Saskatchewan Tax Return Verkko Welcome to SETS Please use the following link to find help guides to assist you with your introduction to SETS Learn how to use SETS You can file returns and make payments without registering on SETS To do this select File your tax return as a guest filer from the Quick Links menu in the bottom right corner

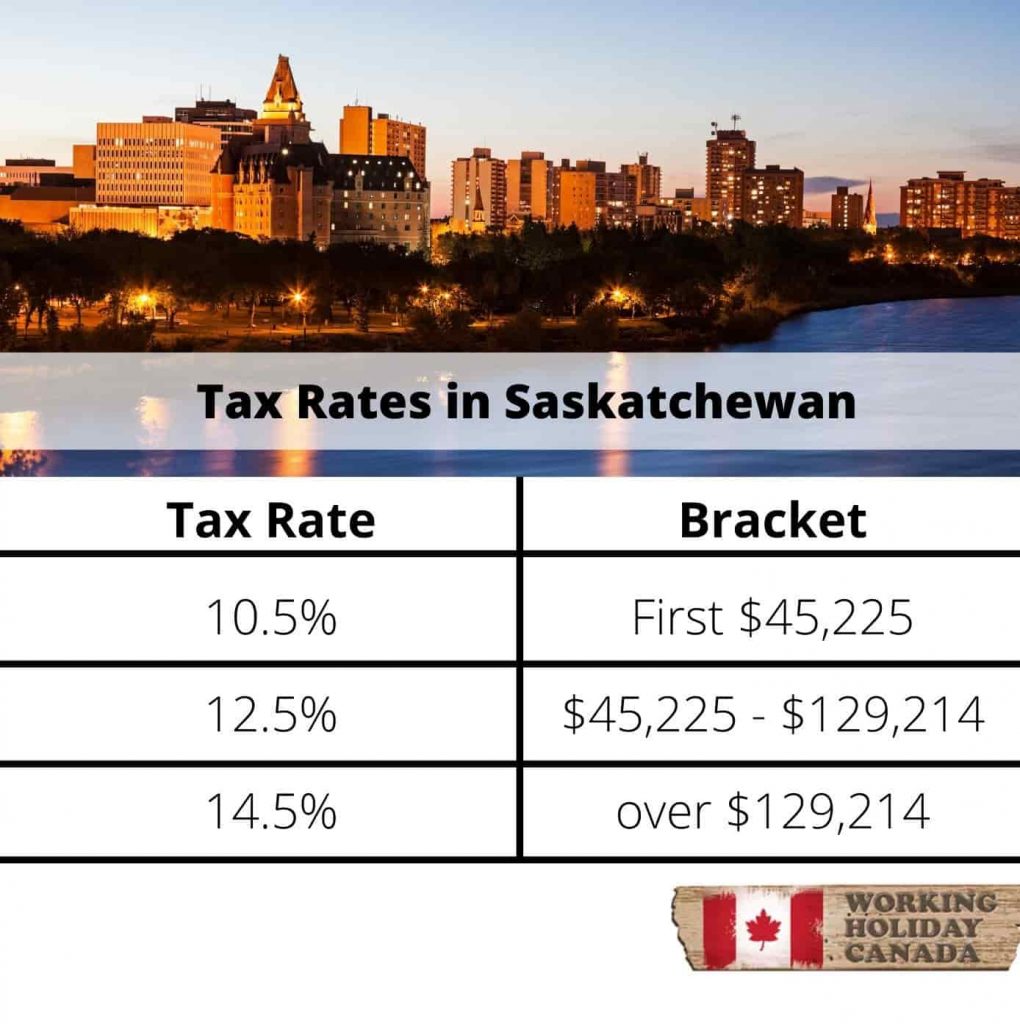

Verkko Saskatchewan Tax Rates on Taxable Income 10 5 on first 49 720 12 5 on next 92 338 14 5 on any remainder Tax Credit Amounts Basic personal amount 17 661 Spousal Equivalent amount Net income threshold 17 661 19 428 Dependent child amount 6 700 Senior supplement 1 421 Age amount Net income threshold Verkko Indexation of the Personal Income Tax system has been resumed with the 2021 taxation year The level of indexation in 2021 is 1 0 per cent matching the national rate of inflation The Active Families Benefit has been re started for the 2021 taxation year providing a refundable tax credit of 150 per year per child to eligible families

Saskatchewan Tax Return

Saskatchewan Tax Return

https://data.templateroller.com/pdf_docs_html/2066/20665/2066512/form-5008-c-sk428-saskatchewan-tax-and-credits-large-print-canada_print_big.png

Saskatchewan Tax Brackets And Rates 2020 Savvy New Canadians

https://www.savvynewcanadians.com/wp-content/uploads/2020/11/Tax-Brackets-and-Tax-Rates-in-Saskatchewan-564x376.jpg

Making The Most Of Your Saskatchewan Tax Return Globalnews ca

https://globalnews.ca/wp-content/uploads/2014/03/tax-tips-pkg.jpg?quality=85&strip=all&w=720&h=379&crop=1

Verkko The tax rates in Saskatchewan range from 10 5 to 14 5 of income and the combined federal and provincial tax rate is between 25 5 and 47 5 Saskatchewan s marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a higher tax bracket Verkko The deadline for most Saskatchewan residents to file their income tax and benefit returns for 2022 is April 30 2023 Since this date is a Sunday a return will be considered filed on time if the CRA receives it or it is

Verkko Tax rates for 2022 10 5 on the portion of your taxable income that is 46 773 or less plus 12 5 on the portion of your taxable income that is more than 46 773 but not more than 133 638 plus 14 5 on the portion of your taxable income that is more than 133 638 Saskatchewan tax Verkko 1 tammik 2023 nbsp 0183 32 TD1 Personal Tax Credits Returns TD1 forms for 2023 for pay received on January 1 2023 or later

Download Saskatchewan Tax Return

More picture related to Saskatchewan Tax Return

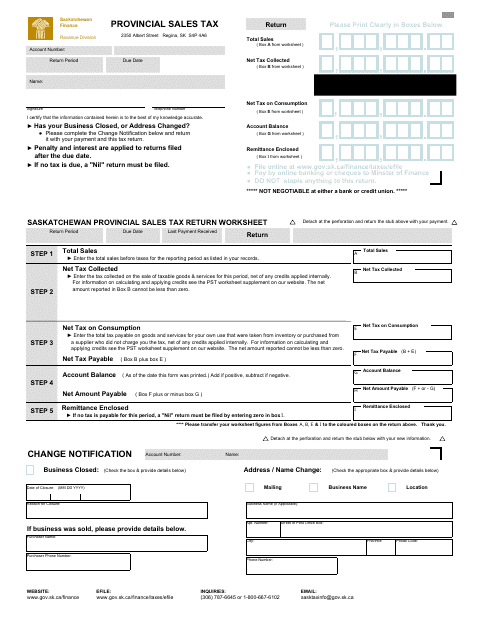

How To File Your Saskatchewan PST Small Business Sales Tax In Canada

https://i.ytimg.com/vi/wL4P-q4wUHQ/maxresdefault.jpg

Saskatchewan Taxpayer Tips When Filing 2016 Income Tax Returns

https://globalnews.ca/wp-content/uploads/2016/04/cpt113333930_high.jpg?quality=85&strip=all

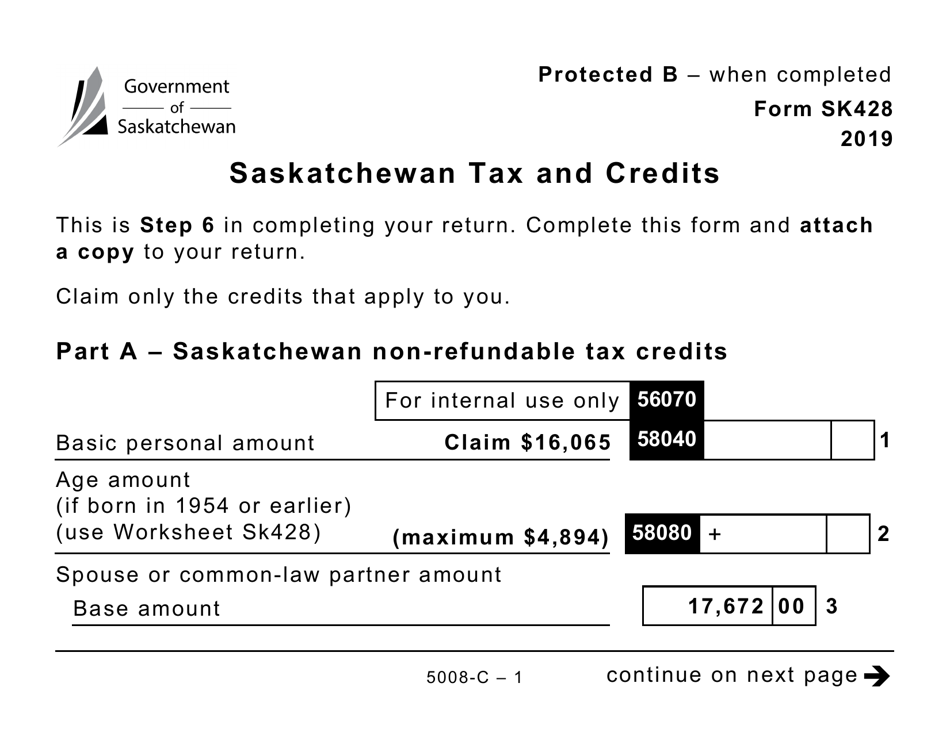

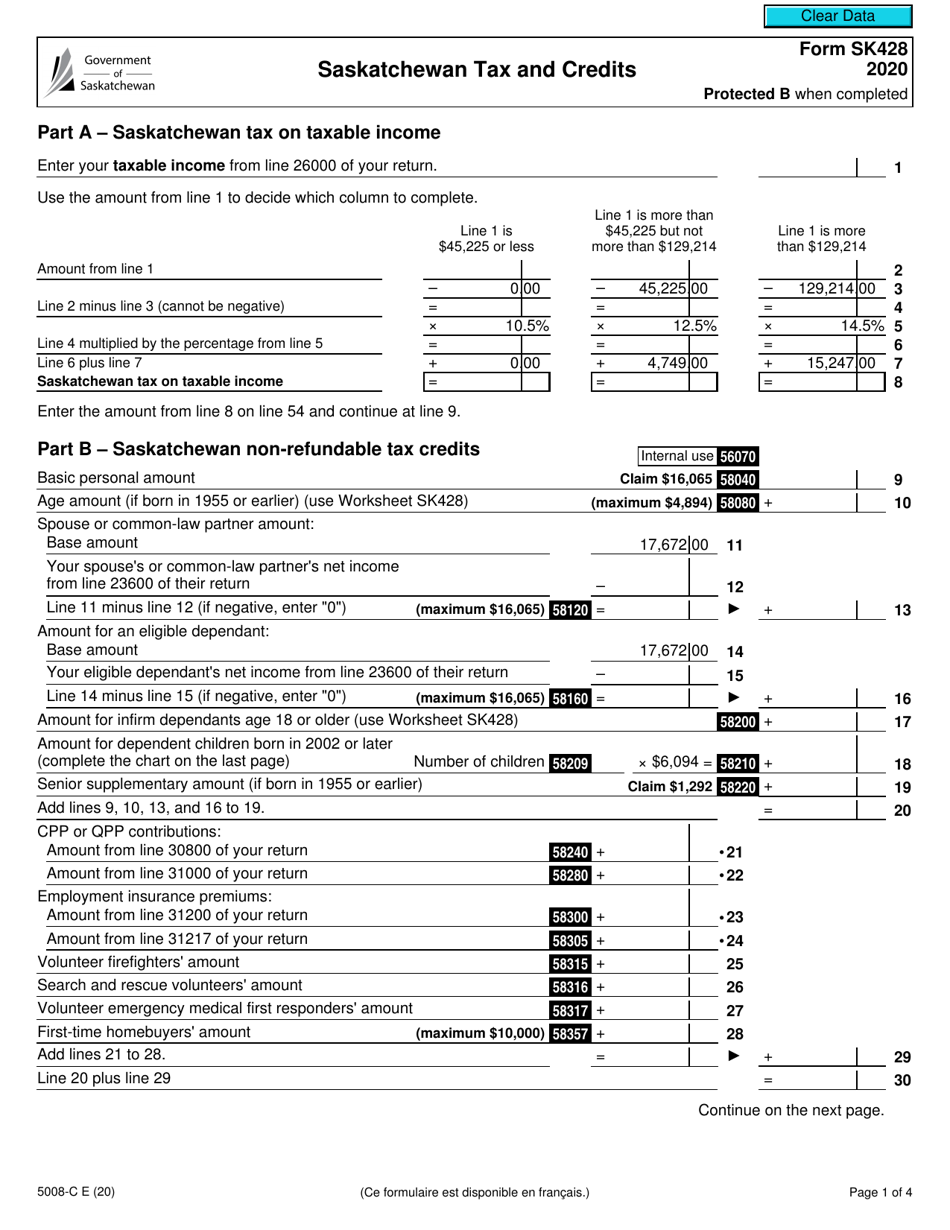

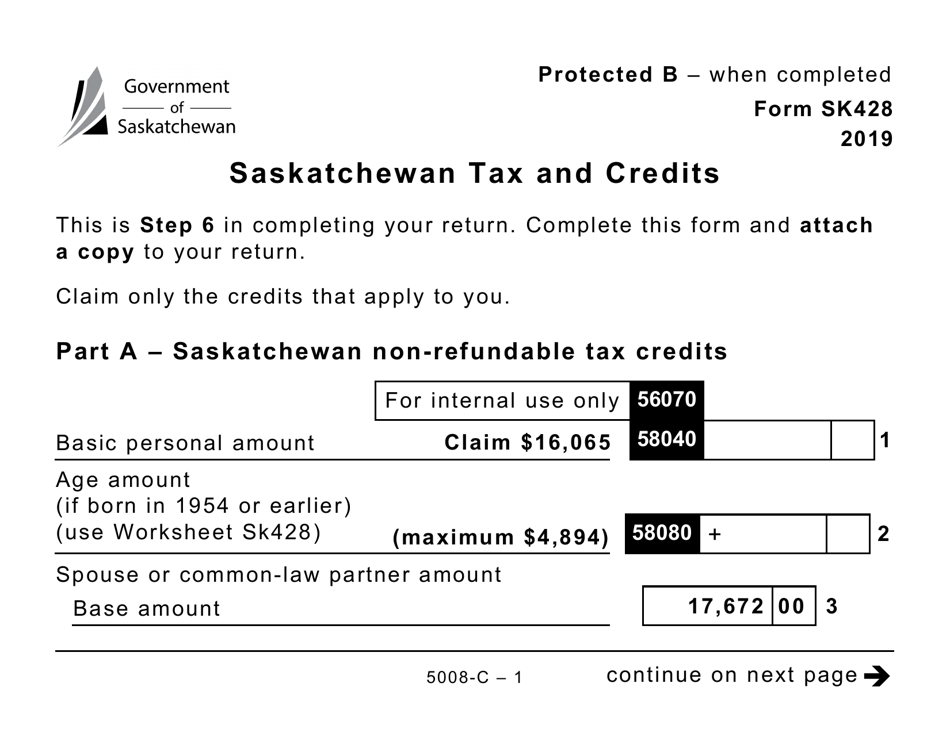

Form 5008 C SK428 Download Fillable PDF Or Fill Online Saskatchewan

https://data.templateroller.com/pdf_docs_html/2135/21356/2135606/form-5008-c-sk428-saskatchewan-tax-and-credits-canada_print_big.png

Verkko Saskatchewan tax rates for 2022 The following tax rates are used in the calculation of your Saskatchewan tax on taxable income 10 5 on the portion of your taxable income that is 46 773 or less plus 12 5 on the portion of your taxable income that is more than 46 773 but not more than 133 638 plus Verkko 21 helmik 2022 nbsp 0183 32 If you are a resident of Saskatchewan and you are eligible you will automatically receive your CAI payments four times a year starting in July 2022 To receive your payments you have to file a tax return even if you have not received income in the year If you have a spouse or common law partner only one of you can get the

Verkko 2023 11 07 Income tax form for trusts residing in Saskatchewan and for non resident trusts carrying on a business through a permanent establishment in Income tax form for trusts residing in Saskatchewan Verkko You must file PST Returns on a monthly quarterly or annual basis depending on the amount of tax you report to us per year as follows Filing Frequency Tax Reported Annually 0 to 4 800 per year Quarterly 4 800 to 12 000 per year

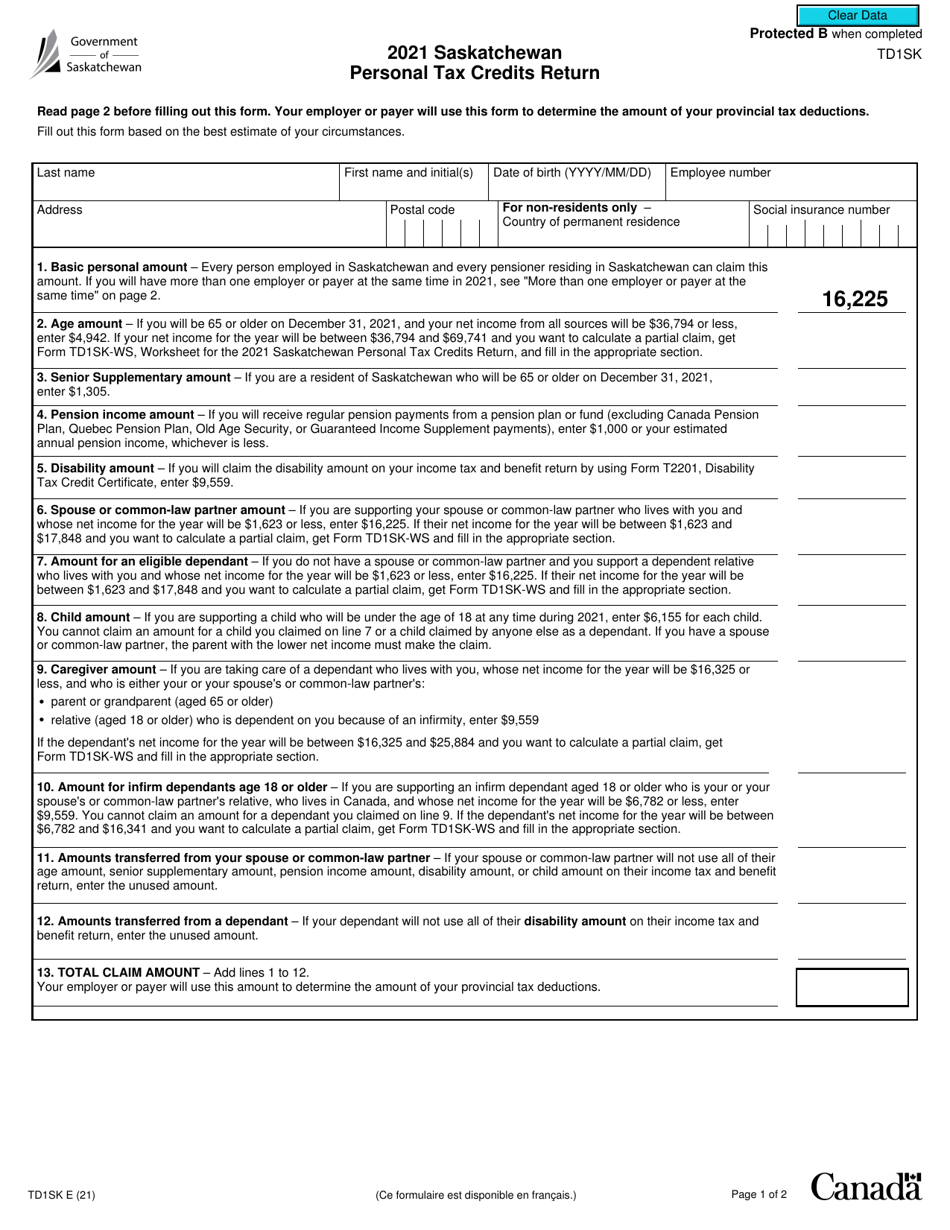

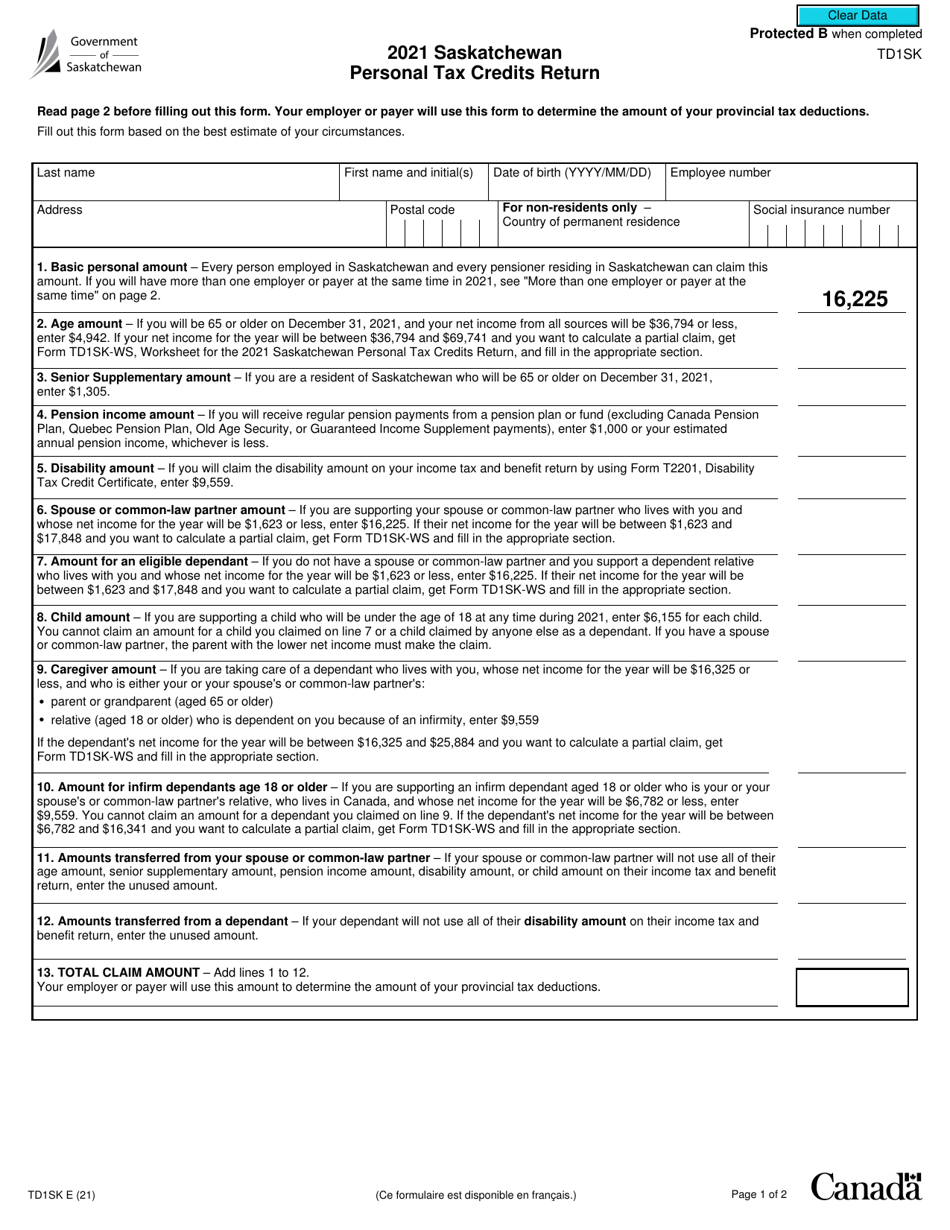

Form TD1SK Download Fillable PDF Or Fill Online Saskatchewan Personal

https://data.templateroller.com/pdf_docs_html/2119/21192/2119298/form-td1sk-saskatchewan-personal-tax-credits-return-canada_print_big.png

How To Register And Open A CRA My Account In 2022 Savvy New Canadians

https://www.savvynewcanadians.com/wp-content/uploads/2021/02/saskatchewan-income-tax-rates-768x512.png

http://www.sets.saskatchewan.ca

Verkko Welcome to SETS Please use the following link to find help guides to assist you with your introduction to SETS Learn how to use SETS You can file returns and make payments without registering on SETS To do this select File your tax return as a guest filer from the Quick Links menu in the bottom right corner

https://www.saskatchewan.ca/residents/taxes-and-investments/personal...

Verkko Saskatchewan Tax Rates on Taxable Income 10 5 on first 49 720 12 5 on next 92 338 14 5 on any remainder Tax Credit Amounts Basic personal amount 17 661 Spousal Equivalent amount Net income threshold 17 661 19 428 Dependent child amount 6 700 Senior supplement 1 421 Age amount Net income threshold

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

Form TD1SK Download Fillable PDF Or Fill Online Saskatchewan Personal

Tax Information Every US Citizen Working In Canada Must Know

Saskatchewan Canada Provincial Sales Tax Return Fill Out Sign Online

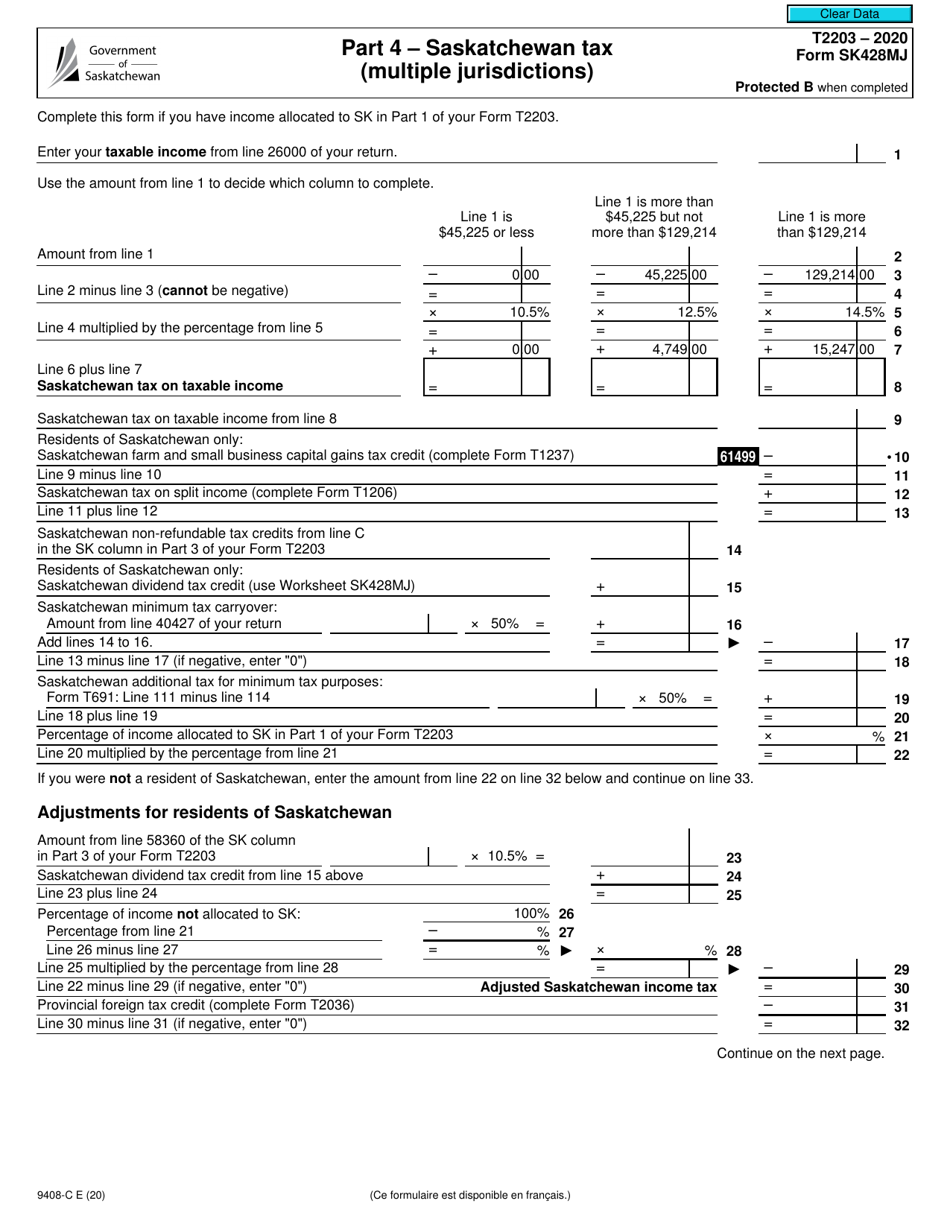

Form T2203 9408 C SK428MJ Part 4 Download Fillable PDF Or Fill

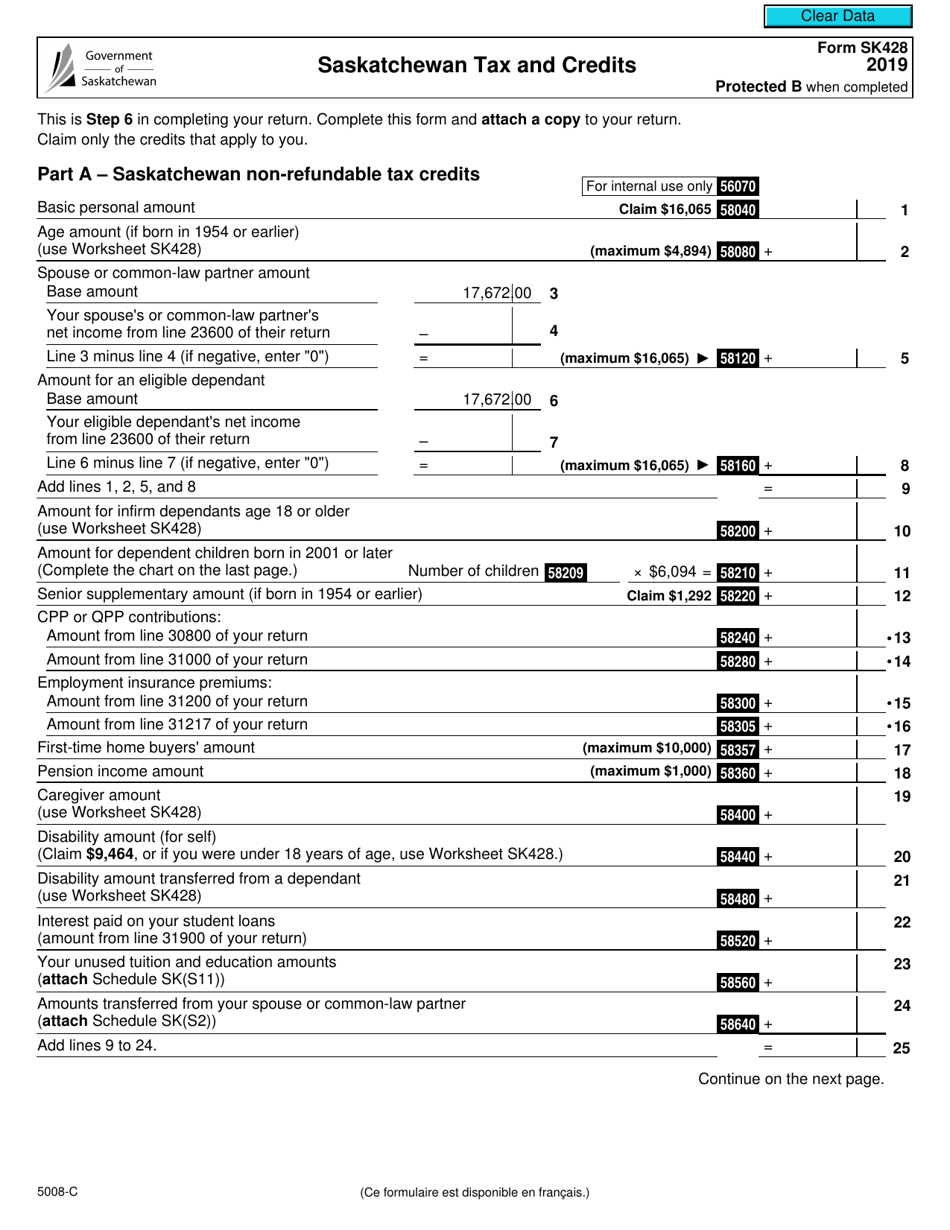

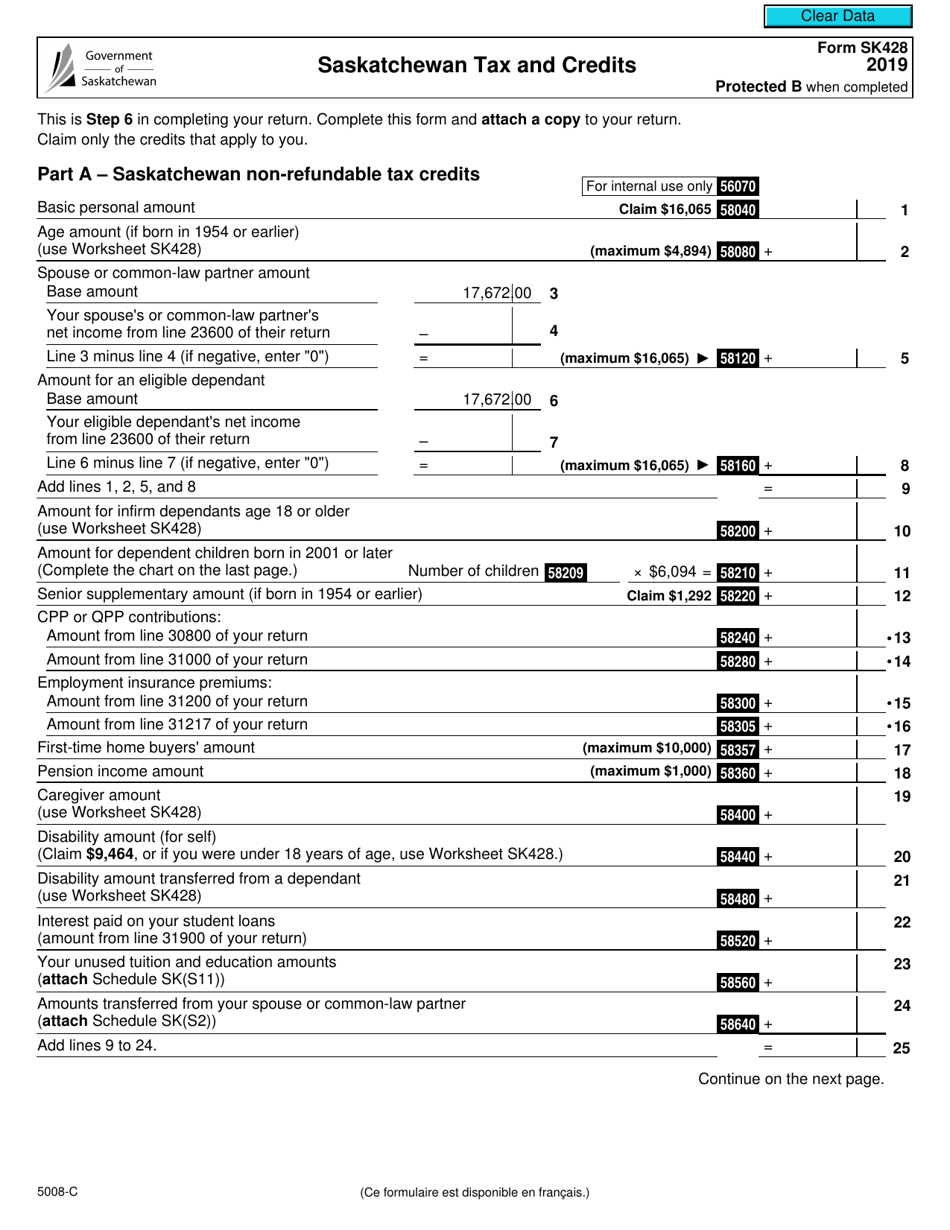

Form 5008 C SK428 Download Fillable PDF Or Fill Online Saskatchewan

Form 5008 C SK428 Download Fillable PDF Or Fill Online Saskatchewan

How PST And Income Tax Changes Will Affect Saskatchewan Globalnews ca

Saskatchewan Affordability Tax Credit SATC Payment Dates 2022 2023

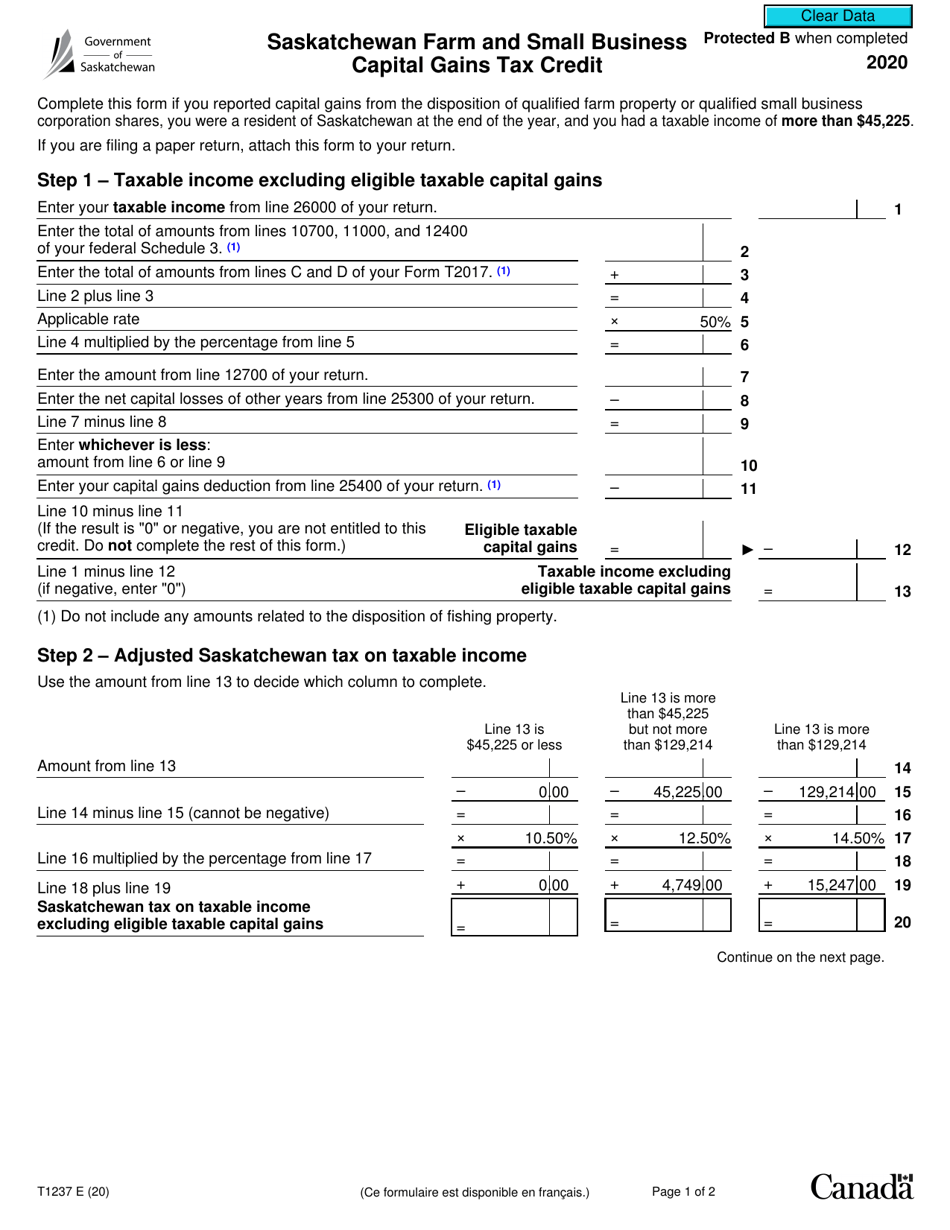

Form T1237 Download Fillable PDF Or Fill Online Saskatchewan Farm And

Saskatchewan Tax Return - Verkko SK Personal income tax and benefit package SK Corporation income tax Revised October 26 2023 Taxtips ca Saskatchewan income tax rates and legislation tax calculator provincial budgets government benefits and links to Saskatchewan personal and corporate tax information