Tax Rebate On Higher Education Web 25 f 233 vr 2021 nbsp 0183 32 Is the deduction under Section 80C only allowed for tuition fees paid for Higher education Ans No Not only colleges or universities but fees paid to schools playschools Nursery schools and cr 232 ches are

Web Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the Web 5 juil 2023 nbsp 0183 32 Dans le formulaire de d 233 claration de revenus 224 remplir en ligne les frais de scolarit 233 sont 224 indiquer dans la partie R 233 ductions d imp 244 t Cr 233 dits d imp 244 t au sein

Tax Rebate On Higher Education

Tax Rebate On Higher Education

https://i2.wp.com/www.manitoba.ca/asset_library/en/edupropertytax/school-taxes.jpg

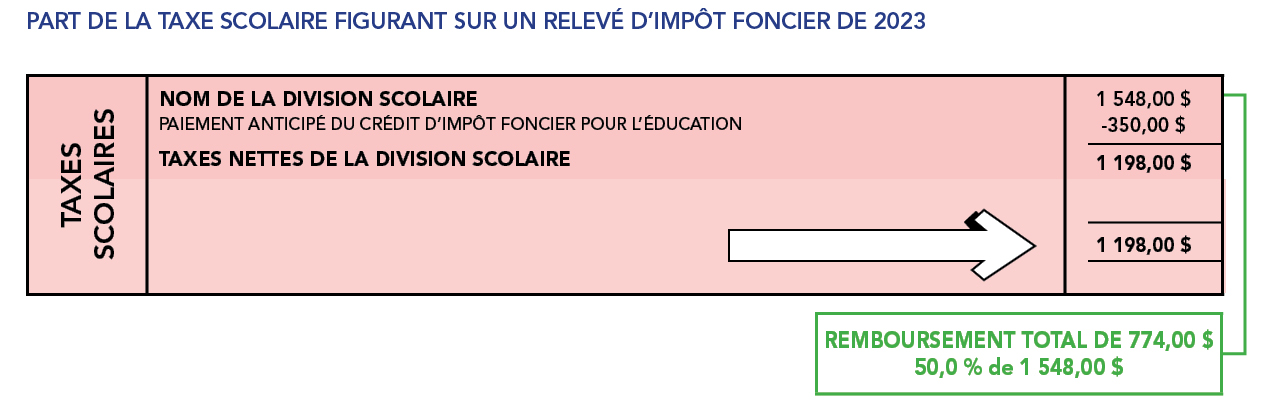

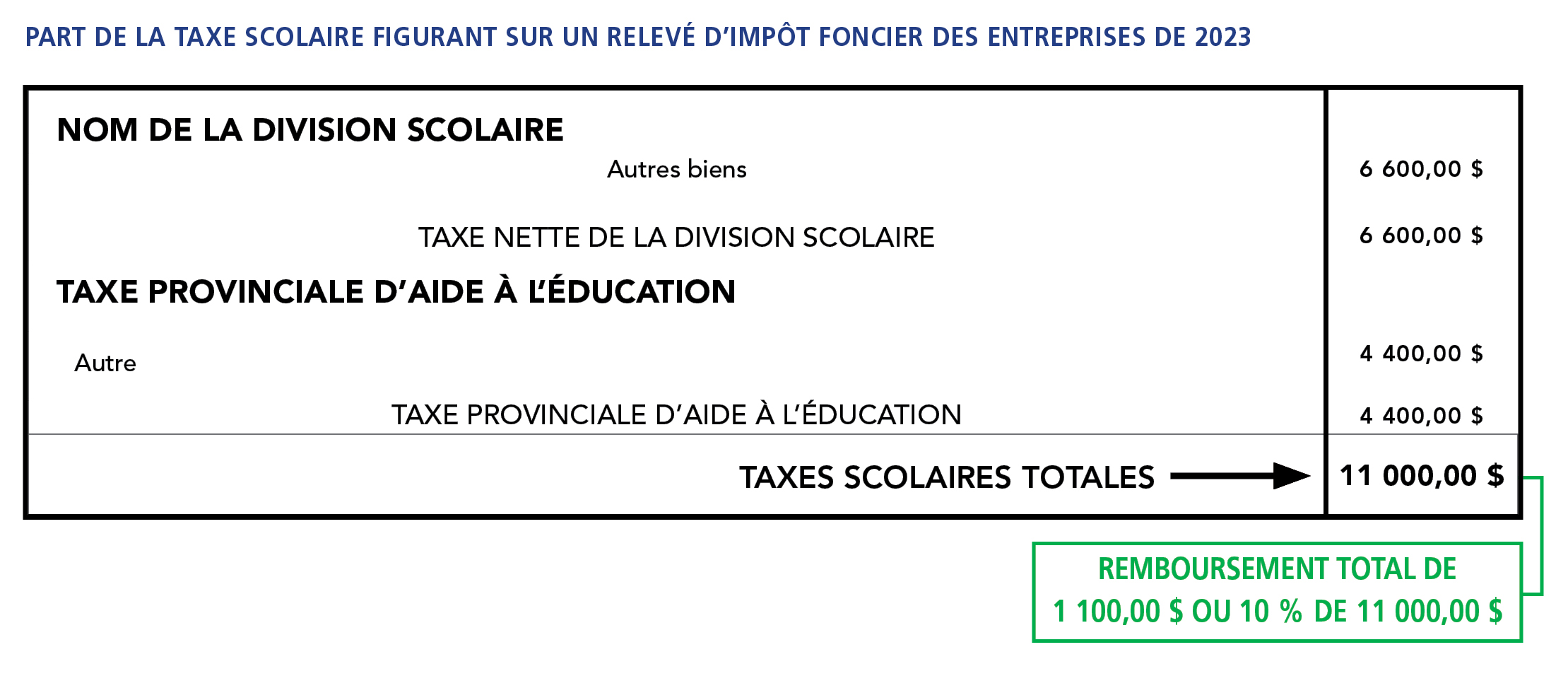

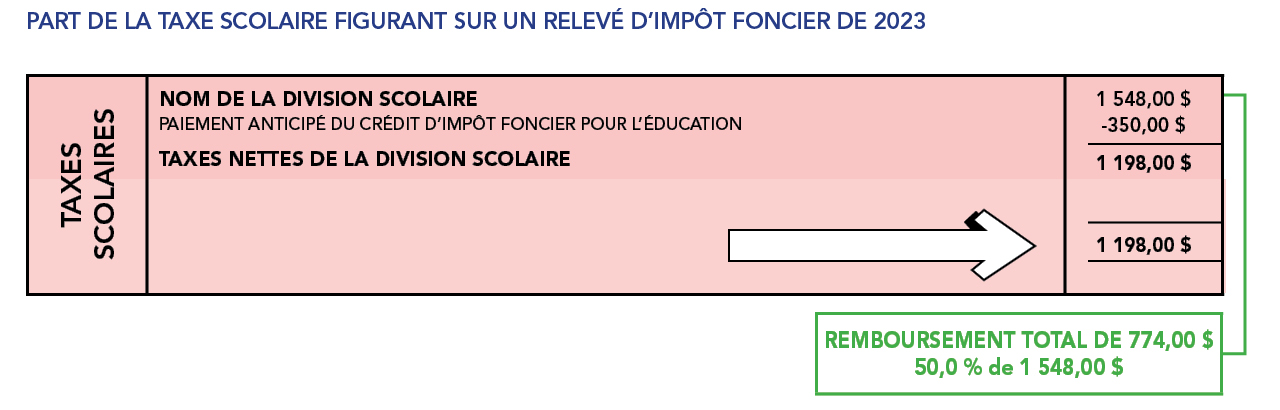

Province Du Manitoba Imp t Foncier Pour L ducation

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/school-taxes.fr.jpg

Province Du Manitoba Imp t Foncier Pour L ducation

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.fr.jpg

Web 27 juin 2023 nbsp 0183 32 Section 80C of the Income Tax Act provides deduction in respect of the tuition fees paid for the education However section 80E of the Income Tax Act Web 25 mai 2022 nbsp 0183 32 The IRS website defines qualified higher education expenses as quot Tuition fees books supplies and equipment required for the enrollment or attendance of a

Web 20 nov 2022 nbsp 0183 32 Qualified Higher Education Expense Expenses such as tuition and tuition related expenses that an individual spouse or child must pay to an eligible post Web 9 sept 2023 nbsp 0183 32 The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years For joint filers the standard deduction in the

Download Tax Rebate On Higher Education

More picture related to Tax Rebate On Higher Education

Higher Education Loan Program Weekly Tax Table Australian

https://img.yumpu.com/31106089/1/500x640/higher-education-loan-program-weekly-tax-table-australian-.jpg

Property Taxes Will Look A Little Different Thanks To Education Rebate

https://golden-west-archive-content.s3.amazonaws.com/content/portageonline/images/property_tax.jpg

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2022/10/bbb-Irish-Tax-Rebates.jpg?fit=1200%2C800&ssl=1

Web Introduction Download Modeling State Tax Rebate Payments in the 2022 CPS ASEC PDF lt 1 0 MB More than twenty states issued special tax rebates in 2022 These payments Web 26 juin 2018 nbsp 0183 32 Interest on educational loan should have been paid for the loan taken for the purpose of pursuing his higher education or of the spouse and children From A Y

Web An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961 The best part about this Web 17 f 233 vr 2017 nbsp 0183 32 This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act 1961 The amount of tax benefit is within the overall limit of the section

Here s How You Calculate Your Adjusted Gross Income AGI

https://flyfin.tax/_next/image?url=https:%2F%2Fdem95u0op6keg.cloudfront.net%2Fflyfin-website%2Fself-employment-resources%2FThreeTaxBenefitsDesktop.png&w=2048&q=100

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

https://okcredit.in/blog/is-education-fee-exem…

Web 25 f 233 vr 2021 nbsp 0183 32 Is the deduction under Section 80C only allowed for tuition fees paid for Higher education Ans No Not only colleges or universities but fees paid to schools playschools Nursery schools and cr 232 ches are

https://www.etmoney.com/blog/education-loa…

Web Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Here s How You Calculate Your Adjusted Gross Income AGI

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Illinois Tax Rebate Tracker Rebate2022

S Corporation Taxes McGraw Hill Higher Education

Education Rebate Program Oleh SWITCH Cikgu El

Education Rebate Program Oleh SWITCH Cikgu El

Province Of Manitoba Education Property Tax

Higher Education Tax Benefits 2013 Tax Year

Tax And Fee Measures Budget 2022 Province Of Manitoba

Tax Rebate On Higher Education - Web 9 sept 2023 nbsp 0183 32 The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years For joint filers the standard deduction in the