Rebate Under Income Tax Act Rebate under section 87A will provide you relief on your tax payable amount Keep reading to understand the provisions on rebate in detail A tax rebate on an

Learn about the provisions of rebates and reliefs under the Income Tax Act in Chapter 8 Discover how these deductions can reduce your tax liability 23 rowsTax rebate under Section 87A of the Income Tax Act 1961 is eligible for

Rebate Under Income Tax Act

Rebate Under Income Tax Act

https://studycafe.in/wp-content/uploads/2022/04/TCS.jpg

Rebate Allowable Under Section 87A Of Income Tax Act TaxGuru

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

Updated Return Under Income Tax Act Filing Of Tax Return

https://neerajbhagat.com/blog/wp-content/uploads/2022/04/Blogs39-800x419.png

Income tax concepts exemption is on specific sources deductions on gross total income Rebate claimed against total tax payable TDS deducts tax at REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 1 In computing the amount of income tax on the total income of an

Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual Relief from taxation in income from retirement benefit account maintained in a notified country

Download Rebate Under Income Tax Act

More picture related to Rebate Under Income Tax Act

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

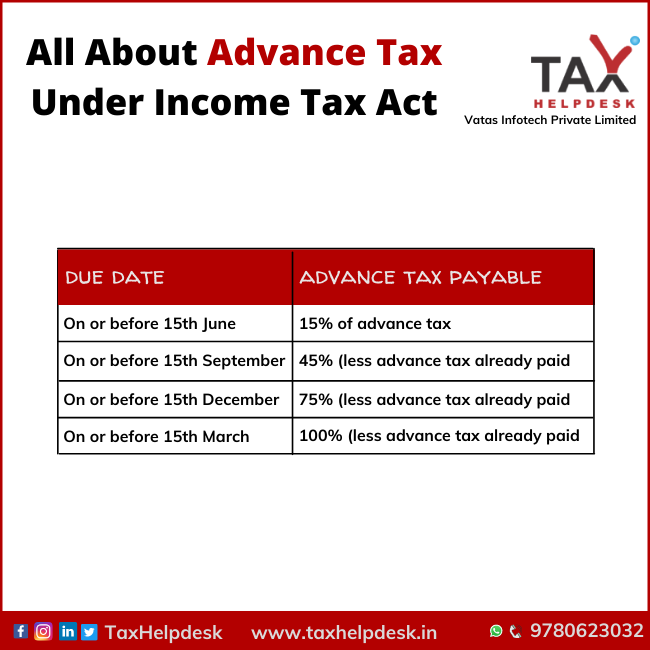

All About Advance Tax Under Income Tax Act

https://www.taxhelpdesk.in/wp-content/uploads/2021/06/All-About-Advance-Tax-Under-Income-Tax-Act.png

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

https://www.staffnews.in/wp-content/uploads/2023/02/budget-2023-24-finance-bill-2023-rates-of-income-tax.jpg

People with taxable incomes under Rs 5 lakhs are eligible for a tax rebate under Section 87A of the Income Tax Act of 1961 in the financial year 2022 23 Both the 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500 In the new tax regime w e f 01 04 2024 in case of a resident Individual the

Post 5th July 2024 The updated utility no longer provides rebate u s 87A for special rate incomes including STCG under Section 111A For Example If an individual income is Rs 7 lakh without any special rate Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-1920x1440.png

https://cleartax.in/s/income-tax-rebate-us-87a

Rebate under section 87A will provide you relief on your tax payable amount Keep reading to understand the provisions on rebate in detail A tax rebate on an

https://taxguru.in/income-tax/rebates-r…

Learn about the provisions of rebates and reliefs under the Income Tax Act in Chapter 8 Discover how these deductions can reduce your tax liability

Mr Punit Agarwal M D C E O Nirvana Realty Budget 2023

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

REBATE AND RELIEFS UNDER INCOME TAX

REBATE AND RELIEFS UNDER INCOME TAX

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

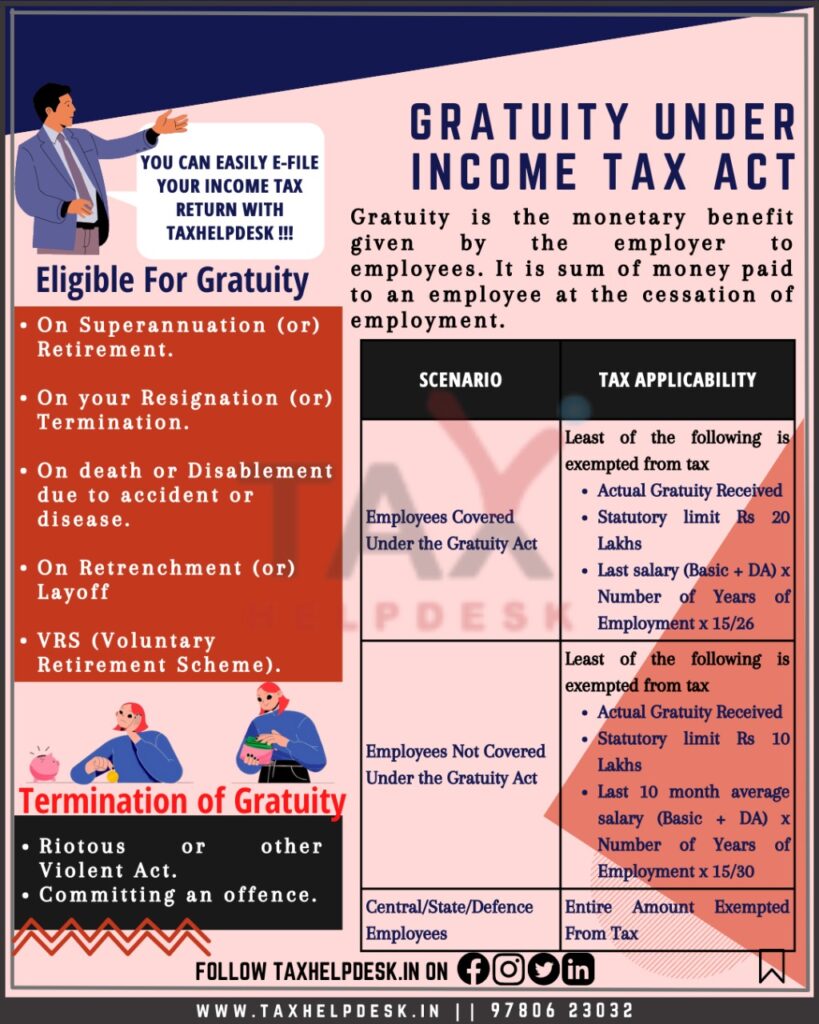

Gratuity Under Income Tax Act All You Need To Know

Rebate Under Income Tax Act - A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to