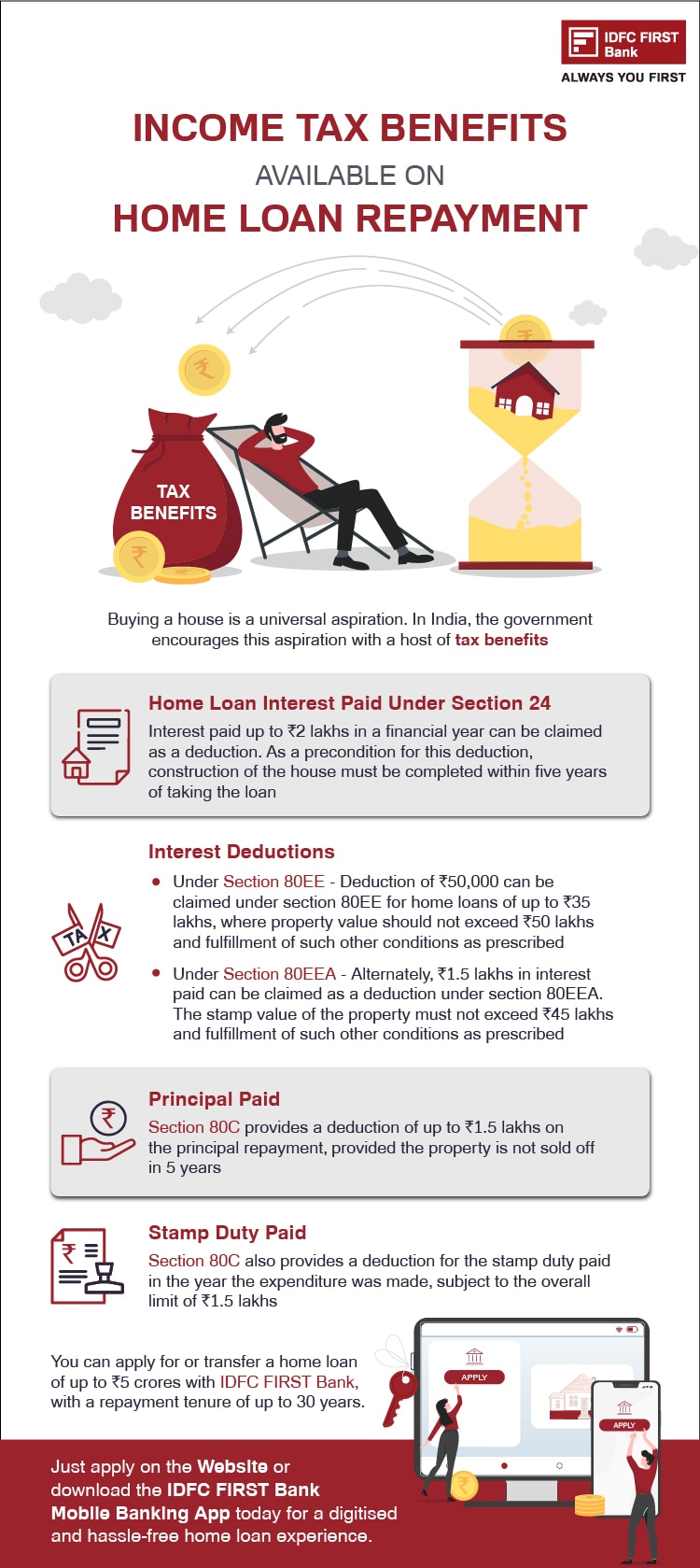

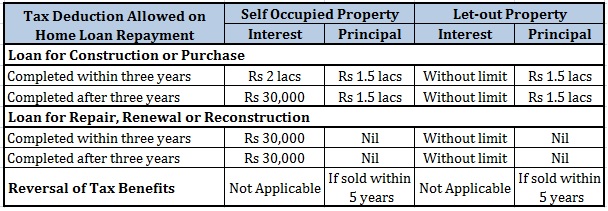

Tax Benefit On Home Loan Under Construction Income tax benefit on home loan s interest in the pre construction period As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid on home

A The maximum tax benefit on under construction property under Section 24B of the IT Act is Rs 2 lakh per financial year Q How much can I claim as the Explore the valuable tax benefits of home loans for under construction properties Maximize your savings and make informed financial decisions with

Tax Benefit On Home Loan Under Construction

Tax Benefit On Home Loan Under Construction

https://cbsnews2.cbsistatic.com/hub/i/r/2018/05/11/544003b6-8a03-4bfe-bf80-9925d8c0616a/thumbnail/1200x630/a6a32c86c1c42ea9dfe5c87ce10ddfb2/istock-121277713.jpg

What Is The Apr On A Home Loan

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

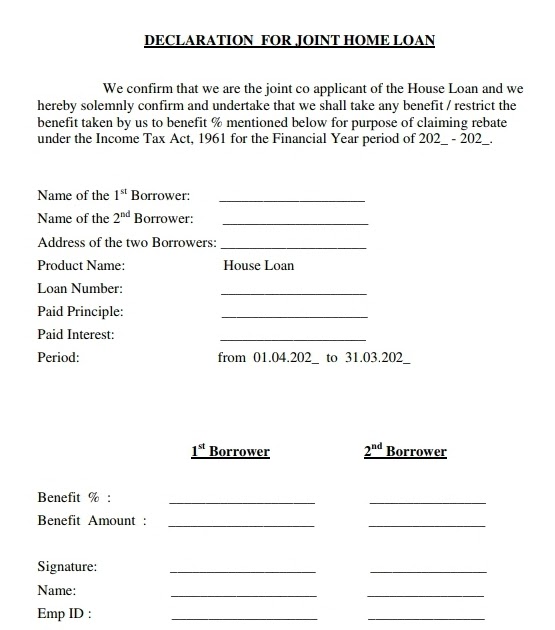

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

This video is about home loan benefit on under construction pre constructed property How to claim tax deduction on interest portion u s 24 and principle Total interest on home loan is Rs 72 000 for FY 2020 21 Since the property is rented out he can claim the entire interest as a deduction Also prakash can claim a deduction for

2 min read A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

Download Tax Benefit On Home Loan Under Construction

More picture related to Tax Benefit On Home Loan Under Construction

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/finance/income-tax-benefit-on-home-loan-repayment.jpg

20151209 Tax Benefits On A Home Loan Personal Finance Plan

https://www.personalfinanceplan.in/wp-content/uploads/2015/12/20151209_Tax-Benefits-on-a-Home-Loan.jpg?x85738

Here are the tax benefits that you can avail yourself when you take a home loan for an under construction property 1 As under construction properties are With effect from the financial year in which the construction is completed the taxpayer can claim for both the interest paid during such year as well as the instalment of

Tax Exemption for Home Construction Loan The pre construction phase is the time between the date of borrowing and the completion of the construction The Indian What are the Under Construction House Tax Benefits under Sec 24 and under Sec 80C How to calculate the interest and principal for claiming the benefit

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202011/home_loan_660_271120090951.jpg

https://www.tatacapital.com/blog/loan-for-home/...

Income tax benefit on home loan s interest in the pre construction period As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid on home

https://www.godrejproperties.com/blog/under...

A The maximum tax benefit on under construction property under Section 24B of the IT Act is Rs 2 lakh per financial year Q How much can I claim as the

Here It Is Good News For Bad Creditors About Improving Their Weak

Income Tax Benefits On Home Loan Loanfasttrack

Home Loan Home Loans Loan Lending Company

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Pin On Home Loan

Pin On Home Loan

Pin On Home Loan

How To Claim Tax Benefit On Home Loan For Under Construction Property

Home Loan Interest Rate New Tax Regime Allows Deduction Of Interest On

Tax Benefit On Home Loan Under Construction - Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan