Real Estate Discount Rate Vs Cap Rate Although they both show a property s annual rate of return there is a significant distinction between the cap rate and discount rate A discount rate less than the anticipated long term growth rate of potential earnings can be used to define a cap rate

Capitalization Rate Net Operating Income Current Market Value where The net operating income is the expected annual income generated by the property like rentals and is arrived at by The cap rate is applied to one year s net operating income while the discount rate is applied to a series of yearly NOI s or net cash flows While most seasoned real estate investors

Real Estate Discount Rate Vs Cap Rate

Real Estate Discount Rate Vs Cap Rate

https://investte.com/wp-content/uploads/2018/11/What-is-Discount-Rate-commercial-real-estate-1024x682.jpg

Difference Between The Cap Rate And The Discount Rate

https://i1.wp.com/property-investment.net/wp-content/uploads/2019/08/cap-rate-discount-rate-e1564766079795.jpeg?fit=1880%2C737&ssl=1

How To Calculate Cap Rate For SFR Real Estate Investments

https://www.limaone.com/wp-content/uploads/Cap-Rate-Example-.png

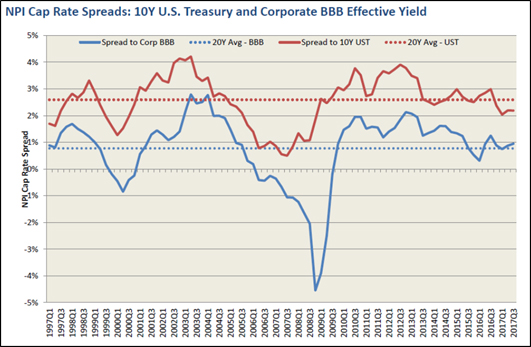

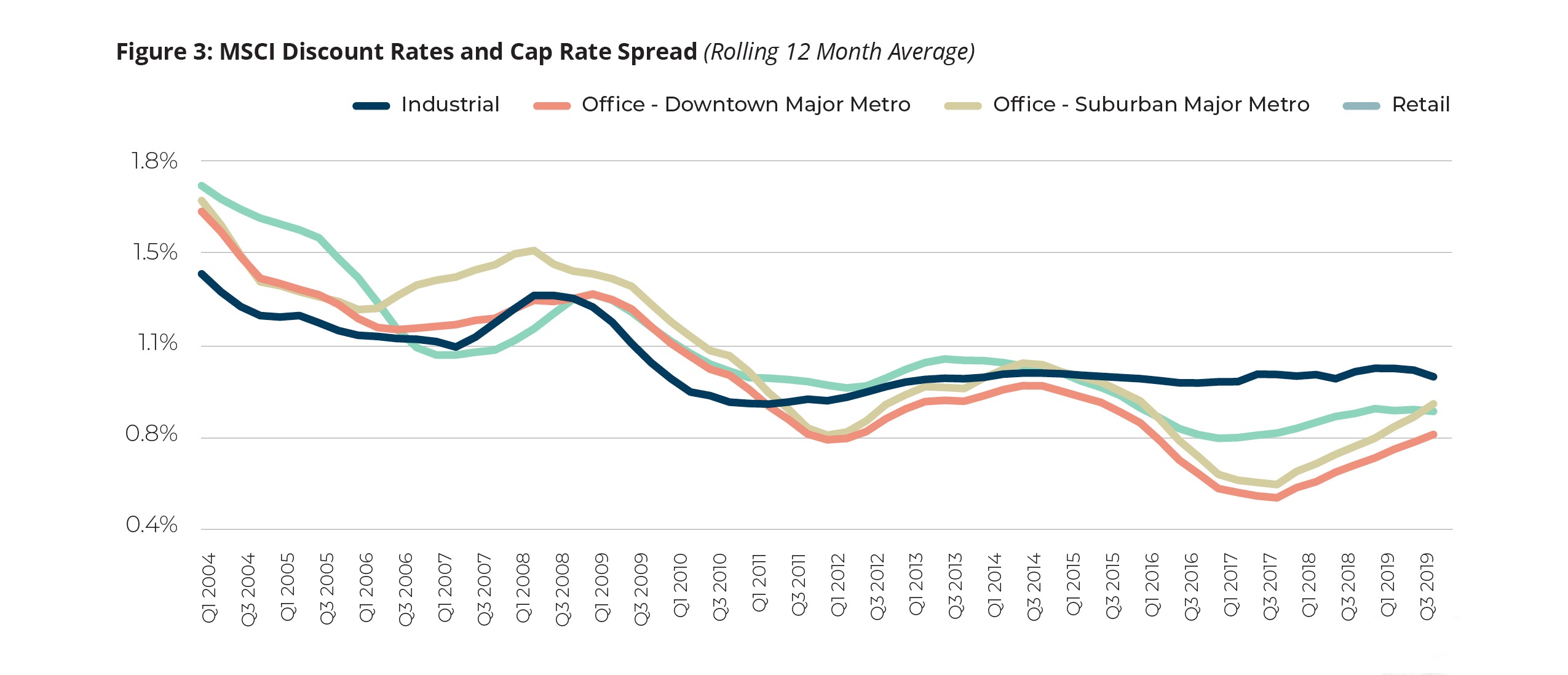

The article mentions the relationship between the discount rate cap rate spread and NOI The author shows that the discount rate cap rate spread moves with changes in NOI He mentions that Generally the higher the spread between discount rates and cap rates the higher the income growth required to justify current property In real estate capitalization rates commonly called cap rates are useful risk measurements for commercial properties The cap rate formula Annual net operating income NOI the property s market value

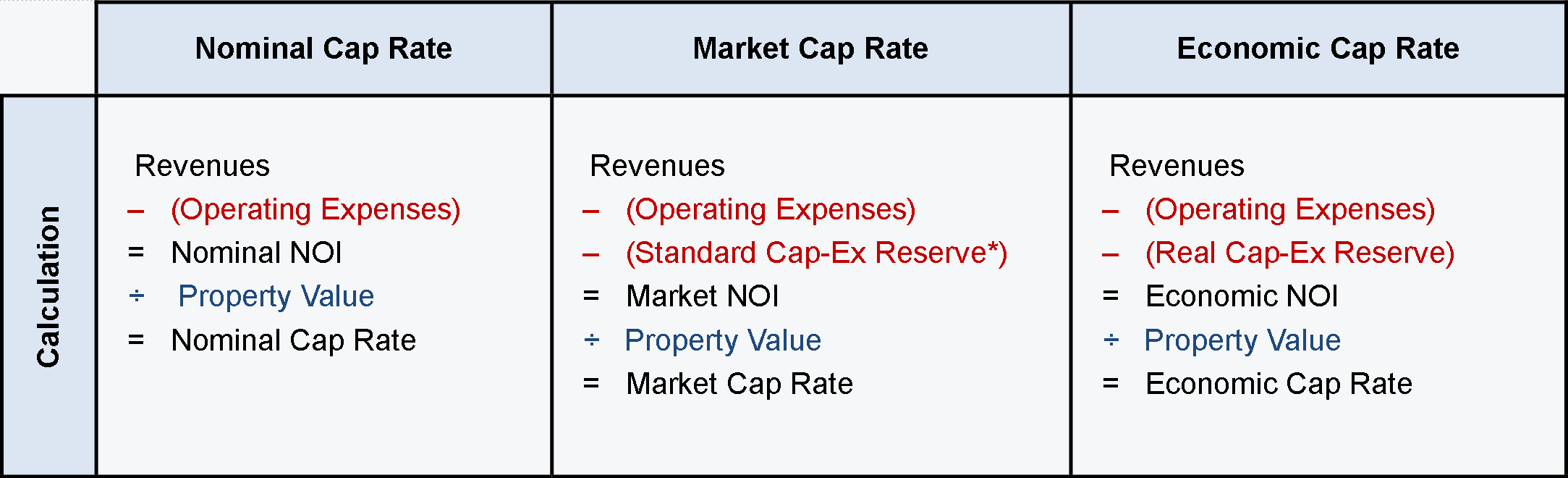

The cap rate is inextricably linked to the discount rate the easiest way to define it is cap rate discount rate growth rate The quick and easy valuation of an investment through dividing the t1 NOI by the cap rate will be equivalent to the valuation of the same investment by discounting future NOI and a terminal value if growth and cf Discount rates are similar to cap rates because they too are used to calculate value using a property s net operating income however discount rates are applied to future income streams while cap rates are applied to a property s current NOI

Download Real Estate Discount Rate Vs Cap Rate

More picture related to Real Estate Discount Rate Vs Cap Rate

Cap Rates Versus Interest Rates When Will The Other Shoe Drop

https://www.commercialsearch.com/news/wp-content/uploads/sites/46/2017/12/CRE-Cap-Rate-Spreads.jpg

Another Cap Rate Abomination OttawaAgent ca

https://ottawaagent.ca/wp-content/uploads/2017/10/Cap-Rate.jpg

Cap Rates Vs IRR In Commercial Real Estate Investments HLC Equity

https://hlcequity.com/wp-content/uploads/2022/02/cap-rates-vs-irr-blog-header.png

What is the difference between one cap rate and a discount rate For that concepts are too flustered this article will discuss that difference between a capitalization fee and one discount rate on commercial real succession and leave you with a clear understanding of the two conceptual The higher the cap rate the higher the potential return and risk all else being equal There is no good cap rate per se since the target return is a subjective matter but most commercial real estate CRE investors perceive cap rates around the 4 to

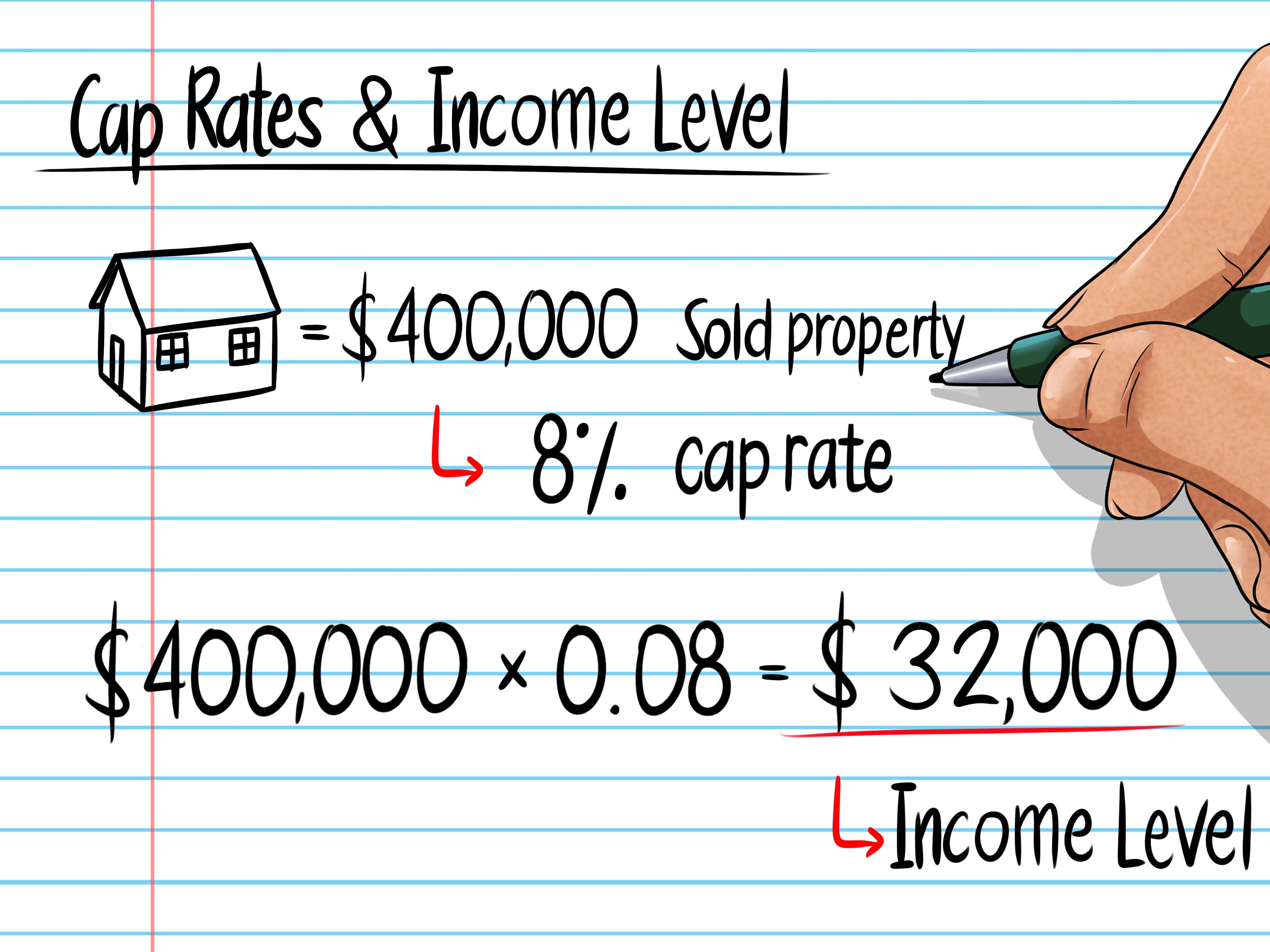

The key difference between the cap rate and the discount rate is that the former is a requiredincome return given a capital return expectation while the latter is a required total return income return plus capital return by the investor when acquiring a property for investment purposes Cap Rate NOI Property Value Cap Rate 25 000 300 000 0 0833 or 8 33 An 8 33 cap rate is on the higher side but still falls within the recommended range depending on the level of risk tolerance Consider the property type current cap rates and average cap rate of the real estate market you re interested in

Cap Rates And Their Role In Commercial Real Estate Leveraged Breakdowns

https://lh3.googleusercontent.com/rK0d6NU6qnsdO1soytna8chxmbkmHefCly1KScFIIoQsMBOhoFHZ-6gJ5bplQpKMF-XLYHKQ8yUl-kpyhFUaUp5q-8oCLCeK4I1fEsbQQyNeXomKNdELqKVXTFjK8TM8HfEl3kYycSSIS7672v-fiE4

Cap Rate In Real Estate

https://f004.backblazeb2.com/file/loftyai/cap-rate/img/fractional-real-estate-investing-app.png

https://willowdaleequity.com/blog/cap-rate-discount-rate

Although they both show a property s annual rate of return there is a significant distinction between the cap rate and discount rate A discount rate less than the anticipated long term growth rate of potential earnings can be used to define a cap rate

https://www.investopedia.com/terms/c/capitalizationrate.asp

Capitalization Rate Net Operating Income Current Market Value where The net operating income is the expected annual income generated by the property like rentals and is arrived at by

Understanding Cap Rate In Commercial Real Estate

Cap Rates And Their Role In Commercial Real Estate Leveraged Breakdowns

Many Ways To Quote A Cap Rate

Yielding Perspective Cap Rates Discount Rates And Relative Value For

Entry Cap Rate Vs Exit Cap Rate Difference Calculation FNRP

Real Estate Cap Rate Calculator

Real Estate Cap Rate Calculator

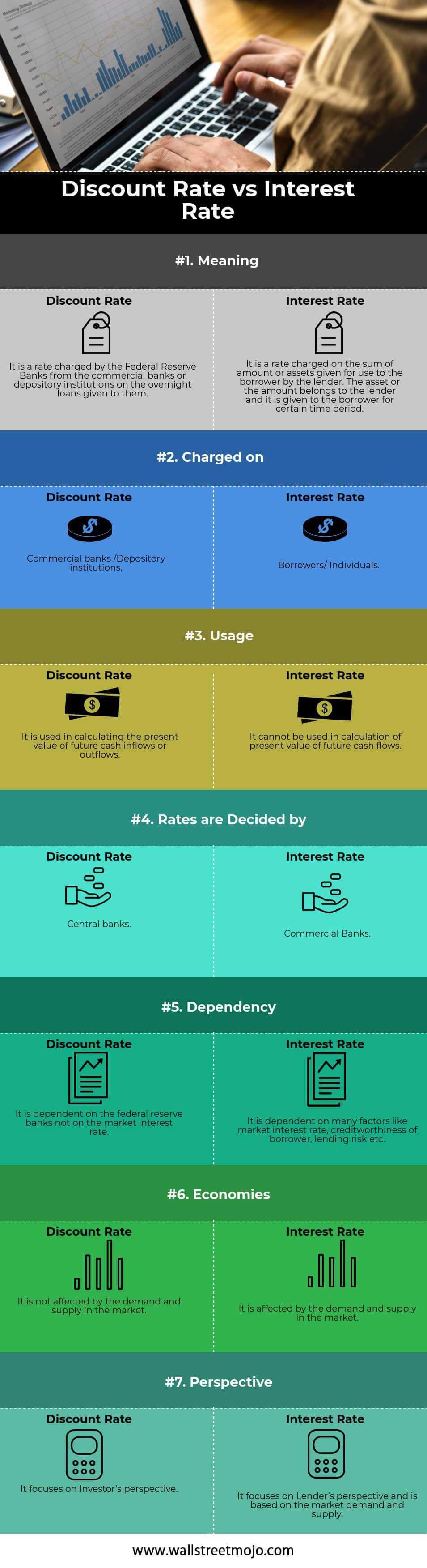

Discount Rate Vs Interest Rate Top 7 Differences with Infographics

Discount Rate Definition Formula Calculation NPV Examples

Are Your Trustees Understanding The Discount Rate Challenge

Real Estate Discount Rate Vs Cap Rate - The article mentions the relationship between the discount rate cap rate spread and NOI The author shows that the discount rate cap rate spread moves with changes in NOI He mentions that Generally the higher the spread between discount rates and cap rates the higher the income growth required to justify current property