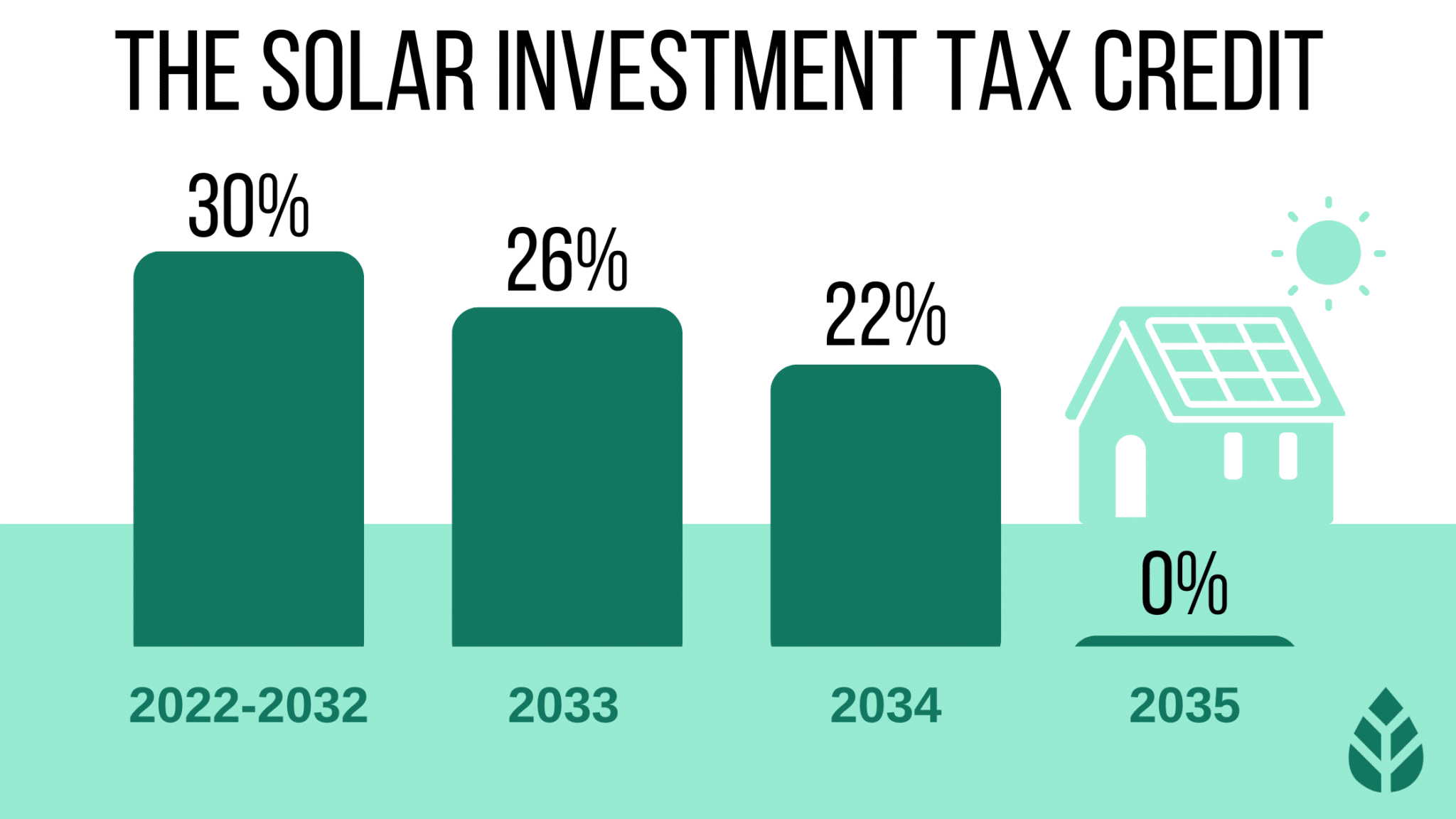

Solar Tax Credit For 2023 Learn how to claim a 30 tax credit for solar and other clean energy property installed in your home from 2022 to 2032 Find out who qualifies what expenses ar

What is a tax credit A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe For example claiming a 1 000 federal tax credit The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe Itemized Deductions in 2023 2024 22

Solar Tax Credit For 2023

Solar Tax Credit For 2023

https://www.livesmartconstruction.com/wp-content/uploads/2020/05/solar-tax-credit.jpg

How Does The Federal Solar Tax Credit Work IVee League Solar

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-750x422.png

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in How does the solar tax credit work in 2023 The federal solar tax credit allows you to deduct 30 of the cost of installing a solar energy system from your

Check out our updated Federal Solar Tax Credit guide for 2024 including how much the credit is worth instructions on how to apply and other solar savings This webpage was updated August 2023 Disclaimer This webpage provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar

Download Solar Tax Credit For 2023

More picture related to Solar Tax Credit For 2023

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Texas Solar Incentives Tax Credits Rebates More In 2023

https://www.ecowatch.com/wp-content/uploads/2022/12/Solar-Investment-Tax-Credit-5-1-3.png

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for and The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump If you qualify for a solar tax credit of 8 000 you can only use 7 000 of that credit on this year s return For instance if you bought your solar panels in 2023 but

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Graphic-06-2048x1136.png

The 30 Solar Tax Credit Has Been Extended Through 2032

https://quickelectricity.com/wp-content/uploads/2022/09/Solar-Federal-Tax-Credit-Increased-to-30-and-Extended-Through-2032-scaled.jpg

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Learn how to claim a 30 tax credit for solar and other clean energy property installed in your home from 2022 to 2032 Find out who qualifies what expenses ar

https://www.energy.gov/.../Homeowners_Guide_to_the_Federal…

What is a tax credit A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe For example claiming a 1 000 federal tax credit

Federal Solar Tax Credits For Businesses Department Of Energy

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit What You Need To Know 2022

26 Federal Solar Tax Credit Extended SolarTech

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

2023 Residential Clean Energy Credit Guide ReVision Energy

What You Need To Know About The ITC Solar Tax Credit Decreasing After

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar Tax Credit For 2023 - These two federal solar tax credits have some important distinctions For instance you may have heard about additional credits above 30 or the ability to sell