Spouse Income Tax Return Australia These can be obtained from your spouse your spouse s Tax return for individuals 2022 and Tax return for individuals supplementary section 2022 if your spouse needed to complete them your spouse s income statement or PAYG payment summary individual non business

Seek this information from your spouse whether or not they need to lodge a tax return The ATO is not able to disclose to you your spouse s taxable income even with your spouse s consent If you can t find out your spouse s taxable income you By including your spouse s income in your tax return we can work out if you re entitled to specific offsets rebates or reductions It also lets us know if you re liable for the Medicare levy surcharge

Spouse Income Tax Return Australia

Spouse Income Tax Return Australia

https://thebeancounter.co.za/wp-content/uploads/2020/08/Filing-tax-return-1536x864.jpeg

Tax Return Australia 2021 FAQs By Rick Mon Accountants Business

https://image.isu.pub/210603055126-f7bbc5b396d48d8de531259cea3b823f/jpg/page_1.jpg

Tax Brackets Australia See The Individual Income Tax Tables Here

https://www.etax.com.au/wp-content/uploads/2020/09/bigstock-189166999.jpg

The ATO uses your spouse s income to work out whether you are entitled to a rebate for your private health insurance you are entitled to the seniors and pensioners tax offset You don t have to lodge a combined tax return if you re married as happens in some other countries Joint income is recorded separately in each spouses tax returns You need to show on your tax return that you now have a spouse and disclose his or her taxable income each year

Do you need to declare your partners income in your tax return No but you still need to notify the ATO of your spouse s earnings This tax guide for couples helps you determine whether you need to include your partner s information on your next tax return Read on to learn what you should tell the ATO this year Who the ATO defines as a spouse for tax purposes is a common cause of confusion

Download Spouse Income Tax Return Australia

More picture related to Spouse Income Tax Return Australia

Personal Income Tax Rates For Australian Residents 2018 2019

https://www.mckinleyplowman.com.au/wp-content/uploads/2018/08/bigstock-Australian-Individual-Tax-Retu-59709716.jpg

Australian Income Tax Work And Travel In Australia

https://www.work-n-travel-australia.com/wp-content/uploads/2016/07/tax_return_web.jpg

If You re A Surviving Spouse Or Estate Executor For Someone Who Died In

https://i.pinimg.com/originals/70/58/18/70581874c62e4fe0bd4a8ed60e5daa6a.jpg

Within your Income Tax Return you must make a legal declaration whether you had a spouse during the year where you answer yes to this question then the Australian Taxation Office ATO require a number of spouse income labels to be completed According to the 2021 Australian Census just over 11 of Australians are living in a de facto relationship When it comes to lodging as a de facto couple it s important to know the details that are specific to your situation to make sure you get the most out of your tax return

You won t need to send us formal advice that you ve separated from your husband if you declare that information on your tax return However you ll still need to let us know if you change other personal details like your last name or address most of which can be done via myGov Your spouse s share of trust income Your spouse s share of trust income on which the trustee is assessed and is not included in your spouse s taxable income Enter the amount any amount of net income of a trust that the trustee was liable to pay tax on because your spouse was under a legal disability

Main Page

https://iorder.com.au/upload/image/publications/ex_2541-6.2023_full.jpg

How To Split Your Tax Refund With Your Spouse YouTube

https://i.ytimg.com/vi/qnruQ2WPvAc/maxresdefault.jpg

https://www.ato.gov.au/individuals-and-families/...

These can be obtained from your spouse your spouse s Tax return for individuals 2022 and Tax return for individuals supplementary section 2022 if your spouse needed to complete them your spouse s income statement or PAYG payment summary individual non business

https://www.ato.gov.au/.../spouse-details

Seek this information from your spouse whether or not they need to lodge a tax return The ATO is not able to disclose to you your spouse s taxable income even with your spouse s consent If you can t find out your spouse s taxable income you

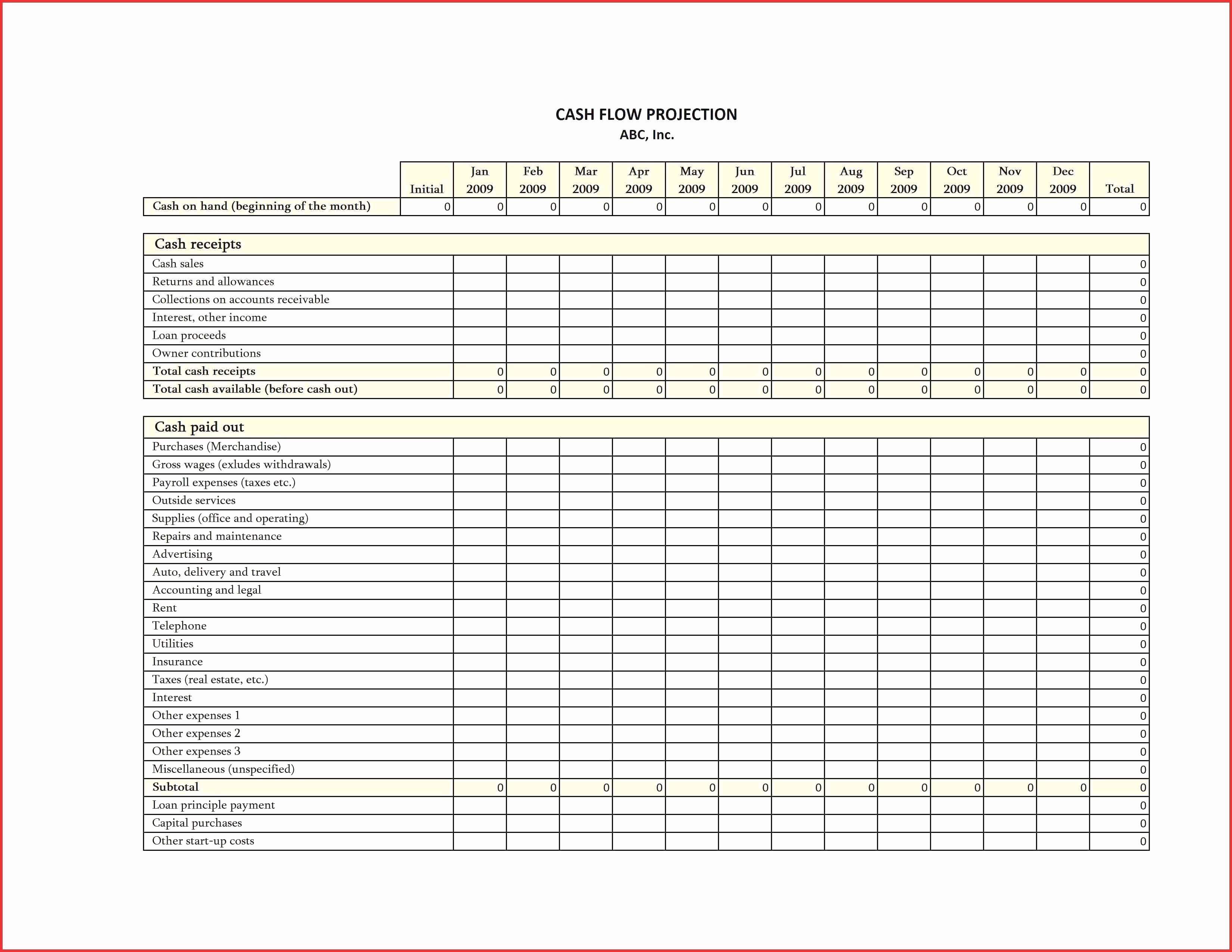

Tax Expenses Template

Main Page

How To Prepare Tax Return Australia 2020 21 Explained YouTube

A COMPREHENSIVE GUIDE FOR INCOME TAX RETURN FILLING

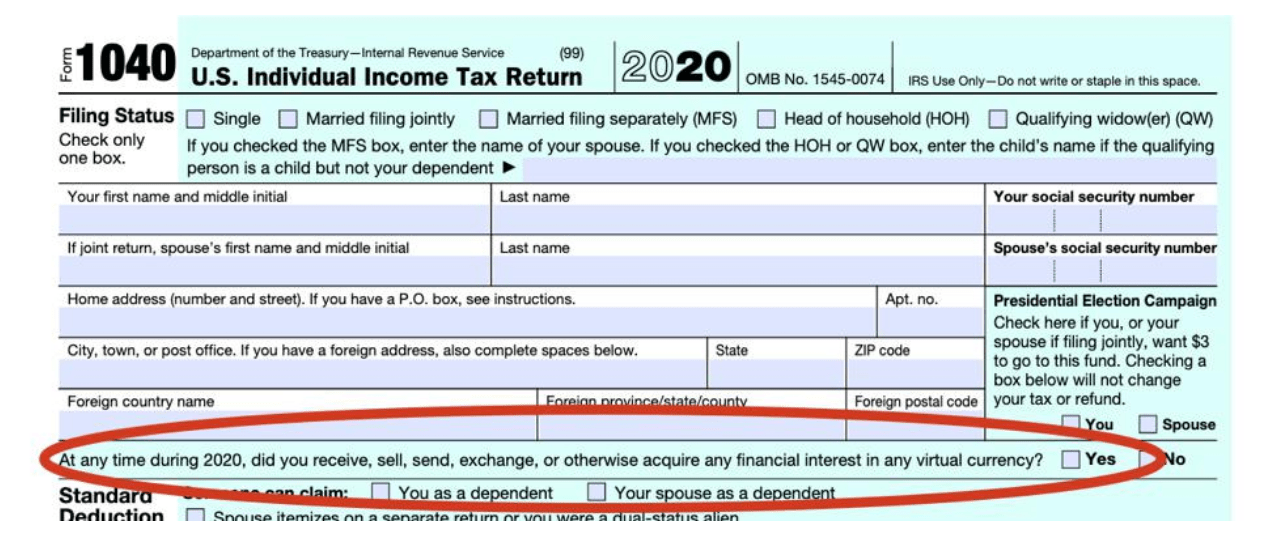

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

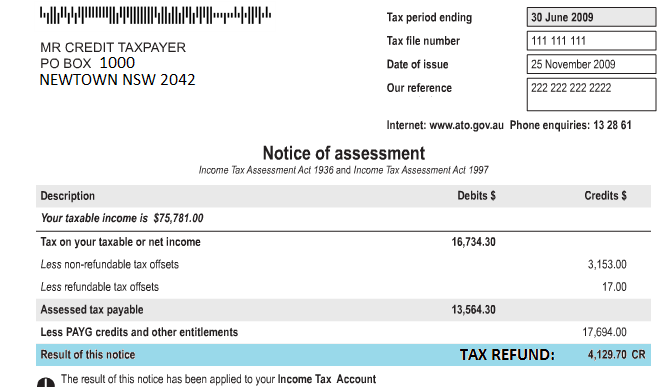

Income Statement Is It Needed To Complete Your Tax Return

Income Statement Is It Needed To Complete Your Tax Return

Learn 85 About Average Tax Return Australia Cool NEC

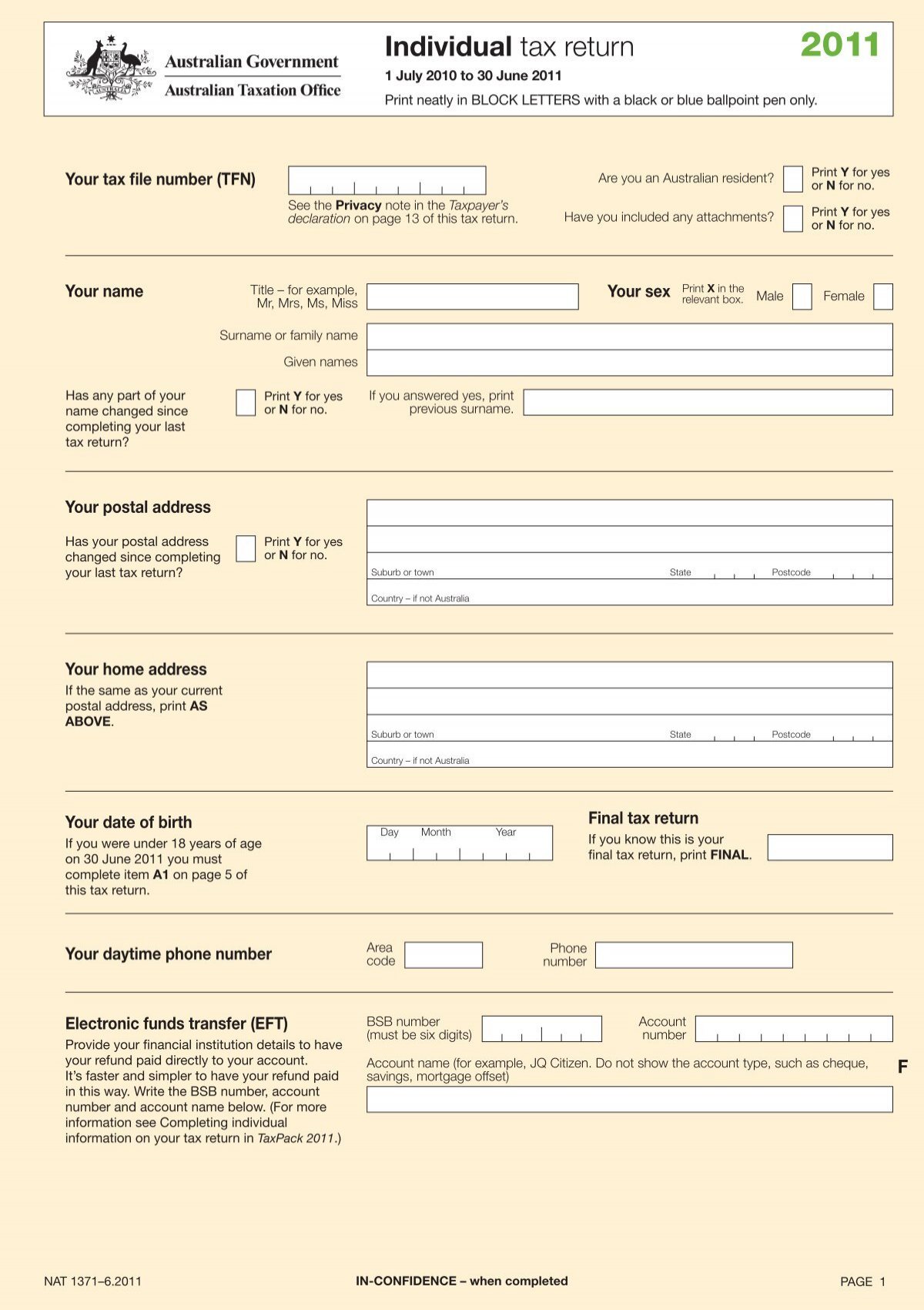

Individual Tax Return Australian Taxation Office

Improved Taxable Income Report For Australian Investors Sharesight

Spouse Income Tax Return Australia - Sign in to myGov and select Australian Taxation Office Select Tax then Lodgements and then Income tax From here you can see the tax returns you need to lodge You can also use the ATO app to lodge your tax return online with myTax