Rebate Recovery Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is a

Rebate Recovery

Rebate Recovery

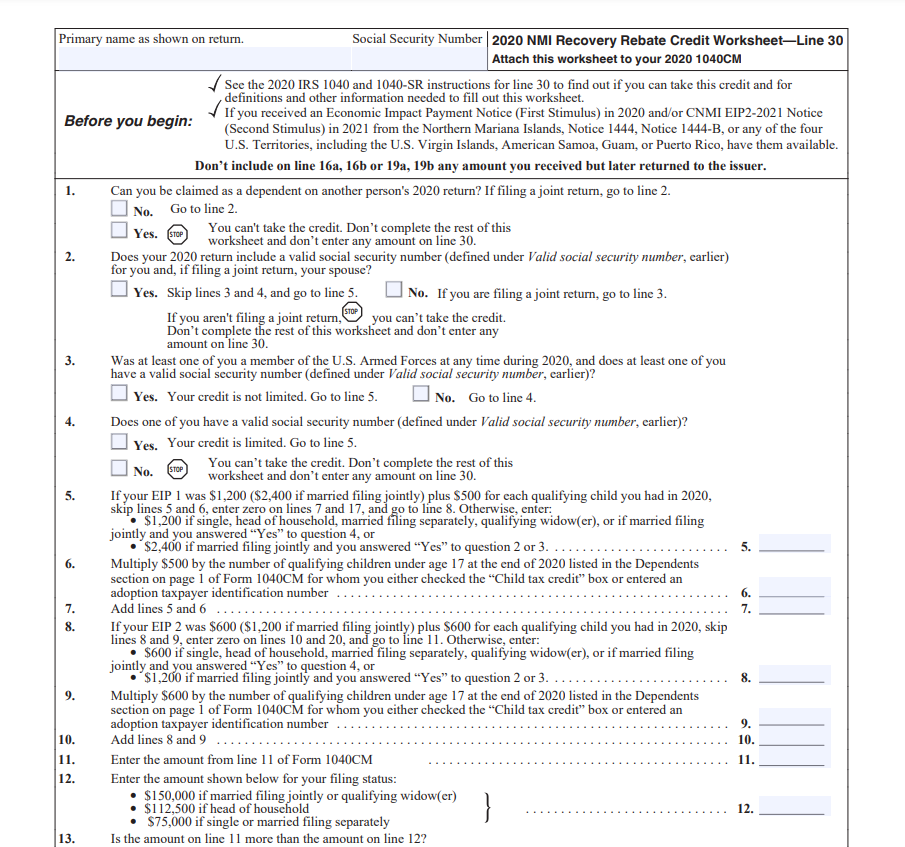

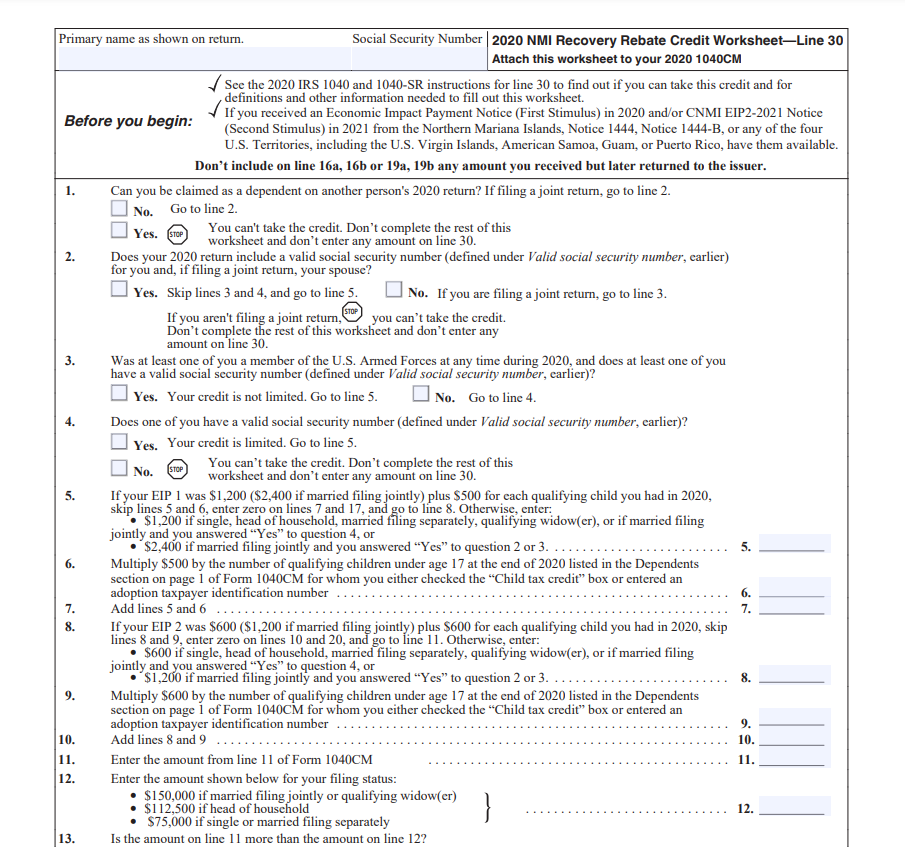

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

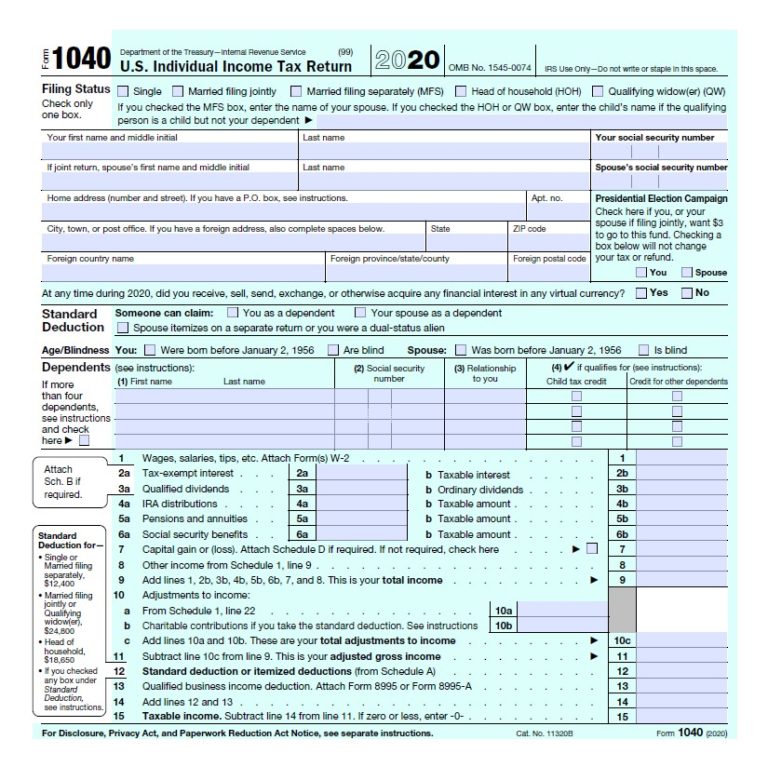

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

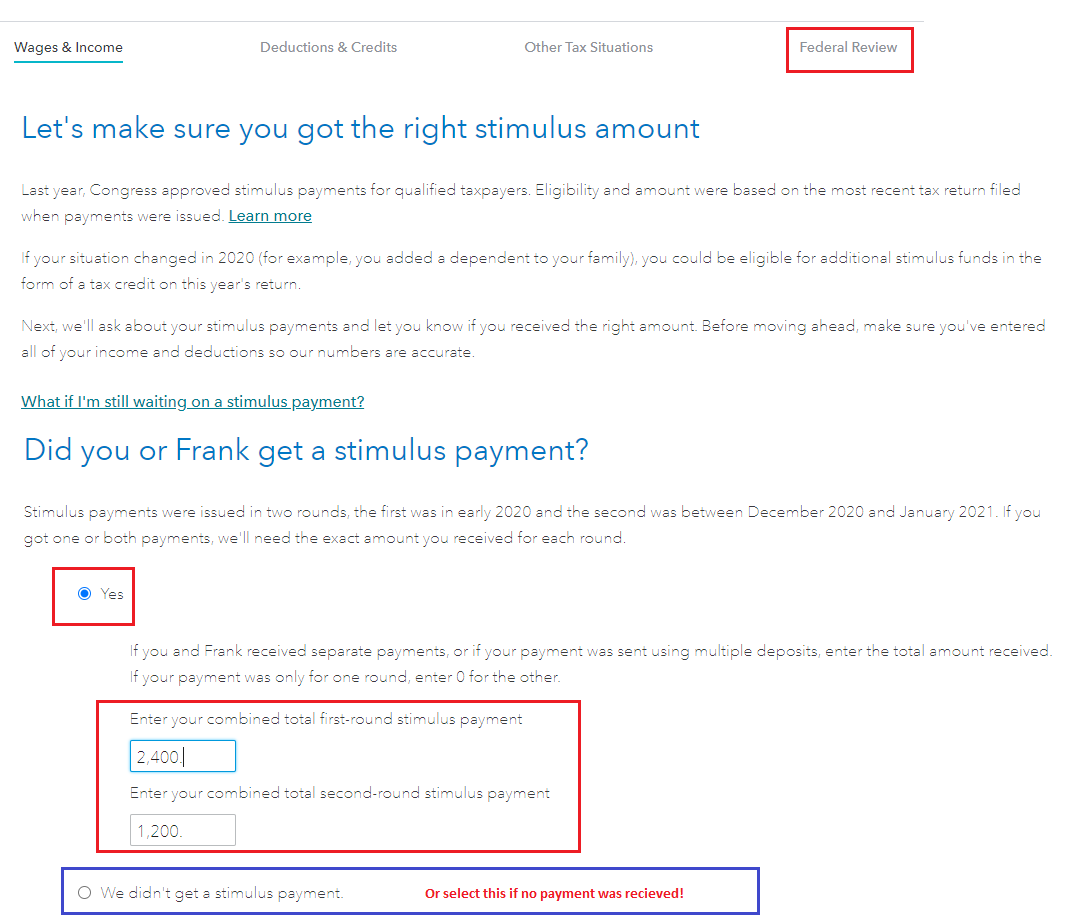

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 15 mars 2023 nbsp 0183 32 You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments through their individual Online

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on Web 15 mars 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit is based on the individual s income and a number of qualifying dependents Each eligible person can receive a credit of up to

Download Rebate Recovery

More picture related to Rebate Recovery

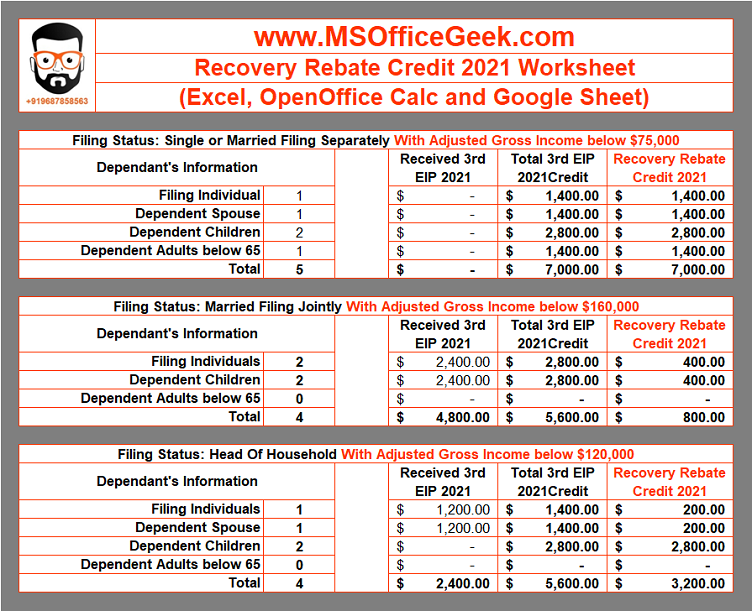

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-example-studying-worksheets.png?w=1125&ssl=1

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

Web 17 ao 251 t 2022 nbsp 0183 32 What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible citizens in Web 29 mars 2021 nbsp 0183 32 This tax season a recovery rebate credit has been added to returns in order for people to file for any unpaid stimulus check funds But you need to send in a

Web 2 nov 2022 nbsp 0183 32 2022 Rebate Recovery Credit The Recovery Rebate allows taxpayers to get a tax refund without having to modify the tax return This program is provided by the Web 19 janv 2022 nbsp 0183 32 Recovery rebate credits are a great way to catch up on a stimulus payment you may have missed during last year or if you simply did not get the full amount If you

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

10 Recovery Rebate Credit Worksheet

Why Your Mailed Stimulus Check Could Take Up To Four Weeks Ktvb

Why Your Mailed Stimulus Check Could Take Up To Four Weeks Ktvb

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit 2020 Calculator KwameDawson

Rebate Recovery - Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form