Salary Tax Deduction Calculator Pakistan Salary income exceeds PRK 75 000 000 This salary tax calculator for year 2023 2024 will help you to calculate your payable income tax You ll learn about tax calculations with charts

Here s how you can calculate your income tax on your salary in Pakistan by using Salary Tax Calculator Pakistan 2023 24 1 Determine Your Gross Salary This is your total Salary Calculator for 2024 2025 Calculate your monthly or annual income Our salary tax calculator is constantly updated with the latest regulations and tax rates in Pakistan

Salary Tax Deduction Calculator Pakistan

Salary Tax Deduction Calculator Pakistan

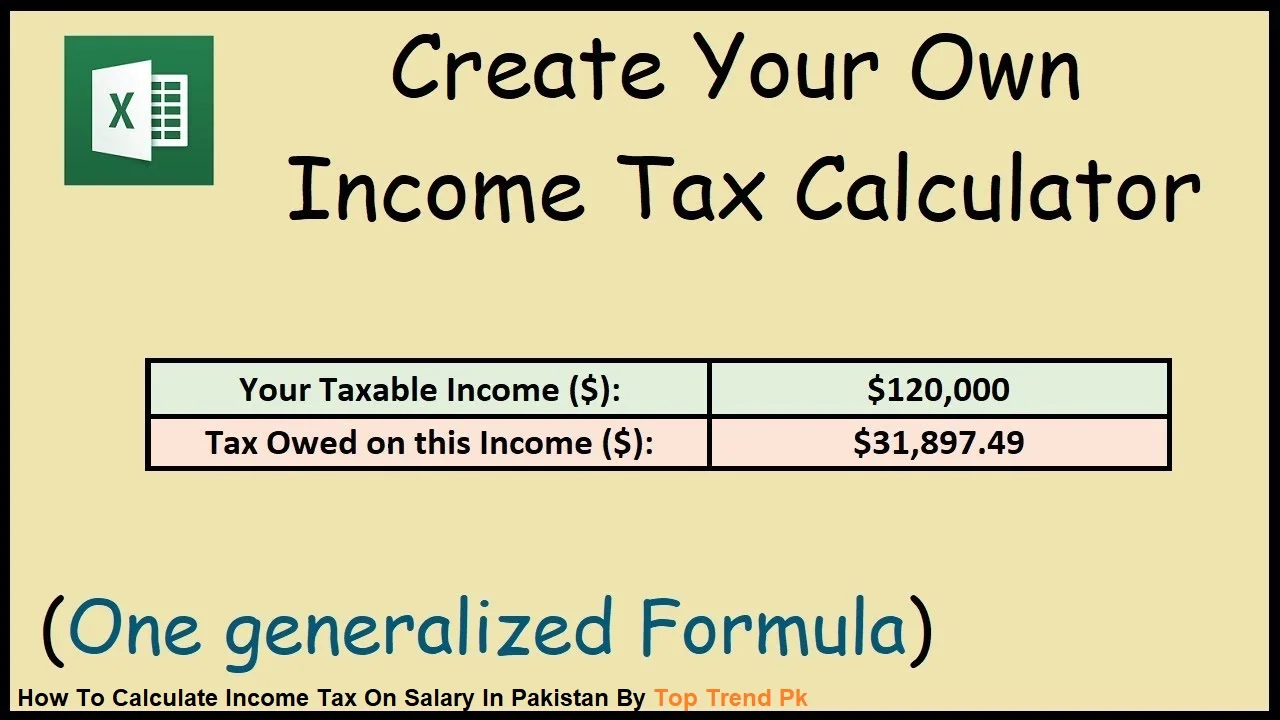

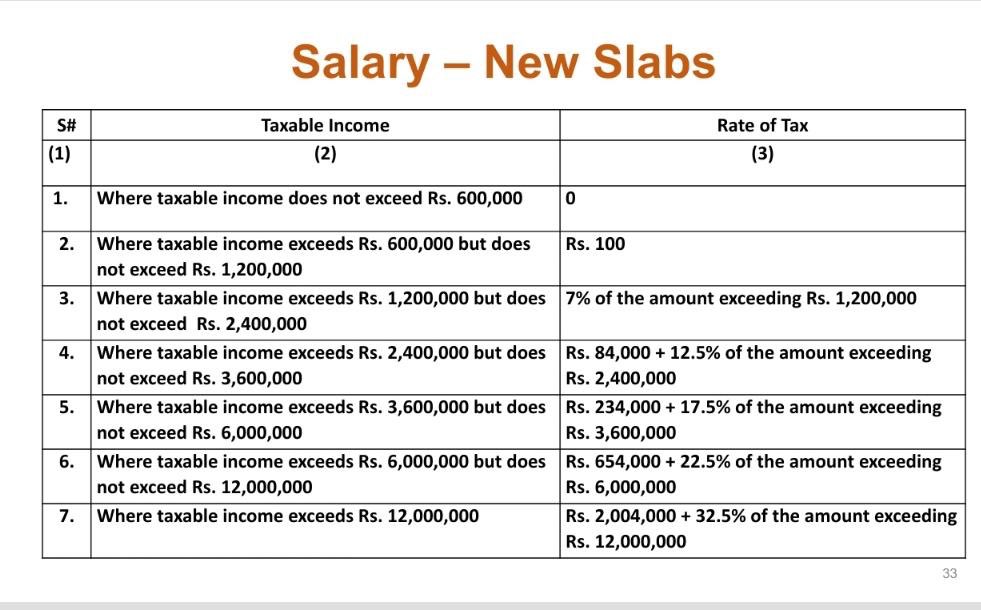

https://i.ytimg.com/vi/zaoFC9aT86c/maxresdefault.jpg

Tax Calculator Pakistan 2022 2023

https://taxcalculator.pk/assets/images/services/4.webp

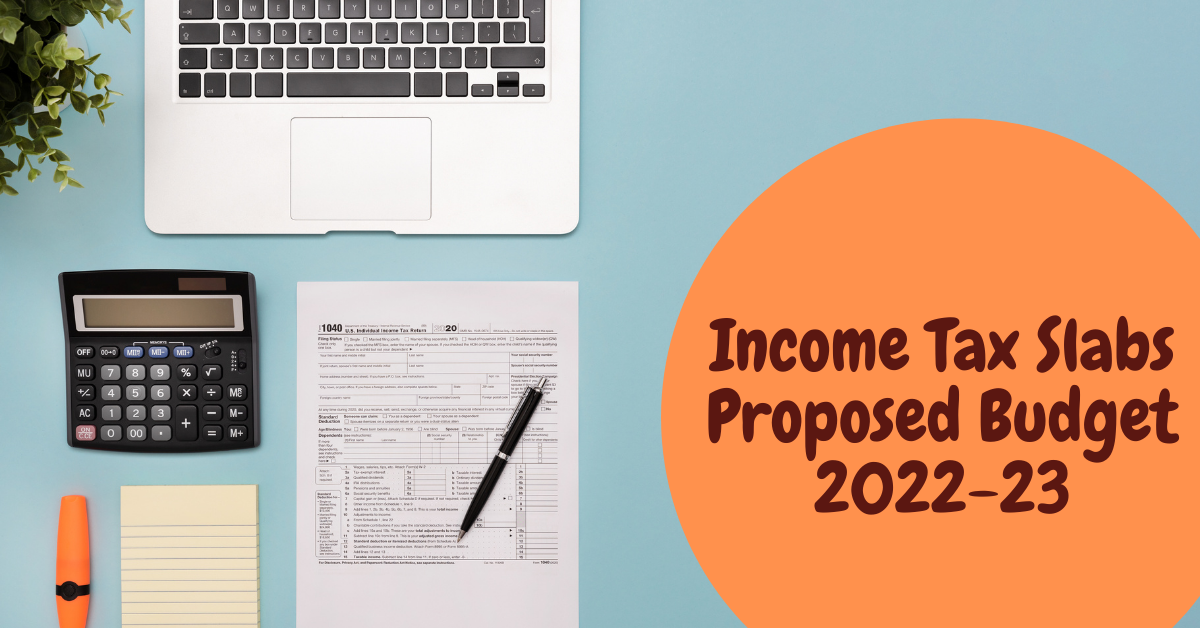

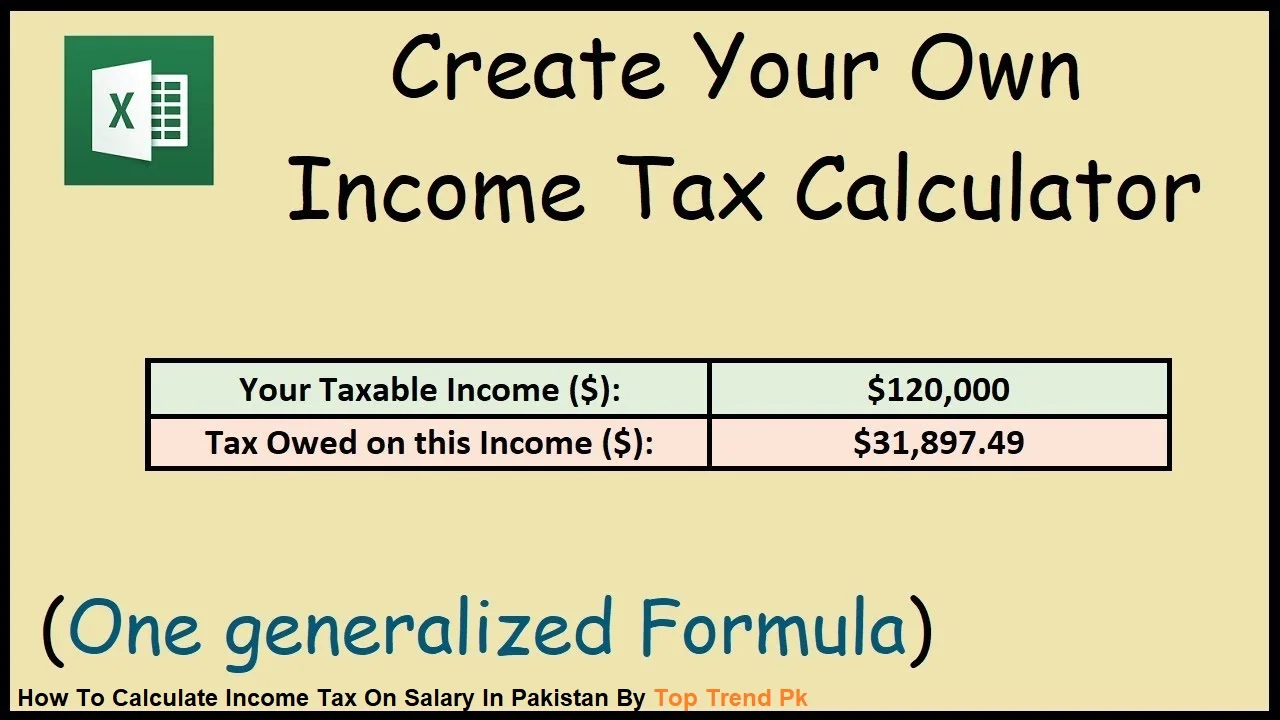

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

https://tax.net.pk/wp-content/uploads/2022/06/Income-Tax-Slabs-Proposed-Budget-2022-and-2023-Salary-Tax-Calculator.png

Pakistan 2021 Income Tax Calculator Pakistan 2020 Income Tax Calculator Pakistan 2019 Income Tax Calculator Calculate your income tax in Pakistan and salary This income tax calculator Pakistan helps you to calculate salary monthly yearly payable income tax according to tax slabs 2023 2024

Salary Tax Calculator 2022 2023 Income Tax Slabs Pakistan This is the latest salary income tax calculator slab as per the 2022 2023 budget presented by the government For instance the tax year 2022 is from July 1 st 2021 to June 30 th 2022 It means that our income tax for Pakistan calculator s tax year 2023 is from July 1st

Download Salary Tax Deduction Calculator Pakistan

More picture related to Salary Tax Deduction Calculator Pakistan

Salary Tax Calculator Income Tax Slabs For FY 2022 23 Zameen Blog

https://zameenblog.s3.amazonaws.com/blog/wp-content/uploads/2020/08/Salary-Tax-Calculator-Cover-25-08.jpg

Employee Salary Tax Calculator RhionnaLetty

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

Budget FY24 Use Our Calculator To Find Out How Much Tax You Will Pay

https://i.dawn.com/large/2023/06/27023355f8a1c2a.png

The Pakistan Tax Calculator below is for the 2023 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Pakistan This includes Use our efficient Pakistan Salary Tax Calculator for quick accurate tax calculations and easy financial planning Essential for 2023 2024

Access a Reliable Calculator Look for a trusted online income tax calculator specifically designed for Pakistan Enter Your Information Input your income deductions and Calculate your annual take home pay in 2021 that s your 2021 annual salary after tax with the Annual Pakistan Salary Calculator A quick and efficient way to compare

2023 Paycheck Calculator HoaiAnastazia

https://apspayroll.com/wp-content/uploads/2021/07/Gross-Pay-Calculation.png

Tax Calculator Pakistan 2022 2023

https://taxcalculator.pk/public/assets/images/banner/main.webp

https://taxcalculatorpakistan.com/salar…

Salary income exceeds PRK 75 000 000 This salary tax calculator for year 2023 2024 will help you to calculate your payable income tax You ll learn about tax calculations with charts

https://taxcal.pk

Here s how you can calculate your income tax on your salary in Pakistan by using Salary Tax Calculator Pakistan 2023 24 1 Determine Your Gross Salary This is your total

Budget 2023 24 high Earners To Pay A Higher Income Tax As Govt

2023 Paycheck Calculator HoaiAnastazia

Salary Tax Calculator For Pakistan 2021 Excel Model For Salary

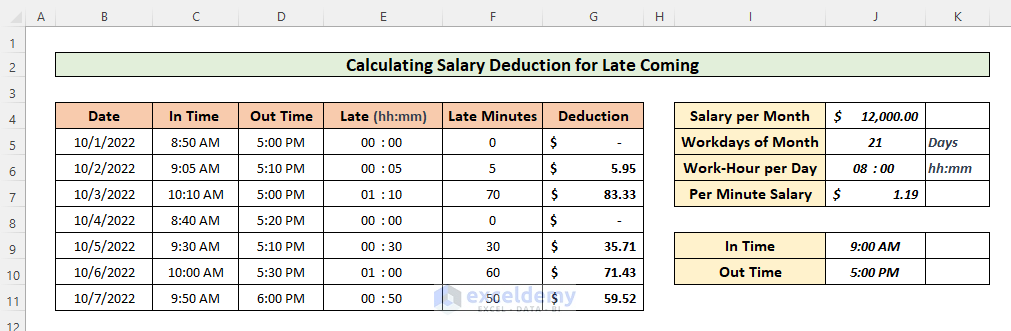

Salary Deduction Formula In Excel For Late Coming with Example

Employment Taxation

How To Calculate Income Tax On Salary In Pakistan With Example 2024

How To Calculate Income Tax On Salary In Pakistan With Example 2024

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Excel Payroll Calculator 2023 JeremyMaiya

Pakistan Budget 2022 23 New Slabs For Taxable Income

Salary Tax Deduction Calculator Pakistan - What Is Income Tax Deduction On Salary In 2023 Income up to Rs600 000 will be tax free Over Rs600 000 but not over Rs1 200 000 Tax rate 2 5 percent on the