Rrsp Contributions And Income Tax Refunds Use the RRSP Tax Refund Calculator to find out your marginal tax rate based on your province of residence and determine how much tax savings your annual RRSP

9 rowsTurboTax s free RRSP tax calculator Estimate your 2023 income tax savings February 29 2024 is the deadline for contributing to your RRSP for amounts you want to deduct on your 2023 income tax and benefit return For more information see Questions

Rrsp Contributions And Income Tax Refunds

Rrsp Contributions And Income Tax Refunds

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

RRSP Contributions How To Avoid Paying Taxes Qopia Financial

https://qopiafinancial.ca/wp-content/uploads/2022/02/RRSP-spelled-out-1080x675.jpg

Advisorsavvy RRSP Tax Deduction

https://advisorsavvy.com/wp-content/uploads/2022/08/RRSP-Tax-Deduction-In-Post-768x1152.jpg

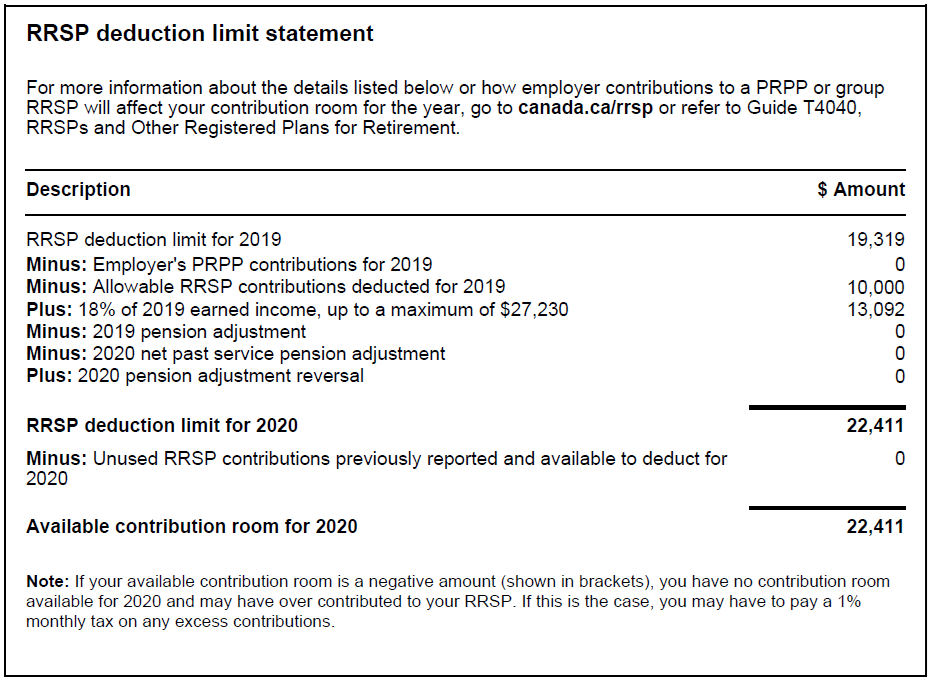

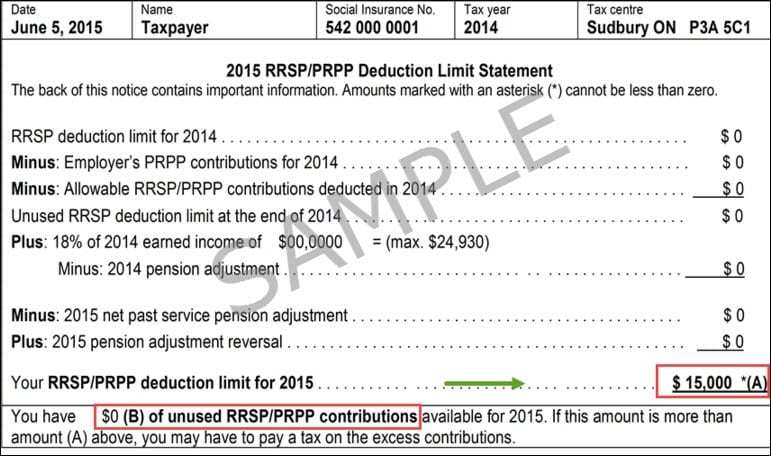

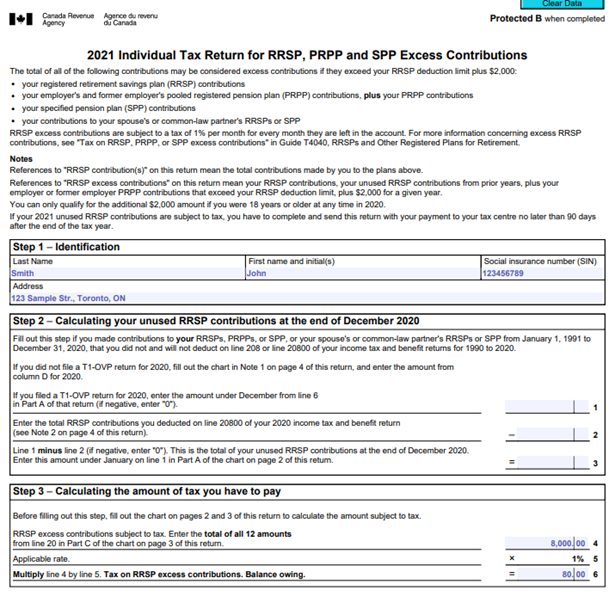

Once you have the online account you can check the status of your refund check for benefit amounts see previous years tax information and notices of assessment and Generally you have to pay a tax of 1 percent per month on your contributions that exceed your RRSP deduction limit by more than 2 000 For more

RRSP contributions can be deducted from your taxable income That can help reduce your tax bill and may result in you getting a refund RRSP contributions may entitle you If you have maxed out your RRSP contributions it would usually make sense to put your RRSP tax refund and any extra available money for saving into a TFSA

Download Rrsp Contributions And Income Tax Refunds

More picture related to Rrsp Contributions And Income Tax Refunds

Understanding RRSP Contributions Deductions And Over Contributions

https://wellington-altus.ca/wp-content/uploads/2021/02/Picture1.png

A User s Guide To RRSPs CBC News

https://i.cbc.ca/1.1500656.1379033983!/httpImage/image.jpg_gen/derivatives/16x9_780/hi-istock18144041-rrsp-8col.jpg

How Much Can I Contribute To My RRSP Common Wealth

https://www.commonwealthretirement.com/wp-content/uploads/2022/02/Sample-notice-of-assessment-RRSP-limit.jpeg

Our powerful tools are designed to help you make informed decisions about your RRSP contributions and tax returns ensuring you get the most out of your retirement Yes our RRSP calculator will show you how much of a tax refund you ll get by contributing to an RRSP It will also calculate how much money you can contribute to an RRSP

Withdrawal from an RRSP must be included as income and is subject to income tax at your combined marginal tax rate Funds withdrawn under the Homebuyers Plan or the First contributions to an RRSP are tax deductible in the year that you deposit the money into the plan Second funds inside an RRSP are fully tax sheltered

Why Tax Refunds Are Shrinking Under First Trump Tax Cut

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

https://www.theglobeandmail.com/.../rrsp-tax-savings

Use the RRSP Tax Refund Calculator to find out your marginal tax rate based on your province of residence and determine how much tax savings your annual RRSP

https://turbotax.intuit.ca/tax-resources/canada-rrsp-calculator.jsp

9 rowsTurboTax s free RRSP tax calculator Estimate your 2023 income tax savings

How To Optimize RRSP Contributions For Income Tax Doing Taxes In

Why Tax Refunds Are Shrinking Under First Trump Tax Cut

RRSP Over Contributions Oakville Financial Planning Bristol Capital

TFSA Vs RRSP In 2021 Saving Tips Higher Income Income

Your Tax Refund Is The Key To Homeownership

Blog East York Accounting Tax

Blog East York Accounting Tax

How RRSP Contributions Affect Your Government Benefits PlanEasy

How High Income Earners Can Legally Reduce Their Tax Rates Buying RRSPs

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Rrsp Contributions And Income Tax Refunds - If you have maxed out your RRSP contributions it would usually make sense to put your RRSP tax refund and any extra available money for saving into a TFSA