Service Tax Rate On Hotel Food Verkko 30 syysk 2015 nbsp 0183 32 Service charges is a kind of tip which is charged by the restaurant or hotel and it normally ranges from 0 to 10 In some cases it may be even higher

Verkko 13 toukok 2019 nbsp 0183 32 1 Since the GST on hotel room depends on the amount received i e Rs 7 000 this falls under 18 slab rate Hence total amount payable including GST Verkko Nation Monday 18 Dec 2023 PETALING JAYA The Customs Department should clarify whether food and beverage F amp B operators should specify the different rates of service tax imposed on their

Service Tax Rate On Hotel Food

Service Tax Rate On Hotel Food

https://freespeech.org/wp-content/uploads/2022/03/20-tax-rate.png

Country Specific Dynamic Optimal Capital Income Tax Rate

https://www.scirp.org/html/3-1500128/9c7218aa-b755-4ed5-9a78-3c938da72b1f.jpg

Associated Company Rules Changing 1 April

https://livinginmindfulukhome.files.wordpress.com/2022/07/income_tax_raids_in_up.jpg

Verkko 31 elok 2023 nbsp 0183 32 The rate of Irish VAT which applies to certain goods and services mainly in the tourism and hospitality sector will increase from 9 back to 13 5 with effect Verkko 27 toukok 2023 nbsp 0183 32 5 or 18 GST Rate Under GST restaurants are subject to either a 5 GST rate without the option to claim Input Tax Credit ITC or an 18 GST rate

Verkko 29 jouluk 2022 nbsp 0183 32 18 GST rate is applicable to the supply of food drinks in a restaurant having a licence to serve liquor 5 Star Hotel Restaurants 28 GST rate is applicable to the supply of food drinks in an air Verkko 25 kes 228 k 2020 nbsp 0183 32 A reading of the definition of specified premises with the definition of restaurant services implies that the food provided by the restaurants in hotel premises which do not have any unit of

Download Service Tax Rate On Hotel Food

More picture related to Service Tax Rate On Hotel Food

Grocery Tax Reduced To 1 Beginning Jan 1 2023 Virginia Tax

https://www.tax.virginia.gov/sites/default/files/news-images/2022-12/grocery-tax-reduction.jpg

What s The Tax Rate On My Bonus If I Invest It In The Stock Market

https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2019/10/bonus-tax-rate-1024x683.jpg

Indirect Taxes Won t Go Up Under Goods And Services Tax Centre

https://assets.thehansindia.com/hansindia-bucket/8988_Untitled-11.jpg

Verkko 27 helmik 2023 nbsp 0183 32 5 GST on food services provided by restaurants both air conditioned and non a c 5 GST on restaurant services including room service and Verkko 26 jouluk 2015 nbsp 0183 32 Service Tax on Hotel Industry Pooja Gupta 26 December 2015 Share Charges and taxes levied on the foods served in the Restaurant Service Charges

Verkko 2 huhtik 2022 nbsp 0183 32 All about GST on Hotels GST rates with effect from 1st October 2019 are as follows Rooms in hotels with a daily rate of less than INR 1000 Rooms in Verkko 7 likes 0 comments deluxeholidaysofficial on December 19 2023 quot AMAZING TRIO With GENTING DREAM CRUISE 3 in 1 Group Tour 13 Days Group Tour Rs52 quot

What Is The Tax Rate On The Entertainment Industry As Per GST

https://khatabook-assets.s3.amazonaws.com/media/post/2023-01-10_113254.6916240000.webp

Tax Rate On Vimeo

https://i.vimeocdn.com/video/1699641267-82f08e4df5e90bd20d8649659a4498bdb23c3f0bb13a5032dbcb9b462d5e0817-d

https://taxguru.in/service-tax/vat-luxury-tax-service-tax-hotel...

Verkko 30 syysk 2015 nbsp 0183 32 Service charges is a kind of tip which is charged by the restaurant or hotel and it normally ranges from 0 to 10 In some cases it may be even higher

https://taxguru.in/goods-and-service-tax/gst-rates-applicable-hotel...

Verkko 13 toukok 2019 nbsp 0183 32 1 Since the GST on hotel room depends on the amount received i e Rs 7 000 this falls under 18 slab rate Hence total amount payable including GST

Who Would Pay A 70 Tax Rate On Income Over 10 Million The Motley Fool

What Is The Tax Rate On The Entertainment Industry As Per GST

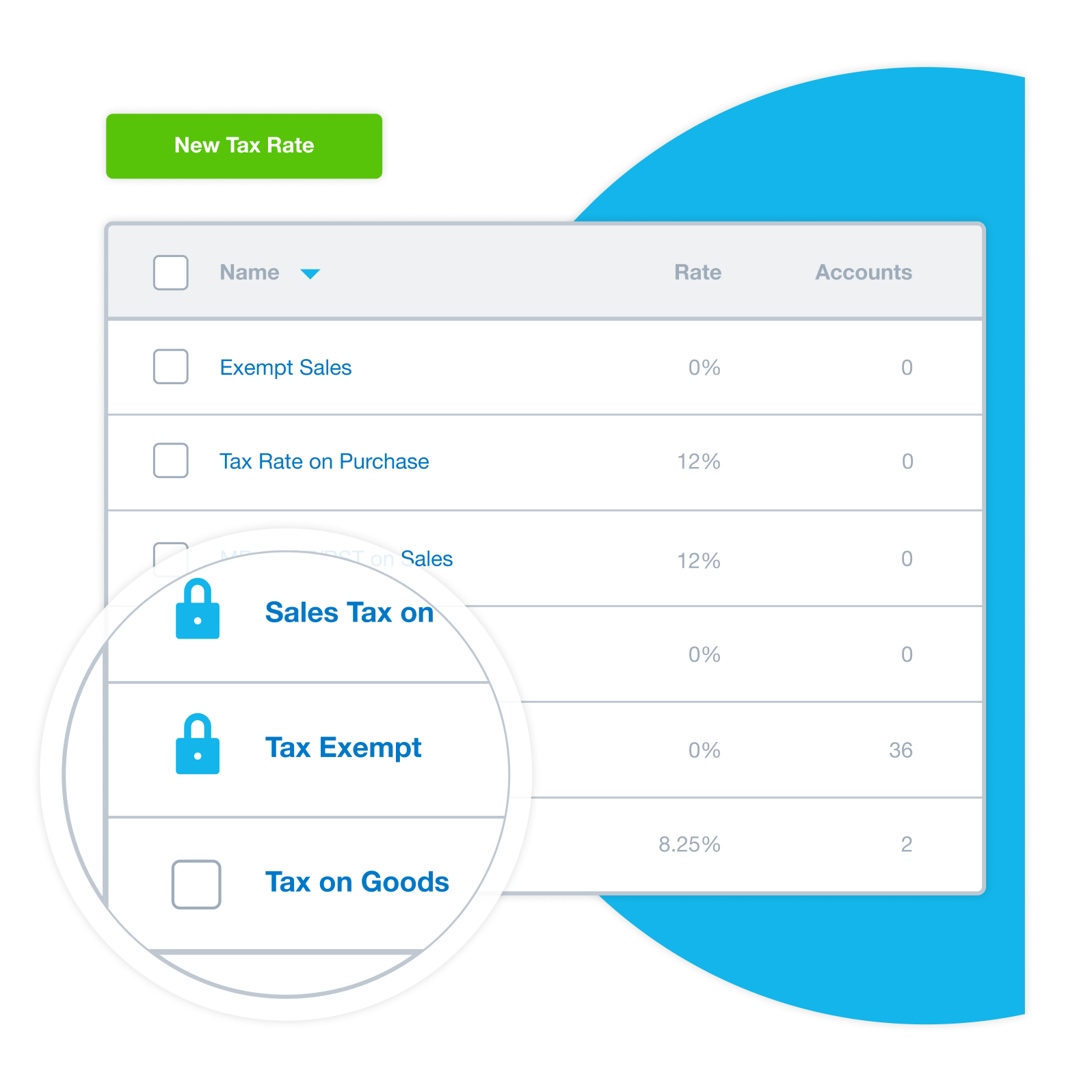

Sales Tax Software Xero PH

Setup Tax Rates For Invoicing

FBR Clarifies News About Payment Of Total Assessed Tax Demand For

Tax Allowance For Investments In Specific Sectors And Regions In

Tax Allowance For Investments In Specific Sectors And Regions In

Kansas Bills Eliminating Food Sales Tax Offer Different Approaches To

Show Tax Rate On Invoice

1040 2020 Internal Revenue Service Business Read How To Apply

Service Tax Rate On Hotel Food - Verkko 27 toukok 2023 nbsp 0183 32 5 or 18 GST Rate Under GST restaurants are subject to either a 5 GST rate without the option to claim Input Tax Credit ITC or an 18 GST rate