Redundancy Tax Free Ireland You may receive a lump sum payment on redundancy or retirement from your employer A lump sum payment on termination of employment may be exempt from tax or

Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each completed year of service The basic exemption may be Do I pay tax on the statutory redundancy payment The statutory redundancy payment is tax free If you get a lump sum as compensation for losing your job part of it may

Redundancy Tax Free Ireland

Redundancy Tax Free Ireland

https://holdenassociates.co.uk/wp-content/uploads/2020/05/redundancy-1024x683.jpg

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

A termination payment from your employer will be tax free if it does not exceed the basic exemption You can count the following towards a full year s work time worked before Most payments from employers to employees are taxable but there is a special tax treatment for lump sum payments on a redundancy or retirement Statutory redundancy payments are exempt from tax There is

How are are redundancy payments taxed in Ireland If you are just receiving the base amount of redundancy payment which is the statutory amount then this will be Statutory redundancy payments are tax free Statutory redundancy is calculated as follows Two weeks pay for each year of reckonable service between ages of 16 and 66 plus one extra week subject to a

Download Redundancy Tax Free Ireland

More picture related to Redundancy Tax Free Ireland

An Employee s Guide To Redundancy Neate Pugh

https://www.neateandpugh.com/wp-content/uploads/2022/03/redundancy-individual-1024x1024.png

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

Letter Of Termination Of Employment Redundancy

https://www.wonder.legal/Les_thumbnails/letter-of-termination-of-employment-redundancy.png

Up to March 2013 your redundancy lump sum may be completely tax free provided 75 or more of your entire period of employment ending on the date of termination was Foreign An employer who proposes to dismiss an employee by reason of redundancy must give that employee notice of the redundancy at least 2 weeks before the date of dismissal

All the elements of income under the employment contract are fully liable to income tax and should be taxed via the PAYE PRSI system as normal The statutory redundancy element is Lump sum payments on a redundancy or a retirement however qualify for special tax treatment they may be exempt from tax or may qualify for some relief from tax Note A lump sum paid

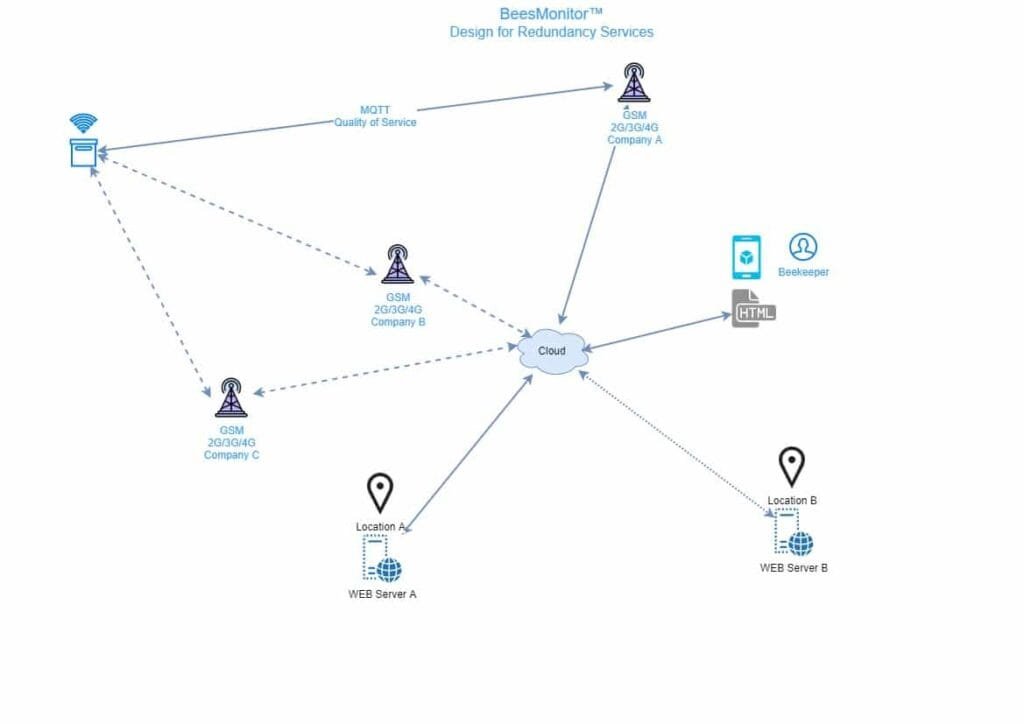

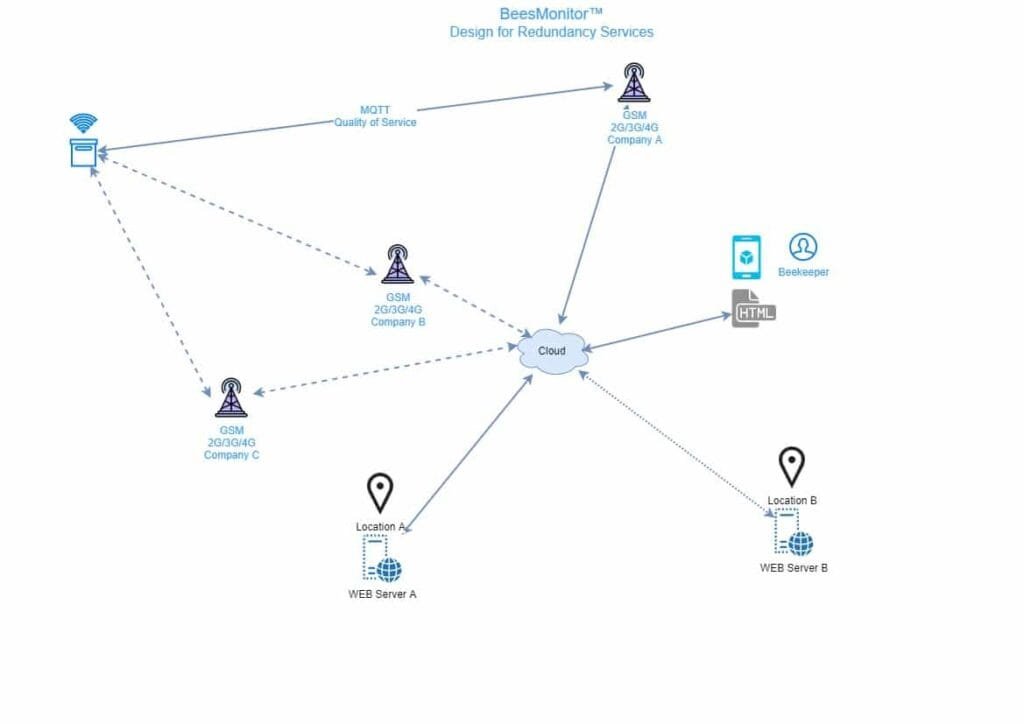

Redundancy High Availability Design BeesMonitor

https://www.beesmonitor.com/wp-content/uploads/2021/02/redundancy_2-1024x724.jpg

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

https://www.revenue.ie › en › personal-tax-credits...

You may receive a lump sum payment on redundancy or retirement from your employer A lump sum payment on termination of employment may be exempt from tax or

https://kpmg.com › ie › en › home › insights › are...

Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each completed year of service The basic exemption may be

6 Methods To Reduce Your Tax In Ireland Cronin Co

Redundancy High Availability Design BeesMonitor

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

Redundancy Photo Blog By Rajan Parrikar

Genuine Redundancy Payment Age Increase Babbage Co

Tax On Redundancy Payments Davis Grant

Tax On Redundancy Payments Davis Grant

Prepare And File Form 2290 E File Tax 2290

Redundancy Your Rights

Redundancy Advice For Employers DavidsonMorris

Redundancy Tax Free Ireland - A termination payment from your employer will be tax free if it does not exceed the basic exemption You can count the following towards a full year s work time worked before