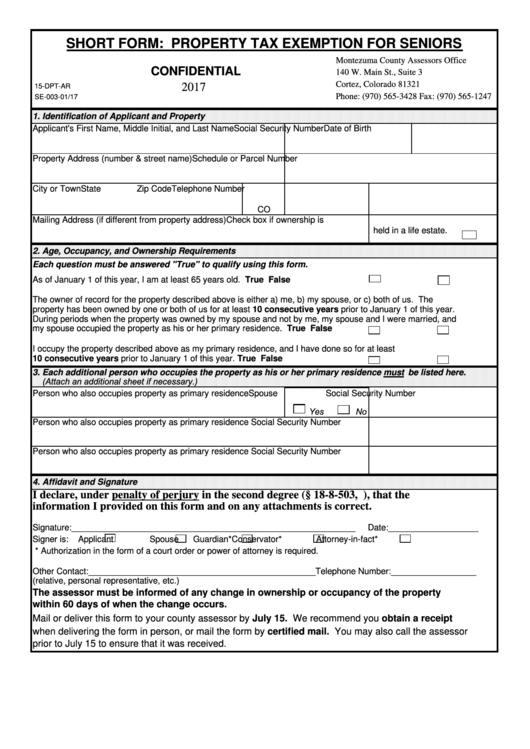

Senior Property Tax Exemption Boulder Colorado Senior Tax Exemption The Colorado Constitution establishes a property tax exemption for qualifying senior citizens and surviving spouses of senior citizens who previously qualified Learn more about qualifications and how to apply Senior Tax Worker Program

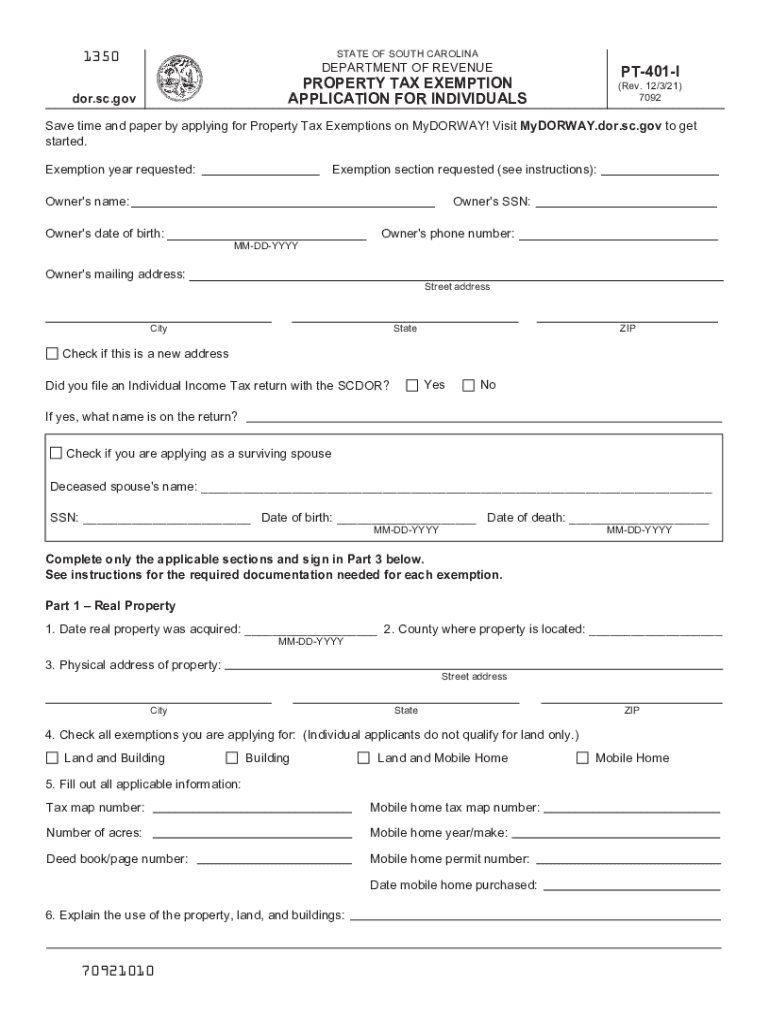

Exceptions to Ownership Occupancy Requirements If Property is Owned by Trust Corporate Partnership or Legal Entity The ownership requirement may be satisfied if your property is owned by a trust a corporate partnership or other legal entity solely for estate planning purposes SHORT FORM PROPERTY TAX EXEMPTION FOR SENIORS CONFIDENTIAL P 303 441 3530 F 303 441 4996 E AssessorSX BoulderCounty gov W BoulderCountyAssessor gov Cynthia Braddock Boulder County Assessor PO BOX 471 Boulder CO 80306 0471 1 Identification of Applicant and Property

Senior Property Tax Exemption Boulder Colorado

Senior Property Tax Exemption Boulder Colorado

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/request-for-exemption-from-denver-sales-use-and-or-business.png

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

Hecht Group In Iowa Seniors May Be Eligible For A Property Tax

https://img.hechtgroup.com/1664416039929.jpg

The property tax exemption program is available to qualifying senior citizens surviving spouses of senior citizens who previously qualified and for disabled veterans Application is available online The Assessor s Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans Senior Tax Worker Program The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes

LONG FORM PROPERTY TAX EXEMPTION FOR SENIORS2024 Cynthia Braddock Boulder County Assessor PO Box 471 Boulder CO 80306 0471 AssessorSX BoulderCounty gov P 303 441 3530 F 303 441 4996 W BoulderCountyAssessor gov E CONFIDENTIAL 1 Identification of Applicant and Property A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies 2 the qualifying senior must be the owner of record and must have

Download Senior Property Tax Exemption Boulder Colorado

More picture related to Senior Property Tax Exemption Boulder Colorado

Senior Property Tax Exemptions 101 How You Can Save Big

https://na.rdcpix.com/0f6ea462159088aa63055d8d4f552cacw-c2145427720rd-w832_h468_r4_q80.jpg

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Senior Citizen Property Tax Exemption California Form Riverside County

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/how-to-apply-for-senior-property-tax-exemption-in-california-prorfety.jpg?fit=1080%2C1349&ssl=1

Senior Homestead Property Tax Exemption Discounted property tax program for seniors In 2000 Colorado voters approved a property tax exemption for qualified seniors also known as the Senior Homestead Exemption as For those who qualify 50 of the first 200 000 in actual value of their primary residence is exempted for a maximum exemption amount of 100 000 in actual value The State of Colorado pays the property taxes on the exempted value

The Colorado Senior Property Tax Exemption also known as the Homestead Exemption is a program to to permanently exempt seniors who have lived in their homes for at least ten 10 years from some property taxes due to the county Similar exemptions are available to disabled veterans and their surviving Gold Star spouses of any age Senior Citizens in Colorado Property Tax Exemption The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens The state reimburses the local governments for the loss in revenue

Colorado Resale Certificate Dresses Images 2022

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

2021 Form SC PT 401 I Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/586/132/586132282/large.png

https://bouldercounty.gov/families/seniors/...

Senior Tax Exemption The Colorado Constitution establishes a property tax exemption for qualifying senior citizens and surviving spouses of senior citizens who previously qualified Learn more about qualifications and how to apply Senior Tax Worker Program

https://assets.bouldercounty.gov/wp-content/...

Exceptions to Ownership Occupancy Requirements If Property is Owned by Trust Corporate Partnership or Legal Entity The ownership requirement may be satisfied if your property is owned by a trust a corporate partnership or other legal entity solely for estate planning purposes

Senior Property Tax Exemption Available Weld County

Colorado Resale Certificate Dresses Images 2022

Jefferson County Property Tax Exemption Form ExemptForm

Find Out If You Qualify For The Senior Homestead Property Tax Exemption

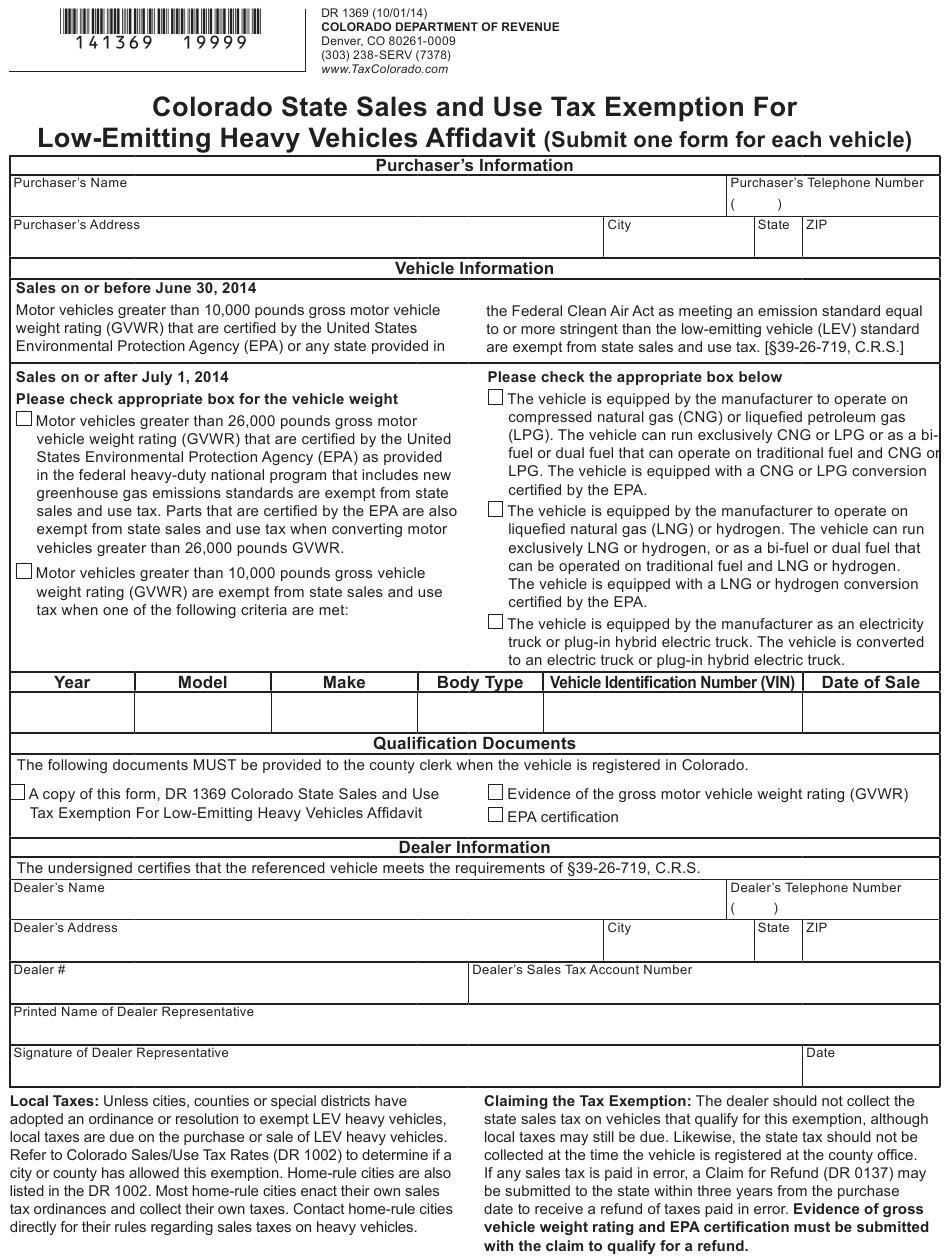

Colorado Sales And Use Tax Exemption Form ExemptForm

Sales Tax Campus Controller s Office University Of Colorado Boulder

Sales Tax Campus Controller s Office University Of Colorado Boulder

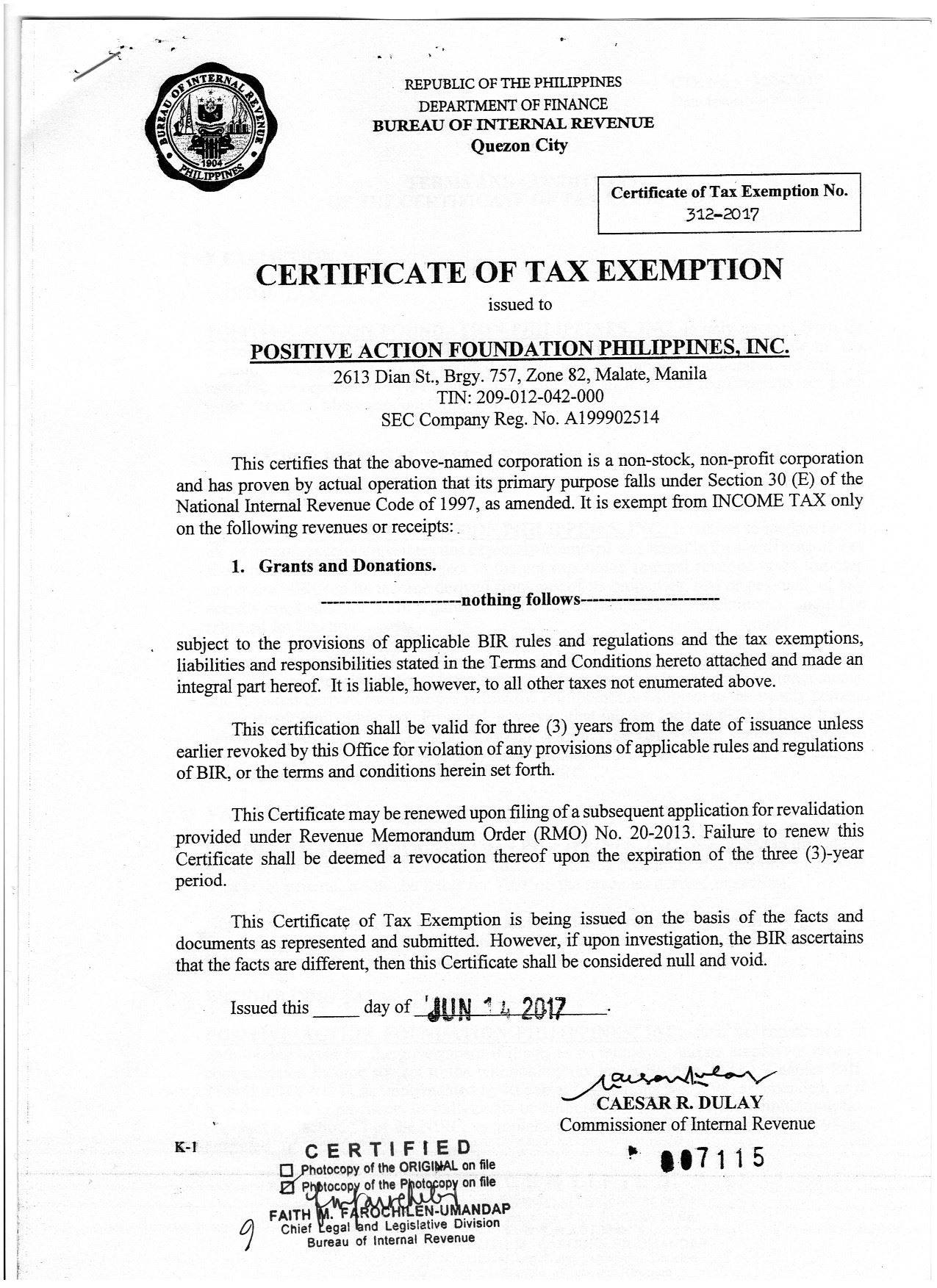

2017 PAFPI Certificate of TAX Exemption Certificate Of

Sales Tax Campus Controller s Office University Of Colorado Boulder

Co To Jest Homestead Property Tax Exemption Karolina Moscicki

Senior Property Tax Exemption Boulder Colorado - What is the Senior Homestead Exemption What is the age requirement Are there other qualifications that need to be met in order to apply What effects are there on taxes through the homestead exemption Boulder County Assessor Video on Senior Homestead Property Tax Exemption Boulder County Senior Tax Exemption Program