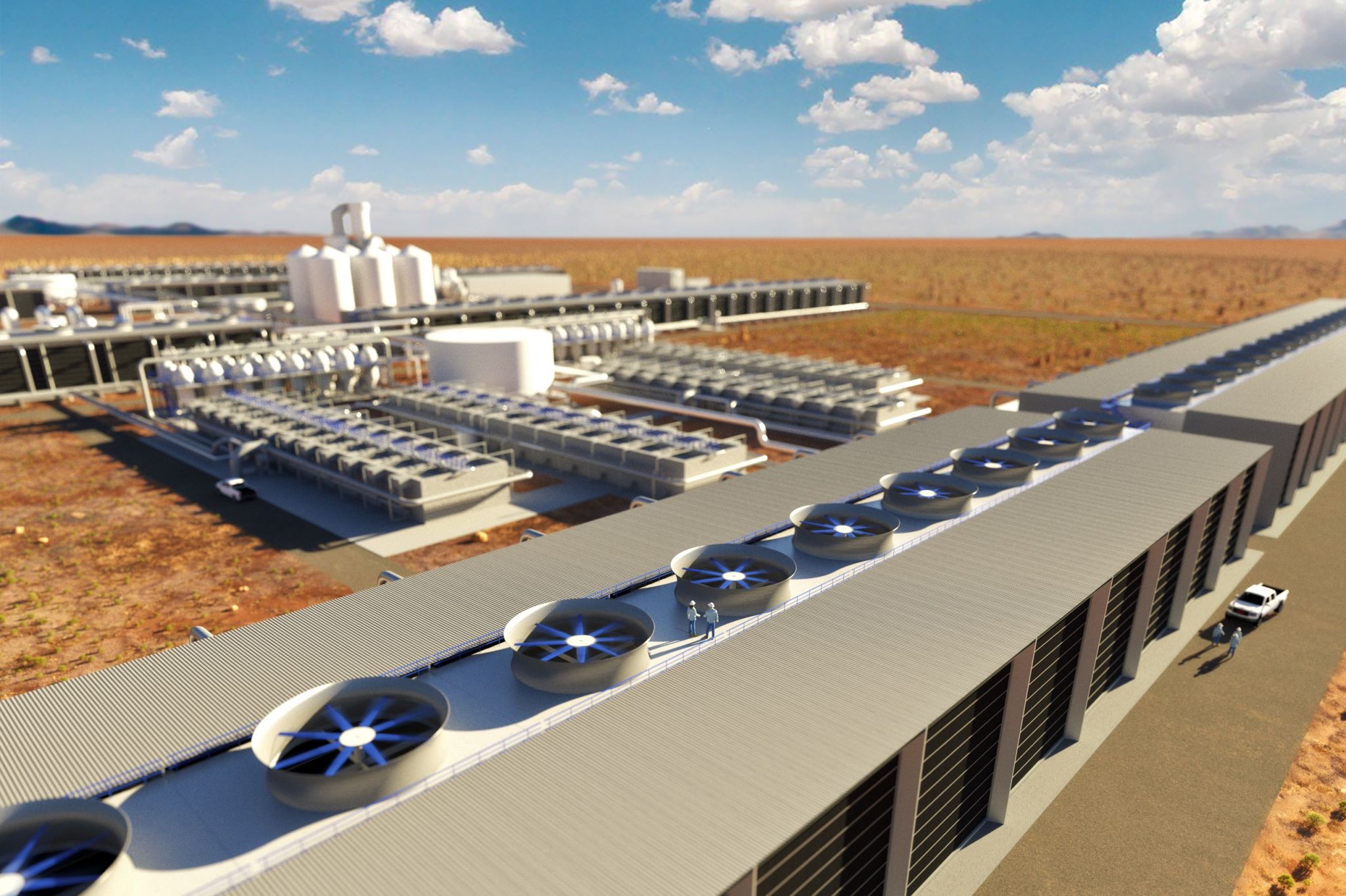

Section 45q Tax Credits For Carbon Capture Section 45Q Tax Credit for Carbon Capture and Sequestration A dollar amount per metric ton of carbon oxide that is captured and sequestered in secure geological storage used in

1 Only qualified carbon oxide captured and disposed of or used within the united states taken into account The credit under this section shall apply only with respect to qualified carbon In January 2021 the IRS issued final regulations for claiming Section 45Q credits including requirements for demonstrating secure geological storage credit recapture and life cycle

Section 45q Tax Credits For Carbon Capture

Section 45q Tax Credits For Carbon Capture

https://www.elliottdavis.com/wp-content/uploads/2023/05/GettyImages-1173244945.jpg

New Beginnings For Carbon Capture With Section 45Q Tax Credits In The

https://www.ieaghg.org/images/easyblog_articles/340/b2ap3_large_REsposito.jpg

IRS Issues Final 45Q Tax Credit Rules For Carbon Capture Projects

https://s.hdnux.com/photos/01/16/07/13/20476655/3/rawImage.jpg

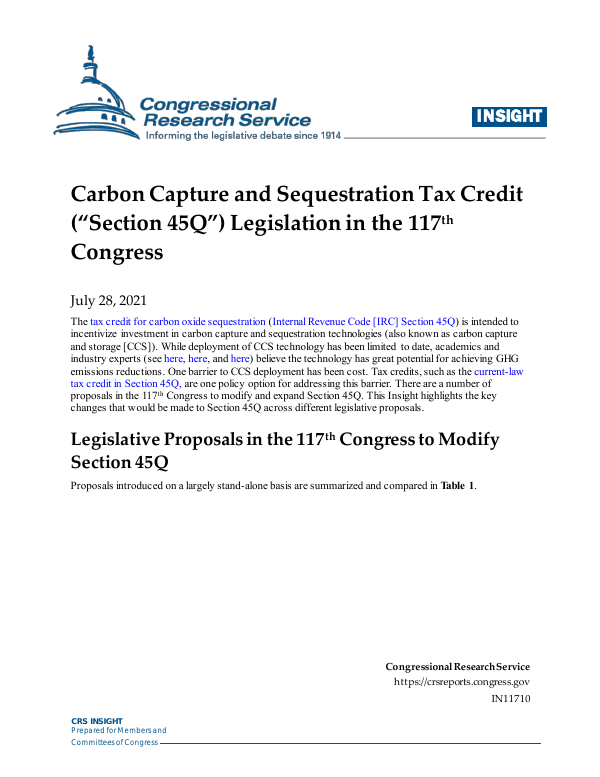

The IRS must approve the taxpayer s LCA before the taxpayer may claim the section 45Q credit Congress enacted the credit for the sequestration of carbon dioxide under section 45Q in the The tax credit for carbon oxide sequestration Internal Revenue Code IRC Section 45Q is intended to incentivize investment in carbon capture and sequestration technologies also

The Revenue Ruling provides guidance on what constitutes carbon capture equipment who is eligible to claim the credit and what is the relevant placed in service date for purposes of the Sec 45Q Credit For Carbon Oxide Sequestration I R C 45Q a General Rule For purposes of section 38 the carbon oxide sequestration credit for any taxable year is an amount equal to

Download Section 45q Tax Credits For Carbon Capture

More picture related to Section 45q Tax Credits For Carbon Capture

Carbon Capture Facts April 2018

http://carboncapturecoalition.org/wp-content/uploads/2018/05/iStock-650699540.jpg

45Q Tax Credit Boosts Values Of Carbon Sequestration Projects Yet Most

https://imageio.forbes.com/specials-images/imageserve/63691e0cf0b25f478762d2d5/0x0.jpg?format=jpg&crop=4294,2416,x0,y393,safe&width=1200

Carbon Capture Permitting Challenges Linger But 45Q Tax Credits To

https://capstonedc.com/wp-content/uploads/2022/06/pipelines.jpg

Under the rules of section 45Q the credit is attributable only to the taxpayer that owns the carbon capture equipment and physically or contractually ensures the capture and disposal Form 8933 is used to claim the carbon oxide sequestration credit which is allowed for qualified carbon dioxide that is captured and disposed of or captured used and disposed of by the

The tax credit for carbon oxide sequestration often referred to using its IRC section 45Q is computed per metric ton of qualified carbon oxide captured and sequestered Before 2018 The BBA expanded the section 45Q credit to include higher credit rates and no cap among other favorable changes for carbon capture equipment placed in service on or after February

Treasury Issues Proposed Regulations On Section 45Q Tax Credit For

https://www.huntonnickelreportblog.com/wp-content/uploads/sites/30/2020/06/iStock_000019447592Small-735x420.jpg

Primer Section 45Q Tax Credit For Carbon Capture Projects Great

https://betterenergy.org/wp-content/uploads/2019/06/Screen-Shot-2019-06-10-at-3.25.50-PM-1024x229.png

https://download.pli.edu/WebContent/pm/383489/pdf/...

Section 45Q Tax Credit for Carbon Capture and Sequestration A dollar amount per metric ton of carbon oxide that is captured and sequestered in secure geological storage used in

https://www.law.cornell.edu/uscode/text/26/45Q

1 Only qualified carbon oxide captured and disposed of or used within the united states taken into account The credit under this section shall apply only with respect to qualified carbon

45Q Tax Credits Quartz

Treasury Issues Proposed Regulations On Section 45Q Tax Credit For

Way Down In The Hole Part 4 For Many Carbon Capture Projects 45Q

Carbon Capture And Storage FAQs CCS 45Q Site Operations Battelle

Carbon Capture And Sequestration Tax Credit Section 45Q Legislation

Three Things To Know About Changes To The 45Q Tax Credit For Carbon

Three Things To Know About Changes To The 45Q Tax Credit For Carbon

Here Are The Top 10 Companies Receiving Section 45Q Credits From The

Opportunities For Advancing Industrial Carbon Capture Rhodium Group

Why You Should Care About The 45Q Carbon Capture Tax Credit

Section 45q Tax Credits For Carbon Capture - Sec 45Q Credit For Carbon Oxide Sequestration I R C 45Q a General Rule For purposes of section 38 the carbon oxide sequestration credit for any taxable year is an amount equal to