Tax Benefit On Home Loan For Second House You can claim the benefit of home loan interest and deduction in respect to the second house also In case the house is self occupied max int deduction including first house

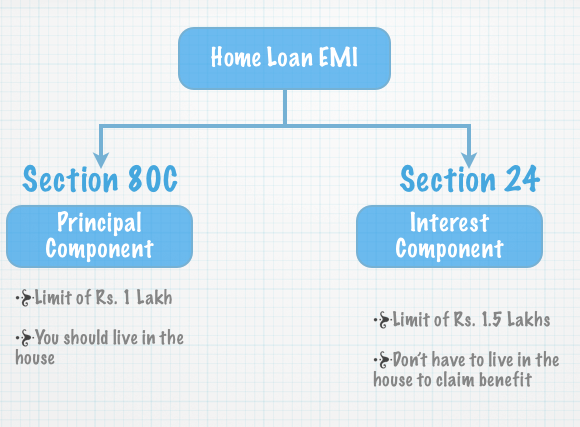

As a result taxpayers can now claim tax benefits on a second Home Loan in addition to their first Home Loan The applicable Home Loan tax benefit under various sections of the Income Tax Tax benefits on home loan interest and principal repayment are available for self occupied houses under the old tax regime

Tax Benefit On Home Loan For Second House

Tax Benefit On Home Loan For Second House

https://images.hydroreview.com/wp-content/uploads/2021/10/lesotho2.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

https://blog.regrob.com/wp-content/uploads/2016/10/tax-benefit-on-home-loan-interest.png

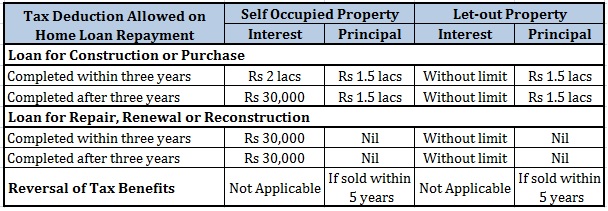

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a personal retreat Typically people fund these property purchases through a home loan If you have bought more than one property with home loan then you can get tax benefit on the second property as well Here s how you can claim tax

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available in case of your second house you can enjoy tax benefits For the rented property you can deduct municipal taxes paid a 30 standard deduction and interest on a home loan from your annual rental income You can claim the entire interest

Download Tax Benefit On Home Loan For Second House

More picture related to Tax Benefit On Home Loan For Second House

How To Claim Tax Benefits On Home Loan Bleu Finance

https://bleu-finance.com/wp-content/uploads/2021/05/Home-Loan0428.jpg

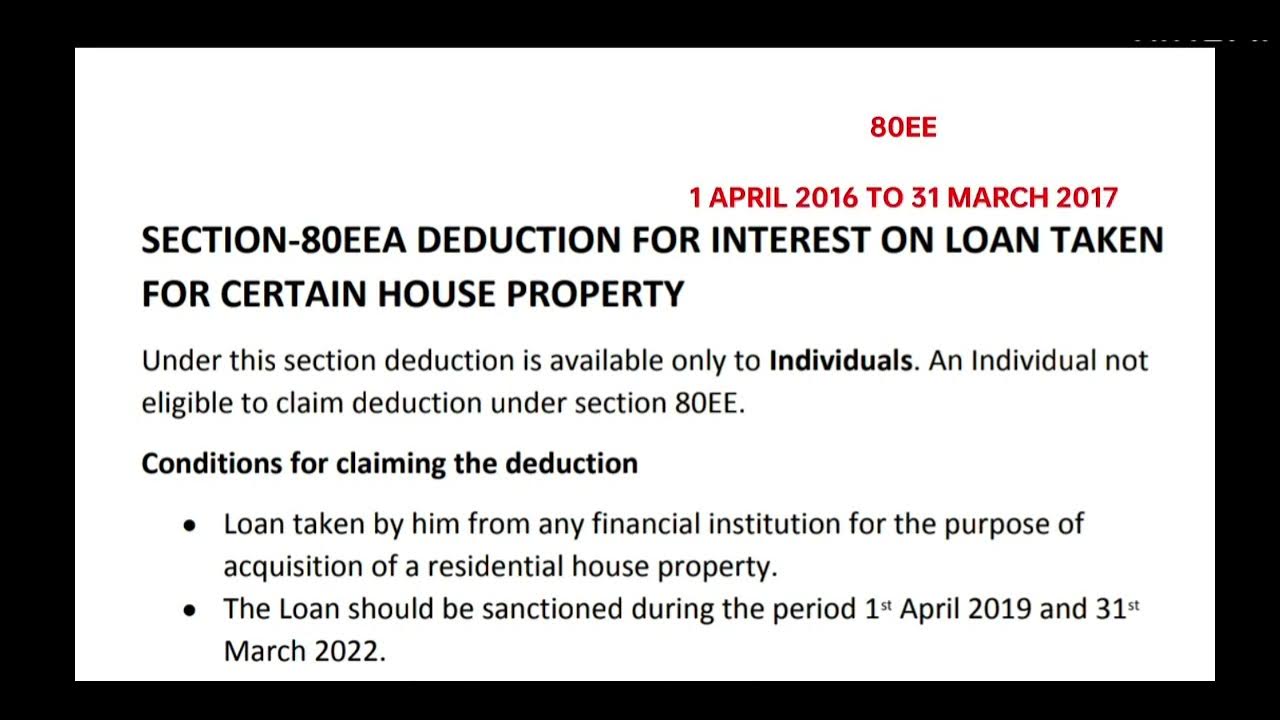

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

https://i.ytimg.com/vi/IEJqgz2FYNs/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYACggWKAgwIABABGGUgZShlMA8=&rs=AOn4CLAks-RAzi6owAVNxH58N3-sKJAQIw

Home Loan Tax Benefits As Per Union Budget 2020

https://www.indiakaloan.com/blog/wp-content/uploads/2020/02/Home-Loan-Tax-Benefits_Blog-Creative.jpg

Here are the key tax benefits for a second home loan in India 1 Interest deduction For self occupied property If you have taken a loan to purchase a second property There is no tax benefit on second home loan under these scenarios If the rental income exceeds the deductions of property tax maintenance allowance and the interest repayment Once the home loan is completely paid there will be no

As the law allows a person to own multiple homes and avail of multiple home loans we look at the implications on tax exemptions on the home loan for the second house Availing of a second Home Loan allows you tax benefits on the principal portion of your Home Loan repayment You can claim a deduction of up to Rs 1 5 Lakh under section 80C of the

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202011/home_loan_660_271120090951.jpg

https://taxguru.in › income-tax › income-tax-benefits...

You can claim the benefit of home loan interest and deduction in respect to the second house also In case the house is self occupied max int deduction including first house

https://www.icicibank.com › blogs › home-loan › tax...

As a result taxpayers can now claim tax benefits on a second Home Loan in addition to their first Home Loan The applicable Home Loan tax benefit under various sections of the Income Tax

20151209 Tax Benefits On A Home Loan Personal Finance Plan

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

How To Claim Stamp Duty Exemption On Property 2023

What Are The Tax Benefit On Home Loan FY 2020 2021

Letter To Bank Manager For Education Loan Second Installment 2 SAMPLES

Letter To Bank Manager For Education Loan Second Installment 2 SAMPLES

Tax Benefit On Home Loan And HRA Both

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

How To Claim Tax Benefit On Home Loan For Under Construction Property

Tax Benefit On Home Loan For Second House - For the rented property you can deduct municipal taxes paid a 30 standard deduction and interest on a home loan from your annual rental income You can claim the entire interest