124 Download Fillable PDF Or Fill Online Neighborhood Electric

Qualified Electric Vehicle Credit Form 8834 - Verkko Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV