Income Tax Rebate On Higher Education Loan Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a

Income Tax Rebate On Higher Education Loan

Income Tax Rebate On Higher Education Loan

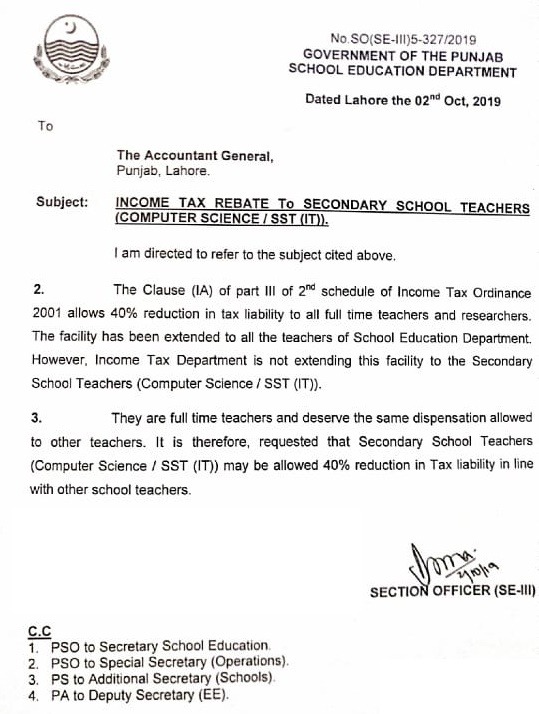

https://employeesportal.info/wp-content/uploads/2019/10/Income-Tax-Rebate-40-to-All-Teachers-of-School-Education-Department.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Higher Education Loan Here s A Few Things You Must Know Loan Trivia

https://2.bp.blogspot.com/-nJ21BdMuzUo/XGF3R2Cop6I/AAAAAAAACrU/WU7P6uJ0dRQzROCEeZCG9NgYScE7H3fqwCLcBGAs/s1600/Higher%2BEducation%2BLoan.png

Is there any income tax rebate on education loans Yes the interest you pay on an education loan is entirely tax free for eight years as you can claim tax deductions against it Is tax benefit available on top up loans An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you

Apart from funding your higher education costs an education loan offers excellent tax benefits No matter if you are a student or a parent you can reduce your taxable income by availing of tax deductions under Section Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden

Download Income Tax Rebate On Higher Education Loan

More picture related to Income Tax Rebate On Higher Education Loan

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

How To Fill Form 10 E For Income Tax Rebate On Arrears Paid

https://i0.wp.com/www.askbanking.com/wp-content/uploads/2016/03/form-10E.jpg?fit=848%2C1200&ssl=1

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Section 80E of the Income Tax Act provides deduction towards interest paid on loan taken for higher education If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan

Section 80E Deduction for Interest on education Loan Have you taken an education loan to support higher studies of yourself or of your spouse Children or for the In addition to the above benefit of tuition fee a person can claim deduction for interest paid on education loan taken to finance higher education of certain relatives under

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

https://img.etimg.com/photo/60155156/infographic-difference-between-tax-deduction-tax-exemption-and-tax-rebate.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

https://tax2win.in/guide/sec-80e-deducti…

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

https://cleartax.in/s/section-80e-deductio…

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Tax Rebate Defined taxservices Www smarttaxservicestx Tax

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

What To Expect With Your Upcoming Tax Rebate Mass gov

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

2022 South Carolina Tax Rebate What You Need To Know Wltx

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate On Higher Education Loan - Is there any income tax rebate on education loans Yes the interest you pay on an education loan is entirely tax free for eight years as you can claim tax deductions against it Is tax benefit available on top up loans