Tax Benefit On Car Lease For Salaried Employees Calculator Our Car Benefit Calculator helps you determine the price and car tax amount as well as the amount of the full or limited company car benefit for the vehicle you are interested in

Unlock tax benefits with a corporate car lease policy Explore how opting for a salary linked car leasing model provided by your employer can significantly reduce taxable income Discover the If you or your family have used a car or van provided by your employer for private purposes you have received a taxable company car benefit Private use

Tax Benefit On Car Lease For Salaried Employees Calculator

Tax Benefit On Car Lease For Salaried Employees Calculator

https://i.ytimg.com/vi/UffcBhvDl9Q/maxresdefault.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

Tax Planning Tips For Salaried Employees ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/02/Tax-Planning-Tips-for-Salaried-Employees-1.gif

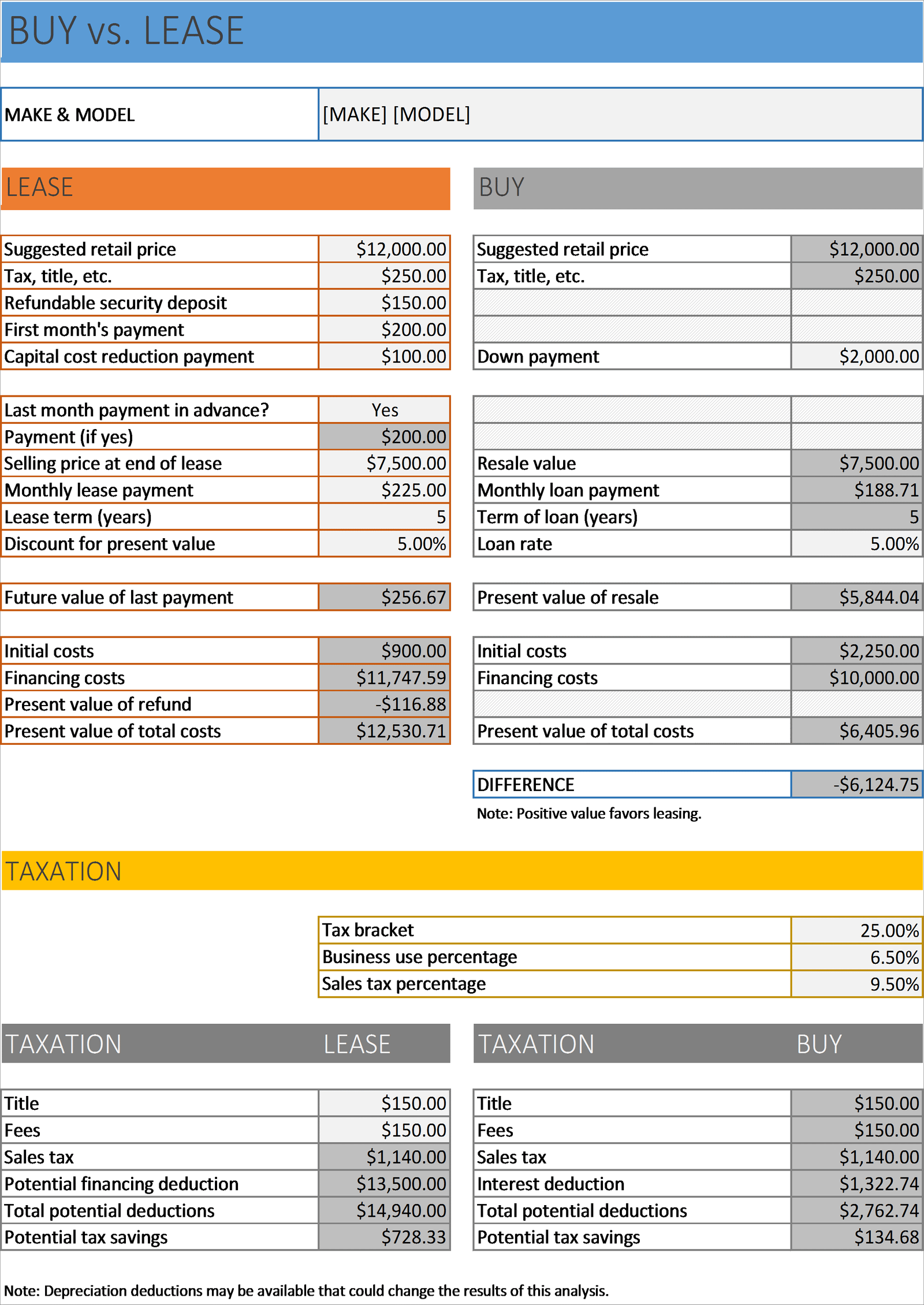

How does a car lease finance option help salaried employees save income tax Many companies give employees the flexibility to change the salary structure to If the employer leases rather than owns the automobile the employer can use the manufacturer s suggested retail price including sales tax title and other purchase

The tax advantage Such a model works well for salaried class as you get a tax benefit of up to 30 annually and you can claim the entire rental as an expense Lease Calculator India The ClearTax lease calculator allows you to calculate monthly lease payments total payments and total interest paid Just enter the required details

Download Tax Benefit On Car Lease For Salaried Employees Calculator

More picture related to Tax Benefit On Car Lease For Salaried Employees Calculator

When Does Leasing A Company Car Save You Tax Times Of India

https://timesofindia.indiatimes.com/img/82047244/Master.jpg

Tax Planning Tips For Salaried Employees ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/02/Tax-Planning-Tips-for-Salaried-Employees.jpg

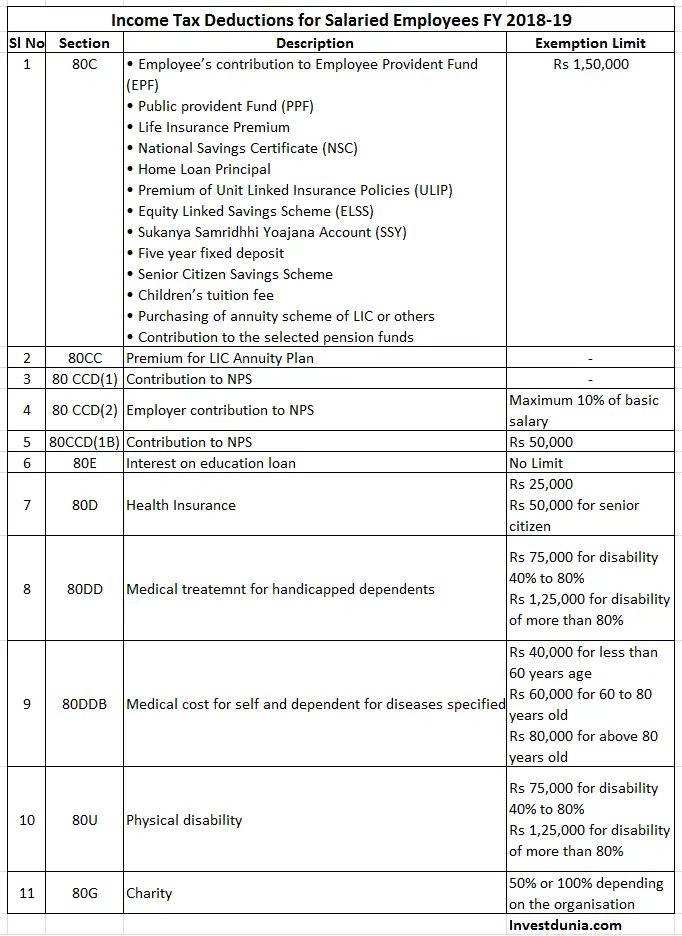

Income Tax Calculator For Salaried Employees Ay 2018 19 In Excel Fasrthai

https://www.apnaplan.com/wp-content/uploads/2018/02/Budget-2018-Income-Tax-Slabs-for-FY-2018-19-1024x493.png

Lease Car Through Your Business Tax Calculator How much can you save by leasing your car through your business Use this calculator to find out Tax benefit The lease amount you pay for a vehicle is eligible for tax relief Leasing a vehicle could help you save as much as 30 on your taxes This is applicable

Calculate tax on employees company cars As an employer if you provide company cars or fuel for your employees private use you ll need to work out the taxable value so you How does a car lease finance option help salaried employees save income tax If you use this option the lease rental amount can significantly reduce your tax

All The Salaried Employees Out There Save More With These Simple Tax

https://www.avivaindia.com/sites/default/files/All the Salaried Employees out there- Save More with these Simple Tax Planning Tips.jpg

Tax Planning For Salaried Employees How To Save Tax FULLY EXPLAINED

https://i.ytimg.com/vi/AF_r-EtULuE/maxresdefault.jpg

https://autoleasing.fi/.../the-car-benefit-calculator

Our Car Benefit Calculator helps you determine the price and car tax amount as well as the amount of the full or limited company car benefit for the vehicle you are interested in

https://taxguru.in/income-tax/income-ta…

Unlock tax benefits with a corporate car lease policy Explore how opting for a salary linked car leasing model provided by your employer can significantly reduce taxable income Discover the

Tax Planning For Salaried Employees Saffollya

All The Salaried Employees Out There Save More With These Simple Tax

Income Tax Calculator Excel Sheet For Salaried Individuals YouTube

Income Tax Planning For Salaried Employees FY 2018 19 Investdunia

Tax Benefit On Car Maintenance Allowance Wealth Caf Financial Advisors

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Car Buy Vs Lease Calculator Excel Business Insights Group AG

Financial Planning For Salaried Employee And Strategies For Tax Savings

Why You Should Consider Timekeeping For Your Salaried Employees

Tax Benefit On Car Lease For Salaried Employees Calculator - The tax advantage Such a model works well for salaried class as you get a tax benefit of up to 30 annually and you can claim the entire rental as an expense