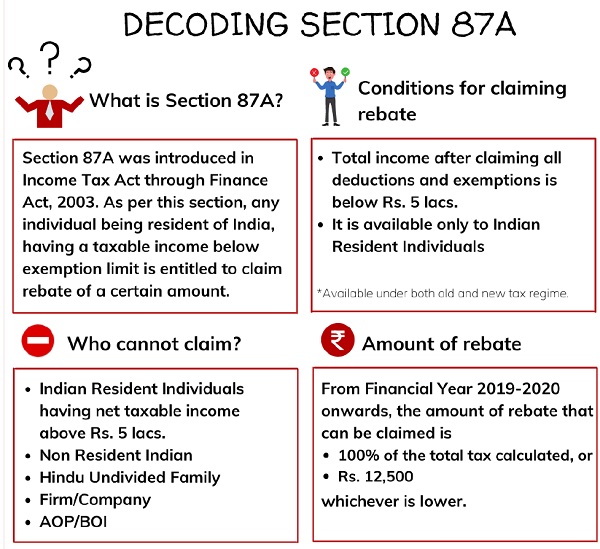

Rebate Income Tax Act Web 3 f 233 vr 2023 nbsp 0183 32 According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs

Web 3 ao 251 t 2021 nbsp 0183 32 Section 87A Eligibility Hold total income after deducting eligible deductions under Section 80 below the total exemption limit i e below 5 00 000 Be available on an amount of tax calculated before Web 20 ao 251 t 2022 nbsp 0183 32 In simple terms rebate is deduction from income tax payable Here Income Tax Payable Tax Payable Cess Surcharge Interest if any TDS Note that

Rebate Income Tax Act

Rebate Income Tax Act

https://taxguru.in/wp-content/uploads/2021/08/Decoding-Section-87A.jpg

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

https://studycafe.in/wp-content/uploads/2019/12/Rebate-under-Section-87A-of-Income-Tax-Act.jpg

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

https://gstguntur.com/wp-content/uploads/2021/07/Section-87A-Rebate-Income-Tax-Act-768x432.png

Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of Web 3 ao 251 t 2023 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget

Web Here are the eligibility criteria to claim income tax rebate under Section 87A of the Income Tax Act Must be a resident of India Your overall income after taking deductions into Web Rebate of income tax in case of certain individuals 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand

Download Rebate Income Tax Act

More picture related to Rebate Income Tax Act

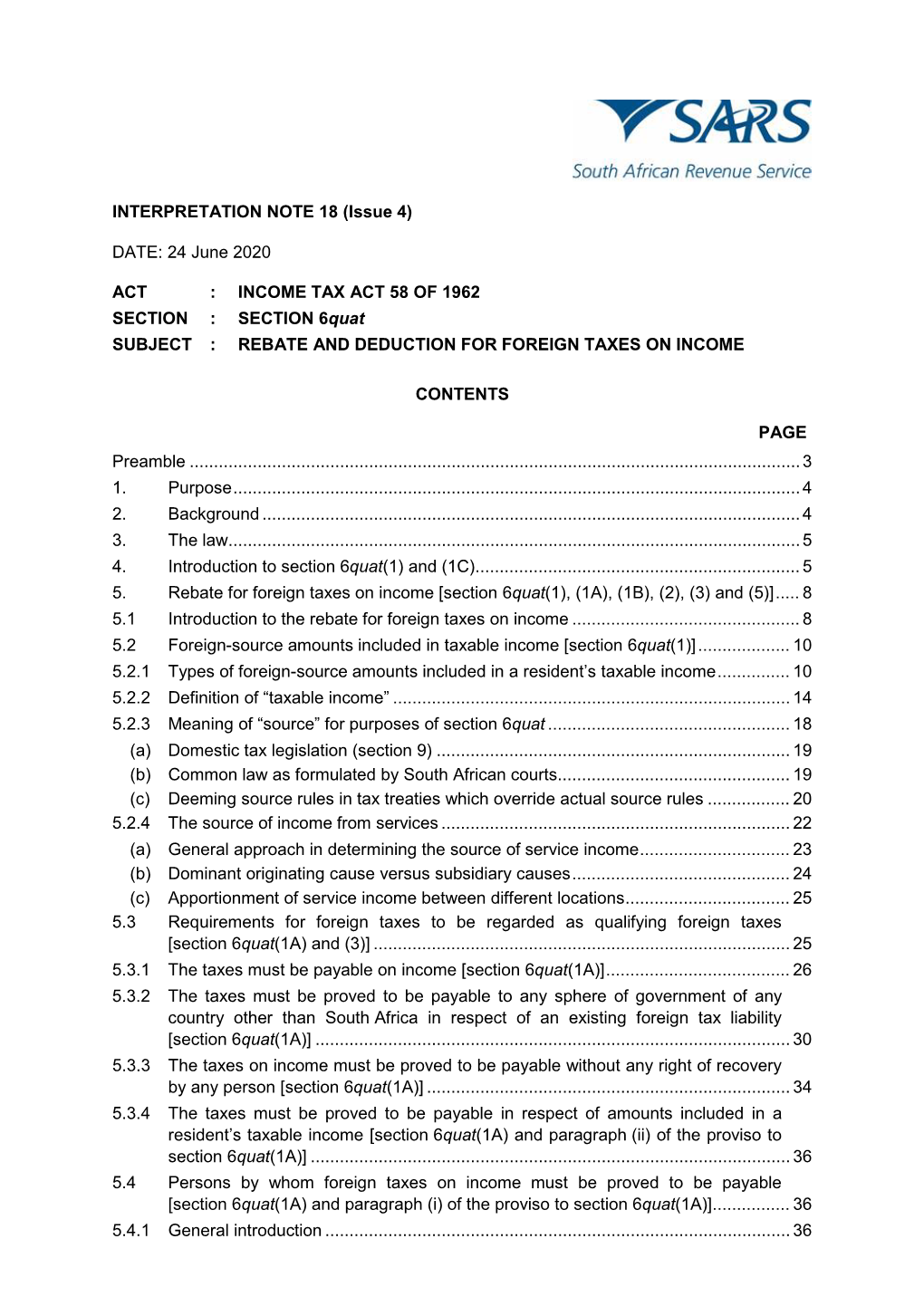

INTERPRETATION NOTE 18 Issue 4 DATE 24 June 2020 ACT INCOME TAX

https://data.docslib.org/img/962983/interpretation-note-18-issue-4-date-24-june-2020-act-income-tax-act-58-of-1962-section-section-6quat-subject-rebate.jpg

Section 87a Of Income Tax Act Income Tax Taxact Income

https://i.pinimg.com/originals/b3/57/9d/b3579d46d1a28f2b1180211b6e7a9b92.png

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web What is tax rebate u s 87A A tax rebate is a type of discount offered on your tax liability If your annual income net of deductions and exemptions does not exceed INR 5 lakhs Web 6 f 233 vr 2023 nbsp 0183 32 Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim points

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web The rebate under this section is allowed only to the resident individual whose net total income is not exceeding Rs 5 00 000 Rebate under this section is available for amount

What Is A Tax Rebate U s 87A Quora

https://qph.fs.quoracdn.net/main-qimg-077b05a573d39e800d19f8ab190296c1

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs

https://taxguru.in/income-tax/decoding-sectio…

Web 3 ao 251 t 2021 nbsp 0183 32 Section 87A Eligibility Hold total income after deducting eligible deductions under Section 80 below the total exemption limit i e below 5 00 000 Be available on an amount of tax calculated before

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

What Is A Tax Rebate U s 87A Quora

Rebate Under Section 87A Of Income Tax Act Section 87A

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

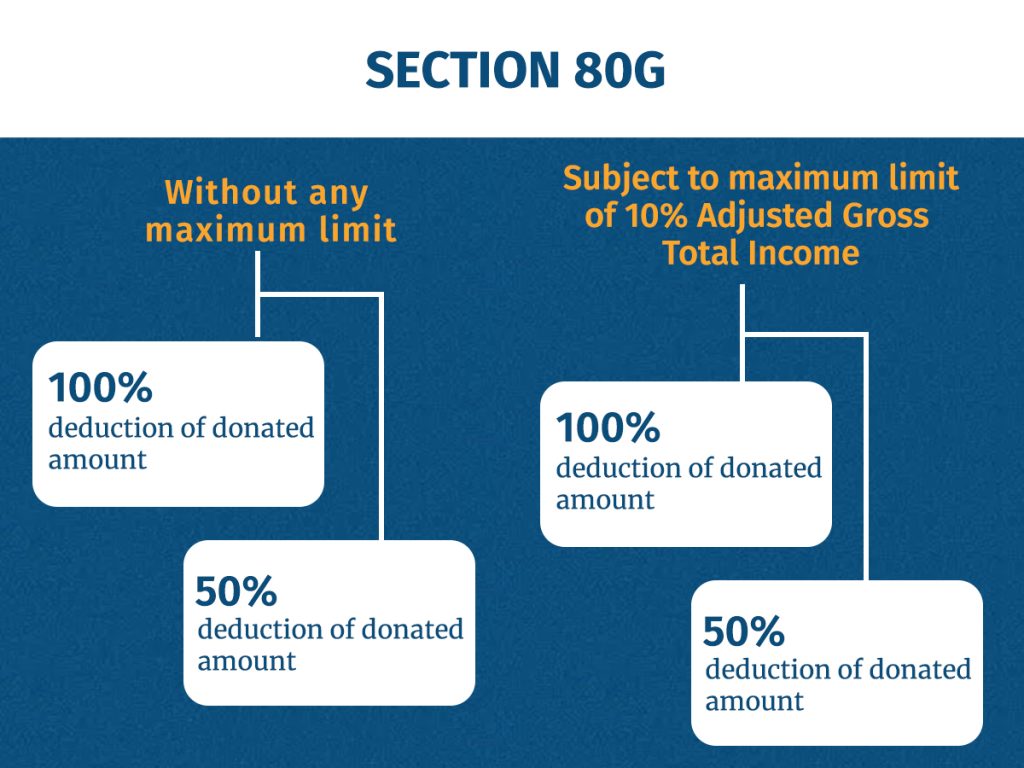

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Rebate Income Tax Act - Web 1 f 233 vr 2023 nbsp 0183 32 Rebate us 87A Under the new tax regime an annual income of up to Rs 7 lakh has been exempted from income tax in India under 87A Section 87A entitles a