Solar Incentive Programs Key Takeaways The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation

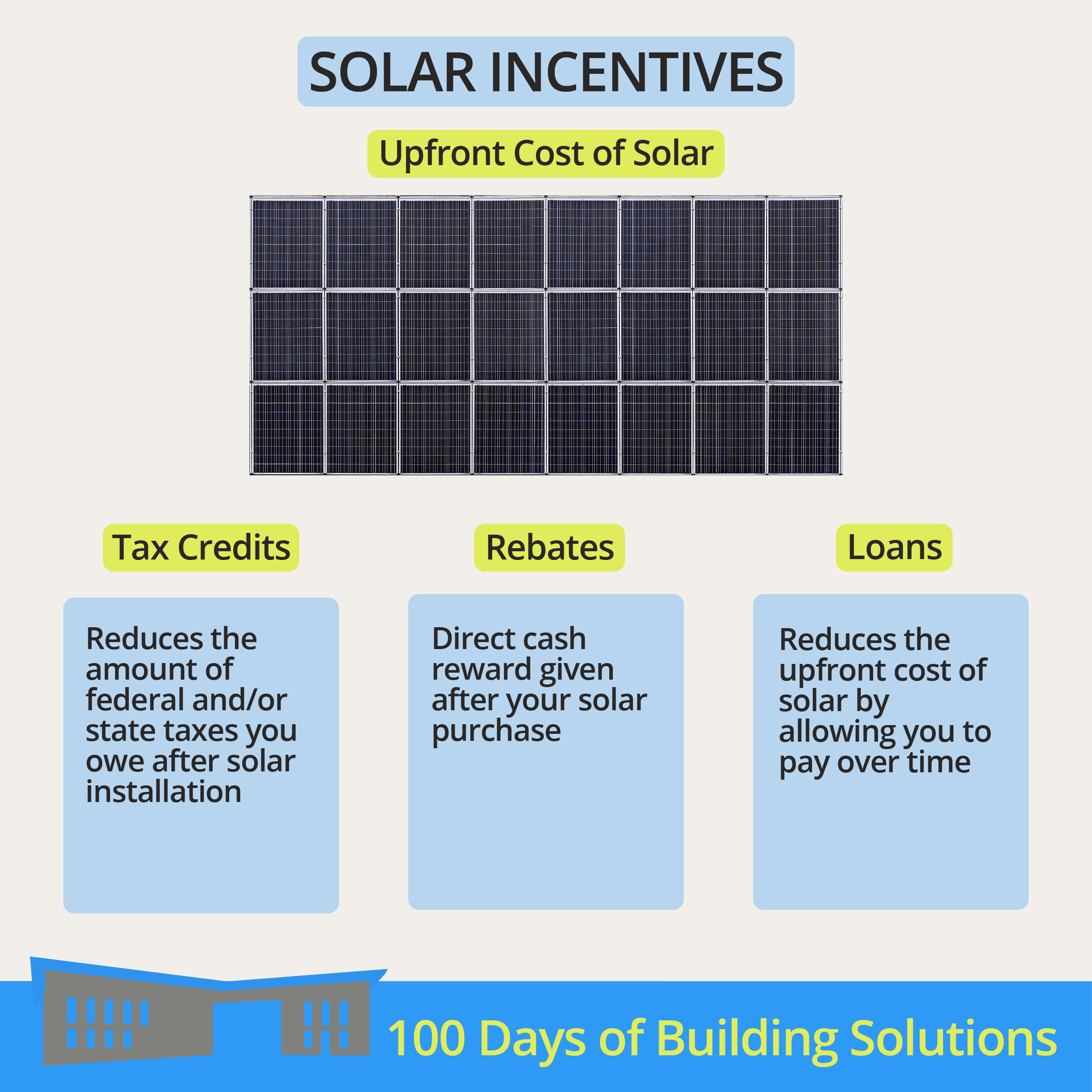

There are several types of solar incentives available for residential solar across the country Here are the ones most commonly used by homeowners to reduce their solar panel costs and shorten their solar The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

Solar Incentive Programs

Solar Incentive Programs

https://goodfaithenergy.com/wp-content/uploads/2022/11/Texas-Solar-Credits.jpg

The Benefits Of Participating In Solar Incentive Programs

https://solarstarinfo.com/wp-content/uploads/2023/04/solar-incentive-1024x576.png

What Are solar Incentive Programs R W Kern Center

https://sites.hampshire.edu/rwkerncenter/files/2021/02/solar-incentives.png

WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America New homeowners can add solar as part of their mortgage with loans available through the Federal Housing Administration and Fannie Mae which allow borrowers to include

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other Solar for All will expand existing low income solar programs and launch new ones The 60 selected applicants will serve households in all 50 states the District of Columbia

Download Solar Incentive Programs

More picture related to Solar Incentive Programs

Successful Solar Incentive Programs Grow Solar

https://s3.studylib.net/store/data/006964668_1-64fa74a3cbc91068f0e5c56f1bc2e2bc-768x994.png

THE IMPACT OF SOLAR INCENTIVE PROGRAMS IN TEN STATES

https://s2.studylib.net/store/data/014673871_1-3b57ad68e3860d10fd7ed8a061ff2443-768x994.png

Made In Minnesota Solar Incentive Program Harmony

https://harmony1.com/wp-content/uploads/2016/11/AdobeStock_72065328.jpeg

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax By Nadja Popovich Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by

There are multiple solar incentive programs to help offset the cost of solar panels Federal and state tax credits rebates and performance payment programs can help you save 30 60 or more off the initial On top of the 30 percent ITC developers can earn a 20 percent bonus credit for wind and solar projects in low income communities a powerful incentive to funnel new

Arkansas Solar Incentive Programs

https://www.solarinsure.com/wp/wp-content/uploads/2009/05/solarpanel.jpg

SOLAR INCENTIVES REBATES Inland Power

https://static.wixstatic.com/media/79b722_73d4c939bb954a5e886d7c236a5d81e7~mv2.jpg/v1/fill/w_1920,h_1302,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/79b722_73d4c939bb954a5e886d7c236a5d81e7~mv2.jpg

https://www.forbes.com/home-improvement/solar/...

Key Takeaways The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation

https://www.solarreviews.com/solar-inc…

There are several types of solar incentives available for residential solar across the country Here are the ones most commonly used by homeowners to reduce their solar panel costs and shorten their solar

Solar Panels In Arizona How Much Can You Save Joule X

Arkansas Solar Incentive Programs

Solar Incentives By State Vantage Solar

PA DEP Solar Incentive Programs

Announcing The Client Incentive Program Ethereum Foundation Blog

Clean Power Research NY solar Incentive Programs Consolidated Into NY SUN

Clean Power Research NY solar Incentive Programs Consolidated Into NY SUN

Incentive Solar CALeVIP

Low Income Solar Incentive Programs California IGS

Solar Incentive Program Pays Huntington Beach Residents Up To 1 500

Solar Incentive Programs - The average household that installed solar panels or made related improvements such as buying batteries for solar energy storage claimed just over 5 000 in tax credits these