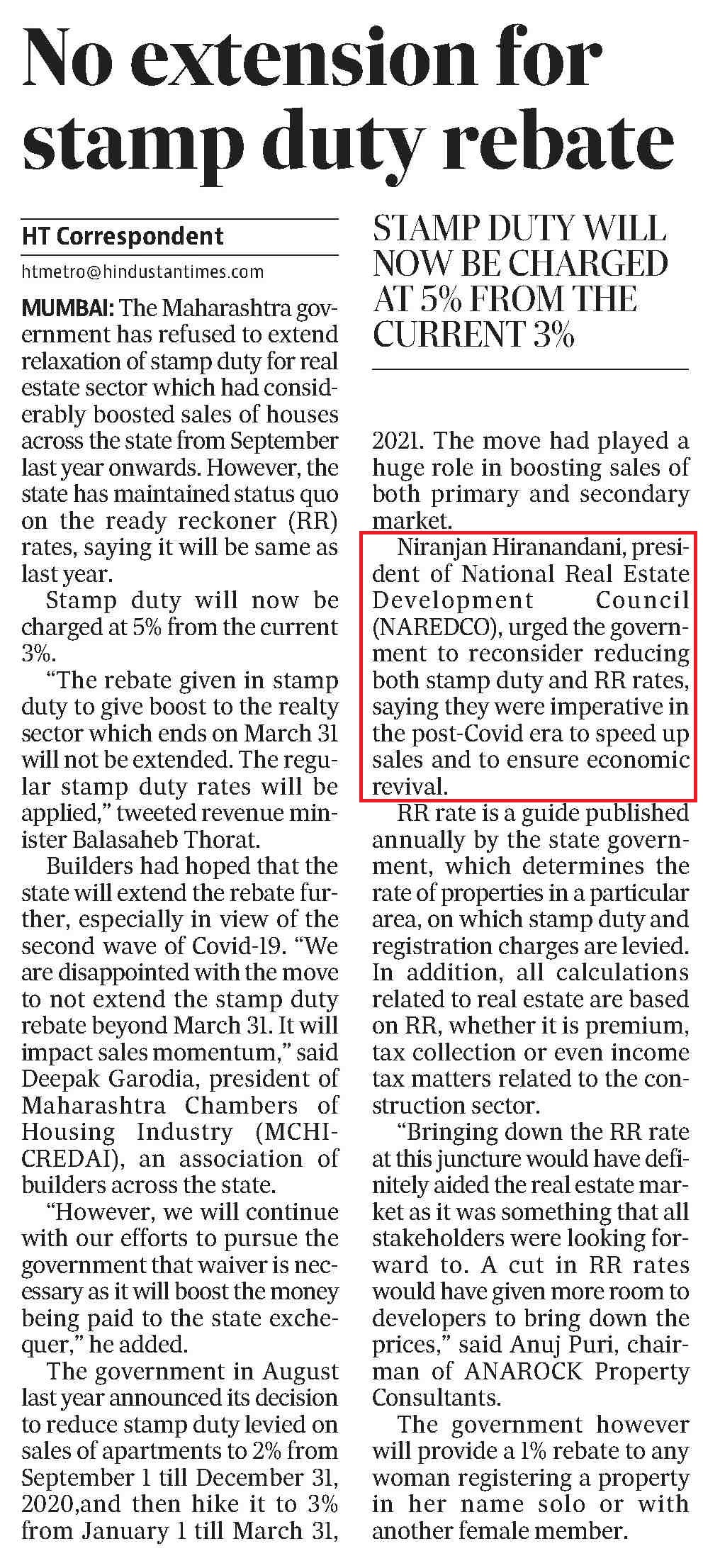

Stamp Duty Tax Rebate India Web 28 mai 2020 nbsp 0183 32 Under the law individuals as well as Hindu Undivided Families HUFs can claim the rebate against stamp duty and

Web 3 nov 2020 nbsp 0183 32 To be eligible for a stamp duty rebate the assessee must be an individual owner a co owner or a member of a Hindu Undivided Family that has purchased a Web 15 sept 2021 nbsp 0183 32 According to Section 80C viii d you can claim tax benefits of up to Rs 1 50 lakhs on your stamp duty and registration charges for a residential property

Stamp Duty Tax Rebate India

Stamp Duty Tax Rebate India

https://niranjanhiranandani.files.wordpress.com/2021/04/no-extension-for-stamp-duty-rebate-hindustan-times.jpg

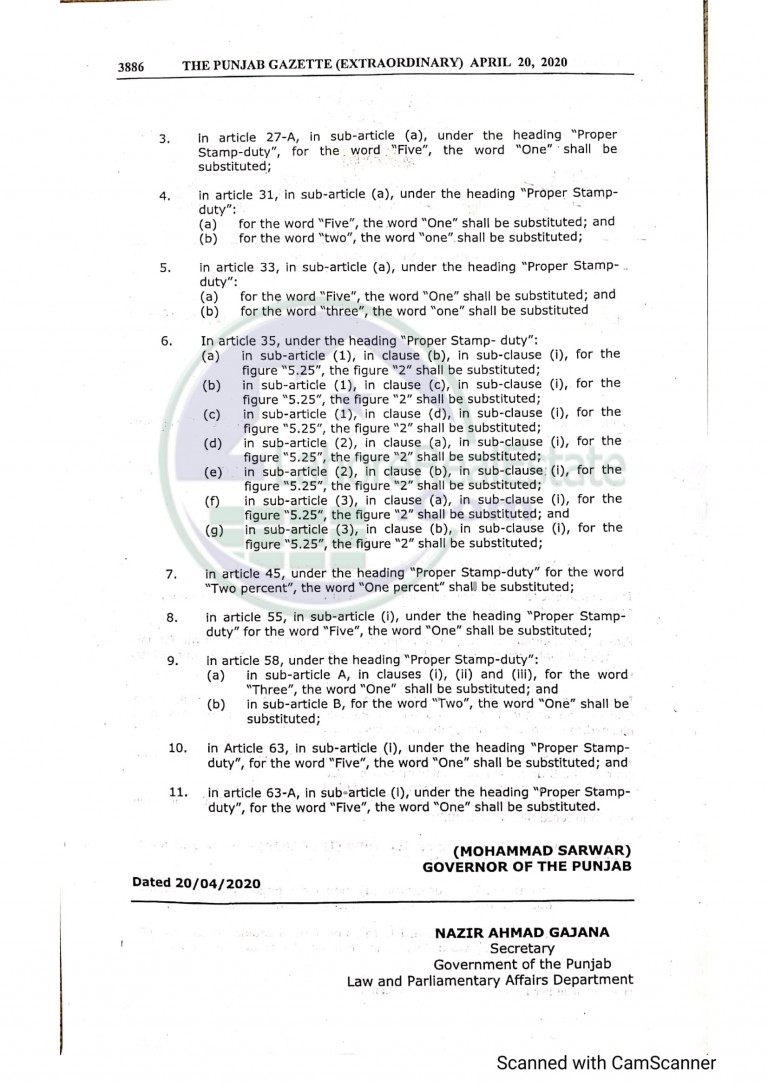

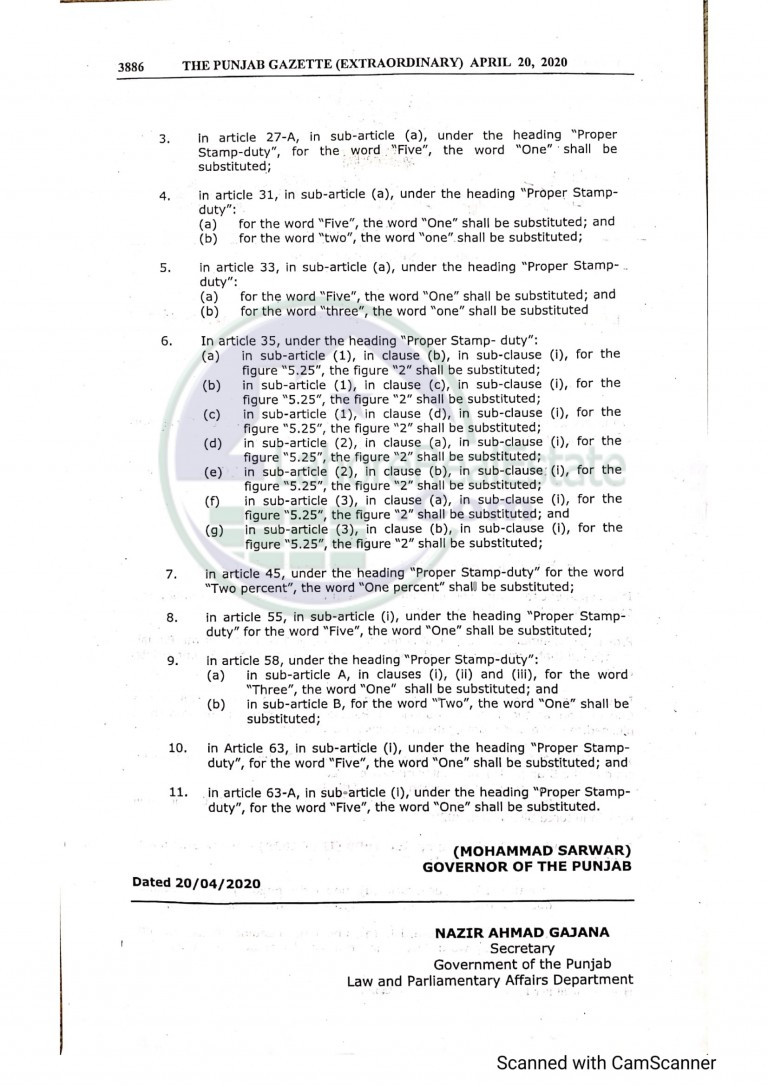

Stamp Duty Reduction Notification In Punjab Gazette Lahore Real Estate

https://lahorerealestate.com/wp-content/uploads/2020/04/CamScanner-04-20-2020-18.17.14-2-768x1087.jpg

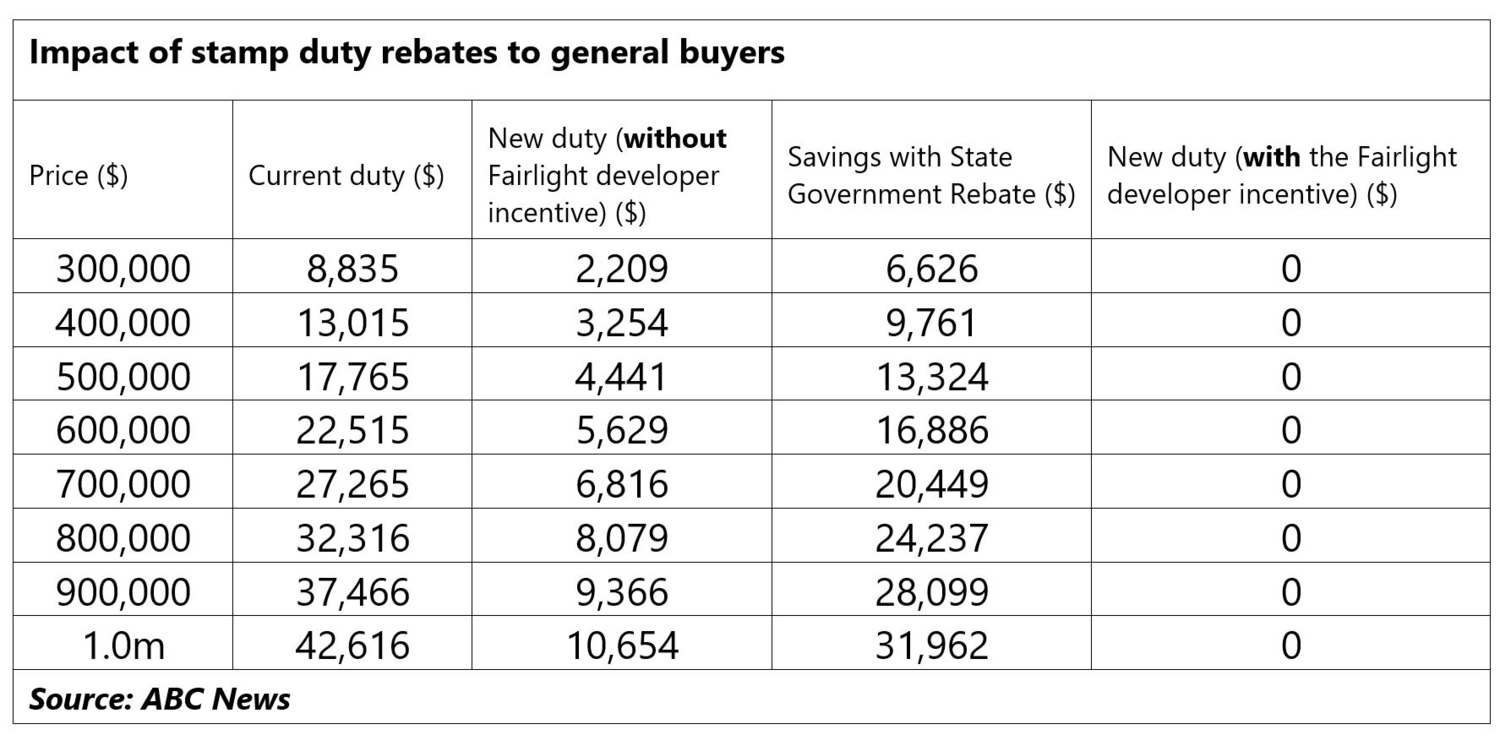

Understanding WA s Off The Plan Stamp Duty Rebates Fairlight

http://static1.squarespace.com/static/5da4582701106247e5071fb8/t/5e601d59d8165420afda7d8d/1583357279151/General-buyers.png?format=1500w

Web 15 f 233 vr 2023 nbsp 0183 32 What is Stamp Duty Tax Exemption Certain expenditures such as the stamp duty help save income tax under Section 80C of the Income Tax Act 1961 Stamp Duty tax exemption is an Income Tax Web 8 janv 2022 nbsp 0183 32 To provide relief to the taxpayers the Government of India has provided deductions for stamp duty and registration charges For the transactions directly related to the transfer can avail deduction for the

Web 9 juin 2023 nbsp 0183 32 Section 80C xviii d of the Income Tax Act 1961 permits a taxpayer being an individual or member of a HUF to claim a deduction for the stamp duty registration fee etc ITR filing AY Web 26 nov 2021 nbsp 0183 32 26 NOVEMBER 2021 You might know that home loans can help you buy the house you always dreamt about You might also know that you can claim tax benefits on

Download Stamp Duty Tax Rebate India

More picture related to Stamp Duty Tax Rebate India

Stamp Duty Claims Claim Your Stamp Duty Rebate TODAY

https://getmytax.co.uk/wp-content/uploads/2023/01/Stamp-Duty-Land-Tax-Rebates.png

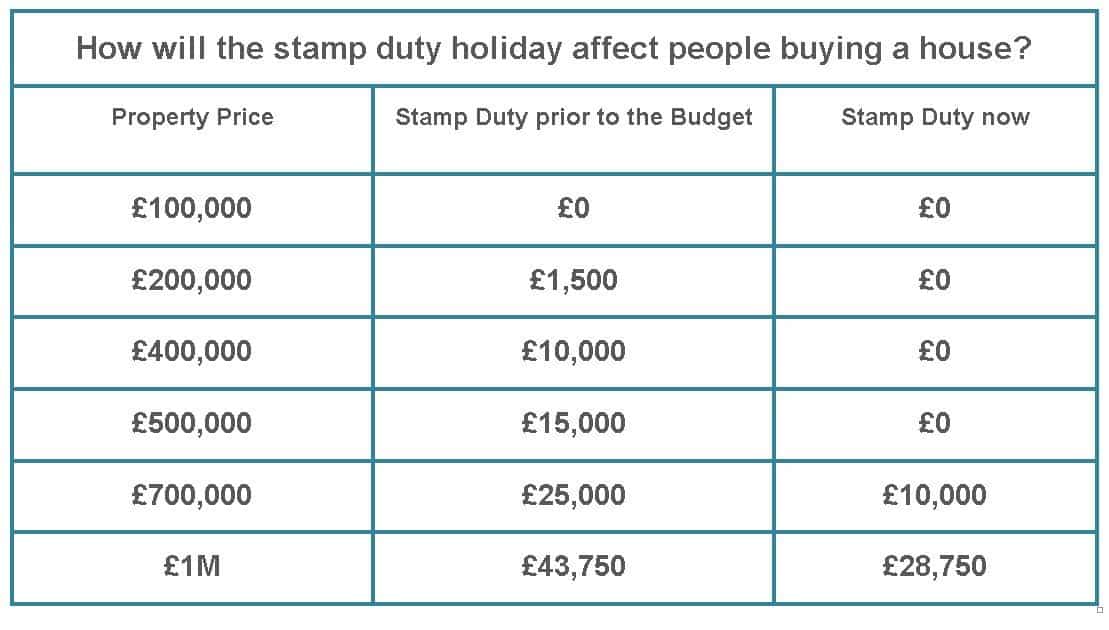

New Stamp Duty Charges For Residential Property Purchases North

https://northainley.co.uk/wp-content/uploads/2020/09/Stamp-duty-table1.jpg

Can You Split The Cost Of Stamp Duty Tax Stamp Duty Rebate

https://stampdutyrebate.co.uk/wp-content/uploads/2023/04/istockphoto-1452495470-612x612-2.jpg

Web Description Department of Revenue functions under the overall direction and control of the Secretary Revenue It exercises control in respect of matters relating to all the Direct Web 6 d 233 c 2022 nbsp 0183 32 There are three methods for paying stamp duty E stamping Franking paper with no judicial stamps Registration fees In addition to paying stamp duty the buyer must also pay a registration fee on the

Web 1 f 233 vr 2022 nbsp 0183 32 Low interest on home loans stamp duty cuts and extension of tax benefits on affordable housing as announced in the previous budget helped the sector reach Web 1 avr 2023 nbsp 0183 32 1 Only Individuals and HUF assesses can claim tax deductions on Stamp Duty and Registration Charges paid 2 The house should be in the name of the

Stamp Duty Rebates should Be Offered In Return For Home Energy

https://s.yimg.com/ny/api/res/1.2/bOF0_MxethrjXQiB932gLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/pa_viral_news_uk_120/3691a876da0e808ba9d88cf56e1f1161

Stamp Duty

https://mr1.homeflow-assets.co.uk/files/site_asset/image/5289/8470/580x_/Blog.jpg

https://www.proptiger.com/guide/post/faqs-on …

Web 28 mai 2020 nbsp 0183 32 Under the law individuals as well as Hindu Undivided Families HUFs can claim the rebate against stamp duty and

https://www.tatacapital.com/blog/loan-for-home/how-to-claim-stamp-duty...

Web 3 nov 2020 nbsp 0183 32 To be eligible for a stamp duty rebate the assessee must be an individual owner a co owner or a member of a Hindu Undivided Family that has purchased a

SDLT1 FORM DOWNLOAD

Stamp Duty Rebates should Be Offered In Return For Home Energy

Stamp Duty And Registration Charges In India What You Need To Know

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Big History Blogger Photography

When Do I Have To Pay Stamp Duty Stamp Duty Rebate

When Do I Have To Pay Stamp Duty Stamp Duty Rebate

Calculating Stamp Duty For Your House Purchase And Move

Stamp Duty Registration Charges In Mumbai Maharashtra 2023

Sell Your House Fast Before Stamp Duty Tax Rises Sell House Fast

Stamp Duty Tax Rebate India - Web 8 janv 2022 nbsp 0183 32 To provide relief to the taxpayers the Government of India has provided deductions for stamp duty and registration charges For the transactions directly related to the transfer can avail deduction for the