Redundancy Tax Exemption Verkko Tax and National Insurance If you re made redundant you may get a termination payment This could include statutory redundancy pay holiday pay unpaid wages

Verkko 6 huhtik 2023 nbsp 0183 32 Any costs your employer pays to help you adjust to redundancy or to help you retrain or find a new job including any related travel expenses are usually exempt from tax Counselling services Verkko Tax free redundancy pay Example 1 Colin receives a redundancy payment of 163 18 000 plus one month s pay in lieu of notice This totals 163 1 000 The redundancy payment is

Redundancy Tax Exemption

Redundancy Tax Exemption

https://www.davisgrant.co.uk/wp-content/uploads/2020/06/redundancies-blog-featured-image-880x360.jpg

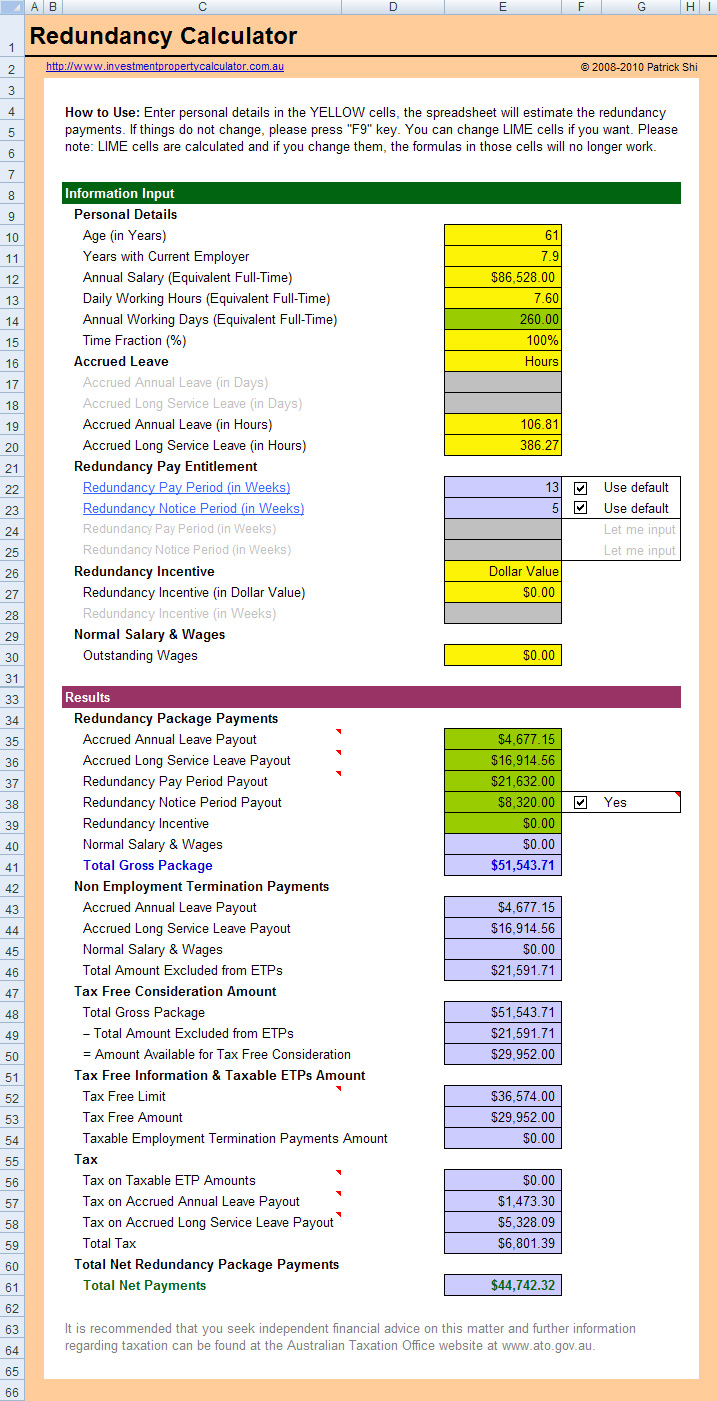

Redundancy Tax Planning Case Study

https://cdn.slidesharecdn.com/ss_thumbnails/redundancy2-201015091517-thumbnail.jpg?width=640&height=640&fit=bounds

COVID 19 Redundancy Tax And Entitlements YouTube

https://i.ytimg.com/vi/pKO4nMFkNe0/maxresdefault.jpg

Verkko 1 jouluk 2023 nbsp 0183 32 Lea D Uradu Fact checked by Suzanne Kvilhaug Severance pay may be given to individuals by their company when their employment is terminated It s taxed as ordinary income and the Verkko is exempt from liability to tax as earnings within the definition given by section 62 ITEPA 2003 see EIM00515 but falls within section 401 ITEPA 2003 as specific employment

Verkko 25 hein 228 k 2023 nbsp 0183 32 Home Life events and personal circumstances Leaving a job and unemployment Redundancy lump sum payments You may receive a lump sum Verkko Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each

Download Redundancy Tax Exemption

More picture related to Redundancy Tax Exemption

Ask An Expert Do I Have To Pay Tax On My Redundancy Pay Which News

https://media.product.which.co.uk/prod/images/original/gm-7523aba6-11b9-4895-8cf2-ba71a01c0fe1-redundant-businesswoman-leaving-office-with-box.jpeg

Some Redundancy Pay Can Be Tax free Business The Sunday Times

https://www.thetimes.co.uk/imageserver/image/%2Fmethode%2Fsundaytimes%2Fprod%2Fweb%2Fbin%2F80b78082-fe5c-11e5-8bec-88a6d6ce282d.jpg?crop=1500%2C844%2C0%2C78&resize=1180

Pay Tax Redundancy Pay Tax Calculator Uk

http://www.landaulaw.co.uk/wp-content/uploads/2015/02/Satellite.jpeg

Verkko Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each Verkko 4 jouluk 2023 nbsp 0183 32 Other non contractual payments may be included under the tax free redundancy allowance However if these payments are not considered part of the normal weekly wage they will not qualify for tax

Verkko 3 syysk 2009 nbsp 0183 32 Redundancy compensation cannot be paid tax free either as a special exemption none exists or as a compensation payment for hurt and humiliation under Verkko redundancy The sum payable as statutory redundancy is exempt from income tax An employer may decide to pay an employee an amount in excess of the statutory lump

Redundancy Pay What Are You Entitled To PayPlan Blog

https://www.payplan.com/wp-content/uploads/2019/10/redudancy-pic.jpg

Redundancy Tax Planning Ian s Story AAB Wealth

https://www.aabwealth.uk/wp-content/uploads/2022/05/Client-2.jpg

https://www.gov.uk/redundancy-your-rights/tax-and-national-insurance

Verkko Tax and National Insurance If you re made redundant you may get a termination payment This could include statutory redundancy pay holiday pay unpaid wages

https://www.litrg.org.uk/.../what-tax-do-i-pay-r…

Verkko 6 huhtik 2023 nbsp 0183 32 Any costs your employer pays to help you adjust to redundancy or to help you retrain or find a new job including any related travel expenses are usually exempt from tax Counselling services

Spotless Again Loses Case For Broad Exemption From Redundancy Pay

Redundancy Pay What Are You Entitled To PayPlan Blog

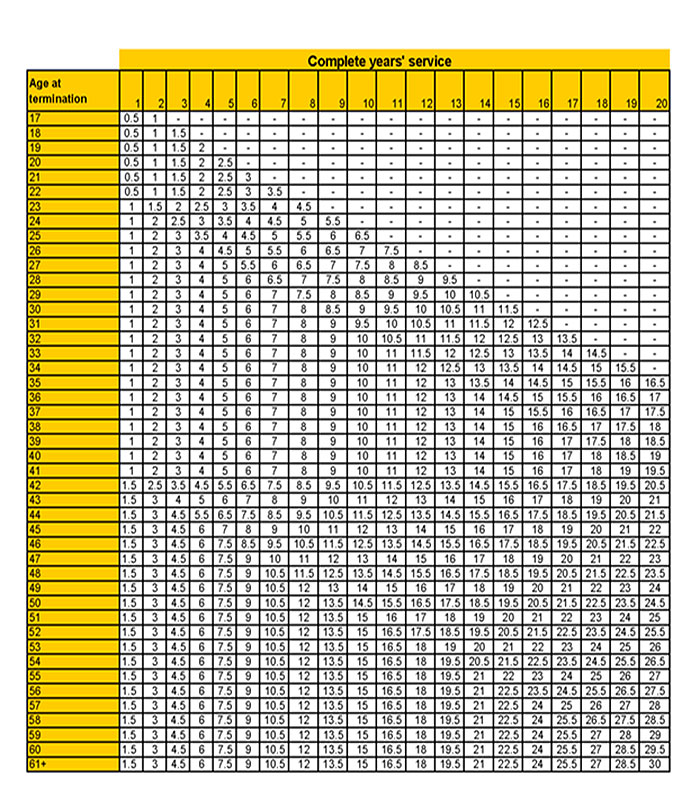

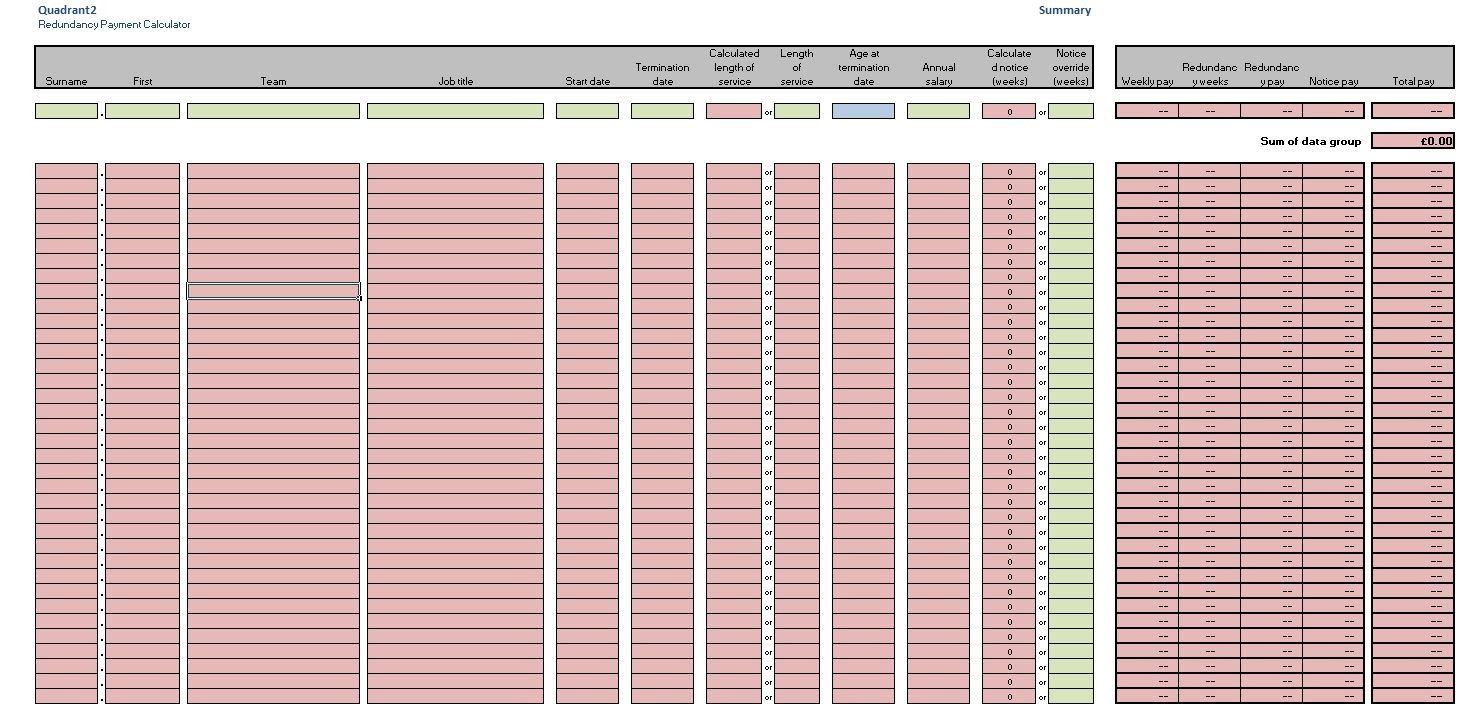

Redundancy Calculator Spreadsheet Within Uk Redundancy Calculator Db

Redundancy Calculator Spreadsheet 2018 Db excel

Public Servants Hit With Redundancy Tax Shocks The Canberra Times

Redundancy Redundancy Is Unnecessary Duplication A Costly Redundancy

Redundancy Redundancy Is Unnecessary Duplication A Costly Redundancy

Directors Redundancy Pay Calculator Redundancy Pay Claim

Will I Have To Pay Tax On My Redundancy Independent ie

Redundancy Calculator Calculate Redundancy Pay Breathe

Redundancy Tax Exemption - Verkko 13 marrask 2020 nbsp 0183 32 The basic exemption exempts payments over and above statutory redundancy up to 10 160 plus 765 for each complete year of service from tax