Standard Deduction On Salary For Ay 2022 23 Learn how to claim a standard deduction of Rs 50 000 or Rs 75 000 under the new tax regime for FY 2023 24 Find out who is eligible how it reduces taxable income and what are the benefits for senior citizens

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Learn about the income tax deductions available under section 80D and other sections for medical expenses insurance disability and more Find out the limits conditions and eligible

Standard Deduction On Salary For Ay 2022 23

Standard Deduction On Salary For Ay 2022 23

https://i.ytimg.com/vi/14FJIvK-4A4/maxresdefault.jpg

Rs 50000 Standard Deduction From FY 2019 20 AY 2020 21 Impact

https://www.relakhs.com/wp-content/uploads/2019/07/Rs-50000-Standard-Deduction-FY-2019-20-AY-2020-21-impact-on-your-net-salary-income-how-much-tax-can-you-save.jpg

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

The only deduction that is allowed under the new income regime in FY 2022 23 is Section 80CCD 2 This deduction is linked to the employer s contribution to the employee s NPS account The maximum deduction that can Find out how much Income Tax you pay in the current tax year 2024 2025 based on your income and Personal Allowance See the tax rates and bands for different income levels and

For salaried individuals for the current financial year i e FY 2022 23 here s how they can calculate standard deductions based on an exclusive interview with different industry experts This handy calculator will show you how much income tax and National Insurance you ll pay in the 2024 25 2023 24 2022 23 and 2021 22 tax years as well as how much of your salary you ll take home How to use the Which income tax

Download Standard Deduction On Salary For Ay 2022 23

More picture related to Standard Deduction On Salary For Ay 2022 23

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

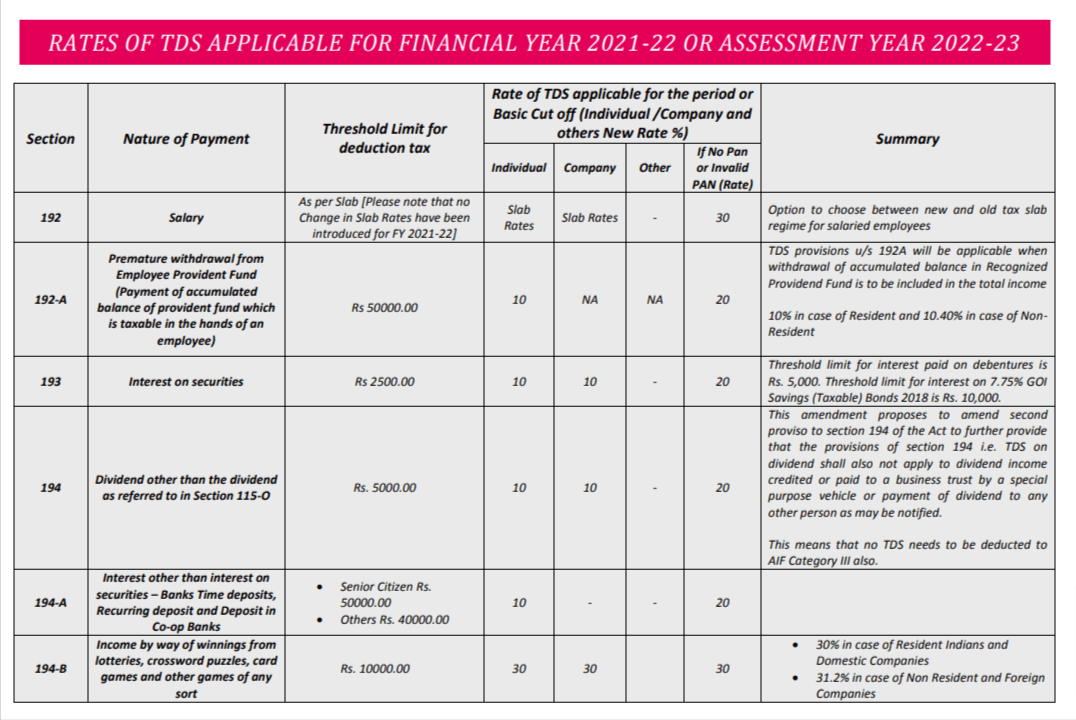

Latest TDS Rates Chart For FY 2022 23 PDF AFD CSD Price List

https://dcsd.in/wp-content/uploads/2022/06/Latest-TDS-Rates-Chart-for-FY-2022-23-PDF.png

TDS Rate Chart For FY 2022 23 AY 2023 24 SimBizz

https://simbizz.in/wp-content/uploads/2022/06/simbizz.in-blog.png

97 rowsLearn about the tax exemptions and deductions available to salaried employees in India for various allowances and perquisites Find out the conditions limits and rules for HRA children education Once the assessee opts for the new tax regime under section 115BAC of the Income tax Act 1961 Act he is not allowed to claim deduction under action 80 TTB of the Act inter alia

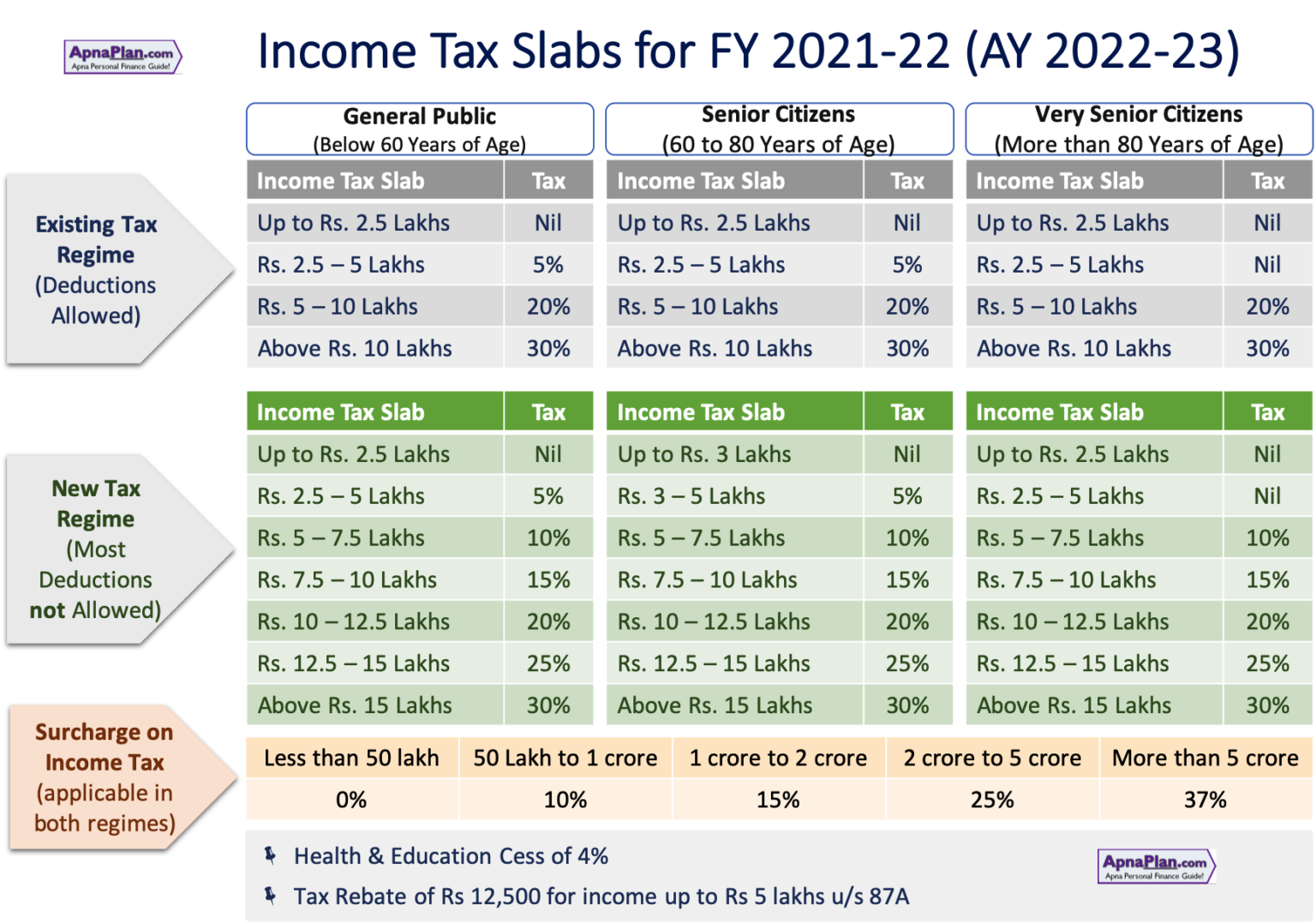

Income tax Income Tax Return filing for salaried employees AY 2022 23 Section 80C deductions on which benefits apply The Income Tax Return ITR deadline for AY 2022 For the AY 2022 23 there are two types of income tax slab regimes applicable to the different taxpayers While the new tax slab provides reduced rates the old tax regime helps taxpayers

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Calculation-Financial-Year-2022-23.png

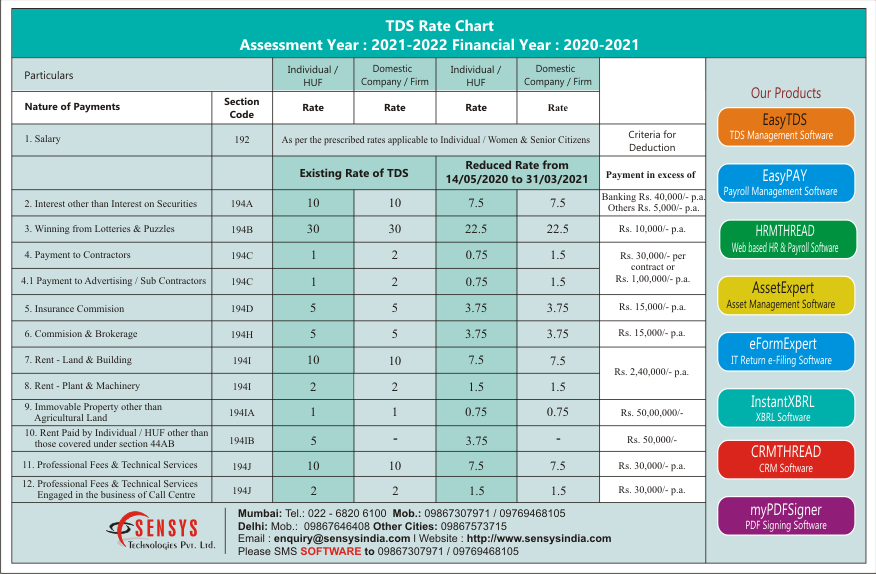

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2020/04/Rate-Chart-AY-2021-22_Sensys_New.png

https://tax2win.in/guide/standard-deduc…

Learn how to claim a standard deduction of Rs 50 000 or Rs 75 000 under the new tax regime for FY 2023 24 Find out who is eligible how it reduces taxable income and what are the benefits for senior citizens

https://cleartax.in/s/income-tax-allowanc…

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

Income Tax Deductions List FY 2020 21 Blog De Livros

Form 16 Calculator Ay 2023 24 Excel Format Printable Forms Free Online

New And Old Tax Regime Comparision For FY 2023 24 Income Tax Slab FY

New And Old Tax Regime Comparision For FY 2023 24 Income Tax Slab FY

Download New TDS Rate Chart FY 2021 22 In PDF Trader

Standard Deduction 2020 Self Employed Standard Deduction 2021

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Standard Deduction On Salary For Ay 2022 23 - The standard deduction is not allowed in new tax regime until FY 2022 23 AY 2023 24 However as per Budget 2023 standard deduction of Rs 50 000 is allowed for