Can I Do My Own Self Assessment Tax Return You can file your Self Assessment tax return online if you are self employed are not self employed but you still send a tax return for example because you receive income from renting

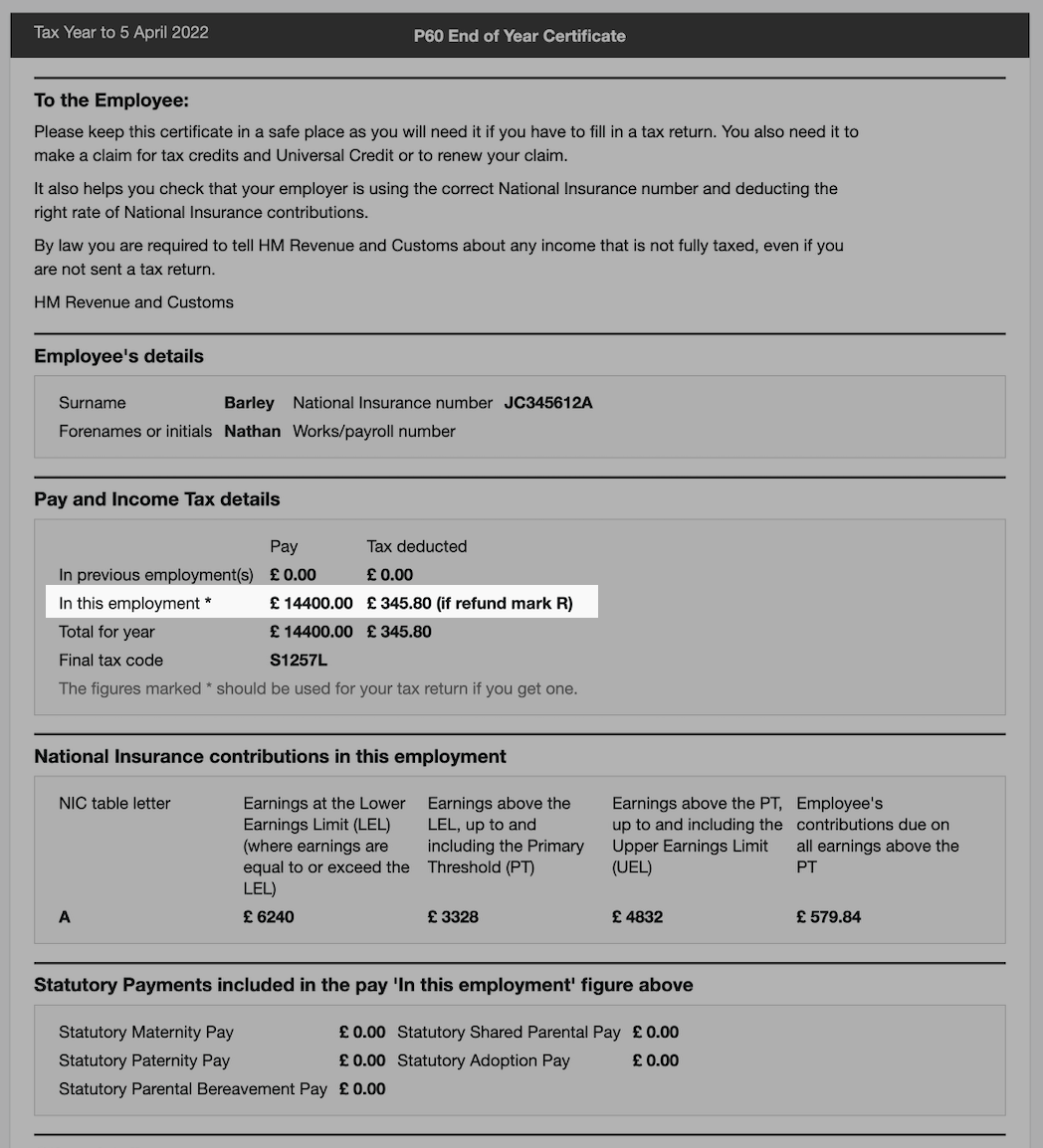

You must register for Self Assessment by 5th October following the end of the year in which you become self employed 31st October Submit your Self Assessment tax return if using a paper based return 30th December Request that HMRC collect any tax you owe through your tax code 31st January See the Self Assessment tax returns page for more information Before you start You may need the following documents and forms to help you fill in the tax return P60 End of Year

Can I Do My Own Self Assessment Tax Return

Can I Do My Own Self Assessment Tax Return

https://www.peninsulagrouplimited.com/wp-content/uploads/2016/01/Tax-Return.jpg

12 Top Tips Filing Your Self assessment Tax Return Deloitte UK

https://www2.deloitte.com/content/dam/Deloitte/uk/Images/blog/promos/deloitte-uk-self-assessment-tax-return-1200.jpg/jcr:content/renditions/cq5dam.web.1200.627.jpeg

How To File Your Self Assessment Tax Return On Time The Cheap Accountants

https://thecheapaccountants.com/wp-content/uploads/2017/01/File-Your-Self-Assessment-Tax-Return.jpg

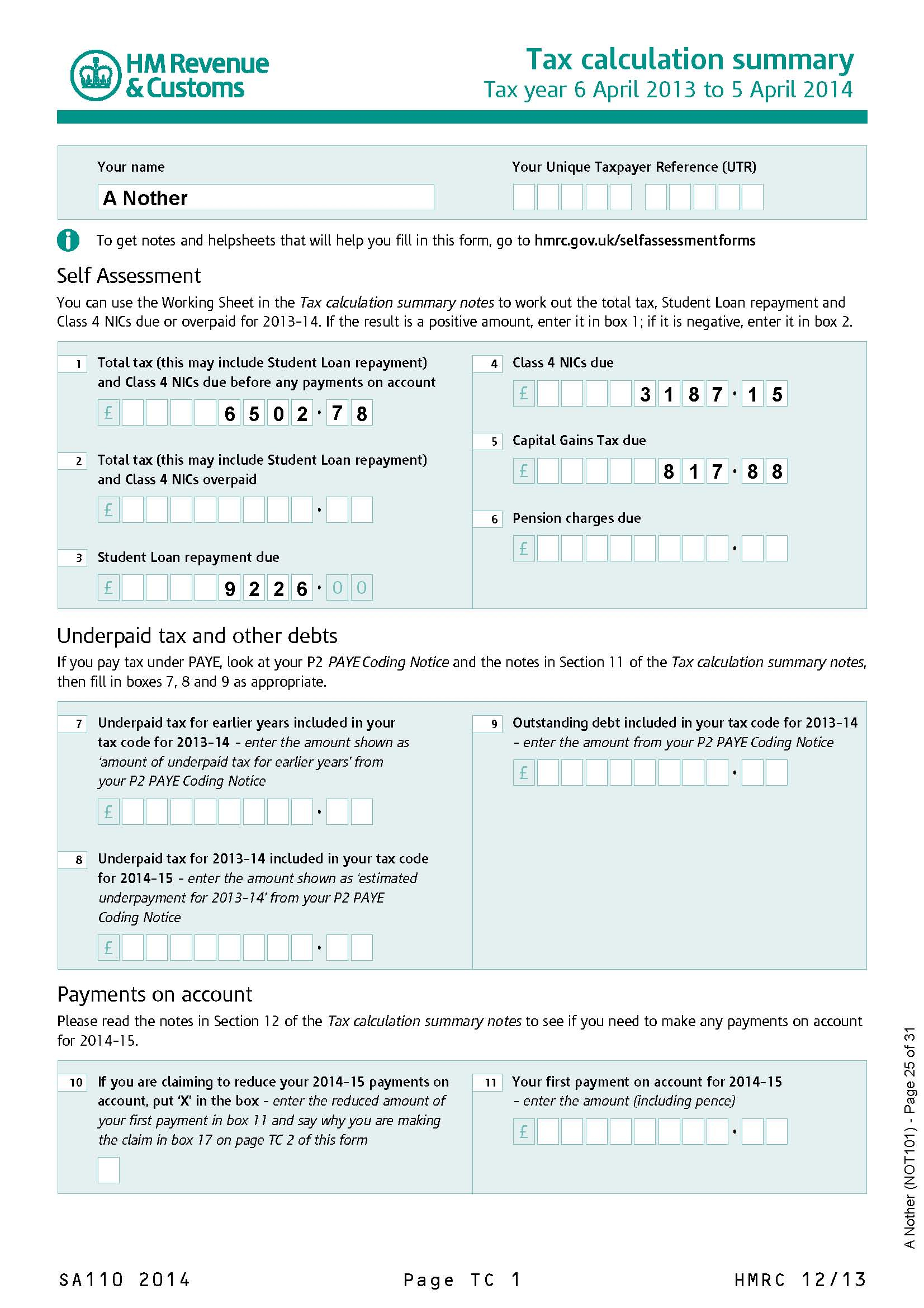

HMRC says you will need to file a return if you were self employed as a sole trader and earned more than 1 000 The same is true if you earned more than 100 000 anywhere or you had to pay If you need to file a tax return in this article we ll offer some tips on how to fill in a Self Assessment tax return online form We ll also provide you with details about dates penalties and allowable expenses and look

If you need to submit a Self Assessment tax return for the 2022 23 tax year You can submit from 6th April 2023 The deadline to submit a paper return is 31st October 2023 The deadline to submit online and to pay your bill is 31st January 2024 How do I submit my self assessment tax return You can submit your return online via the HMRC website Alternatively you can use the Which tax calculator to send direct to HMRC for a small fee You can also submit a paper tax return in the post You can find HMRC s address on your forms and any other correspondence How do I

Download Can I Do My Own Self Assessment Tax Return

More picture related to Can I Do My Own Self Assessment Tax Return

How To Fill In A Self Assessment Tax Return UK YouTube

https://i.ytimg.com/vi/53kodFNm-Mc/maxresdefault.jpg

Filing A Self Assessment Tax Return A Complete Guide CloudCo

https://www.cloudcogroup.com/wp-content/uploads/2020/01/self-assessment-tax-return-how-to-fill.jpg

Do I Have To File A Self Assessment Tax Return With HMRC

https://www.dsaprospect.co.uk/hubfs/Blog Images/Header Images/Blog Header Do I Need to Complete a Self Assessment Tax Return.png

But if you do need to file a self assessment tax return there are two things you need to do ASAP File a complete self assessment tax return for the 2018 19 tax year You ll need to do this online as the deadline for filing a paper return was 31 October 2019 and paper returns are no longer being accepted Pay your tax bill You usually don t need to fill in a Self Assessment tax return if you re an employee who has paid tax through the Pay As You Earn PAYE system This is unless you earned over 100 000 You can find out if you need to fill in a Self Assessment tax return at GOV UK Opens in a new window

The most obvious benefit of doing your own tax return is avoiding an accountant s fee The amount saved will vary depending on your location type of business bookkeeping needs and the number of transactions in the year But realistically you would be looking at a saving in the region of 250 to 500 per year If you re self employed individual who owns your own business you ll need to submit what s known as a Self Assessment tax return This is so you can then pay the right amount of Income Tax and National 5 Minute Read Last Updated 5th May 2022 Self Assessment Sole Traders Tax Return

2021 UK Form SA100 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/569/541/569541319/large.png

Our Blog Wellway Accountants Limited

https://www.wellwayconnect.co.uk/wp-content/uploads/2023/01/Self_Assessment_Tax_Return.jpg

https://www.gov.uk/log-in-file-self-assessment-tax...

You can file your Self Assessment tax return online if you are self employed are not self employed but you still send a tax return for example because you receive income from renting

https://www.theaccountancy.co.uk/self-assessment/...

You must register for Self Assessment by 5th October following the end of the year in which you become self employed 31st October Submit your Self Assessment tax return if using a paper based return 30th December Request that HMRC collect any tax you owe through your tax code 31st January

Top Tips For Your Online Self Assessment Tax Return Sensible Reviewer

2021 UK Form SA100 Fill Online Printable Fillable Blank PdfFiller

Self assessment Tax Return Tips 21 Things You Need To Know

Self Assessment Accountant Don t Worry We Can Help You

7 Tips For Filing Your Self Assessment Tax Return Red Infographics

Do You Need An Accountant For Your Tax Return

Do You Need An Accountant For Your Tax Return

Self Assessment Tax Returns Sterling Accountancy Services

The Employment Page Of The Self Assessment Tax Return For Limited

Self Assessment Tax Return Form Employment Pages Employment Form

Can I Do My Own Self Assessment Tax Return - How do I submit my self assessment tax return You can submit your return online via the HMRC website Alternatively you can use the Which tax calculator to send direct to HMRC for a small fee You can also submit a paper tax return in the post You can find HMRC s address on your forms and any other correspondence How do I