Tax Break For Daycare 2022 Verkko 19 lokak 2023 nbsp 0183 32 The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent

Verkko 20 maalisk 2022 nbsp 0183 32 The maximum you can set aside in 2022 is 5 000 per household for individuals or couples filing jointly or 2 500 for a married person filing separately You Verkko 1 jouluk 2023 nbsp 0183 32 The Child and Dependent Care Tax Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent

Tax Break For Daycare 2022

Tax Break For Daycare 2022

https://invinity.com/wp-content/uploads/2021/05/shutterstock_1911122770_Tax-return-scaled.jpg

Tax Break Emergency Budget Likely For Next Week

https://www.landlordtoday.co.uk/upload/images/Miscellaneous/tax.jpg

There s Still Time To Get A Tax Break For Donations To Charity Callan

https://callancapital.com/wp-content/uploads/2021/12/iStock-1280945508-scaled.jpg

Verkko 16 lokak 2023 nbsp 0183 32 This means the family will receive a tax break of 1 200 bringing their total cost to hire their nanny down to 30 276 50 The Child Care Tax Credit has offset Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care tax credit is a tax break for working people with qualifying dependents It can help to offset the costs of caregiving expenses

Verkko 27 marrask 2023 nbsp 0183 32 For the 2023 tax year 2022 2025 The 2021 ARPA enhancements ended 20 Popular Tax Deductions and Tax Breaks for 2023 2024 Dive even deeper in Taxes Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child

Download Tax Break For Daycare 2022

More picture related to Tax Break For Daycare 2022

)

Federal Budget 2022 Tax Breaks For Small Business

https://assets.cdn.thewebconsole.com/S3WEB6522/blogImages/626a2a3351489.jpg?v=2&geometry(550>)

How Do You Write Off Fuel On Your Taxes Leia Aqui Is It Better To

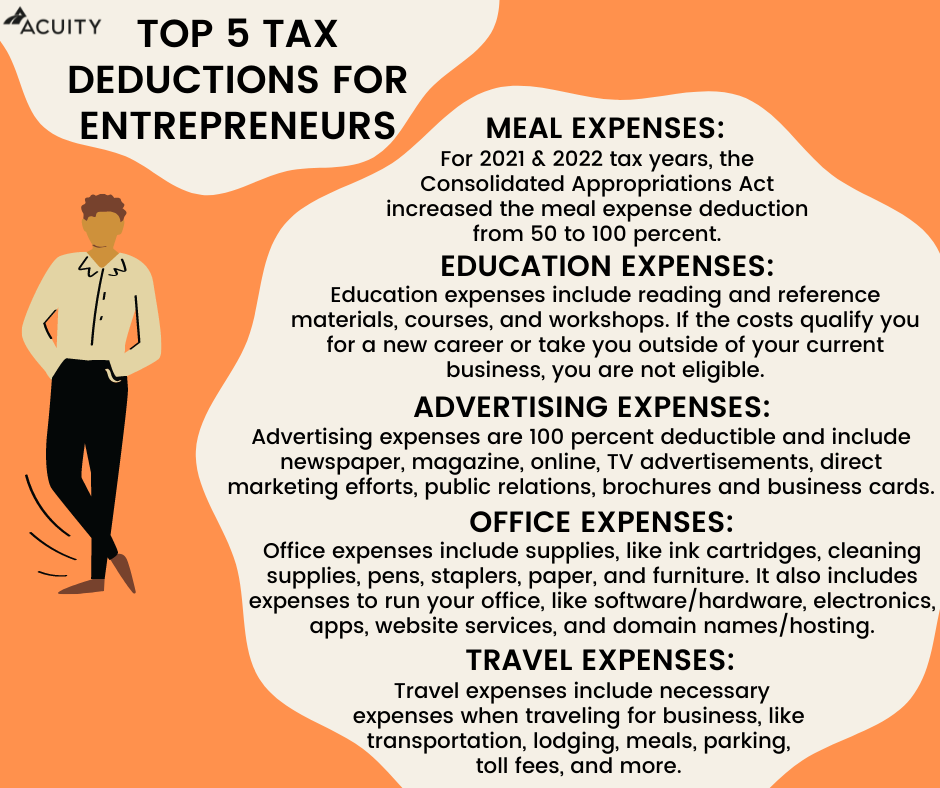

https://acuity.co/wp-content/uploads/2021/01/top-5-tax-deductions.png

How To Score A Tax Break For Your Charitable Giving

https://image.cnbcfm.com/api/v1/image/106268833-1574881176855gettyimages-522951298.jpeg?v=1574881259&w=1920&h=1080

Verkko 5 jouluk 2022 nbsp 0183 32 How much of a tax credit can I get on my day care costs Taking a tax break on day care expenses is considered a credit not a deduction It s important to Verkko 13 tammik 2022 nbsp 0183 32 Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or

Verkko 12 helmik 2022 nbsp 0183 32 The child and dependent care credit is a tax break designed to let parents claim expenses from child care For example if you paid for a day care Verkko 11 kes 228 k 2021 nbsp 0183 32 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

3 Lesser known Ways To Lower Your 2022 Tax Bill Or Boost Your Refund

https://i1.wp.com/image.cnbcfm.com/api/v1/image/102289145-147265650.jpg

https://turbotax.intuit.com/tax-tips/family/the-ins-and-outs-of-the-child-and...

Verkko 19 lokak 2023 nbsp 0183 32 The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent

https://hermoney.com/earn/taxes/child-care-tax-breaks-you-need-to-take...

Verkko 20 maalisk 2022 nbsp 0183 32 The maximum you can set aside in 2022 is 5 000 per household for individuals or couples filing jointly or 2 500 for a married person filing separately You

Daycare Tax Statement Daycare Tax Form Illustration Par Watercolortheme

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Getting A Tax Break For Donating To Charity YouTube

164 New Jobs Crown Gets Tax Break For New Nichols Plant

If I Were Starting A Home Daycare In 2022 Here s What I d Do YouTube

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

Federal Tax Breaks For Graduate School Other Tax Benefits Graduate

Tax Break For Landlords

Ending Tax Break For Ultrawealthy May Not Take Act Of Con Flickr

An Under Utilized Tax Break For Tracy Taxpayers Summer Day Camp

Tax Break For Daycare 2022 - Verkko 16 lokak 2023 nbsp 0183 32 This means the family will receive a tax break of 1 200 bringing their total cost to hire their nanny down to 30 276 50 The Child Care Tax Credit has offset