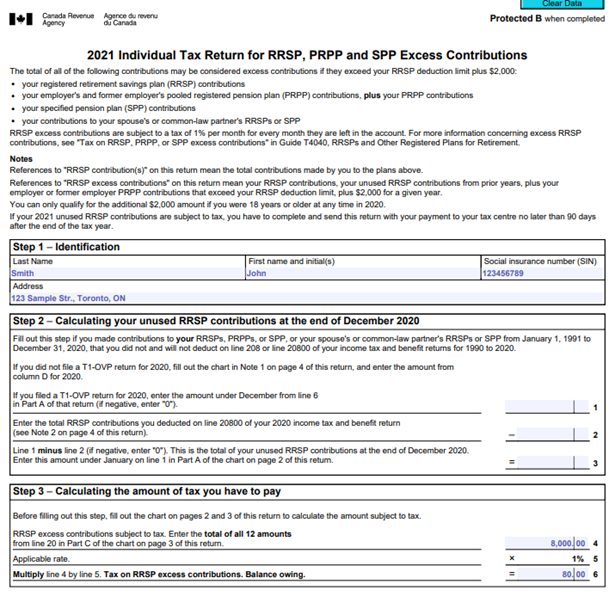

Rrsp Contribution Income Tax Return On the surface it s simple you open an account and make contributions daily weekly monthly annually whenever you want You file your tax

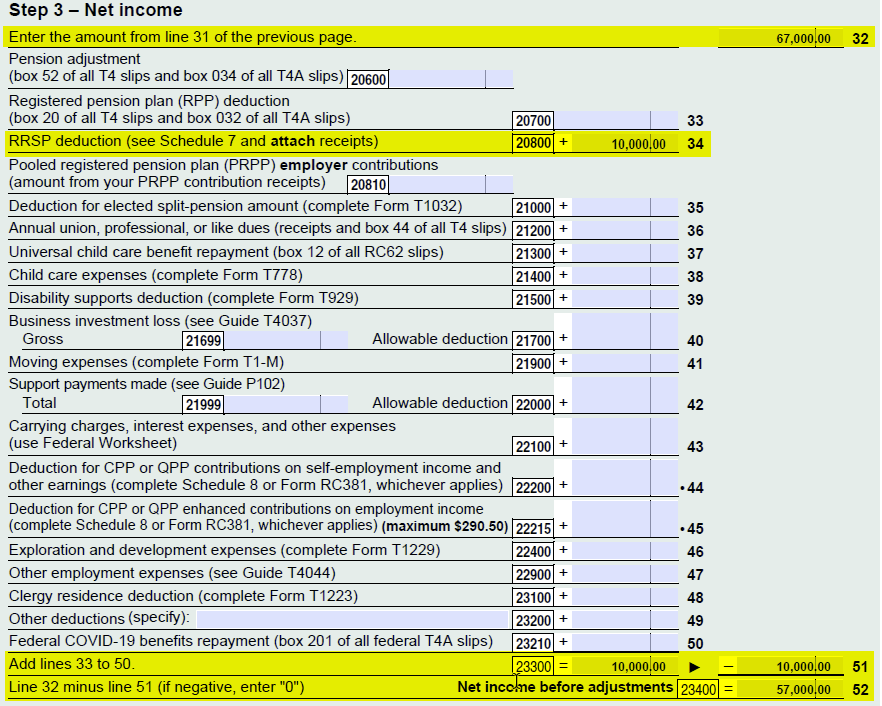

Filling out your Income Tax and Benefit Return On line 12900 enter the total of amounts shown in boxes 16 18 28 and 34 of your T4RSP slips Also include the amounts from TurboTax s free RRSP tax calculator Estimate your 2023 income tax savings your RRSP contribution generates in each Canadian province and territory

Rrsp Contribution Income Tax Return

Rrsp Contribution Income Tax Return

https://www.capcorp.ca/wp-content/uploads/2022/02/RRSP-IMAGE.jpg

How To Calculate Rrsp Contribution For Tax Refund Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-rrsp-contribution-for-tax-refund-768x527.jpg

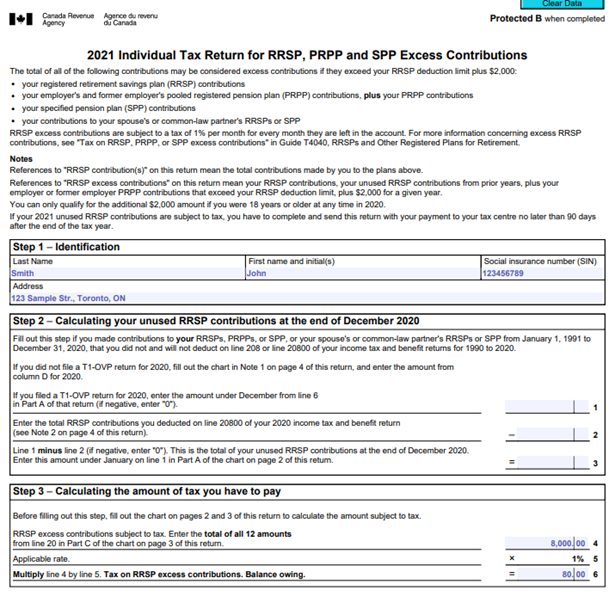

Understanding RRSP Contributions Deductions And Over Contributions

https://wellington-altus.ca/wp-content/uploads/2021/02/Picture1.png

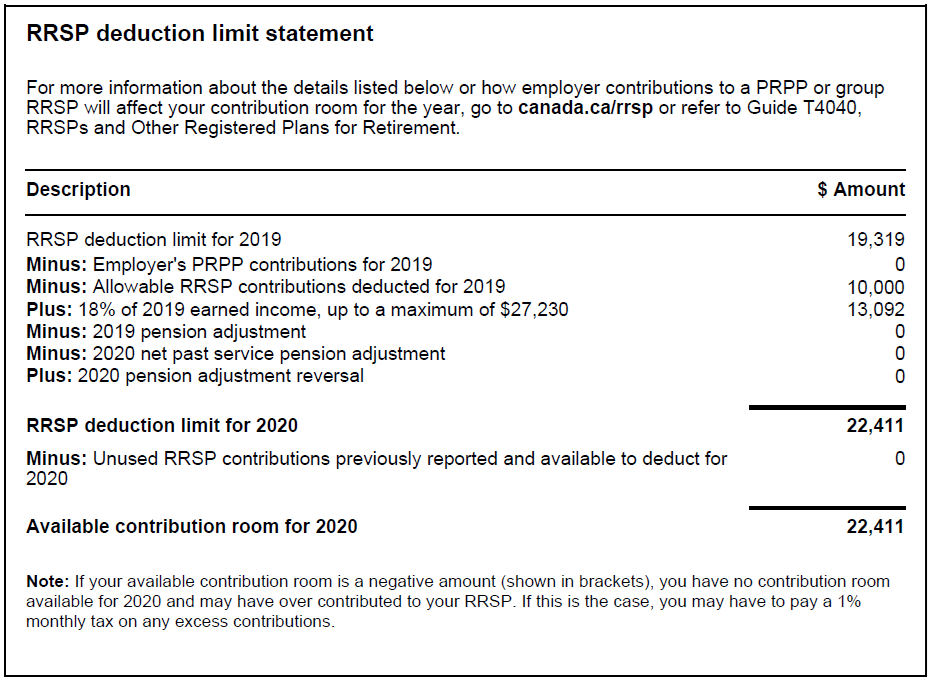

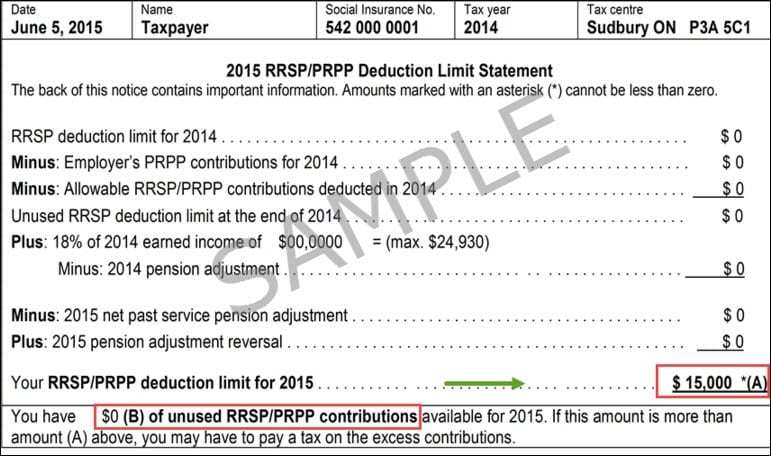

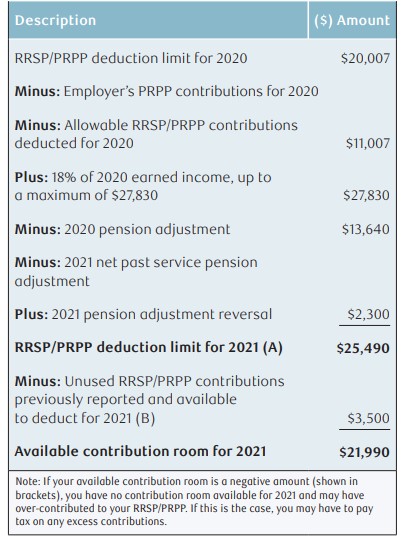

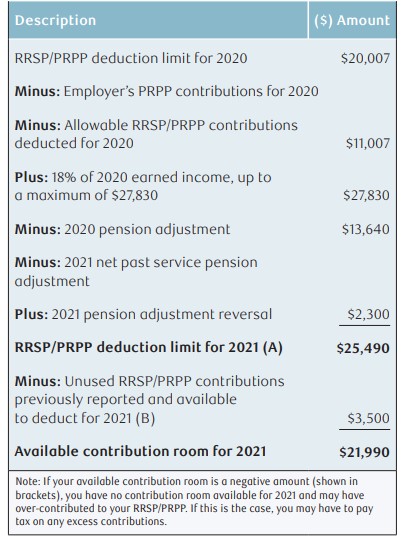

RRSP contribution room also referred to as contribution limit is the maximum amount of money you can put into your RRSP accounts in any given year Use the RRSP Tax Refund Calculator to find out your marginal tax rate based on your province of residence and determine how much tax savings your annual RRSP

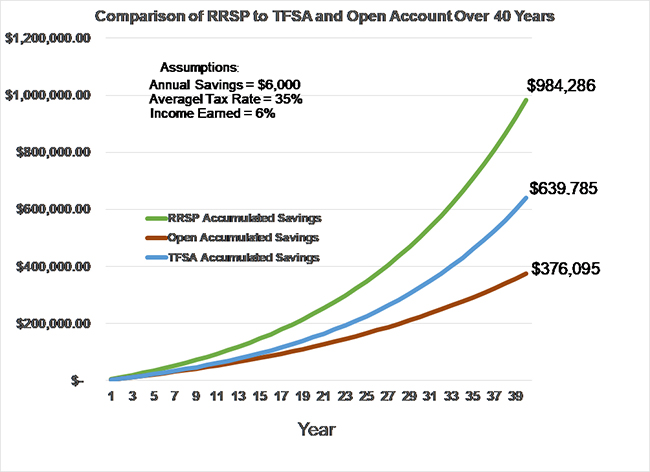

By contributing to an RRSP you may claim a tax deduction which can help to reduce the total amount of income tax you pay Income earned within the RRSP is also tax Our RRSP contribution calculator will let you know how much you can contribute to your RRSP It will also provide an estimate of how much your RRSP will be worth in the

Download Rrsp Contribution Income Tax Return

More picture related to Rrsp Contribution Income Tax Return

RRSP Contributions How To Avoid Paying Taxes Qopia Financial

https://qopiafinancial.ca/wp-content/uploads/2022/02/RRSP-spelled-out-1080x675.jpg

RRSP Contribution Deduction On Tax Return Example PlanEasy PlanEasy

https://www.planeasy.ca/wp-content/uploads/2022/04/RRSP-Contribution-Deduction-on-Tax-Return-Example-PlanEasy.png

2021 RRSP CONTRIBUTION DEADLINE SJ Chartered Accountants Etobicoke

https://jainfinancial.com/wp-content/uploads/2022/02/content-900x480.png

For 2024 the RRSP contribution limit is 31 560 Contributions to an RRSP reduce the amount of income tax individuals must pay each year so the Canada Revenue Agency Calculate the tax savings your RRSP contribution generates in each province and territory

Your RRSP contributions can be put into investments or savings deposits while in the plan Your contributions are tax deductible That means you can claim First contributions to an RRSP are tax deductible in the year that you deposit the money into the plan Second funds inside an RRSP are fully tax sheltered

RRSP Over Contributions Oakville Financial Planning Bristol Capital

https://www.bristolcapital.ca/wp-content/uploads/2022/07/29.png

How Much Can I Contribute To My RRSP Common Wealth

https://www.commonwealthretirement.com/wp-content/uploads/2022/02/Sample-notice-of-assessment-RRSP-limit.jpeg

https://turbotax.intuit.ca › tips

On the surface it s simple you open an account and make contributions daily weekly monthly annually whenever you want You file your tax

https://www.canada.ca › ...

Filling out your Income Tax and Benefit Return On line 12900 enter the total of amounts shown in boxes 16 18 28 and 34 of your T4RSP slips Also include the amounts from

The RRSP Success To Saving Types Of Taxes Social Media Resources

RRSP Over Contributions Oakville Financial Planning Bristol Capital

What Is A Group RRSP And How Does It Work Blog Avalon Accounting

How Do The RRSP Contribution Carry Forward Rules Work Strategic

Optimizing Your RRSP Contribution Strategy To Build Your Retirement

The So Wealth Management Group RRSP Contribution VS Deduction Limit

The So Wealth Management Group RRSP Contribution VS Deduction Limit

Taxes RRSPs And You Scheper Financial

2013 RRSP Contribution Limit Financial Planner Kingston Belleville

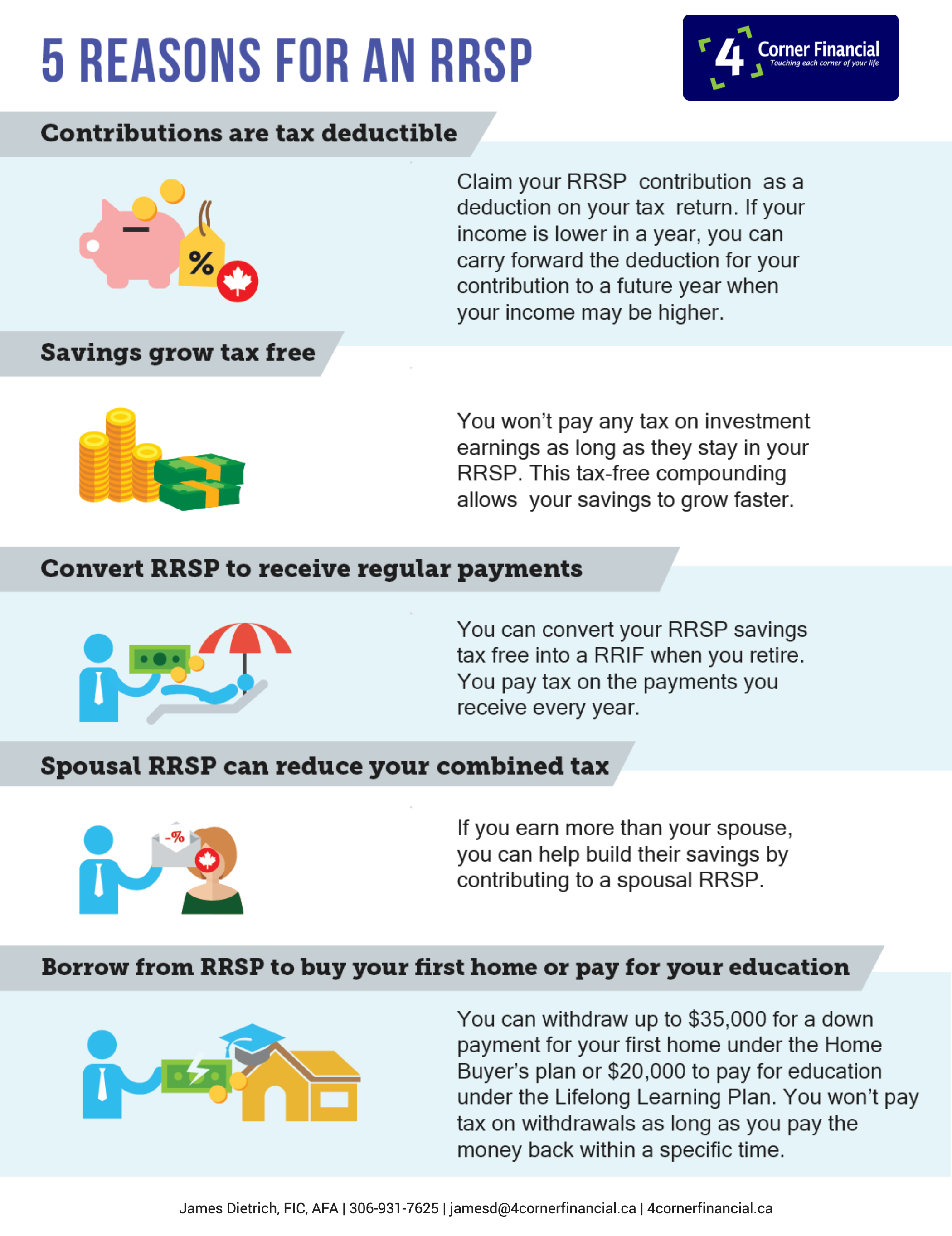

5 Reasons For An RRSP 2020 4 Corner Financial

Rrsp Contribution Income Tax Return - An RRSP Calculator giving Canadians new insights to make better RRSP contribution decisions Instead of using only income tax rates this RRSP Calculator uses your