Sr Citizen Interest Income Tax Exemption Limit Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks post office or co operative banks The deduction is allowed for a maximum interest

8 rowsUnder the old tax regime the basic exemption limit for senior citizens Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable

Sr Citizen Interest Income Tax Exemption Limit

Sr Citizen Interest Income Tax Exemption Limit

https://images.indianexpress.com/2020/08/documents-for-income-tax-return-1200.jpg

Interest Rate And Rule Of Senior Citizen Saving Scheme Your Guide To

https://healthnewsreporting.com/wp-content/uploads/2019/02/Who-Can-Open-Senior-Citizen-Savings-Scheme-Account.jpg

Income Tax Exemption Limit Likely To Be Enhanced In Budget

https://www.siasat.com/wp-content/uploads/2020/03/income-tax.jpg

Are my wages exempt from federal income tax withholding Determine if your retirement income is taxable Use the Interactive Tax Assistant to get retirement income Even if the interest income exceeds Rs 2 5 lakhs you can still use Form 15H This is so because the maximum income exemption for senior citizens is Rs 3 00 000 and the

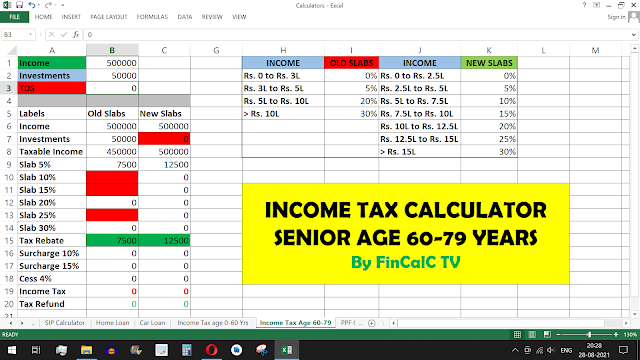

What are the basic exemption limit Under the old tax regime Senior citizens 60 years and older but less than 80 years Income up to Rs 3 lakh is exempt from tax Super senior citizens 80 years and older Income up The Budget is closing loopholes in the tax system including ending the unfair current treatment of carried interest and replacing the non dom tax regime with a new residence

Download Sr Citizen Interest Income Tax Exemption Limit

More picture related to Sr Citizen Interest Income Tax Exemption Limit

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

House Of Representatives Files Bill Of Tax Exemption For Senior

https://filipinojournal.com/wp-content/uploads/2021/03/senior_citizen_task_force_web.jpg

Under this section senior citizens can avail a deduction of upto Rs 50 000 from interest income earned on deposits during the relevant financial year However there are certain limitations and exceptions to this section As the interest under Section 80TTB is exempt up to Rs 50 000 resident senior citizens benefit Mint Section 80TTB of the Income Tax Act outlines the tax benefits that

Senior citizens have higher deduction limits and exemption benefits than younger taxpayers The primary difference lies in the basic exemption ceiling which denotes the The Income Tax Act of 1961 recognizes the financial challenges that senior and super senior citizens may face during their retirement years To provide relief the Act offers a

Income Tax Clarification Opting For The New Income Tax Regime U s

https://blog.quicko.com/wp-content/uploads/2020/04/tax-slabs-scaled-1-1024x512.jpg

The Negative Income Tax NIT And The Welfare State An Effective

https://www.ecepaa.eu/wordpress/wp-content/uploads/Picture3.png

https://www.incometax.gov.in/iec/foportal/help/...

Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks post office or co operative banks The deduction is allowed for a maximum interest

https://tax2win.in/guide/income-tax-for-senior-citizens

8 rowsUnder the old tax regime the basic exemption limit for senior citizens

2013 09 27

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Calculator Ay 2023 24 Excel Printable Forms Free Online

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Income Tax Interest How Is Interest Income Taxed Calculate Income

10 Calculate Tax Return 2023 For You 2023 VJK

10 Calculate Tax Return 2023 For You 2023 VJK

Income Tax Rates For Senior Citizens For Assessment Year Page My XXX

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

Senior Citizen Savings Scheme SCSS Interest Rate 2023 Tax Benefits

Sr Citizen Interest Income Tax Exemption Limit - The Budget is closing loopholes in the tax system including ending the unfair current treatment of carried interest and replacing the non dom tax regime with a new residence