Solar Energy Incentive Programs Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032

The EPA seeks applications to fund residential solar programs that lower energy costs and advance environmental justice for low income and Federal Solar Tax Credit Resources Developed by the U S Department of Energy DOE Solar Energy Technologies Office SETO these guides provide overviews of the

Solar Energy Incentive Programs

Solar Energy Incentive Programs

https://www.irstaxapp.com/wp-content/uploads/2022/12/california-solar-incentives.png

All Solar Panel Incentives Tax Credits In 2023 By State

https://www.solarreviews.com/images/og/SolarIncentives.jpg

Government Incentive Programs For Solar Energy Projects Energy

https://i.pinimg.com/736x/fb/d3/6a/fbd36a9c81dd960f30506bc6b256ea2e.jpg

Learn how homeowners can take advantage of solar incentives and rebates provided by government entities utility companies manufacturers and more The Solar for All program will deliver residential solar projects to over 900 000 households in low income and disadvantaged communities across the

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re eligible for

Download Solar Energy Incentive Programs

More picture related to Solar Energy Incentive Programs

Manitoba Hydro Offers Solar Energy Incentive Program CBC News

https://i.cbc.ca/1.2035890.1381643590!/httpImage/image.jpg_gen/derivatives/16x9_620/hi-solar-panel2-istock-852.jpg

Government Solar Panel Help In 2024 Inc Schemes Solar Panel Prices

http://www.solarpanelprices.co.uk/wp-content/uploads/2021/04/government-solar-panel-help.jpg

Business Owners In 2021 Solar Energy Solutions Incentive Incentive

https://i.pinimg.com/736x/12/65/ae/1265ae938c43de4eeffab27bc9fc8b35.jpg

On top of the 30 percent ITC developers can earn a 20 percent bonus credit for wind and solar projects in low income communities a powerful incentive to funnel Solar renewable energy certificates SRECs are performance based solar incentives that allow you to earn additional income from your home s solar energy

There is a federal investment tax credit ITC for solar energy systems in place until December 31st 2023 Both residential and commercial customers can take advantage Learn how to claim the federal solar tax credit which covers 30 of the solar system cost until 2033 and applies to solar panels water heaters and storage

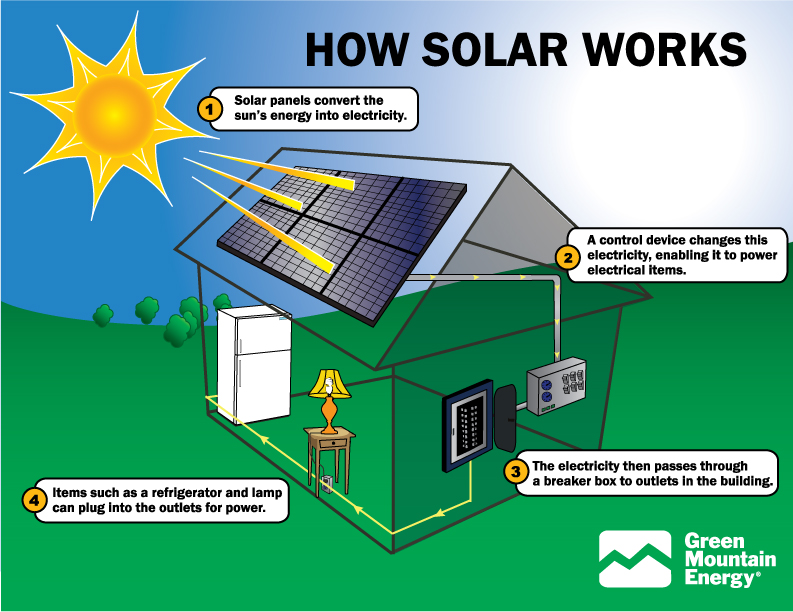

A Quick Guide To Solar Energy

https://myclosets.us/wp-content/uploads/2017/03/A-Quick-Guide-To-Solar-Energy.jpg

Solar Energy

https://cdn.bitrix24.site/bitrix/images/landing/krayt/solar_energy/1.jpg

https://www.energy.gov/eere/solar/h…

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032

https://www.epa.gov/newsreleases/biden-harris...

The EPA seeks applications to fund residential solar programs that lower energy costs and advance environmental justice for low income and

A Quick Guide To Solar Energy

Solar Energy Production By State WorldAtlas

Progressive Charlestown Renewable Energy Fund Could Use Some Tweaks

Solar Energy Concept Stock Image Image Of Concept Sustainable 63632591

Solar Energy Concept Stock Image Image Of Concept Sustainable 63632591

Colorado Solar Energy Systems Eligible For Tax Exemptions

Energy Guidance Nexus Energy Solutions

Solar Energy Incentive Programs - The Solar for All program will deliver residential solar projects to over 900 000 households in low income and disadvantaged communities across the