Tax Benefit For Buying New Car Verkko 2 tammik 2024 nbsp 0183 32 by Tanaka Martin EA Updated February 16 2022 Buying a new car is a giant expenditure More likely than not you ll be planning to use your new vehicle for personal and business purposes The IRS took that into consideration when they made the rules for deductions on cars you purchase for work

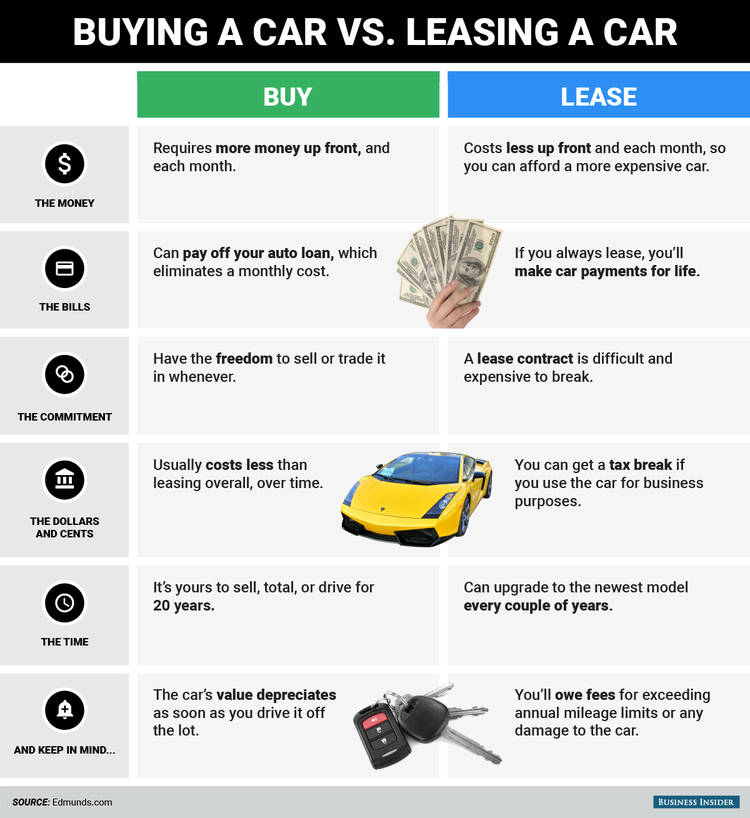

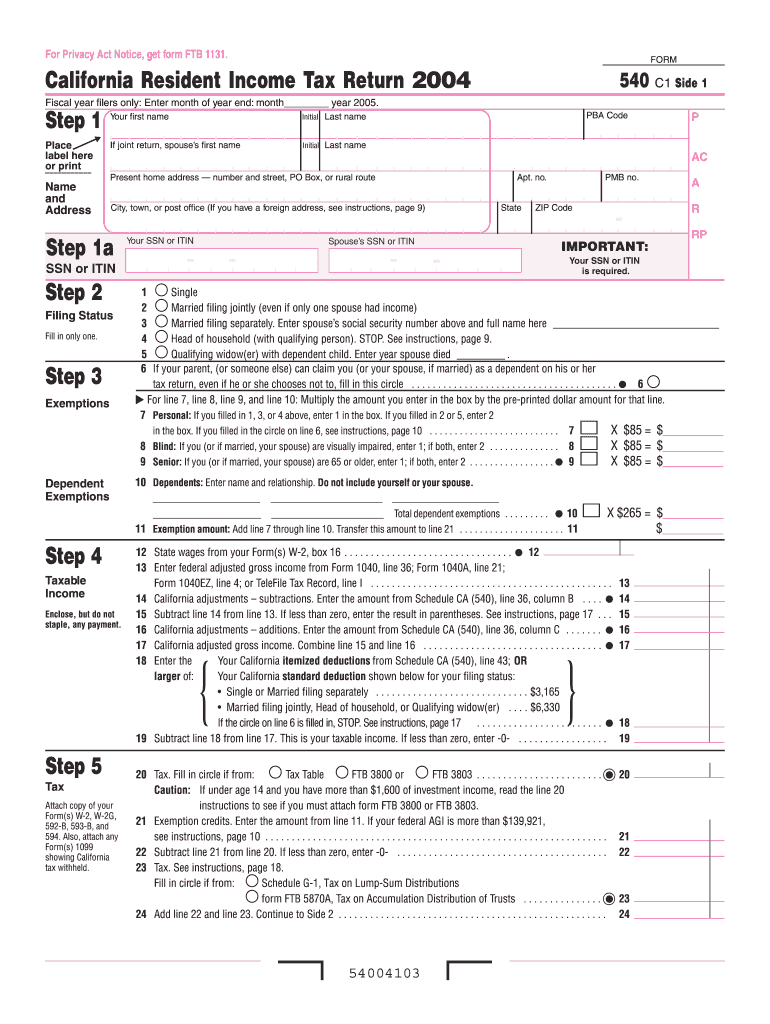

Verkko 30 maalisk 2022 nbsp 0183 32 Buying a car for personal or business use may have tax deductible benefits The IRS allows taxpayers to deduct either local and state sales taxes or local and state income taxes but not both If you use your vehicle for business charity medical or moving expenses you could deduct the costs of operating it Verkko Many people wonder if the cost of a new car is tax deductible and if they can save money through tax benefits This article will explore whether a new car purchase is tax deductible examining both personal and business scenarios

Tax Benefit For Buying New Car

Tax Benefit For Buying New Car

https://thumbs.dreamstime.com/b/closeup-photo-young-man-saving-money-buying-new-car-closeup-image-young-man-saving-money-buying-new-car-127009953.jpg

Buying Vs Leasing Koons Ford Of Silver Spring Silver Spring MD 2022

https://www.koonssilverspringford.com/static/dealer-13393/11.png

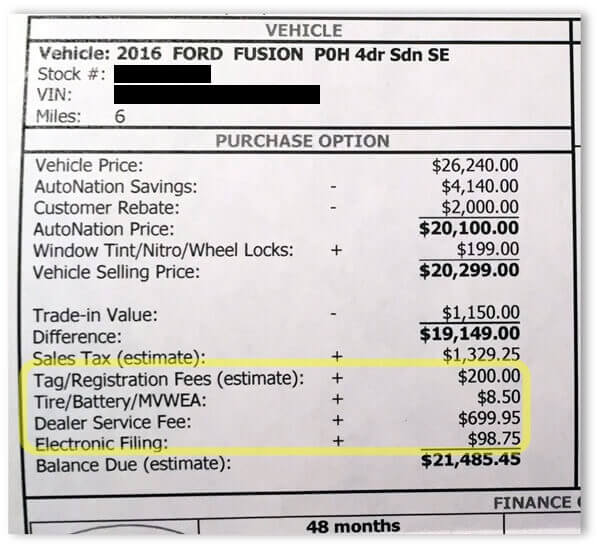

How Buying A Great Car Is Exactly Like Buying A Great Stock Dashboard

http://www.dashboard-light.com/wp-content/uploads/2018/07/autonation-quote.jpg

Verkko Find out if your work vehicle qualifies for a business vehicle tax deduction under Section 179 and how to calculate your savings Can You Write Off a Car Purchase or Lease as a Business Expense When people talk about the SUV Tax Loophole or the Hummer Deduction they refer to IRS Tax Code Section 179 Verkko 20 jouluk 2023 nbsp 0183 32 As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks

Verkko 28 jouluk 2023 nbsp 0183 32 Yes a salaried individual can get tax benefits for buying a car but only if it is an EV The government of India offers a tax deduction of up to 1 50 000 on the interest paid on the car loan taken for buying an electric vehicle under section 80EEB of the Income Tax Act This is done to promote the sales of EVs in India Verkko 28 tammik 2020 nbsp 0183 32 Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business AND you buy it brand new from the dealer no private party used vehicle It has to be brand new The amount on the example factors in a brand new SUV over 6 000 lbs

Download Tax Benefit For Buying New Car

More picture related to Tax Benefit For Buying New Car

CA FTB 540 2014 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/6/152/6152116/large.png

Portrait Of Happy Customer Buying New Car Stock Photo Image Of

https://thumbs.dreamstime.com/z/portrait-happy-young-customer-buying-new-car-portrait-happy-customer-buying-new-car-132825242.jpg

Modelo De La Carrocer a Buying A Used Car Checklist Uk

http://s-media-cache-ak0.pinimg.com/736x/67/ce/84/67ce8459c5d234cdc739f2b11670520b.jpg

Verkko 15 maalisk 2023 nbsp 0183 32 CONTENTS Show Are you considering buying a car and contemplating buying a new car or an old one The purchase of a car cannot be considered an investment as it depreciates over time Its value starts declining from the next day you purchase a vehicle Hence you have to evaluate the cost effectiveness Verkko Carol Yepes Getty Images A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you

Verkko 16 marrask 2022 nbsp 0183 32 If you purchase before the end of the year you ll still be able to take advantage of a tax perk coming out of the 2017 Tax Cuts and Jobs Act 100 bonus depreciation But there are rules you need to be aware of before you take your first test drive Keisha L Rondeno CPA shared these tips with attendees of NAR NXT The Verkko IR 2023 160 Sept 1 2023 The Internal Revenue Service reminded consumers considering an automobile purchase to be sure to understand several recent changes to the new Clean Vehicle Credit for qualified plug in electric drive vehicles including qualified manufacturers and tax rules

Congratulations For Buying A New Car Messages Quotes

https://the6track.com/wp-content/uploads/2018/07/Congratulations-wishes-from-parents-for-buying-a-new-car.jpg

New Car Wishes Messaggi Di Congratulazioni Per La Nuova Auto Jiotower

https://www.wishesmsg.com/wp-content/uploads/new-car-wishes-funny-768x620.jpg

https://www.keepertax.com/posts/is-buying-a-car-tax-deductible

Verkko 2 tammik 2024 nbsp 0183 32 by Tanaka Martin EA Updated February 16 2022 Buying a new car is a giant expenditure More likely than not you ll be planning to use your new vehicle for personal and business purposes The IRS took that into consideration when they made the rules for deductions on cars you purchase for work

https://www.lendingtree.com/auto/buying-car-tax-deductible

Verkko 30 maalisk 2022 nbsp 0183 32 Buying a car for personal or business use may have tax deductible benefits The IRS allows taxpayers to deduct either local and state sales taxes or local and state income taxes but not both If you use your vehicle for business charity medical or moving expenses you could deduct the costs of operating it

Pin On Best Of MapleMoney

Congratulations For Buying A New Car Messages Quotes

Congratulations For New Car Congratulations Sms Messages New Cars

Beauitful Woman Buying New Car At The Dealership Stock Photo Image Of

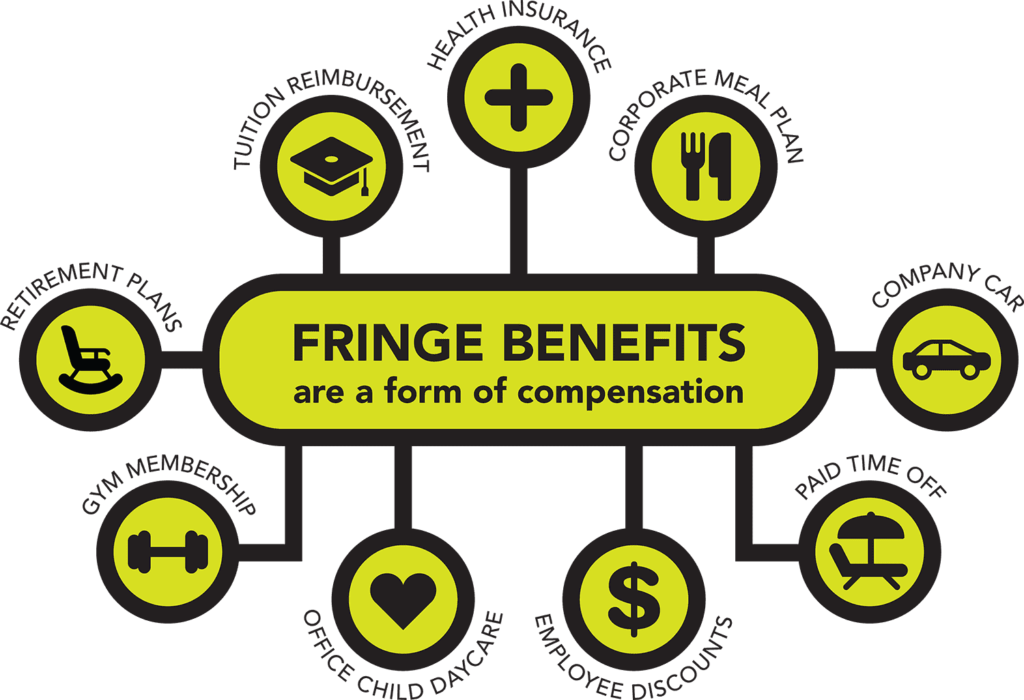

The Comprehensive Guide To Fringe Benefits AttendanceBot

NPS For Tax Benefit

NPS For Tax Benefit

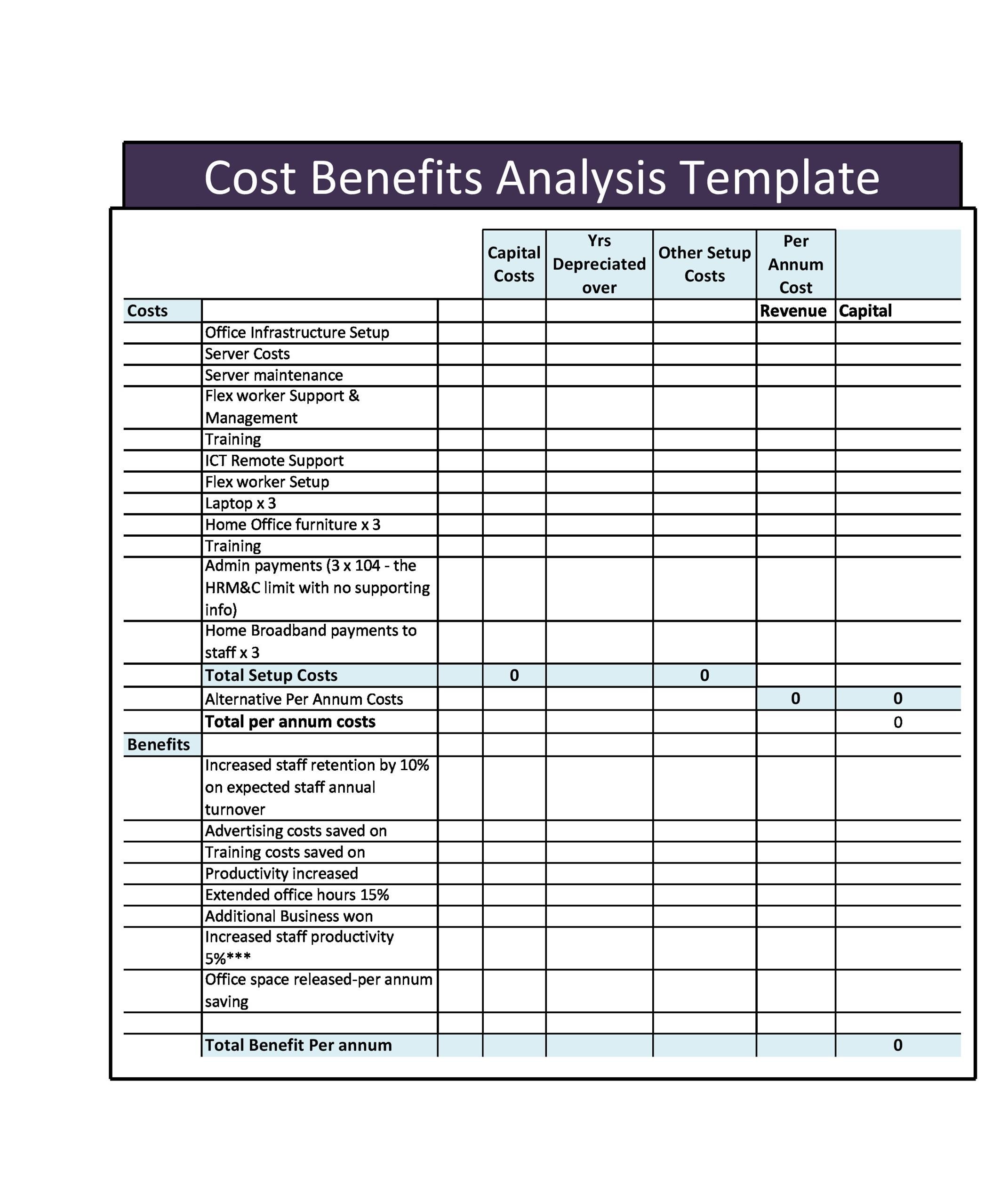

40 Cost Benefit Analysis Templates Examples TemplateLab

newcar safejourney congratulations wishyourfriends fornewcar New

Are You Offering These Benefits To Attract Top Talent HR Daily Advisor

Tax Benefit For Buying New Car - Verkko 28 tammik 2020 nbsp 0183 32 Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business AND you buy it brand new from the dealer no private party used vehicle It has to be brand new The amount on the example factors in a brand new SUV over 6 000 lbs