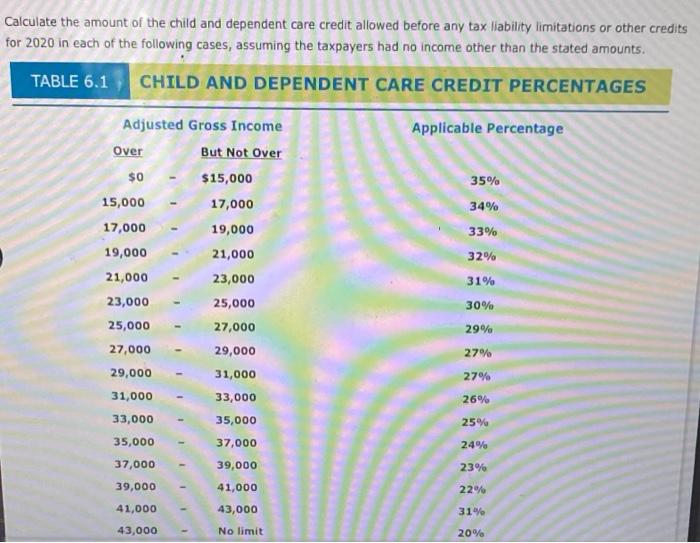

Tax Credit For Child Care 2022 Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

Verkko 11 kes 228 k 2021 nbsp 0183 32 FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons Verkko 27 marrask 2023 nbsp 0183 32 For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional

Tax Credit For Child Care 2022

Tax Credit For Child Care 2022

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

Why An Ontario Tax Credit For Child Care Is A Bad Idea

https://images.theconversation.com/files/268690/original/file-20190410-2914-et61eq.jpg?ixlib=rb-1.1.0&q=15&auto=format&w=600&h=391&fit=crop&dpr=3

New Child Tax Credit For 2021 Explained By CPA New Child Tax Credit

https://www.thetechsavvycpa.com/wp-content/uploads/2021/05/New-Child-Tax-Credit-Update-For-2021-1280x720.jpg

Verkko 24 elok 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or

Verkko 19 lokak 2023 nbsp 0183 32 In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t disappear except for 2021 In 2021 the credit is unavailable for any taxpayer with adjusted gross income over 438 000 Verkko 13 tammik 2022 nbsp 0183 32 Sarah O Brien sarahtgobrien Share Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000

Download Tax Credit For Child Care 2022

More picture related to Tax Credit For Child Care 2022

2022 Child Tax Credit Dates Latest News Update

https://i2.wp.com/images.sampleforms.com/wp-content/uploads/2016/10/Child-Tax-Credit-Form.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_794xN.3736849859_31z4.jpg

2022 Child Tax Credit Calculator Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2023/01/2022-child-tax-credit-calculator-1024x557.png

Verkko 18 lokak 2023 nbsp 0183 32 Topic No 602 Child and Dependent Care Credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work Verkko 2022 2023 For tax years 2022 and 2023 there is a limit of 3 000 for one qualifying person or 6 000 for two or more qualifying persons The credit is not refundable Your credit amount is dependent on your income and can be between 20 and 35 600 1 050 of the expenses The program will calculate the credit for you when you enter

Verkko Jan 3 2022 Monthly benefits to rent and child care kept millions of children out of poverty What we ve seen with the child tax credit is a policy success story that was unfolding Verkko Tax Year 2022Childcare TaxCredit This 2022 Child and Dependent Child Care Calculator tool will let you know if you qualify for this non refundable federal tax credit for Tax Year 2022 Since October of 2023 you can no longer e file 2022 tax returns and can only use paper forms to file your return Current year tax returns are due by April and

2022 Child Tax Credit Chart Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t16-0179.gif

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

https://www.nerdwallet.com/.../taxes/child-and-dependent-care-tax-credit

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs

Verkko 11 kes 228 k 2021 nbsp 0183 32 FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons

2022 Child Tax Credit Refundable Amount Latest News Update

2022 Child Tax Credit Chart Latest News Update

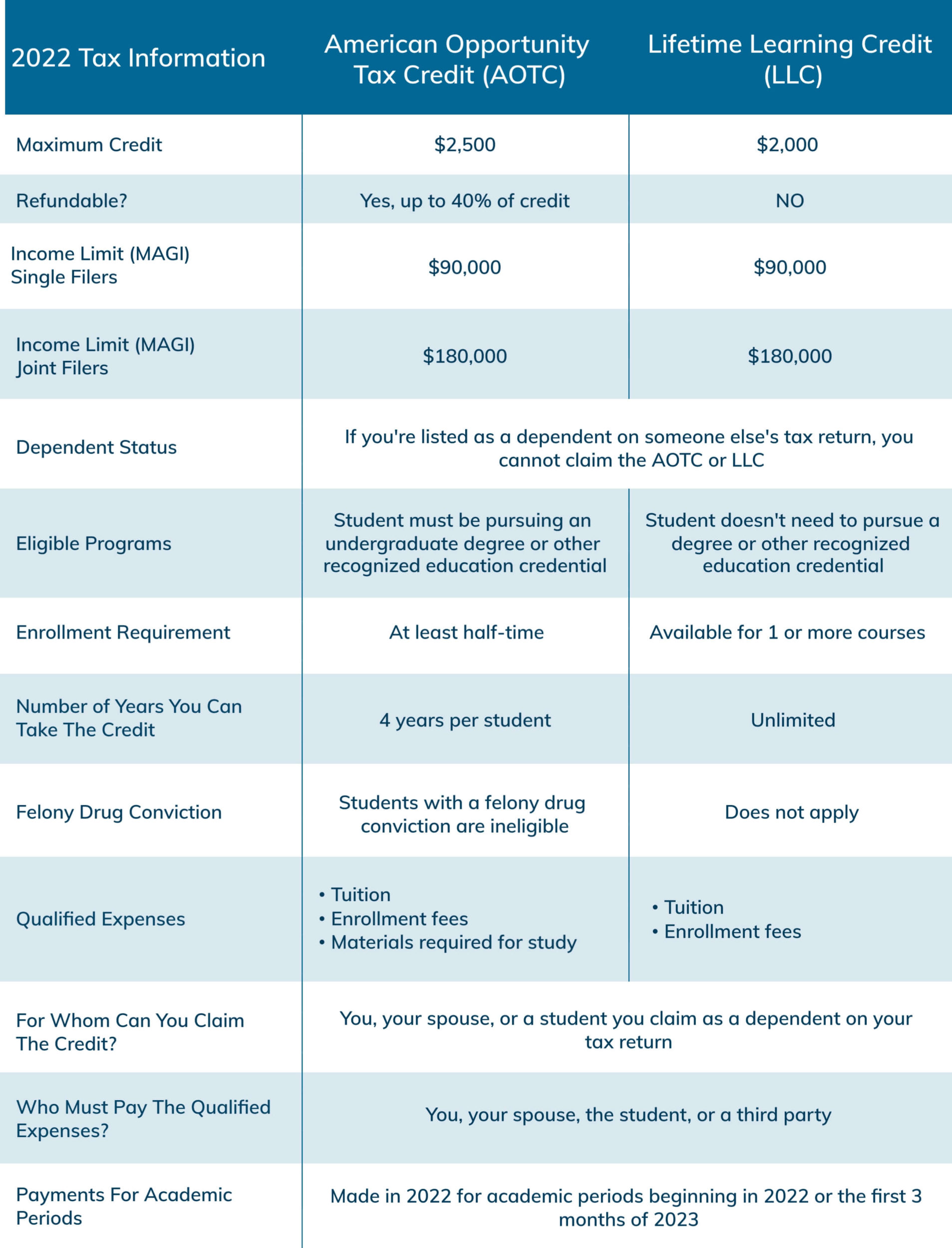

Tution Tax Credit For Students NCS CA

Solved Calculate The Amount Of The Child And Dependent Care Chegg

Enhanced Child Tax Credit 2022

The Child Tax Credit 2021 What Changes Can Families Expect This Year

The Child Tax Credit 2021 What Changes Can Families Expect This Year

What The New Child Tax Credit Could Mean For You Now And For Your 2021

2022 Education Tax Credits Are You Eligible

What Families Need To Know About The CTC In 2022 CLASP

Tax Credit For Child Care 2022 - Verkko 13 maalisk 2022 nbsp 0183 32 The child and dependent care credit is a fully refundable tax credit which means even if you don t owe the IRS any money you can still receive the credit as a tax refund You can claim up to