Redundancy Tax Credit Nz Redundancy payments and retirement allowances are taxable income When your employer pays you they ll deduct tax and you ll get the after tax amount in your hand How much tax Your employer will estimate your income for the year including your redundancy payment or retirement allowance

Redundancy may increase or decrease the income you are expecting in a financial year which can impact your Income tax Working for Families tax credits entitlements KiwiSaver contributions Student loan repayments and balance Child support More details are provided by the IRD here Redundancy will likely affect your income for the financial year It can affect your income tax working for families tax credits entitlements Kiwisaver student loan and child support In this blog we will look at how your income tax may be affected

Redundancy Tax Credit Nz

Redundancy Tax Credit Nz

https://holdenassociates.co.uk/wp-content/uploads/2020/05/redundancy-1024x683.jpg

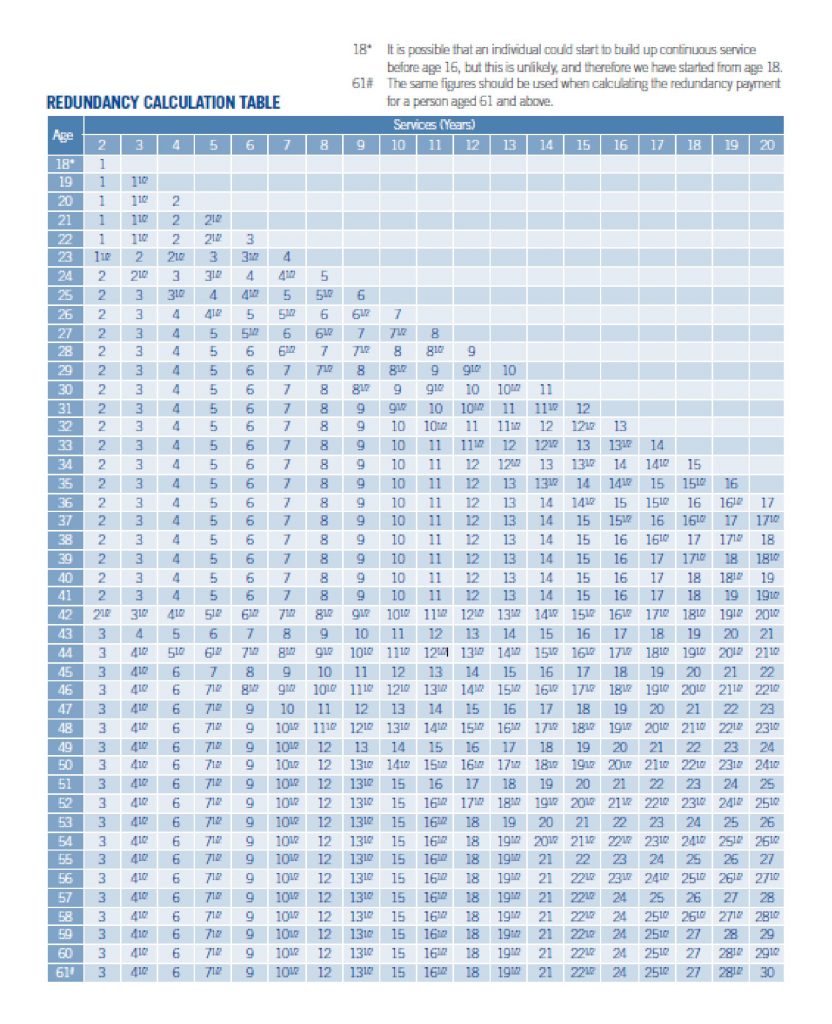

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

An Employee s Guide To Redundancy Neate Pugh

https://www.neateandpugh.com/wp-content/uploads/2022/03/redundancy-individual-1024x1024.png

Redundancy compensation Whether employees receive redundancy payments is dependent on the applicable employment agreements and is a matter for negotiation between the parties However all employees whose employment is ending due to redundancy must be given notice in terms of the employment agreement Search Tips Remedial items Extending the redundancy tax credit The cessation date for the redundancy tax credit has been extended to payments made on or after 1 Apr 2011 Section ML 2 1 of the Income Tax Act 2007 The redundancy tax credit ceased for redundancy payments made on or after 1 October 2010

Revenue Minister Peter Dunne today announced an extension to the redundancy tax credit The tax credit was repealed in Budget 2010 with effect from 1 October 2010 but will now be extended to 31 March 2011 He said that the decision to extend the credit was in response to the Christchurch earthquake Mr Dunne said it had Redundancy payments are subject to tax at the lump sum rate and you have to deduct PAYE on lump sum payments based on your employee s tax code Key Takeaways In New Zealand you are not legally required to pay redundancy compensation to your employees unless you have agreed to it in your employment agreement

Download Redundancy Tax Credit Nz

More picture related to Redundancy Tax Credit Nz

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Redundancy tax credit The redundancy tax credit introduced in April 2008 provides some immediate tax relief for taxpayers receiving redundancy compensation The effect of the tax credit is to allow an employee to apply for an If you re made redundant during the tax year it may turn out that you ve paid too much tax and are due a refund have not paid enough tax and have some more to pay This depends on what entitlements you qualify for and how you were taxed during the year Income tax assessments Individual income tax return IR3 If you cannot pay a tax bill

Govt introduces fairer taxation of redundancy pay Michael Cullen Finance The government today introduced legislation to make the taxation of redundancy payments fairer to people who are pushed into a higher tax Redundancy and retirement allowance tax and entitlements This factsheet explains how redundancy payments and retirement allowances are taxed and how these payments may affect your entitlements The tax rate used to tax redundancy payments and retirement allowances is based on your expected income for the year

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

https://i.ytimg.com/vi/YVQNoJvJlu4/maxresdefault.jpg

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

https://www.fica.org.nz/blog/post/110080/how...

Redundancy payments and retirement allowances are taxable income When your employer pays you they ll deduct tax and you ll get the after tax amount in your hand How much tax Your employer will estimate your income for the year including your redundancy payment or retirement allowance

https://www.moneyhub.co.nz/redundancy-payouts-and-entitlements.html

Redundancy may increase or decrease the income you are expecting in a financial year which can impact your Income tax Working for Families tax credits entitlements KiwiSaver contributions Student loan repayments and balance Child support More details are provided by the IRD here

Tax On Redundancy Payments Davis Grant

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

Redundancy Advice For Employers DavidsonMorris

Tax Deduction Vs Tax Credit What s The Difference With Table

Tax On Redundancy Payments TaxAssist Accountants

Taxes Tippinsights

Taxes Tippinsights

How Redundancy Affects Your Income Tax Ean Brown Partners Limited

Tax Reduction Company Inc

Individual Tax WEC CPA Blog

Redundancy Tax Credit Nz - Redundancy payments are subject to tax at the lump sum rate and you have to deduct PAYE on lump sum payments based on your employee s tax code Key Takeaways In New Zealand you are not legally required to pay redundancy compensation to your employees unless you have agreed to it in your employment agreement