Rebate U S 87a For Senior Citizens Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not eligible to claim the 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will

Rebate U S 87a For Senior Citizens

Rebate U S 87a For Senior Citizens

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Overview of Rebate u s 87A Senior citizens above 80 years of age For detailed information refer to the Applicable Income Tax Slabs for FY 2023 24 Steps to Claim Rebate u s Senior citizens who fall in age group 60 80 years can avail refund under Section 87A Premium rebates cannot be claimed by super senior citizens aged 80 and above The rebate will be applicable on total income tax before

Income Tax Rebate under section 87A of Income Tax Act 1961 provides a rebate from income tax up to Rs 12500 to an individual resident assessee whose total income taxable income does not exceed Rs five lakhs Things to Remember while Availing Rebate Under Section 87A The rebate can be applied to the total tax before adding a health and education cess of 4 Only resident

Download Rebate U S 87a For Senior Citizens

More picture related to Rebate U S 87a For Senior Citizens

What Is Income Tax Rebate Under Section 87A HDFC Life

https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/knowledge-center/images/tax/section-87A.jpg

Income Tax Rebate Under Section 87A

http://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

Explained Long term Capital Gains From Shares And Rebate Under Section

https://www.livemint.com/lm-img/img/2023/08/11/1600x900/taxation_rules_for_senior_citizens_1691737451575_1691737451766.jpg

Are senior citizens eligible for a Section 87A tax rebate Yes senior citizens are eligible for a tax rebate under Section 87A This benefit is available to persons aged 60 years to less than 80 years What is Income Tax Rebate under Section 87A The Income Tax Rebate under Section 87A offers tax relief to eligible resident Indians For FY 2023 24 the new tax regime allows a rebate of up to Rs 25 000 for taxable

Resident senior citizens i e 60 years and above and super senior citizens i e 80 years and above can also claim the rebate provided their taxable income falls within the Senior citizens above 60 years and below 80 years are eligible to claim income tax rebate under section 87A Below mentioned is the way in which the calculation of taxable

Income Tax Sec 87A Amendment Rebate YouTube

https://i.ytimg.com/vi/sg50vzyjXQY/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

https://www.incometax.gov.in › iec › foportal › help › individual

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

https://tax2win.in › guide

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not eligible to claim the

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Sec 87A Amendment Rebate YouTube

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

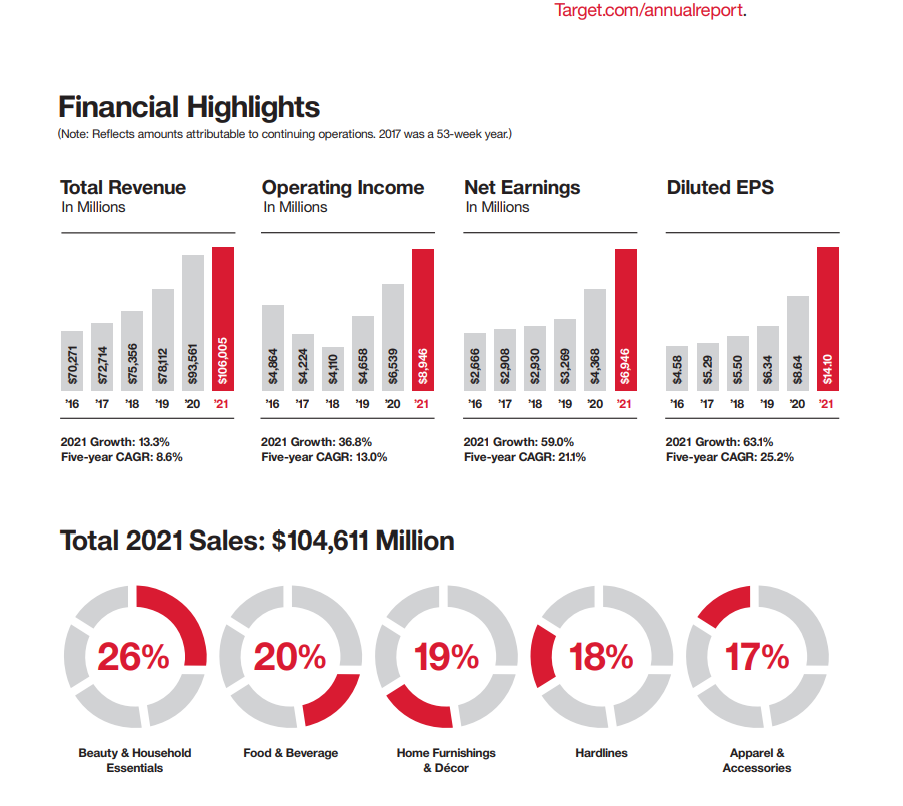

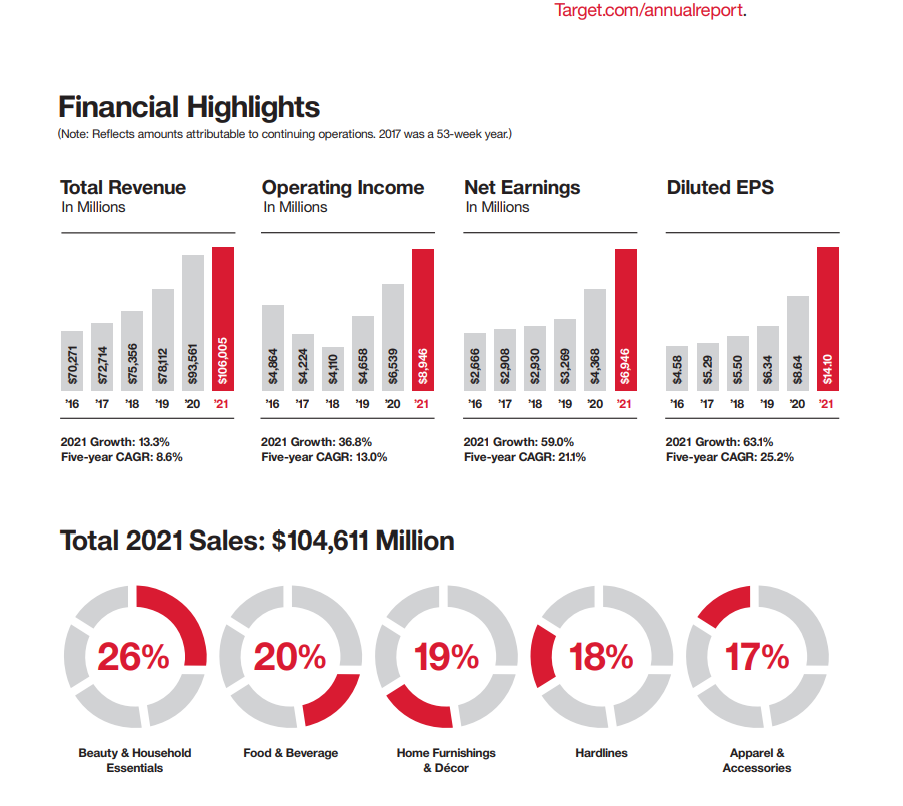

Target Corporation Rebate PrintableRebateForm

Target Corporation Rebate PrintableRebateForm

Rebate U s 87A Of I Tax Act Income Tax

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

FAQs On Rebate U s 87A FinancePost

Rebate U S 87a For Senior Citizens - While senior citizens aged between 60 and 80 years can avail of the rebate us 87A super senior citizens aged over 80 years are not eligible to claim this benefit Under the new