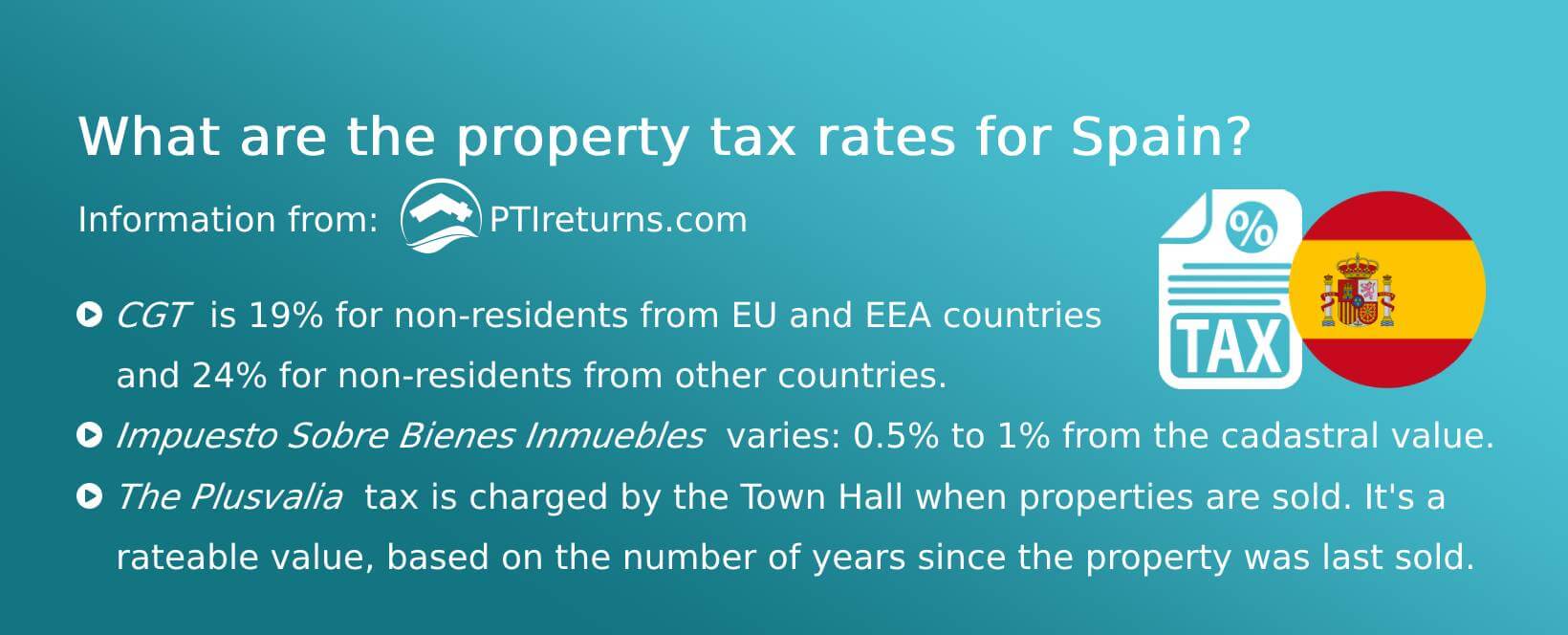

Spanish Tax On Rental Income Income from properties is categorized as investment income in the Spanish tax laws Nonresident foreigners EU EEA earning rental income are taxed at 19 flat

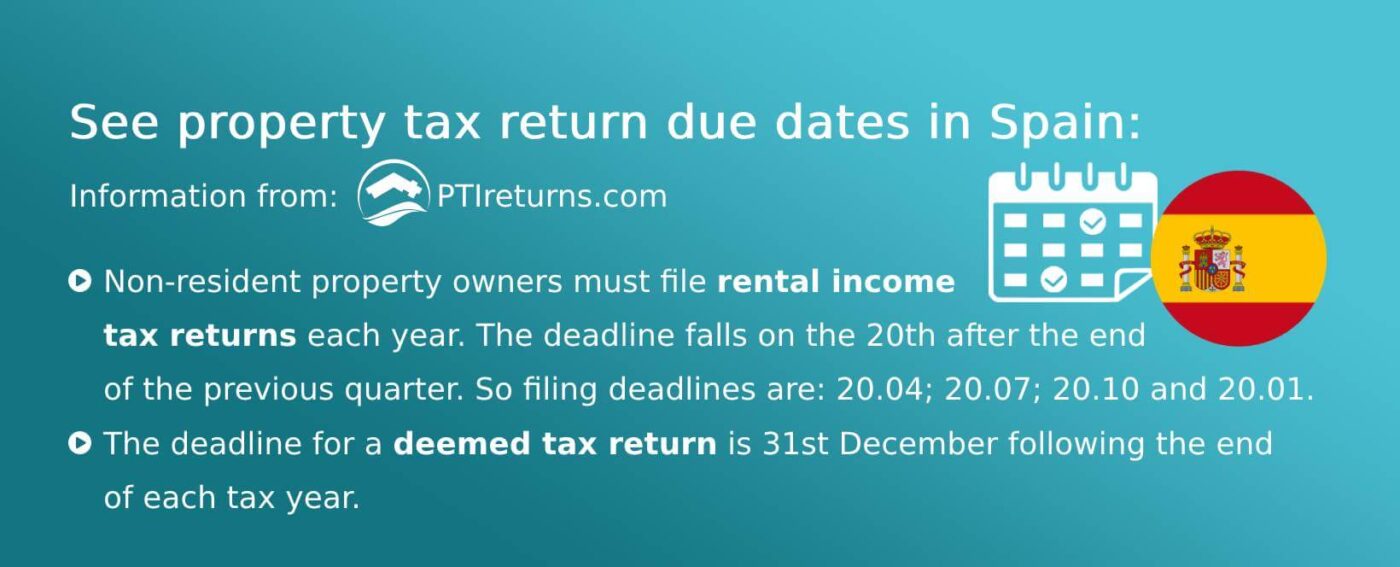

The Spanish Tax Authority collects taxes on rental income quarterly on the following dates First quarter 20th April January The income tax rate in Spain for non residents is 19 This applies to residents from the EU and EEA The tax rate is 24 for residents of other countries EU residents may

Spanish Tax On Rental Income

Spanish Tax On Rental Income

https://www.ptireturns.com/blog/wp-content/uploads/2020/10/Spanish-property-owners-1000x667.jpg

Spanish Tax On Rental Income In 2023 File A Spanish Tax Return Online

https://www.ptireturns.com/wp-content/uploads/2020/03/spain4.jpg

Spanish Tax On Rental Income Rates Deadlines And Recommendations

https://blog.abacoadvisers.com/wp-content/uploads/2019/12/tax-on-rental-income-1-1200x797.jpg

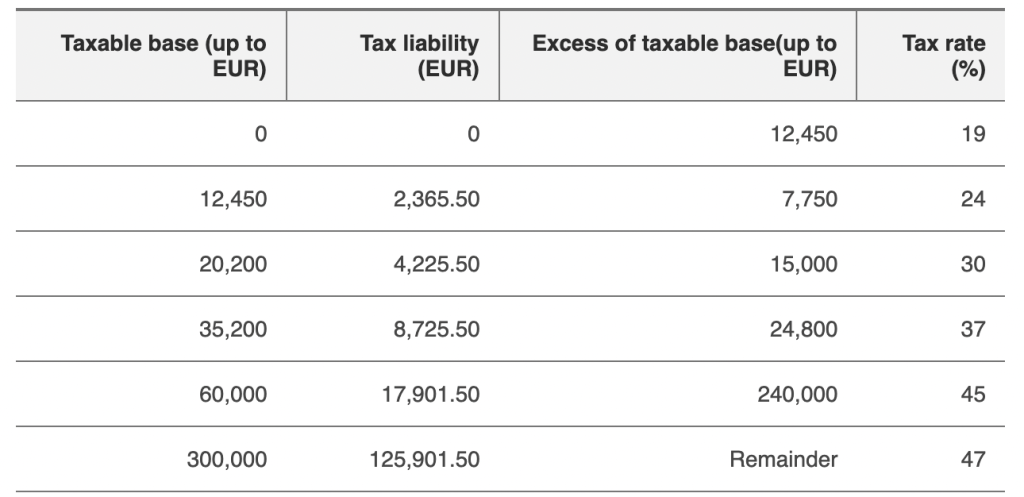

If you have a prop erty you rent out in Spain and live in Spain your self you will have to de clare the in come on your Span ish tax re turn de clara cion de la renta de las per so nas fis icas every year in the May Income from rentals in Spain is taxable whether or not you are a resident in the country For 2019 rental income tax is 19 for those who are tax resident in a country within the European Union Norway or

However a non resident of Spain is only required to pay tax on any Spanish income such as rental income from a Spanish property The income tax for non Make sure you re clued up on taxes in Spain Find out if you re liable and explore up to date rates income brackets VAT and more

Download Spanish Tax On Rental Income

More picture related to Spanish Tax On Rental Income

Non Resident Tax In Spain And Spanish Tax On Rental Income

https://www.ptireturns.com/blog/wp-content/uploads/2020/10/tax-deadlines-Spain-1400x567.jpg

Spanish Tax On Rental Income In 2023 File A Spanish Tax Return Online

https://www.ptireturns.com/wp-content/uploads/2019/10/spain2.jpg

Non Resident Tax In Spain And Spanish Tax On Rental Income

https://www.ptireturns.com/blog/wp-content/uploads/2020/10/Spanish-property-tax-rates.jpg

Under Spanish law the tenant of the premises deducts 19 from the rental rate and pays it to the authorities as tax on your income from the rent So for example if the monthly rental rate is 1 000 the tenant will deduct The way the Spanish tax system treats rental income is reasonably logical but there are some peculiarities that need to be understood Firstly treatment depends

However Spanish Income Tax takes into account the benefits arising in Spain If you are a non resident you must pay 24 75 for rental income You cannot reduce 50 as in the As a non resident property owner in Spain you are required to pay tax on any income you earn from renting out your property every quarter This is done by filing

Tax On Rental Income 4 Common Pitfalls To Avoid Www Gkaplancpa

https://www.gkaplancpa.com/wp-content/uploads/2017/10/tax-on-rental-income.png

Spanish Tax On UK Property The Spectrum IFA Group

https://spectrum-ifa.com/wp-content/uploads/2022/03/Spanish-Tax-UK-Porperty.png

https://www.globalpropertyguide.com/europe/spain/taxes-and-costs

Income from properties is categorized as investment income in the Spanish tax laws Nonresident foreigners EU EEA earning rental income are taxed at 19 flat

https://blog.abacoadvisers.com/tax-on-r…

The Spanish Tax Authority collects taxes on rental income quarterly on the following dates First quarter 20th April January

Spanish Tax On Personal Pensions The Spectrum IFA Group

Tax On Rental Income 4 Common Pitfalls To Avoid Www Gkaplancpa

Spanish Tax System English Speaking Lawyers In Spain

How Much Tax Do You Pay On Rental Income Goselfemployed co

To Foreigners Paying The Tax In Spain Can Be Confusing This Guide

Taxes On Rental Income Roberts Nathan Roberts Nathan

Taxes On Rental Income Roberts Nathan Roberts Nathan

Expat Taxes In Spain 2023 Non Resident Tax Rates Spain

Rental Income Tax Benefits Available For Landlords Chandan Agarwal

How To File Back Taxes Yourself Wealth Chatroom Navigateur

Spanish Tax On Rental Income - Make sure you re clued up on taxes in Spain Find out if you re liable and explore up to date rates income brackets VAT and more