Tax Benefit For Education Loan In India Verkko 27 kes 228 k 2023 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E

Verkko 28 jouluk 2023 nbsp 0183 32 Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on your education loan Explore our comprehensive guide at Tax2Win Read about Sec 80E Deduction for ineterst paid on education loan for 8 years Verkko Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan There are other benefits to an education loan and they can be taken for professional courses as well as diplomas Let us take a look at how an education loan how is tax deductable what you need to claim the tax benefit and the other

Tax Benefit For Education Loan In India

Tax Benefit For Education Loan In India

https://gyandhan.s3.amazonaws.com/uploads/ckeditor/pictures/928/content_Student_Education_Loan_Details.jpg

Education Loans 9 Common Education Loan Terms You Need To Know

https://blog.financedragon.com/wp-content/uploads/2020/09/Education-Loans-in-India.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Verkko To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 Verkko 10 elok 2023 nbsp 0183 32 So before you settle for any of them learn about education loan exemptions like a collateral free loan income tax rebate on education loans and the education loan tax benefit limit Broadly speaking there are two types of education loans Domestic and Study Abroad

Verkko 3 24 Tax Collected at Source TCS on Remittance Total Interest Paid 4 18 334 Total Tax Rebate 2 46 532 Effective Interest Paid On EL Apply Now Income Tax benefits with ICICI Bank iSMART Education Loans Verkko 19 hein 228 k 2023 nbsp 0183 32 a comphrehensive guide on education loan tax benefits under section 80 E of income tax this is over the Rs 1 5 lakh deduction permitted under Section 80C

Download Tax Benefit For Education Loan In India

More picture related to Tax Benefit For Education Loan In India

Letter To Bank Manager For Education Loan Repayment 2 SAMPLES FORMAT

https://1.bp.blogspot.com/-ZIb4tdxOdXw/YPulGCxZgVI/AAAAAAAAAVE/R-n9sKZpI8Yn5CWIb5PC7E1xo_WSK7z4ACLcBGAsYHQ/w1600/Webp.net-compress-image.jpg

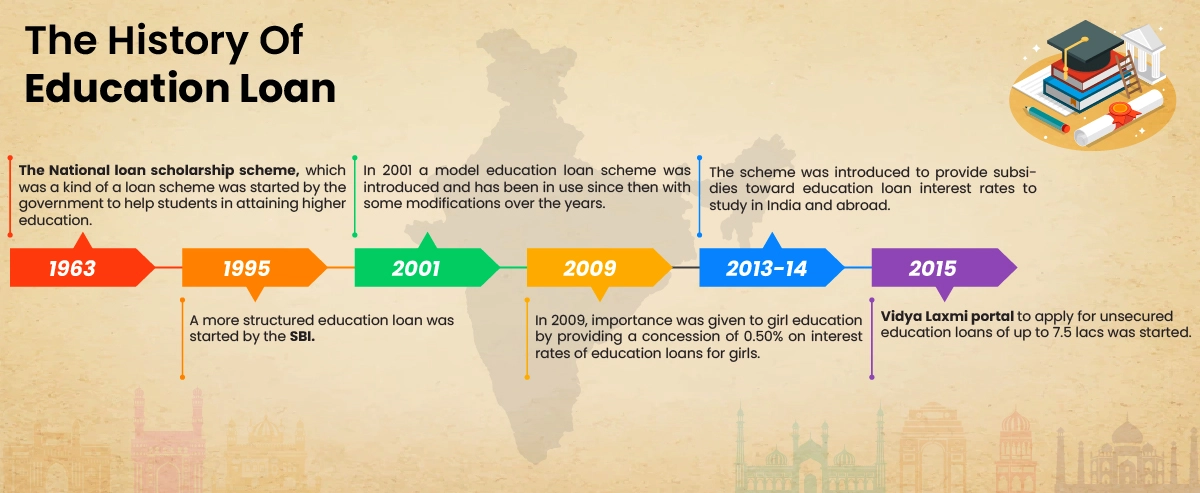

The History Of Education Loan Trends And Facts

https://www.wemakescholars.com/uploads/blog/The-history-of-education-loan-in-India.webp

Education Loan Process

https://i.pinimg.com/originals/a0/23/9b/a0239b32c7f40ca452cb045ad4648d98.jpg

Verkko 12 tammik 2023 nbsp 0183 32 The Government of India wished to provide a tax deduction on the interest component of an education loan availed for higher studies For this purpose Section 80E allows taxpayers to claim a deduction to the extent of actual repayments made on educational loans Verkko In India tax benefits are available for educational loans under Section 80E of the Income Tax Act This section allows individuals to claim deductions on the interest paid on an educational loan taken for the purpose of higher education

Verkko 12 huhtik 2022 nbsp 0183 32 Here s what you need to know about tax benefits on education loan 2022 Eligibility As per the regulations only an individual can claim a tax benefit and no deductions are applicable on joint loans Having said that you can claim tax benefits under section 80E of the Income Tax Act 1961 if you are Verkko 16 helmik 2021 nbsp 0183 32 You are eligible for tax benefits on education loan provisioned by the Income Tax Act of 1961 However certain conditions must be met before claiming any tax benefits Here are the ins and outs to know before you can claim tax benefits

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

https://cleartax.in/s/section-80e-deduction-interest-education-loan

Verkko 27 kes 228 k 2023 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Verkko 28 jouluk 2023 nbsp 0183 32 Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on your education loan Explore our comprehensive guide at Tax2Win Read about Sec 80E Deduction for ineterst paid on education loan for 8 years

Enugu CP Inaugurates Octopus Tactical Team Office Charges Officers On

Income Tax Benefits On Housing Loan In India

How To Get An Education Loan For Study Abroad In India Sakal India

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

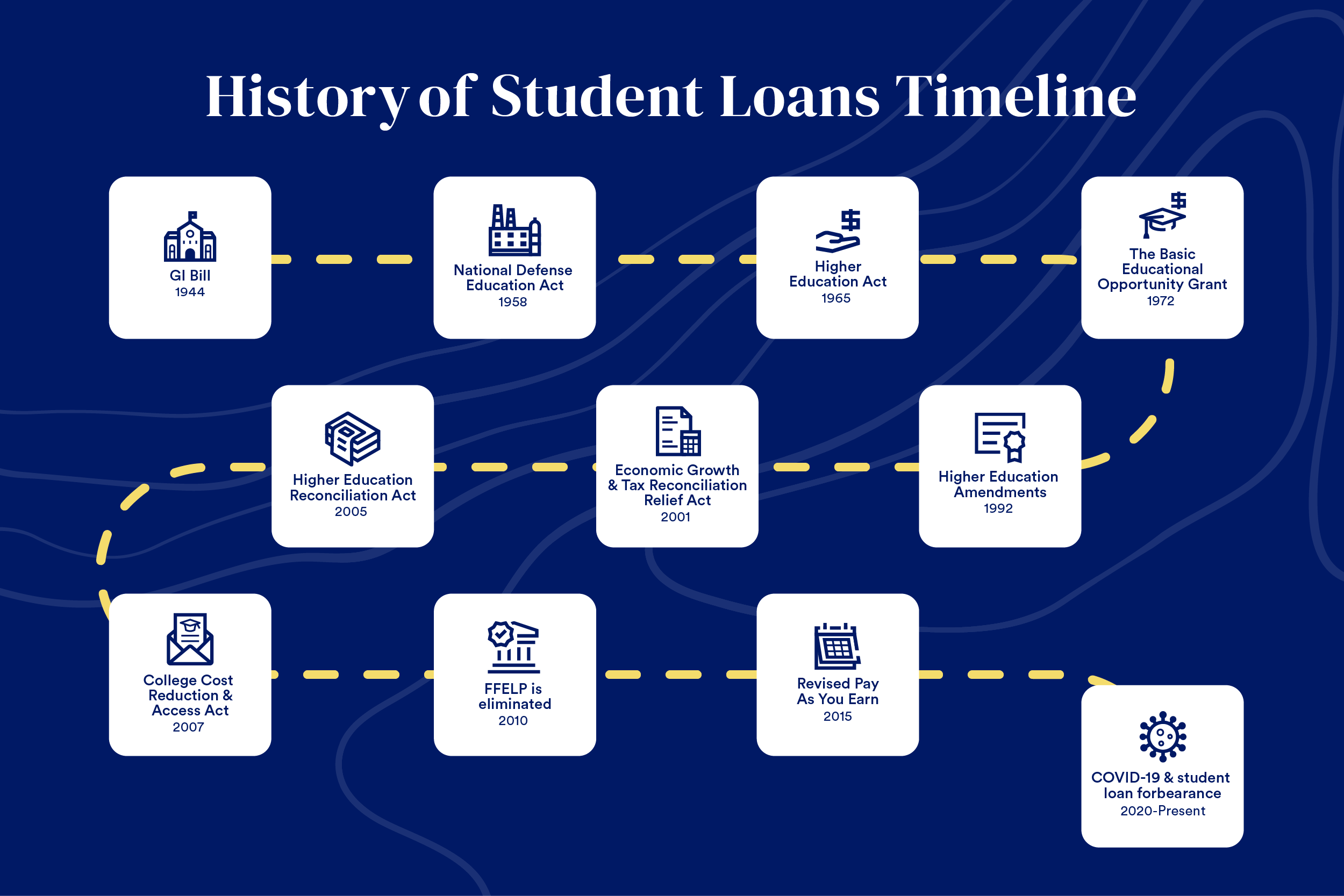

The Complete History Of Student Loans Bankrate Vette Leader

Employee Retention Credits Badlands Consulting Accounting Services

Employee Retention Credits Badlands Consulting Accounting Services

How To Apply For Education Loan In India

Best Banks For Education Loan In Nepal

Here s How You Find The Best Education Loan In India Education Loan

Tax Benefit For Education Loan In India - Verkko 26 huhtik 2018 nbsp 0183 32 The tax laws allow you a deduction up to Rs 1 50 lakh every year in respect of the tuition fee paid for full time education of a maximum of two of your children in India