Spain Vat Refund Rate The standard VAT rate in Spain is 21 Spain will reimburse between 12 75 and 15 3 of the amount you spend during your trip on products subject to standard VAT rates The

Spain s standard VAT rate is 21 and the refund rate can be 10 4 to 15 7 of the purchase amount It s worth mentioning that there is no minimum spending requirement for a tax refund in Spain since The traveler may request a refund of the VAT incurred on their purchases in Spain provided that they meet all the legally required requirements and that the electronic

Spain Vat Refund Rate

Spain Vat Refund Rate

https://api.tourismthailand.org/upload/live/content_article/1124-20932.jpeg

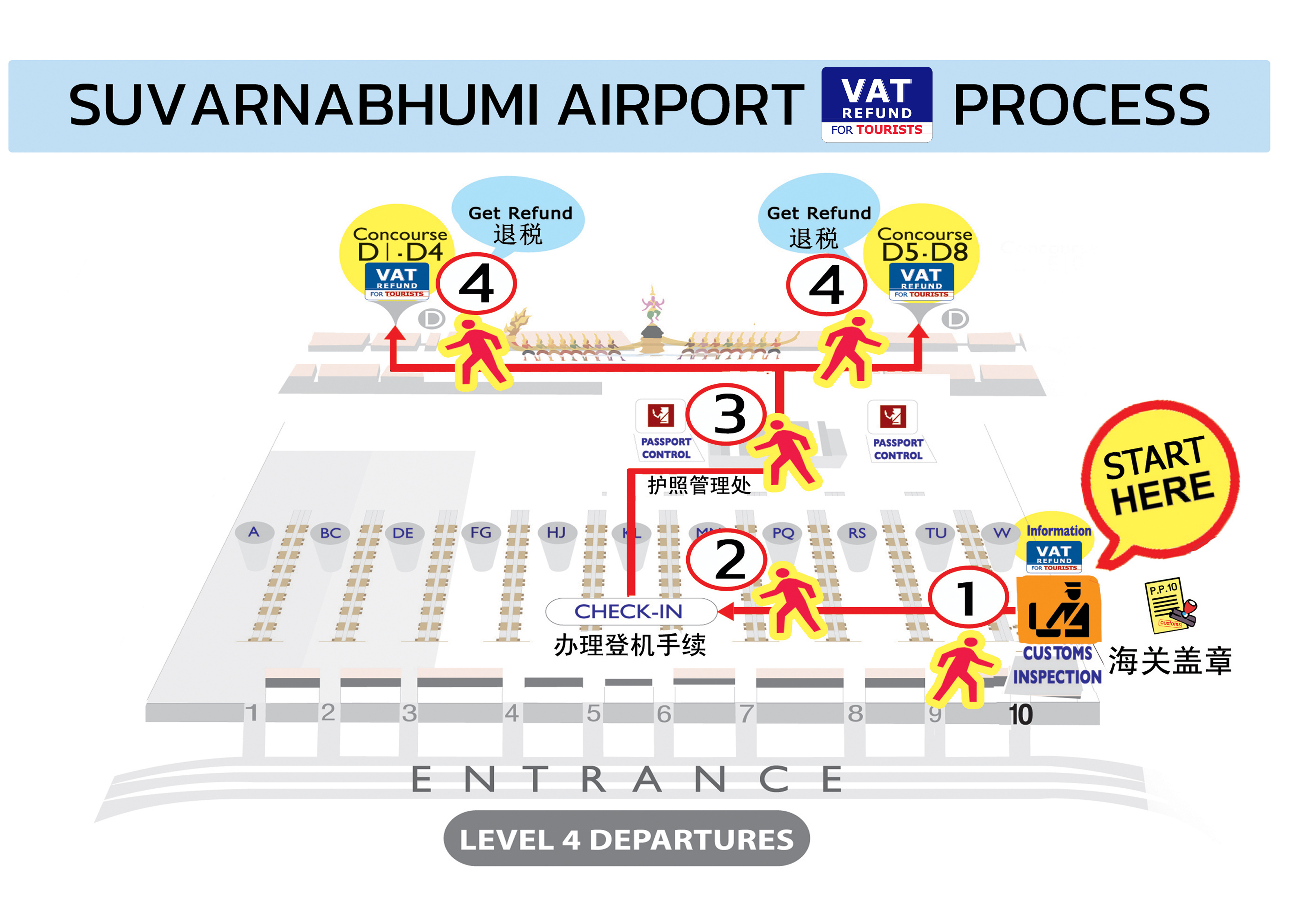

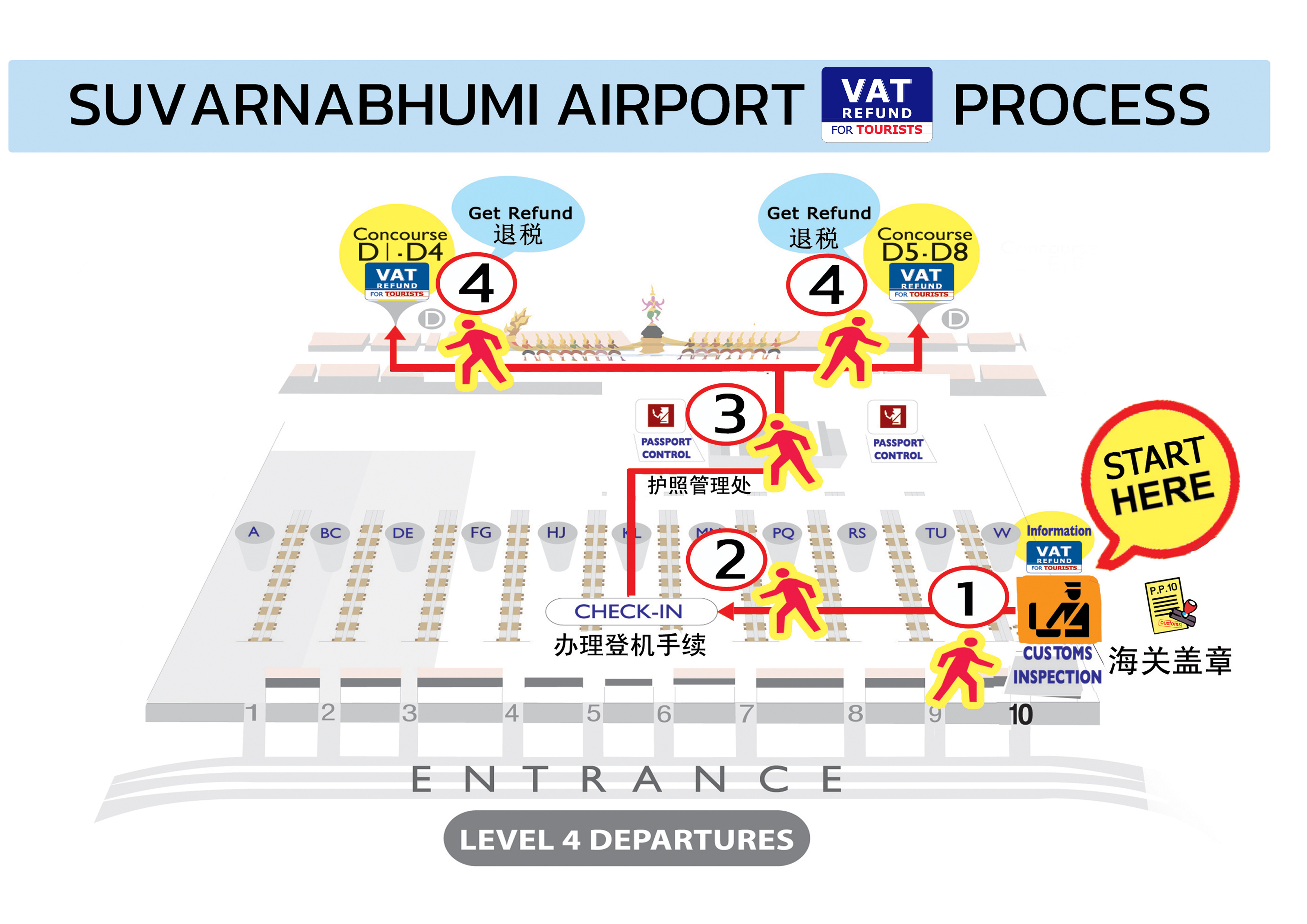

VAT Refund For Tourists Process

https://api.tourismthailand.org/upload/live/content_article/1124-20937.jpeg

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-1024x677.jpg

There are 4 different Spanish VAT rates There is the regular VAT rate 21 the reduced VAT rate 10 the highly reduced VAT rate 4 and the waived The main VAT rate is 21 however 4 and 10 can be applied for certain products You must get the form validated at customs within 3 months of the purchase

VAT at the appropriate rate will be included in the price you pay for the goods you purchase As a visitor to the EU who is returning home or going on to another non EU Contenidos Requirements to claim a VAT refund in Spain How to make a VAT refund in Spain VAT refund through the store where you bought the product VAT refund

Download Spain Vat Refund Rate

More picture related to Spain Vat Refund Rate

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

7 Practical Ways To Lower Your Refund Rate MemberMouse

https://membermouse.com/wp-content/uploads/2018/10/3b8410bf-header.png

How To Apply For The EU VAT Refund In France France Travel Tips

https://www.francetraveltips.com/wp-content/uploads/2022/06/Tax-refund-area-at-Charles-de-Gaulle-airport-1-780x585.jpeg

The refund application must cover the amounts incurred during a calendar year a calendar quarter a period less than a quarter when it relates to the set of Standard rate 21 Reduced rate 10 This applies to some foodstuffs accommodation restaurants and transport Reduced rate 4 This applies to some food stuffs and some

Your quick guide to recover VAT on business activities in Spain covering eligibility criteria current VAT rates claim submission deadlines and recovery process Fernando Matesanz May 10 2023 Fernando Matesanz of Spanish VAT Services explains the VAT refund system for travellers in Spain and why a harmonised refund scheme for

VAT Returns Refund The Netherlands First VAT All VAT Services At

https://1vat.com/wp-content/uploads/2020/04/VAT-Returns-Refund_1vat_NL_1.png

Changes In VAT Refund Rates DKV Euro Service Benelux

https://www.dkv-benelux.com/wp-content/uploads/2016/11/38867870_ml.jpg

https://glocalzone.com/vat-refund-calculator/spain

The standard VAT rate in Spain is 21 Spain will reimburse between 12 75 and 15 3 of the amount you spend during your trip on products subject to standard VAT rates The

https://www.wevat.com/blog-articles-en/t…

Spain s standard VAT rate is 21 and the refund rate can be 10 4 to 15 7 of the purchase amount It s worth mentioning that there is no minimum spending requirement for a tax refund in Spain since

How To Get A VAT Refund IVA In Spain Express Digest

VAT Returns Refund The Netherlands First VAT All VAT Services At

Europe Search Marketing Country Information

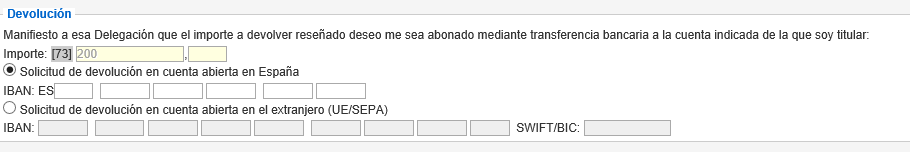

Spain Bank Account Details For The VAT Returns International VAT

VAT Refund For Tourists In UAE 2023 Guide

How To Claim Your VAT Refund In UAE A Guide For Tourists UAE Expatriates

How To Claim Your VAT Refund In UAE A Guide For Tourists UAE Expatriates

2024 VAT Tax Refund Process In Paris France Petite In Paris

VLOG Thailand VRT VAT Refund For Tourist

Spain Vat Refund Rate - Contenidos Requirements to claim a VAT refund in Spain How to make a VAT refund in Spain VAT refund through the store where you bought the product VAT refund