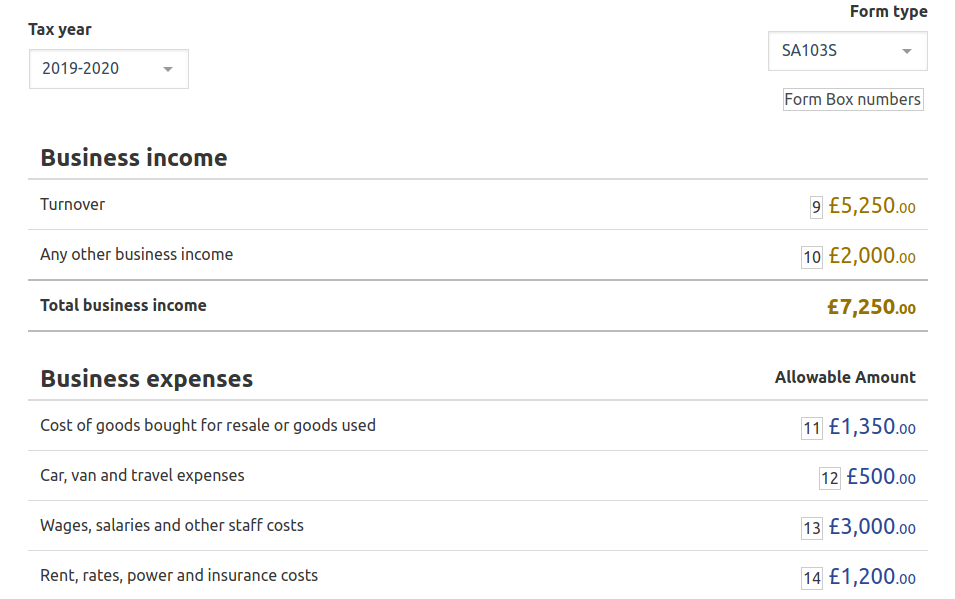

Self Assessment Tax Return Form Sa103s If you re self employed have relatively simple tax affairs and your annual business turnover was below 73 000 use the SA103S 2023 short version of the Self employment

If after reading TRG 2 you choose to complete the Self employment short pages because you expect your turnover to exceed 1 000 in the next tax year only complete Tax year 6 April 2020 to 5 April 2021 2020 21 Please read the Self employment short notes to check if you should use this page or the Self employment full page For help

Self Assessment Tax Return Form Sa103s

Self Assessment Tax Return Form Sa103s

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/guides/self-assessment/Self_Assessment_4_avoid_these_common_mistakes.png

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

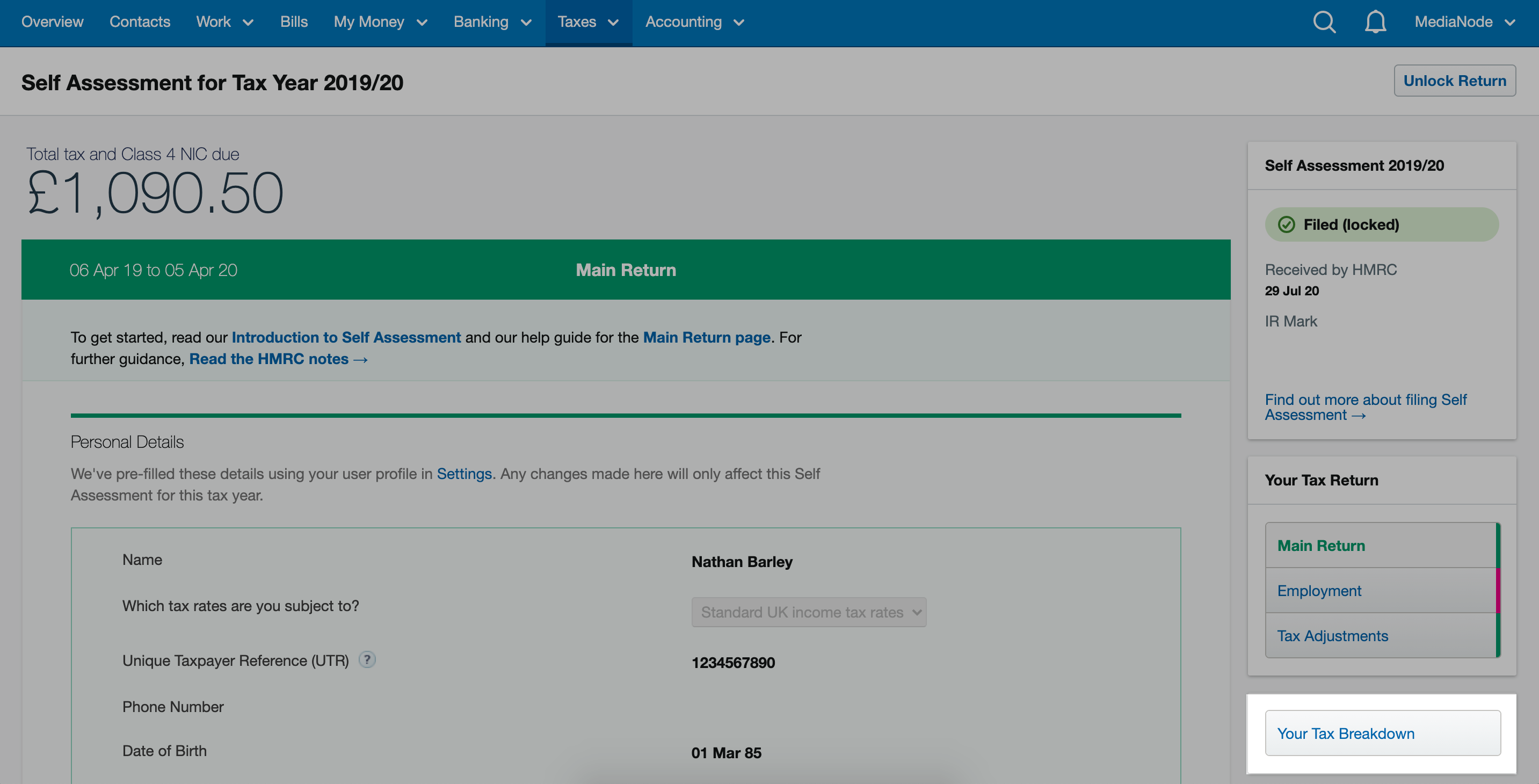

Self Assessment Tax Return A Step By Step Filing Guide

https://www.freshbooks.com/wp-content/uploads/2021/09/self-assessment-tax-return.jpg

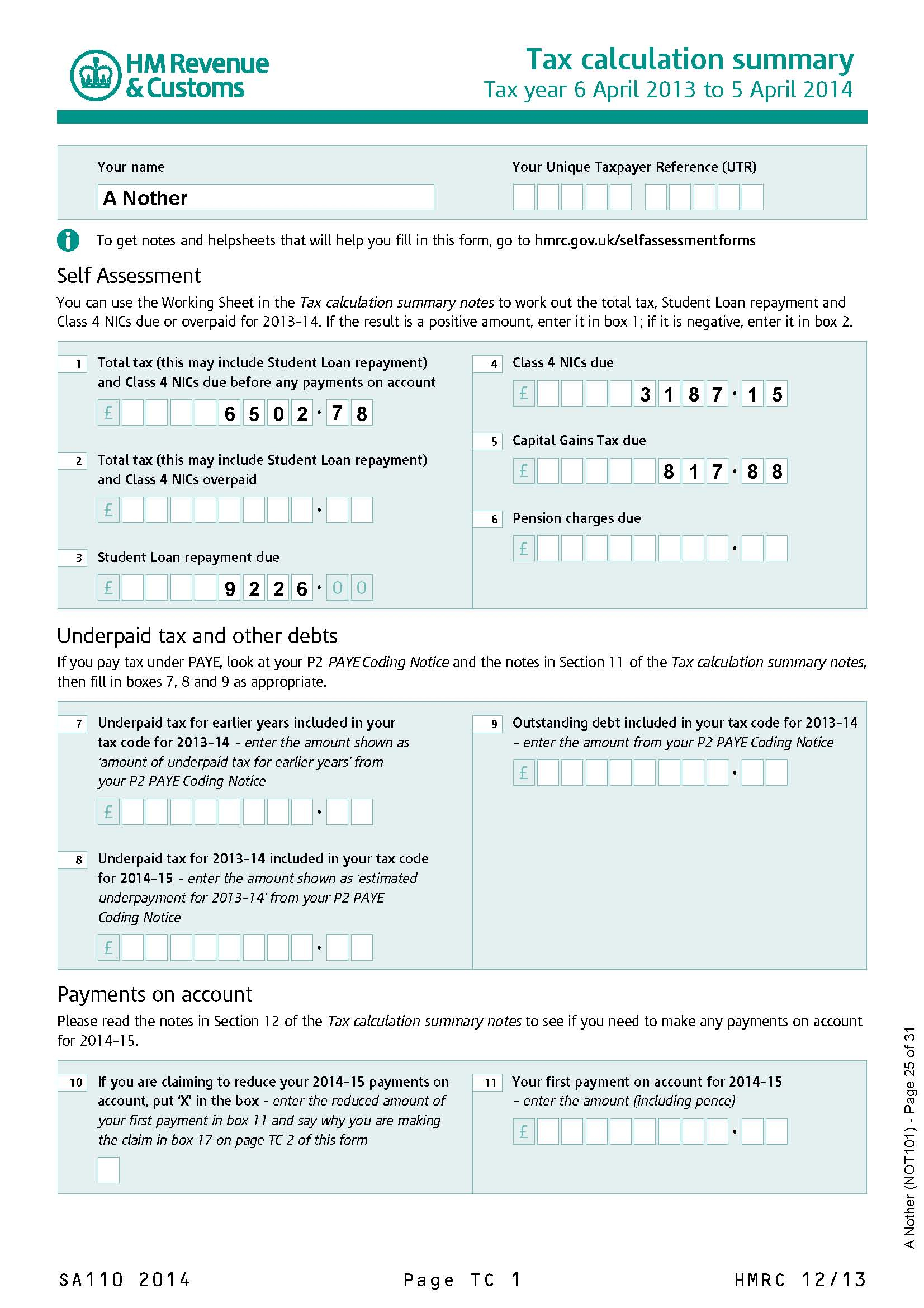

Last updated 28 Mar 2024 The SA103 form is the document you need to complete so you can pay tax on income from self employment There are two kinds of SA103 the short version called SA103S which can be If you re self employed have relatively simple tax affairs and your annual business turnover was below the VAT threshold for the tax year use the SA103S short version of the self

1 SA103S Short Version Suitable for individuals with self employment income less than 85 000 2 SA103F Full Version Used if self employment income exceeds 85 000 Eligibility for Filling Use supplementary pages SA103S to record self employment income on your SA100 tax return if your annual business turnover was below the VAT threshold for the tax year

Download Self Assessment Tax Return Form Sa103s

More picture related to Self Assessment Tax Return Form Sa103s

2021 UK Form SA100 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/569/541/569541319/large.png

Filing A Self Assessment Tax Return A Complete Guide

https://cloudcogroup.com/wp-content/uploads/2020/01/guide-to-filling-in-self-assessment-tax-returns.jpg

How To Complete Your Self Assessment Tax Return Superscript

https://res.cloudinary.com/dig-risk/image/upload/fl_lossy,f_auto,w_2000,h_1050,c_limit/v1639583982/dr-website/blog/Ten_tips_for_freelancers_to_get_a_Self_Assessment_tax_return_sorted-1.jpg

The SA103 is a form that you need to attach to your SA100 main Self Assessment tax return form if you need to pay tax on income from self employment The SA103 forms are supplementary tax return forms filling out details about your self employment on your Self Assessment Which type of SA103 form do I need to fill out

Self employment short Tax year 6 April 2020 to 5 April 2021 2020 21 SA103S Notes 2020 21 Page SESN 1 HMRC 12 20 Fill in the Self employment short pages if your Please read the Self employment short notes to check if you should use this page or the Self employment full page To get notes and helpsheets that will help you fill in this

Hmrc Self Assessment Form Employment Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/hmrc-self-assessment-form-employment.jpg

A Step by Step Guide To Filing Your Self Assessment Tax Return

https://adamaccountancy.co.uk/wp-content/uploads/2024/01/Self-assessment-tax-return.png

https://assets.publishing.service.gov.uk/...

If you re self employed have relatively simple tax affairs and your annual business turnover was below 73 000 use the SA103S 2023 short version of the Self employment

https://assets.publishing.service.gov.uk/media/65...

If after reading TRG 2 you choose to complete the Self employment short pages because you expect your turnover to exceed 1 000 in the next tax year only complete

HMRC Self Assessment tax return SPICe Spotlight Solas Air SPICe

Hmrc Self Assessment Form Employment Employment Form

Self Assessment My Tax Digital Docs

How To Complete A Self Assessment Tax Return Workingmums co uk

Can I Amend My Self Assessment Tax Return Jon Davies Accountants

Paper Self assessment Tax Return Deadline Reminder PKB Accountants

Paper Self assessment Tax Return Deadline Reminder PKB Accountants

How To Print Your Self Assessment Tax Return FreeAgent

Self Assessment Tax Returns QuickRebates

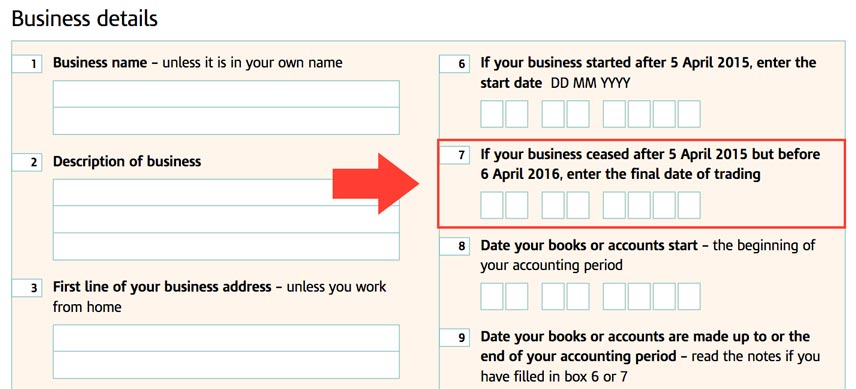

How To Stop Trading As Self Employed And Inform The HMRC

Self Assessment Tax Return Form Sa103s - Use supplementary pages SA103S to record self employment income on your SA100 tax return if your annual business turnover was below the VAT threshold for the tax year