South Carolina Motor Fuel Income Tax Credit 2023 Verkko 25 tammik 2023 nbsp 0183 32 Full or part year taxpayers can claim the refundable credit for the lesser of the increase in South Carolina Motor Fuel

Verkko 7 kes 228 k 2022 nbsp 0183 32 FOR IMMEDIATE RELEASE 6 7 2022 For the sixth consecutive year South Carolina s Motor Fuel User Fee which helps support road bridge and Verkko Motor Fuel Estimates Body the revenue and fiscal affairs office provides projections on motor fuel revenue data on historical revenue distributions and information on Motor

South Carolina Motor Fuel Income Tax Credit 2023

South Carolina Motor Fuel Income Tax Credit 2023

https://abcnews4.com/resources/media/b8886d87-ee31-47c2-b390-bb459b9c3a3c-large16x9_GaspumpGettyImages.jpg?1608567110489

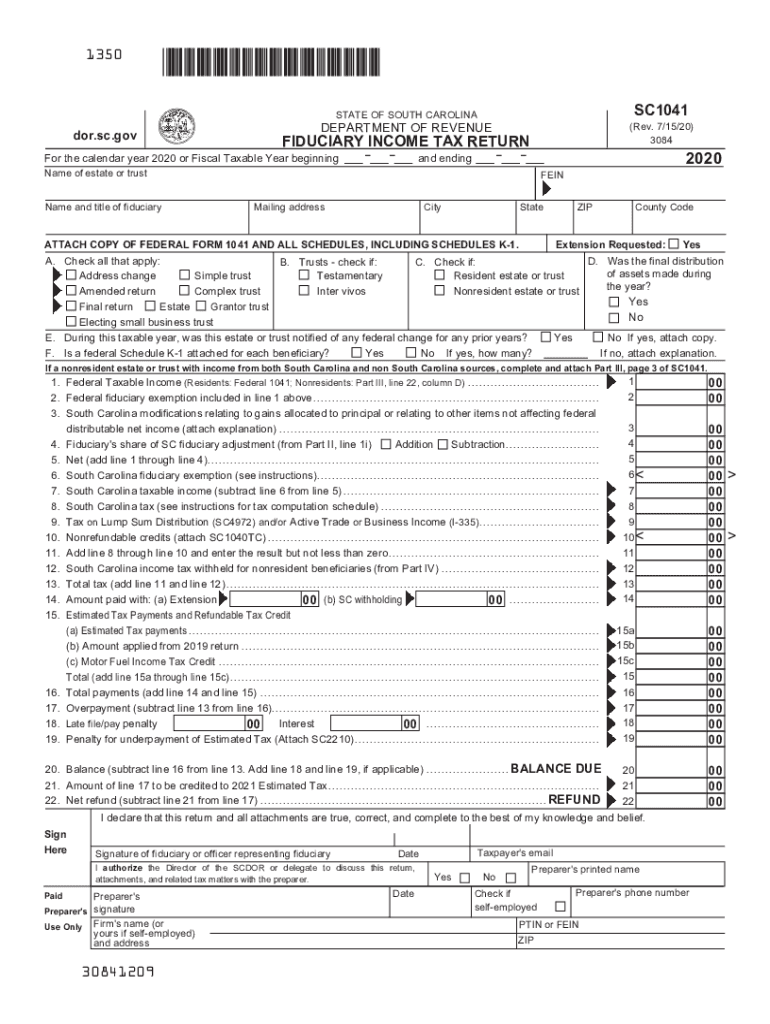

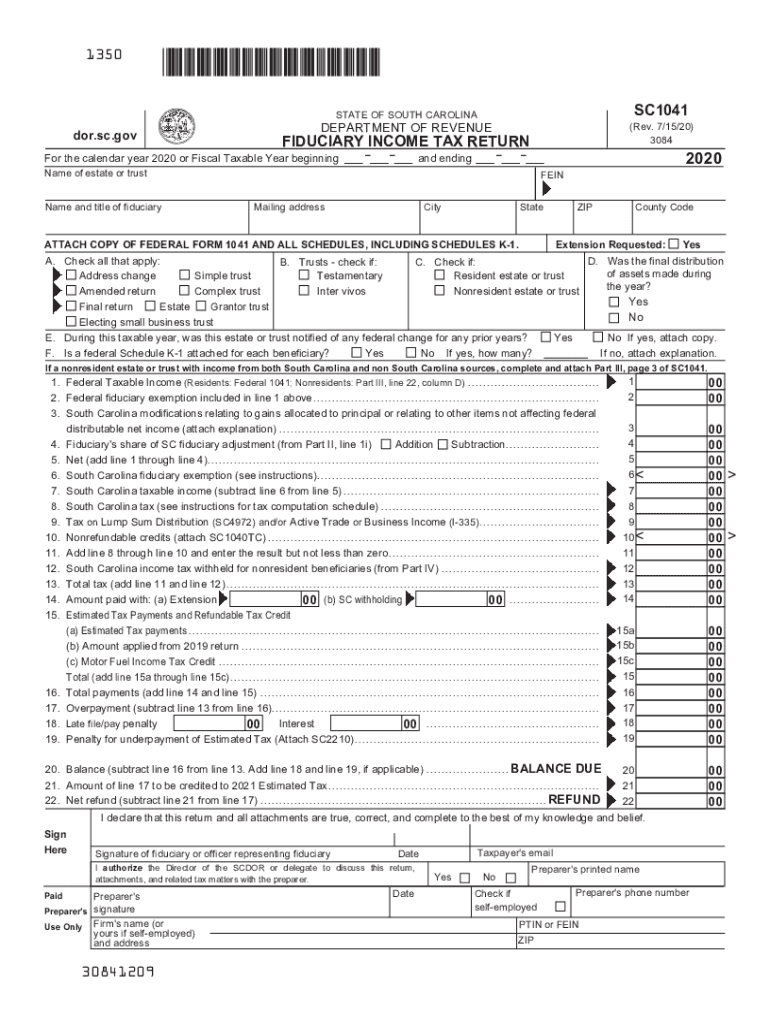

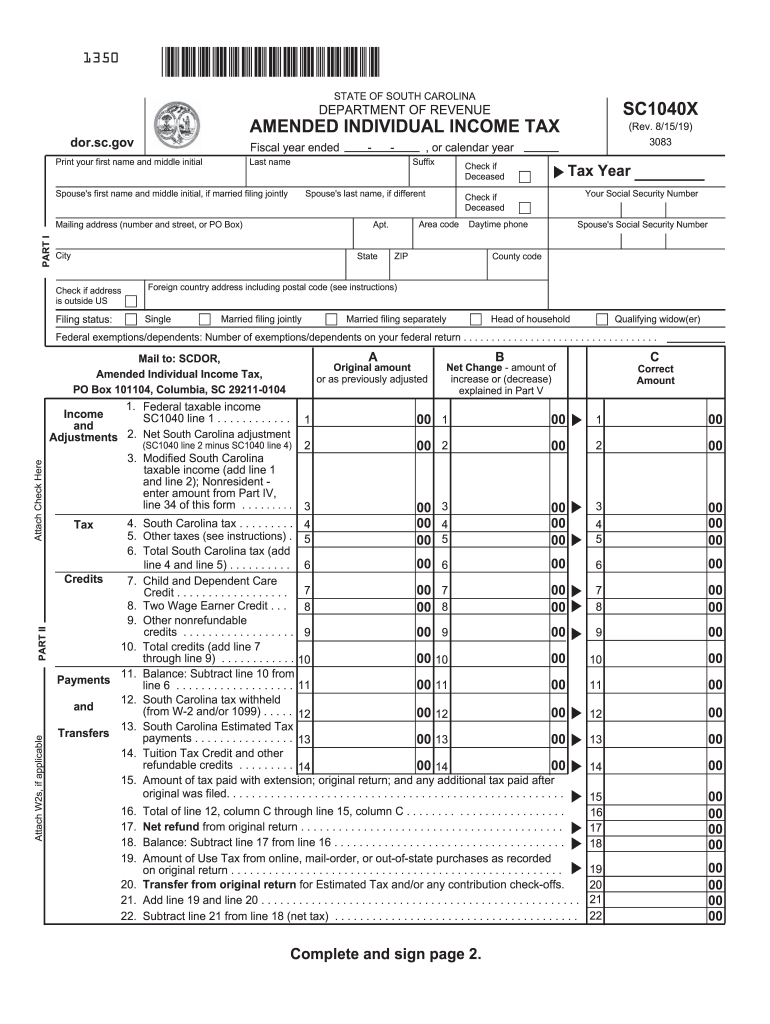

Income Tax In South Carolina Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/552/450/552450635/large.png

In 2021 The SC Gas Tax Credit Is Worth More And There s An App To Help

https://bloximages.newyork1.vip.townnews.com/postandcourier.com/content/tncms/assets/v3/editorial/5/90/590d0634-4956-11eb-958e-ffb4eee5eec0/5953b43513f6e.image.jpg?resize=1623%2C1276

Verkko South Carolina Department of Revenue PO Box 125 Columbia SC 29214 0825 General tax credit questions TaxCredits dor sc gov Angel Investor Credit Parental Verkko determine the amount of credit for each vehicle Add the total credit for Vehicle 1 and Vehicle 2 to get your total Motor Fuel Income Tax Credit Enter the total here and on

Verkko 4 jouluk 2017 nbsp 0183 32 Lisa Wilson 843 706 8103 South Carolina taxpayers have the chance to save a little extra money by keeping receipts when they fuel up their vehicles starting in January That s when a new Verkko 12 tammik 2021 nbsp 0183 32 The upcoming tax filing season is the third year South Carolinians can claim the Motor Fuel Income Tax Credit on their tax returns The credit offsets the Motor Fuel User Fee commonly

Download South Carolina Motor Fuel Income Tax Credit 2023

More picture related to South Carolina Motor Fuel Income Tax Credit 2023

South Carolina s Motor Fuel User Fee Increasing Again July 1 WCIV

https://abcnews4.com/resources/media/1073fd21-bf92-41f1-b2a6-2bc843974169-large16x9_GasPump.jpg?1622560131046

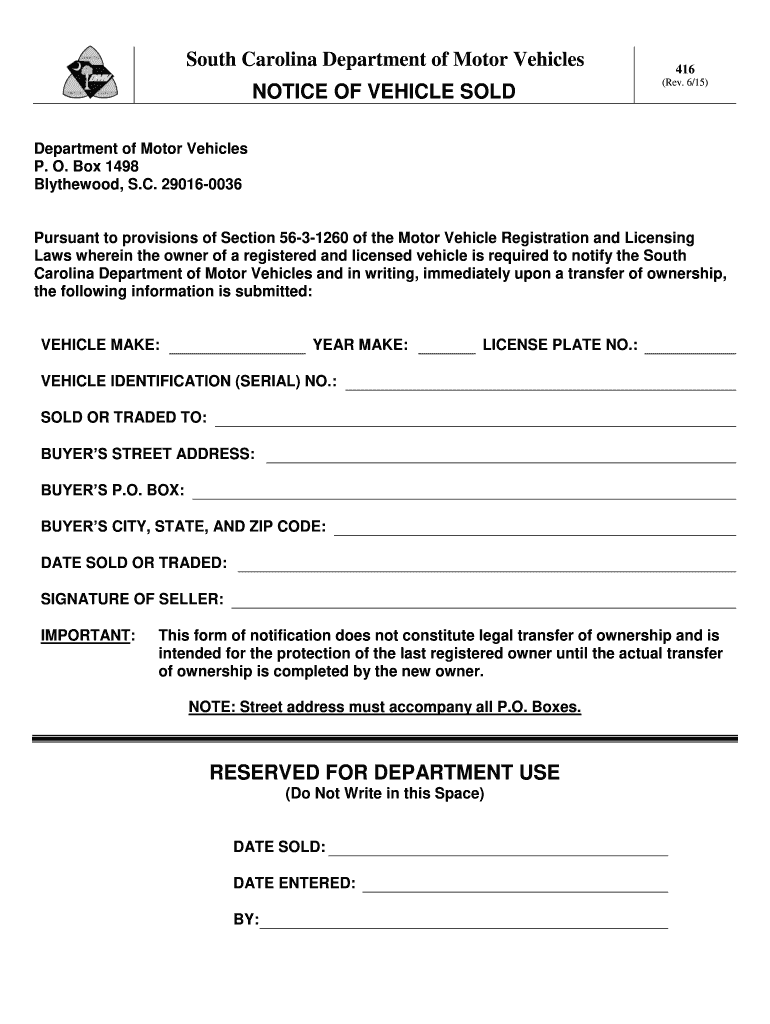

Free South Carolina Motor Vehicle Bill Of Sale Form Legal Templates

https://legaltemplates.net/wp-content/uploads/South-Carolina-vehicle-bill-of-sale.png

![]()

SC Gas Tax Credit App En App Store

https://is2-ssl.mzstatic.com/image/thumb/Purple124/v4/02/c9/d9/02c9d9bb-c0db-ce7f-a633-e18a1e55c20a/AppIcon-0-0-1x_U007emarketing-0-0-0-7-0-0-sRGB-0-0-0-GLES2_U002c0-512MB-85-220-0-0.png/1200x630wa.png

Verkko 19 jouluk 2019 nbsp 0183 32 This credit offsets the motor fuel user fee which goes up 0 02 every July 1st The South Carolina Department of Transportation said that as of Oct 31 Verkko 27 syysk 2023 nbsp 0183 32 Income Taxes The top marginal income tax rate will continue to be gradually reduced from 6 5 in 2022 to 6 by 2027 Income tax brackets collapsed

Verkko I SOUTH CAROLINA MOTOR FUEL TAX RATES The following table gives an overview of how the motor fuel tax rate has changed since it was first enacted The rate Verkko Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV

SC Gas Tax Credit App Apps On Google Play

https://play-lh.googleusercontent.com/-pBYRB4z2Bt8wZilWXJuq4q9n_ittEekgt4bdrYeH73-aozeZXFEbAov2AY7J2-R3A

South Carolina Motor Vehicle Bill Of Sale Download Printable Pdf

https://www.pdffiller.com/preview/0/183/183284/large.png

https://www.thestate.com/news/state/south-c…

Verkko 25 tammik 2023 nbsp 0183 32 Full or part year taxpayers can claim the refundable credit for the lesser of the increase in South Carolina Motor Fuel

https://dor.sc.gov/resources-site/media-site/Pages/Coming-July-1,-A...

Verkko 7 kes 228 k 2022 nbsp 0183 32 FOR IMMEDIATE RELEASE 6 7 2022 For the sixth consecutive year South Carolina s Motor Fuel User Fee which helps support road bridge and

1945 South Carolina Motor Cycle Drivers License

SC Gas Tax Credit App Apps On Google Play

Fuel DSC Chartered Accountants

North Carolina Department Of Revenue Excise Tax Division

Taxable Social Security Worksheet 2021 Fill Online Printable 6AB

20 558 Vintage Signs Stock Photos Free Royalty Free Stock Photos

20 558 Vintage Signs Stock Photos Free Royalty Free Stock Photos

North Carolina Motor Fuels Tax Bond A Comprehensive Guide

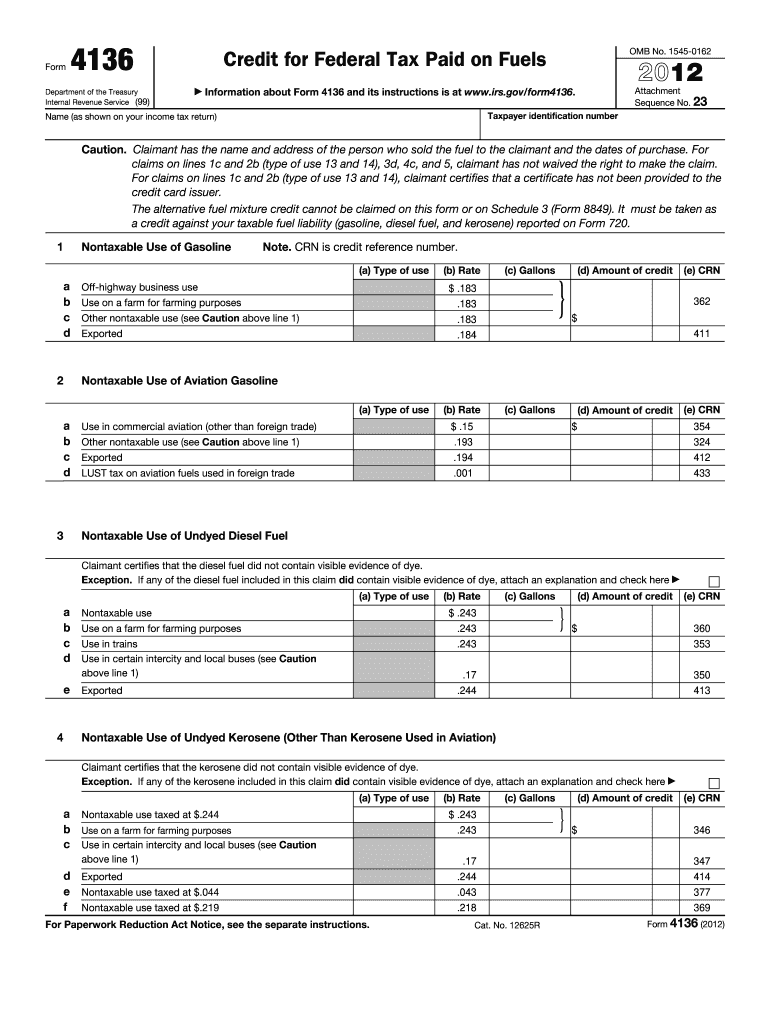

Credit For Federal Tax Paid On Fuels IRS Gov Fill Out And Sign

Free South Carolina Motor Vehicle Bill Of Sale PDF Word EForms

South Carolina Motor Fuel Income Tax Credit 2023 - Verkko 4 jouluk 2017 nbsp 0183 32 Lisa Wilson 843 706 8103 South Carolina taxpayers have the chance to save a little extra money by keeping receipts when they fuel up their vehicles starting in January That s when a new