Should I Claim Mortgage Interest What types of home loans qualify for a mortgage interest deduction How to claim the mortgage interest deduction on your tax return

The mortgage interest deduction is a tax incentive for homeowners This itemized deduction allows homeowners to subtract You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build

Should I Claim Mortgage Interest

Should I Claim Mortgage Interest

https://www.pnc.com/content/dam/pnc-thought-leadership/personal-finance/borrow/pnc_insights_p_mortgage-interest-rate-explained.jpg

Can I Claim The Mortgage Interest Deduction

https://assets.site-static.com/blogphotos/4070/7671-mortgage-interest.jpg

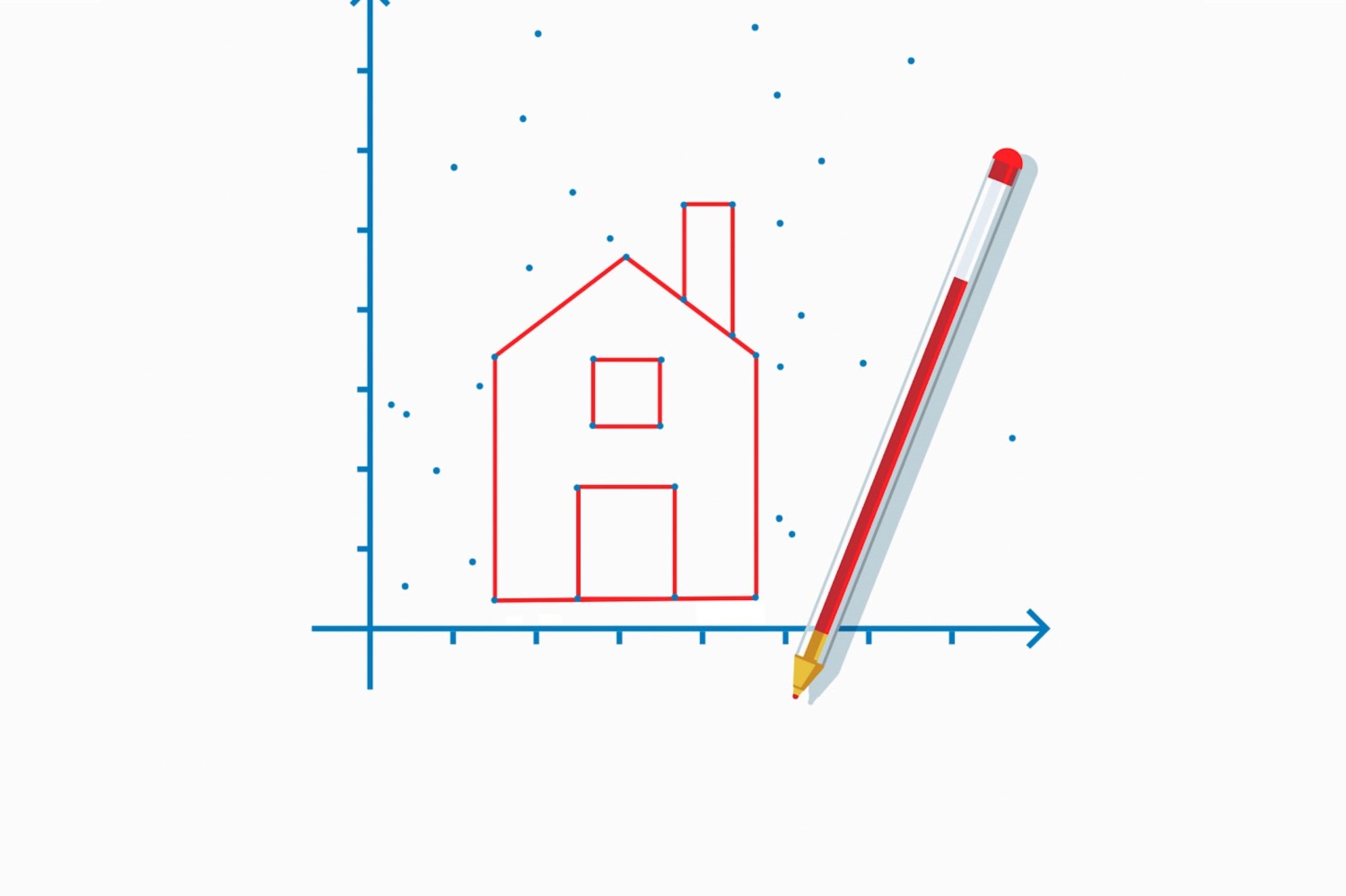

Mortgage Rates For August 4 2023 Rates Trending About The Same

https://www.usatoday.com/money/blueprint/images/uploads/2023/06/06163704/Daily-mortgage-rates-4-Cropped-scaled.jpg

Homeowners can deduct mortgage interest from their income with the mortgage interest deduction Learn what qualifies for this deduction and how you can benefit Mortgage Interest Tax Deduction What You Need to Know Should you claim the mortgage interest deduction when you file your federal tax return

Should you claim the mortgage interest deduction Should the deduction affect your home buying decision Politics behind mortgage tax deductions Who qualifies for the You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government Figure the credit on Form 8396 Mortgage Interest Credit If you take this credit you must

Download Should I Claim Mortgage Interest

More picture related to Should I Claim Mortgage Interest

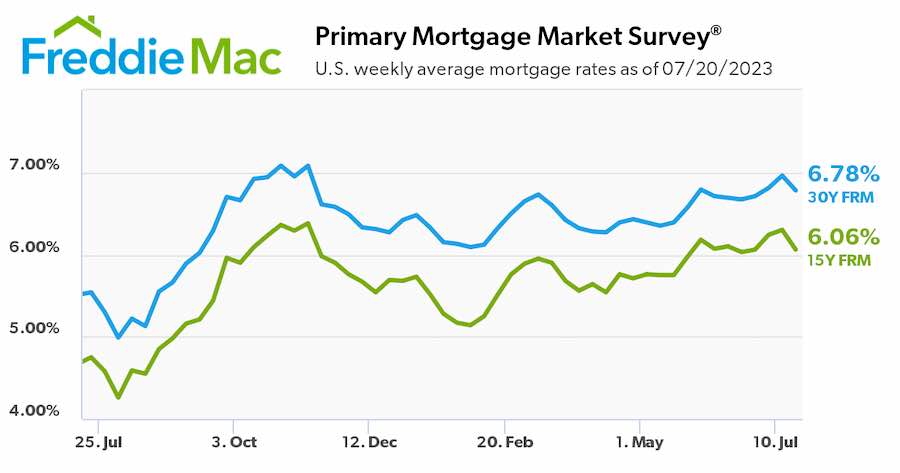

MORTGAGE INTEREST RATES 2023 FED RAISE INTEREST RATES TODAY

https://i.ytimg.com/vi/KiJju1vvpw4/maxresdefault.jpg

Can Both Owners Claim Home Loan Interest Leia Aqui Can I Claim

https://image.cnbcfm.com/api/v1/image/107216561-1680030077228-gettyimages-1470077165-tracyjenjaronnov21-047.jpeg?v=1680886801

Mortgage Interest Rates FALL Sharply YouTube

https://i.ytimg.com/vi/qD3IYi-xy_g/maxresdefault.jpg

Key Takeaways You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of Should I deduct my mortgage interest The key thing to understand about the home mortgage interest deduction is that it only applies if you are itemizing your deductions and for most people it doesn t make financial sense to do so

The answer for those wondering Is mortgage interest deductible is yes To reduce your taxable income you can deduct the interest you pay each tax year on your individual income tax return which is of value amidst rising mortgage Learn how the mortgage interest tax deduction works who qualifies and how to maximize your savings when filing your tax return

Grant Lyons Financial Advice

https://img.money.com/2022/01/Mortgage-Higher-Interest-Rates-Are-Speeding-Up-Homebuyers.jpg

Can I Claim Mortgage Interest On Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/can-i-claim-my-childs-student-loan-interest-loan-walls.jpeg

https://www.bankrate.com/mortgages/…

What types of home loans qualify for a mortgage interest deduction How to claim the mortgage interest deduction on your tax return

https://www.rocketmortgage.com/learn/…

The mortgage interest deduction is a tax incentive for homeowners This itemized deduction allows homeowners to subtract

Can You Claim Mortgage Interest Yes How Section 24 Example

Grant Lyons Financial Advice

Interest Rates In July 2023 Are Heading In The Right Direction St

Should I Claim From Insurance For A Car Crash Ask The Car Expert

How Many Exemptions Should I Claim 5 Shocking Facts

Historical Mortgage Rates Vs Housing Prices 1992 2022

Historical Mortgage Rates Vs Housing Prices 1992 2022

Could I Have A 1 000 Mortgage Payment Increase Oportfolio

Mortgage Rates Are Rising After Years Of Downward Pressure

Today s Lowest Mortgage Rate Try 15 year Terms August 28 2023

Should I Claim Mortgage Interest - Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up