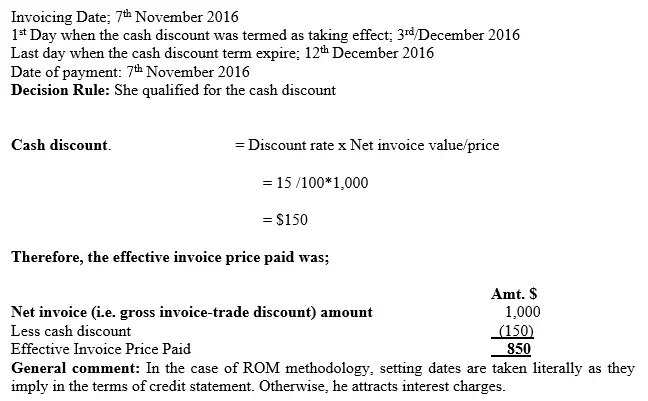

Quantity Discount Accounting Treatment Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

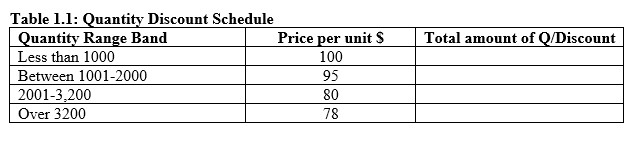

This IFRS Viewpoint provides our views on the purchaser s accounting treatment for the different types of rebate and discount along with some application examples Our IFRS A quantity discount is a reduction in the price of a product if the buyer chooses to acquire goods in a large quantity This discount may be issued by the seller

Quantity Discount Accounting Treatment

Quantity Discount Accounting Treatment

https://i.ytimg.com/vi/3Yp1V6sSqXU/maxresdefault.jpg

Busy Software Price 50 Discount Accounting Software Price For

https://i.ytimg.com/vi/nF07mRvmnAM/maxresdefault.jpg

Cash Discount CA Ambition

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

What is a Sales Discount A sales discount is a reduction in the price of a product or service that is offered by the seller in exchange for early payment by the Quantity discounts are price reductions based on the volume of goods purchased These discounts encourage customers to buy in larger quantities helping

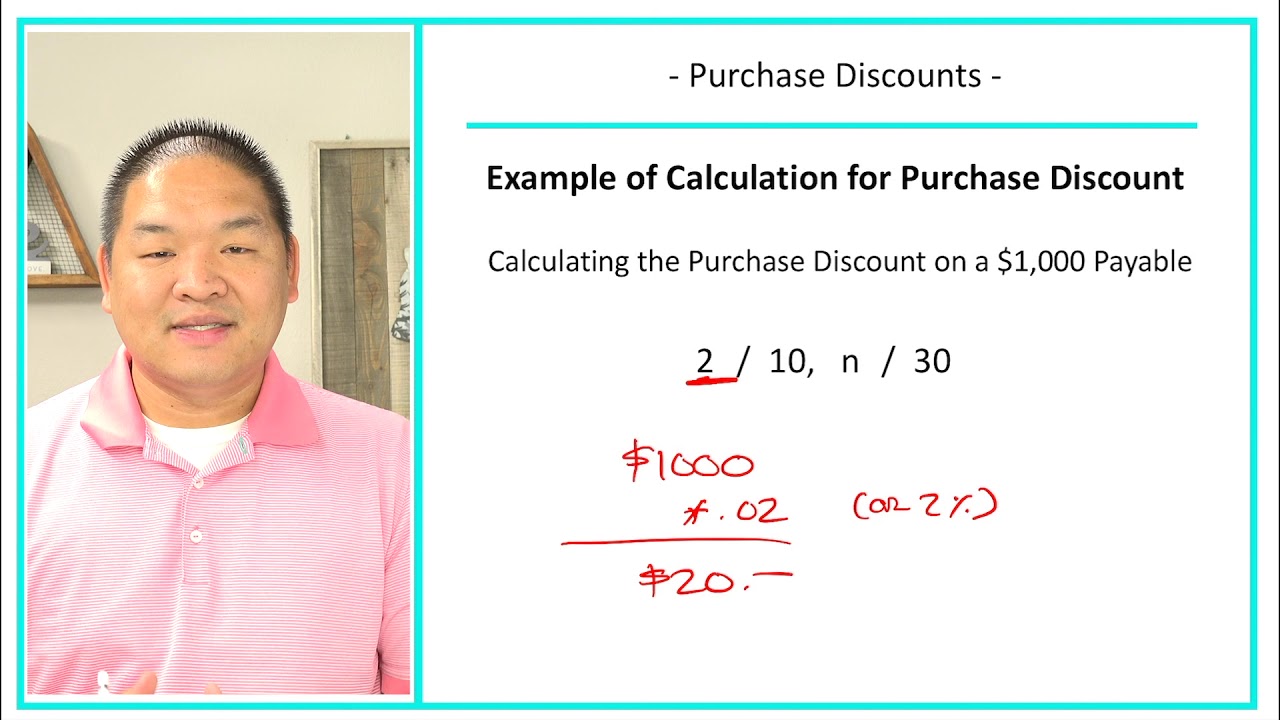

An entity shall allocate a discount entirely to one or more but not all performance obligations in the contract if all of the following criteria are met a The entity regularly There are two methods an entity can use when accounting for discounts The first is to create a contra revenue account and the second is to simply net the discount

Download Quantity Discount Accounting Treatment

More picture related to Quantity Discount Accounting Treatment

Discount Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/09/Discount-Formula-768x395.jpg

Accounting Nest Quantity Discount

https://www.accountingnest.com/images/69af8ad7-6a66-4101-ab37-0f2ba2998970.png

Accounting Business Acronym QDA Quantity Discount Agreement Stock

https://d2gg9evh47fn9z.cloudfront.net/1600px_COLOURBOX16670040.jpg

What is the accounting treatment for sales discounts Sales discounts are recorded as a reduction in revenue under the line item called accounts receivable Sales discounts do not reduce any assets Settlement discount is a discount for prompt payment of invoice by the customer Let s say you sell something for 1 000 on 30 day credit and you offer 3 off if a customer pays within 10 days Those 3

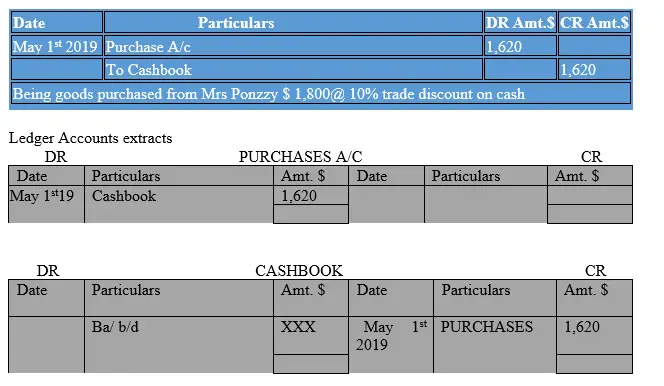

There are two primary types of discounts in accounting that might occur in your small business trade discounts and cash discounts A quantity discount is an incentive offered to a buyer that results in a decreased cost per unit of goods or materials when purchased in greater numbers A

Glory Bad Debts Recovered In Trial Balance Need Of Cash Flow Statement

https://concept-stories.s3.ap-south-1.amazonaws.com/test/Stories - Images_story_93985/image_2019-11-29 03:51:59.028067%2B00:00

Accounting Nest Cash Discount

https://www.accountingnest.com/images/8269911a-b16a-4b72-a537-e47cd6f0cbbc.png

https://www.accaglobal.com/.../f3/technical-articles/discounts.html

Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

https://www.grantthornton.global/globalassets/1...

This IFRS Viewpoint provides our views on the purchaser s accounting treatment for the different types of rebate and discount along with some application examples Our IFRS

Accounting Nest Trade Discount

Glory Bad Debts Recovered In Trial Balance Need Of Cash Flow Statement

Wonderful Accounting Equation Class 11 Extra Questions Balance Sheet

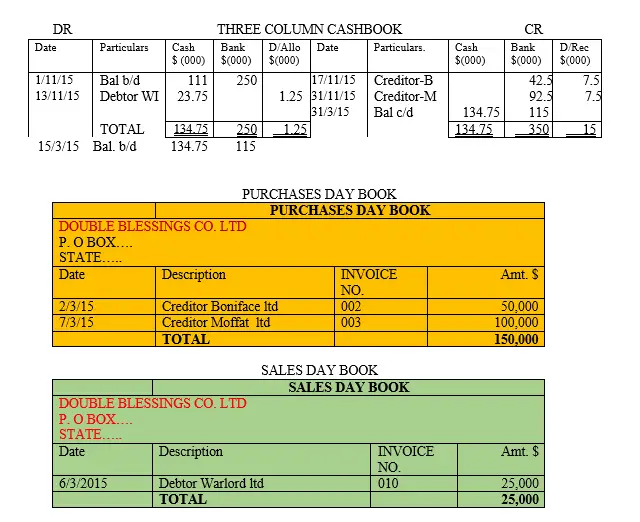

Financial Accounting Lesson 6 12 Purchase Discounts YouTube

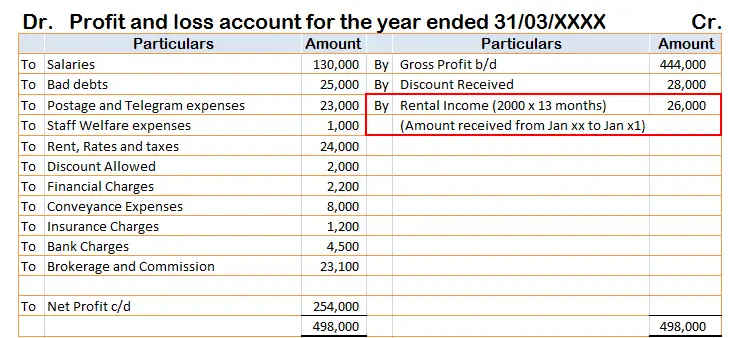

Is Rent Received In Advance Included In Taxable Income

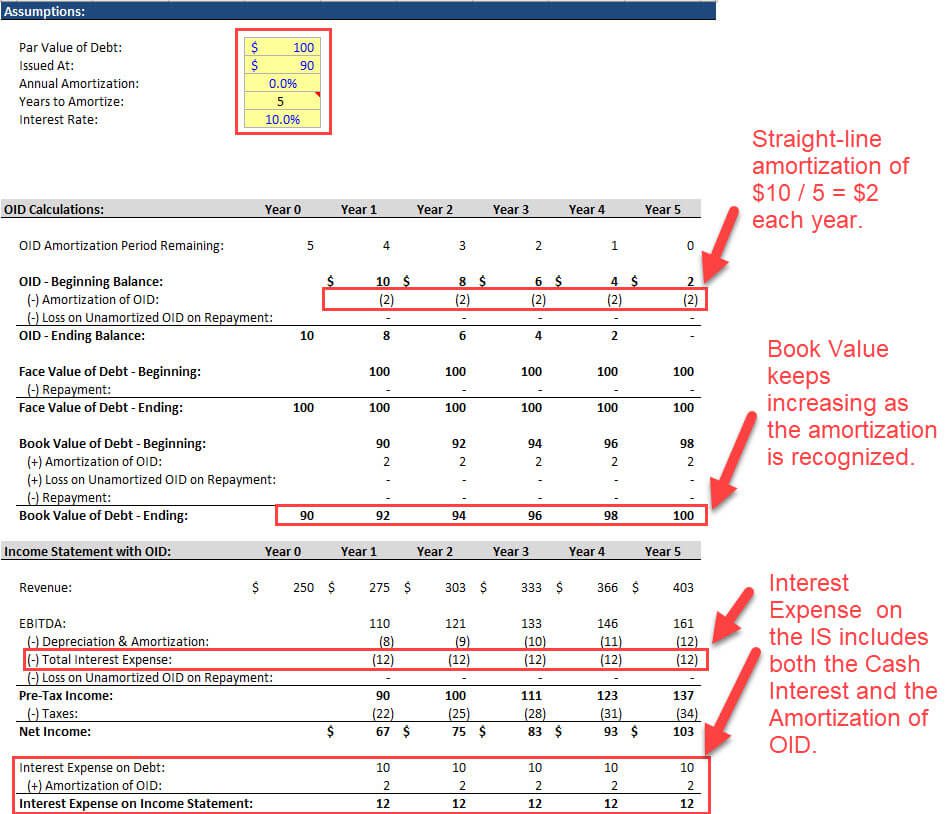

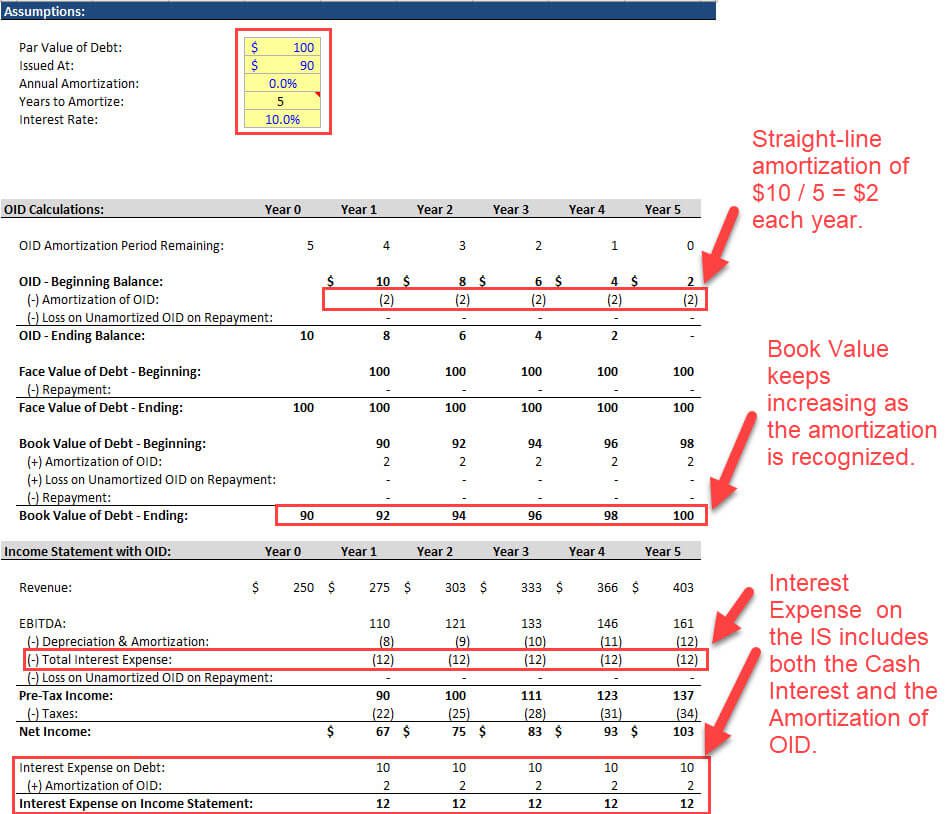

Original Issue Discount Debt OID On Bonds Full Tutorial

Original Issue Discount Debt OID On Bonds Full Tutorial

3 Ways For Discount Accounting In Tally YouTube

Basics Of Accounting Types Of Discount Journal Entries Of Discount

Accounting Nest Cash Discount

Quantity Discount Accounting Treatment - Discounts may be classified into two types Trade Discounts offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers