Tax Benefit For Student Loan Interest Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and Verkko Student loan interest deduction For 2022 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 70 000 and 85 000 145 000 and 175 000 if you file a joint return You can t claim the deduction if your MAGI is 85 000 or more 175 000 or more if you file a joint return See chapter 4

Tax Benefit For Student Loan Interest

Tax Benefit For Student Loan Interest

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

How Student Loans Affect Taxes And Tax Debt Relief Wiztax

https://www.wiztax.com/wp-content/uploads/2022/08/Student-Loans-Tax-Debt_m-scaled.jpeg

Student Loan Interest Rates Update Plan 1 2 Etc CIPP

https://www.cipp.org.uk/static/uploaded/e865dc5e-0558-4639-a954c8c314139d7b.jpg

Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 Up to 2 500 of student loan interest can be tax deductible each year Depending on the loan forgiveness program you participate in Tax Benefit Definition Types and IRS Rules Verkko 26 lokak 2023 nbsp 0183 32 The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable

Verkko 6 lokak 2021 nbsp 0183 32 The student loan interest deduction is a tax benefit that can offset the costs of borrowing to pay for your education If you qualify you can deduct up to 2 500 of student loan Verkko 28 elok 2020 nbsp 0183 32 To claim the student loan interest deduction you ll need to Have made interest payments on a qualifying student loan for you your spouse or another dependent for the tax year you re filing

Download Tax Benefit For Student Loan Interest

More picture related to Tax Benefit For Student Loan Interest

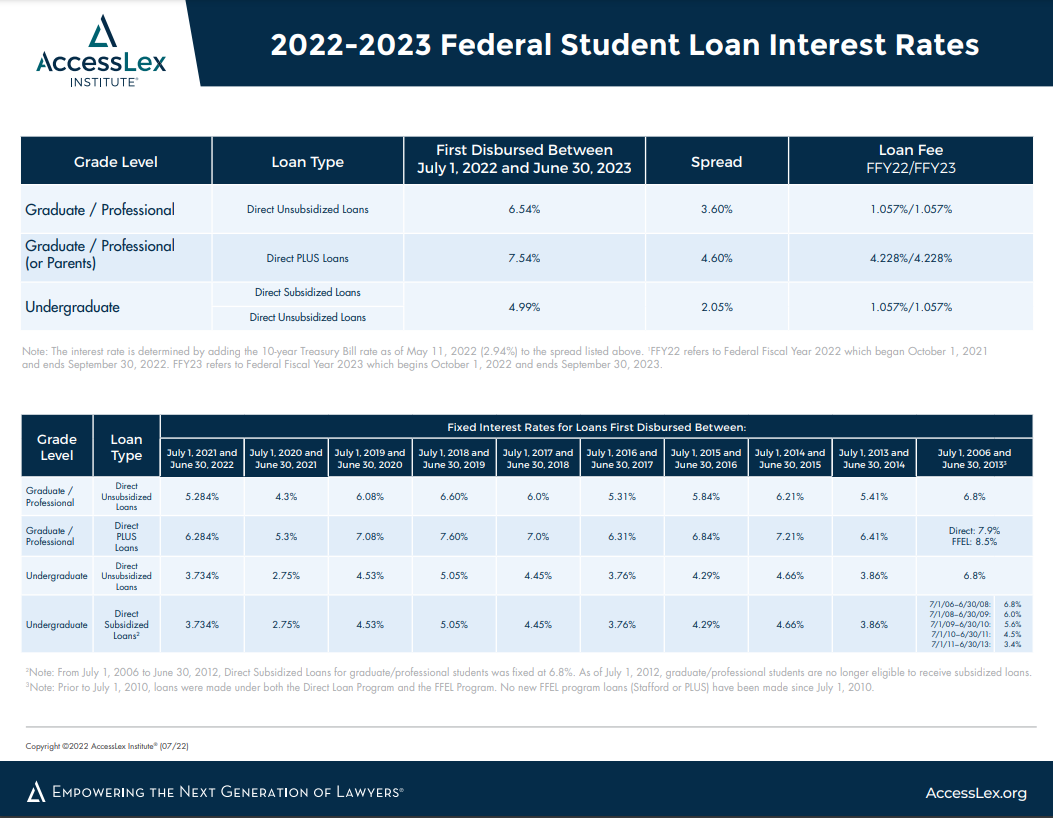

Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

What US Student Loans Actually Cost 5 Real Stories

https://www.refinery29.com/images/11090138.jpg?crop=40:21

Student Loan Tax Deduction Milliken Perkins Brunelle

https://millikenperkins.com/wp-content/uploads/2021/12/12_21_21_1224502855_ITB_560x292.jpg

Verkko Reporting the amount of student loan interest you paid in 2022 on your federal tax return may count as a deduction A deduction reduces the amount of your income that is subject to tax which may benefit you by reducing the Verkko 8 tammik 2021 nbsp 0183 32 Say a borrower has the average student loan balance of about 37 500 at 5 interest and is on a 10 year repayment plan They ll pay more than 10 250 in interest alone if they make only the minimum payments for the full repayment period That breaks down to roughly 1 800 in interest they could deduct in their first

Verkko 12 jouluk 2023 nbsp 0183 32 The student loan interest tax deduction The tax benefits of your student loan don t end with the above credits A deduction is also available for the interest payments you make when you start repaying your loan As of 2023 the deduction is available to the following filers Single filers with MAGIs of 90 000 or less Verkko 12 huhtik 2023 nbsp 0183 32 In other words if you pay 100 toward your student loans your employer could provide a matching contribution of 100 toward your 401 k plan This benefit may allow student loan borrowers to

Federal And State Government Take Action To Ease Burden On Some Student

https://www.postnewsgroup.com/wp-content/uploads/2021/12/student-debt-featured-web-1000x600.jpg

Student Loan Interest Waiver Here s How It Works Money

https://content.money.com/wp-content/uploads/2020/03/gettyimages-174976043_stuentloan.jpg

https://www.nerdwallet.com/.../loans/student-loans/8-student-faqs-taxes

Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

https://www.irs.gov/taxtopics/tc456

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

What Does Inflation Mean For Student Loans The Student Loan Sherpa

Federal And State Government Take Action To Ease Burden On Some Student

Certificate Courses Student Loans Higher Education Expand Goo

This Could Be Even Bigger Than Student Loan Cancellation

Student Loan Payment Pause 180 Organizations Urge Biden To Extend

Congrats To Laurel Rd Student Loan Refinancing Refinance Student

Congrats To Laurel Rd Student Loan Refinancing Refinance Student

Treasury Sets Student Loan Interest Rates Near Historic Lows

Claiming The Student Loan Interest Deduction

Tax Benefits Of Home Loan

Tax Benefit For Student Loan Interest - Verkko 26 lokak 2023 nbsp 0183 32 The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable