Recovery Rebate Irs Letter Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The IRS issued Letter 6475 Economic Impact Payment EIP 3 End of Year in January 2022 This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns

Recovery Rebate Irs Letter

Recovery Rebate Irs Letter

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

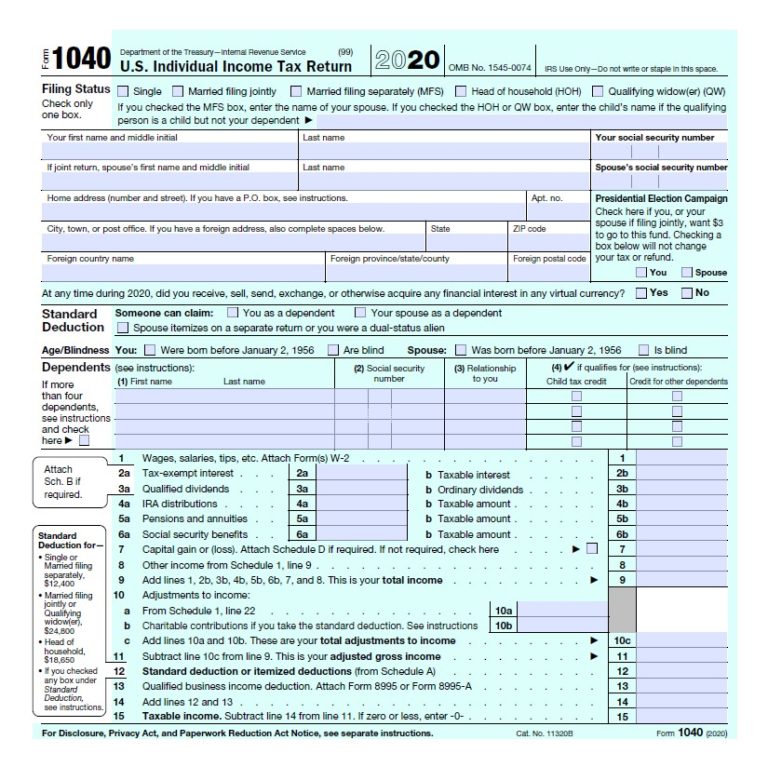

Recovery Rebate Form 1040 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-2.png

IRS gov has a special section Correcting Recovery Rebate Credit issues after the 2020 tax return is filed that provides additional information explaining what errors may have occurred Taxpayers who disagree with the IRS calculation should review their letter as well as the questions and answers for what information they should have Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or

To get any missing first or second EIPs file a 2020 tax return with the IRS and claim the 2020 Recovery Rebate Credit RRC immediately People should file the 2020 tax return even if they have no income to report for 2020 When the tax return is processed the IRS will pay the RRC as a tax refund Economic Impact Payments EIPs are considered advanced payments against a new credit called the Recovery Rebate Credit RRC that can be claimed when you file your 2020 individual tax return

Download Recovery Rebate Irs Letter

More picture related to Recovery Rebate Irs Letter

Irs Sent Letter About Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/2020-tax-return-notices-to-be-aware-of-go-green-tax-5.jpg

Irs Rebate Recovery Letter Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/recovery-rebate-credit-worksheet-tax-guru-ker-tetter-letter-87.jpg

Credit Recovery Rebate Irs Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-tax-guru-ker-tetter-letter-8.jpg

The IRS is sending letter 6475 ahead of filing their 2021 tax returns It can help determine if you are owed more money with Recovery Rebate Credit The letter can help tax filers determine if they are owed more money and discover if they re eligible to claim the Recovery Rebate Credit on their 2021 tax return when they file a return this

If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

IRS Updates Info On Recovery Rebate Credit And Pandemic Response

https://www.abercpa.com/wp-content/uploads/2022/01/irs-updates-info-on-recovery-rebate-credit-and-pandemic-response.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

https://www.irs.gov › newsroom

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

https://www.irs.gov › newsroom

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Can The IRS Keep My Recovery Rebate Credit

IRS Updates Info On Recovery Rebate Credit And Pandemic Response

Irs Recovery Rebate Credit Letter Scam Recovery Rebate

IRS Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

Recovery Rebate Credit Update FAQs And IRS Letters YouTube

IRS Provides FAQs Regarding The Recovery Rebate Credit YouTube

IRS Provides FAQs Regarding The Recovery Rebate Credit YouTube

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

IRS Free File Available Today Claim Recovery Rebate Credit And Other

Menards 5879 Printable Rebate Forms RebateForMenards

Recovery Rebate Irs Letter - To get any missing first or second EIPs file a 2020 tax return with the IRS and claim the 2020 Recovery Rebate Credit RRC immediately People should file the 2020 tax return even if they have no income to report for 2020 When the tax return is processed the IRS will pay the RRC as a tax refund